- On the price charts, LINK broke out of a bullish flag pattern after weeks of consolidation

- Whales stepped up their activity, purchasing a significant portion of LINK

Over the past day, LINK experienced a significant increase in value by approximately 1.65%. This growth has added to its weekly progress, now standing at a substantial 22.35% increase. In other words, this upward trend could indicate the possibility of further price fluctuations on the charts.

It seems quite likely that LINK might experience significant increases in value within the next short while, given the positive investor outlook and current market trends. This is especially true if the ongoing bullish trend continues uninterrupted.

Double-digit gains to push LINK to $50?

Based on insights from well-known crypto expert Ali, LINK appears to be making an initial advance in a significant bullish trend. This follows the coin breaking through a crucial resistance point within its bullish trading pattern.

In simpler terms, we’re observing a pattern called a “bullish flag.” This happens when the price moves within a specific range after a significant rise (the ‘upswing’). The lower boundary is the support, and the upper boundary is the resistance. Once the resistance level is surpassed, it often signals further price increase, which is exactly what LINK has accomplished already.

The graph, featuring Fibonacci retracement lines, signaled a period where the price could briefly dip but would likely resume its ascent. The projected peak from this area is approximately $58.64, representing almost a threefold increase over its current value of $22.906.

Based on AMBCrypto’s assessment, the buildup of LINK by large investors (whales) could significantly contribute to the upward trend we see in the price charts.

Whale purchases could drive LINK’s surge

According to IntoTheBlock’s findings, there has been a significant increase in large-scale investment from prominent investors in LINK. These investors, who generally control between 0.1% and 1% of the total supply, have been instrumental in driving the recent price fluctuations of LINK.

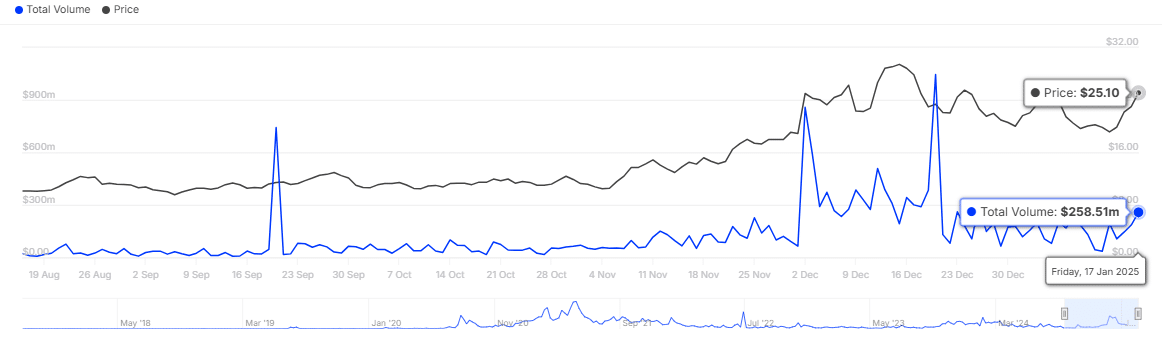

Over just the past day, there was a significant increase in major LINK transactions, reaching a total of 593 transactions, amounting to approximately 10.3 million LINK and valued at an impressive $258.51 million.

When significant trades are accompanied by an increase in prices and a surge in positive trends on the graph, it suggests that purchasing actions have been more prevalent than selling ones over this timeframe.

