- Jupiter rocketed past the local resistance zone at $0.95, and the price was just below the $1.15 resistance at press time

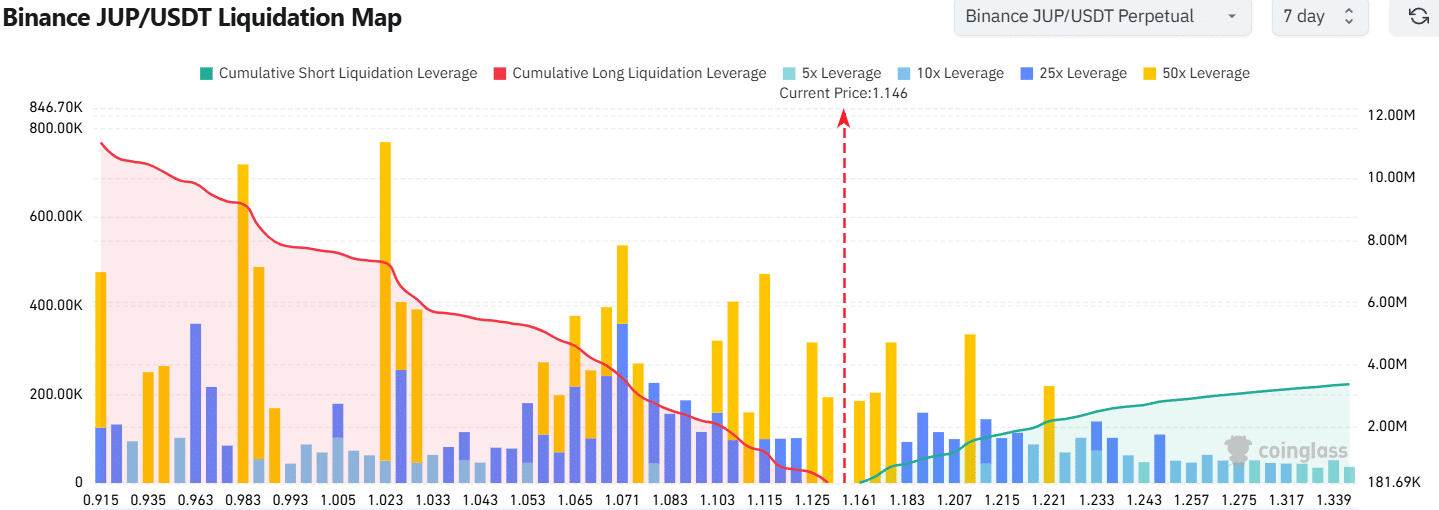

- There is potential for a drop to $1.06 in the near future

On January 18th, there was a significant increase of 36.76% in the value of JUP (Jupiter). The previous 24-hour trading period experienced a 34% rise, and a massive 678% surge in daily trading volume for Jupiter. This suggests a very bullish trend for the altcoin.

💣 ALERT: EUR/USD Could Crash After Trump’s New Tariff Plans!

Explosive report reveals upcoming turbulence that could upend markets!

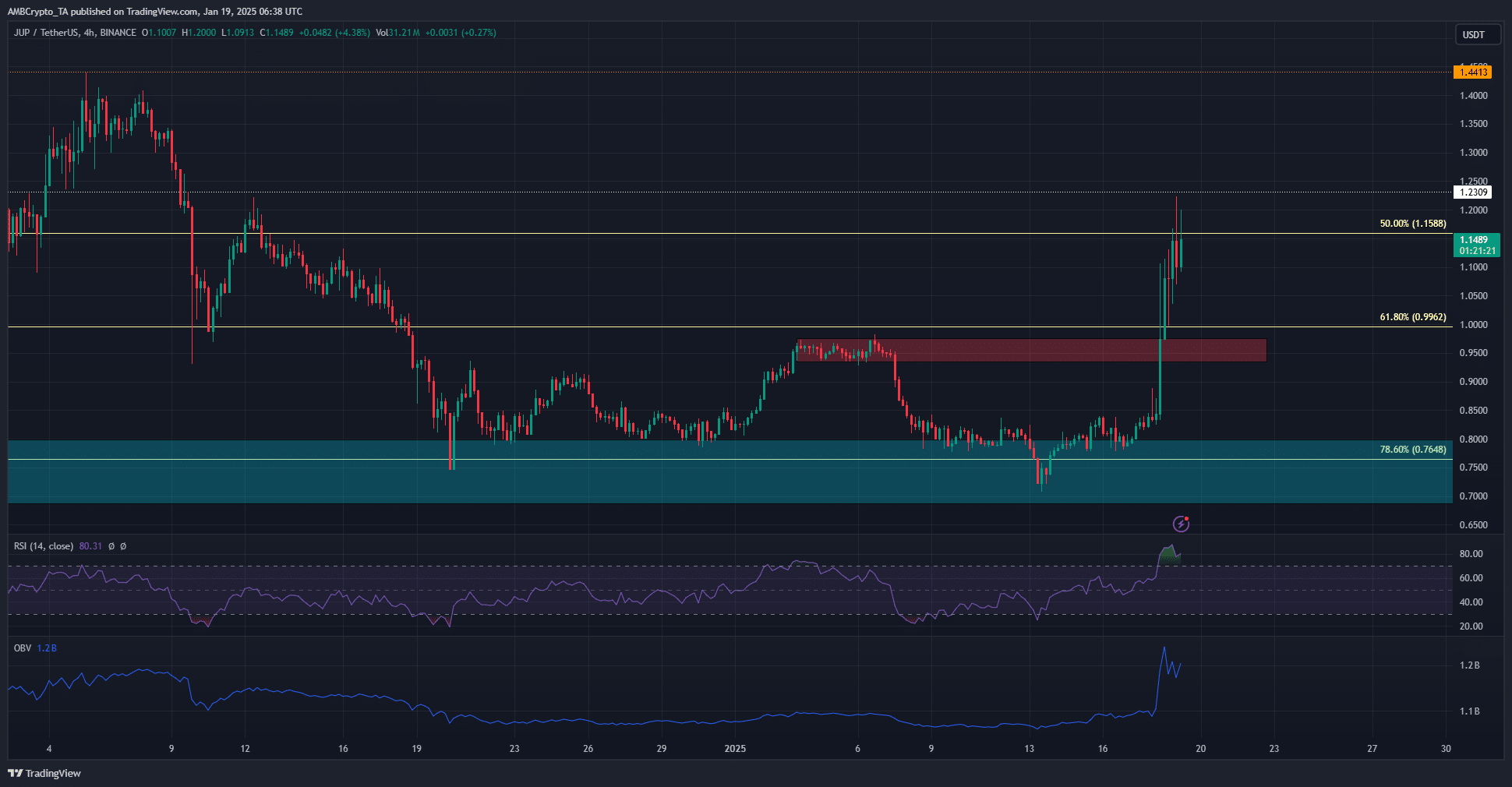

View Urgent ForecastOn a day-to-day and 4-hour basis, the altcoin’s market trend showed signs of bullishness, but there might be an impending correction that could take its value down to approximately $1. Given the strong support at $1.06, which is around 9% lower than the current price point, it’s possible that this dip may not exceed this level significantly.