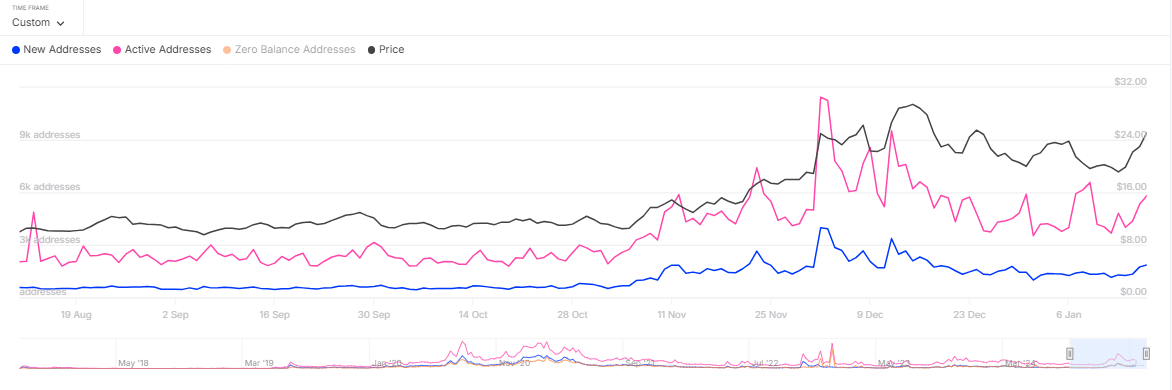

Additionally, there’s been a significant increase in both existing and newly activated addresses, suggesting an uptick in market activity that probably played a role in the recent price surge.

Over the past day, I’ve noticed a significant increase in activity within the Chainlink network. Specifically, the number of unique addresses participating in transactions jumped up to 5,810, and an impressive 1,860 new investors joined the ranks.

Each week, these figures showed an increase of approximately 39.02% and 40.42%, demonstrating robust optimism in the market.

Or:

Every seven days, we saw a surge of around 39.02% and 40.42%. This strong upward trend suggests that investors were feeling quite bullish.

If these tendencies persist, the persistent rise in significant transactions, increased usage at new addresses, and heightened activity among existing addresses might strengthen the momentum of LINK.

Is a supply squeeze on the horizon?

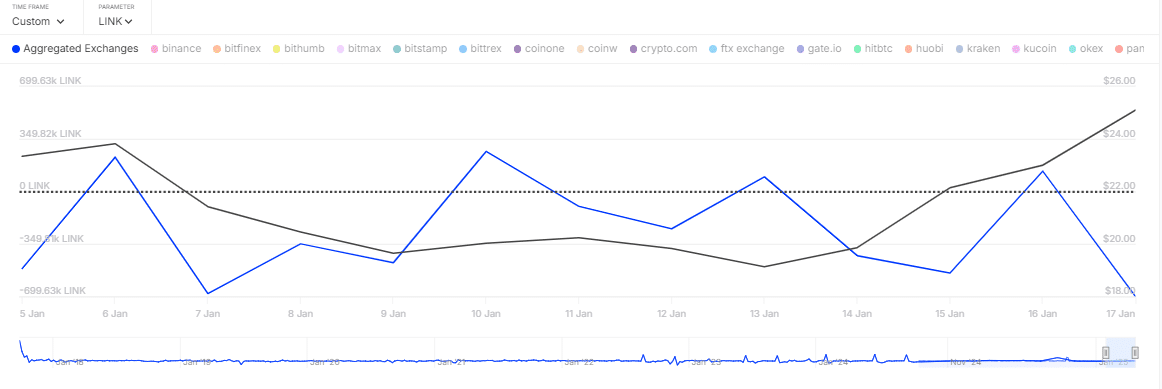

Ultimately, it was discovered that large amounts of LINK were being withdrawn off the exchange platforms, moving out more than what was coming in as new investments.

The data was obtained using Aggregated Exchange Netflow, a system that monitors deposits and withdrawals of different cryptocurrencies across multiple exchanges. At the moment, the netflows indicate a withdrawal of 149,670 LINK.

As an analyst, I observe that such a substantial withdrawal indicates market players are leveraging the current bullish momentum by keeping their LINK in secure, long-term storage off exchanges. This action may create a shortage of supply for the altcoin, potentially escalating its scarcity and price.

If this trend persists and the outflow keeps being negative, it might indicate a prolonged increase in the price of LINK, possibly causing a shortage in supply.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-19 06:15