JUP bulls challenge the $1.15 resistance

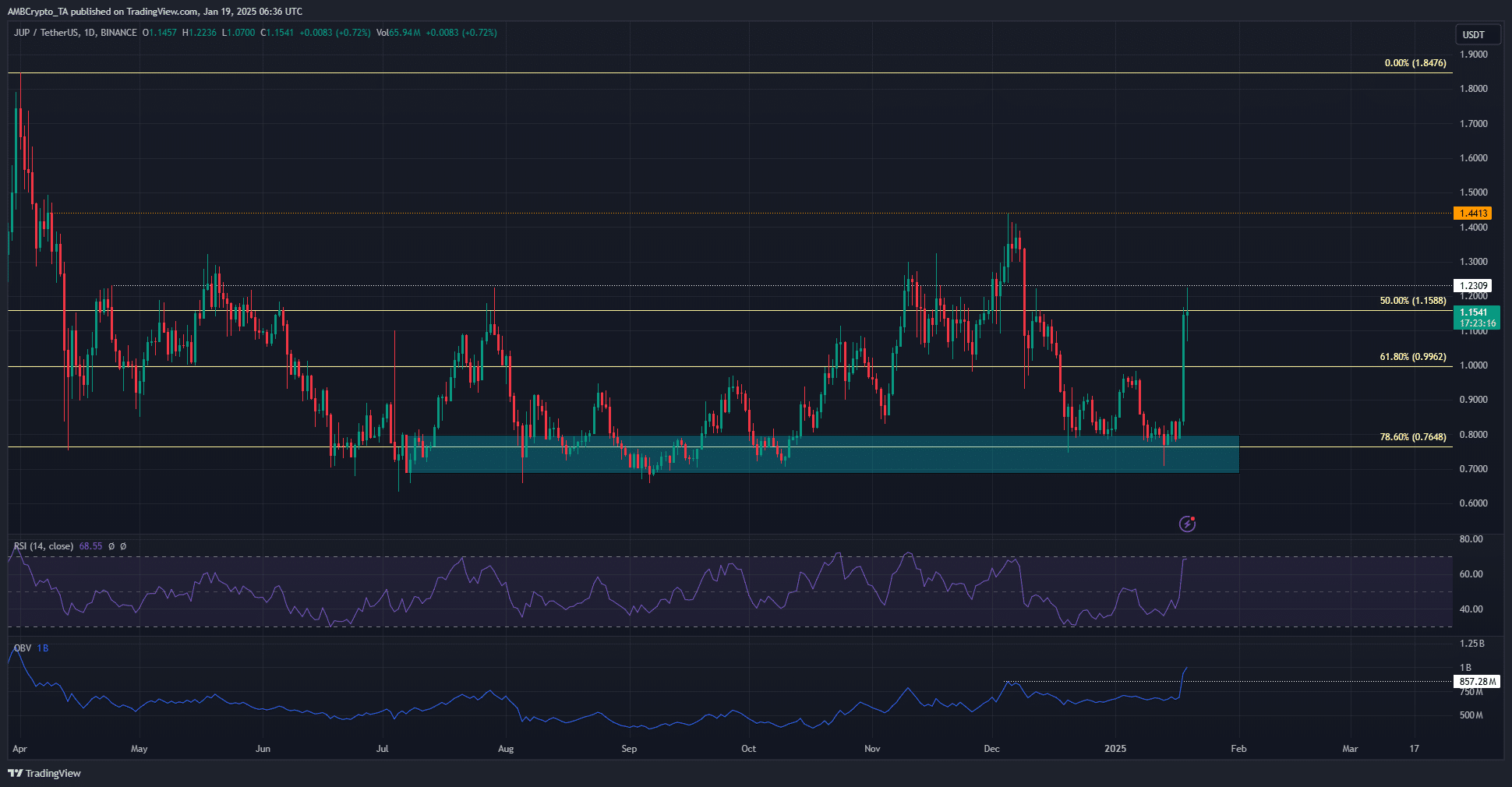

For the past nine months, I’ve observed a persistent effort by the bulls to safeguard the 78.6% retracement level at approximately $0.76. This significant resistance level was derived from Jupiter’s remarkable rally in March, which propelled its price from around $0.47 to $1.84, serving as a benchmark for these retracement levels.

Yesterday’s market structure suggested optimism, as it showed a strong upswing, and the Relative Strength Index (RSI) was significantly above 50, hinting at robust upward movement. This surge in momentum was accompanied by an increase in demand, which was further reflected by the On-Balance Volume (OBV) breaching a local high, indicating increased buying pressure.

With growing interest and impetus, JUP might surpass its immediate resistance levels at $1.15 and $1.23. In the upcoming days, there’s a strong possibility that the previous high of $1.44 could be retested once more.

Over the past few days, the H4 chart clearly demonstrated a significant surge in the asset’s momentum. The levels of $0.95 and $0.99, which are typically strong resistance points, were quickly overcome without much difficulty, and there was hardly a need for a second glance as the crypto’s price continued to climb.

On the 4-hour chart, the rapid selling may have overshot its mark, which doesn’t automatically mean a downward trend. Lately, there seems to be some profit-taking based on the decline in On Balance Volume (OBV) over recent sessions. It’s plausible that we might see a shift towards the $0.95-$1 support zone in the near future. Should it be reached, this area could present an attractive buying opportunity.

Read Jupiter’s [JUP] Price Prediction 2025-26

The map showing total liquidation indicates higher accumulated leverage towards the southern region compared to the north. This suggests there might be a wave of liquidations, possibly leading to a temporary price drop. If this happens, the near-term goals for the price could be around $1.11 and $1.06.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Silver Rate Forecast

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

2025-01-19 18:15