- Bitcoin crossed the $109,000 mark ahead of Trump’s inauguration, driven primarily by Korean market activity.

- U.S. investors have yet to contribute significantly to this rally, leaving room for further gains.

Over the last seven days, the market has displayed a continuous positive trend, as Bitcoin [BTC] surged by approximately 15.06%. The upward momentum grew even stronger within the past day, with an additional increase of 2.68%, setting a new all-time high.

It can be stated that the surge in Bitcoin’s price has been significantly influenced by Korean investors, bolstered by growing market optimism and a rise in the number of actively used Bitcoin accounts.

Insights from AMBCrypto suggest that further upside potential remains as conditions evolve.

Bitcoin hits new all-time high as on-chain activity spikes

On January 20th, Bitcoin hit a record peak price of $109,114.88 per coin, as reported by CoinMarketCap at the time of publication. Moreover, the trading volume for BTC experienced a significant increase of approximately 120.34%, amounting to over $110 billion. This surge in activity has boosted Bitcoin’s market capitalization to an impressive $2.13 trillion.

Today’s milestone occurs prior to the inauguration of Donald Trump. The growing market optimism, driven by the assumption that he is pro-cryptocurrency, could be stimulating a positive outlook in the crypto market.

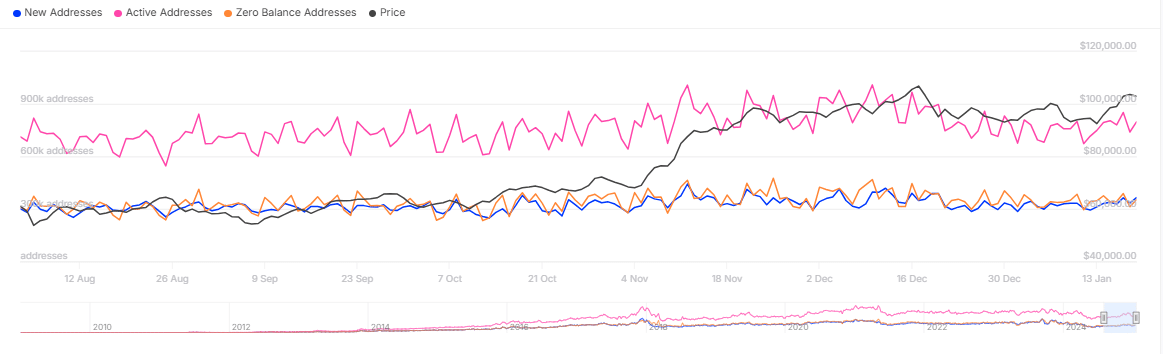

Over the last 24 hours, there’s been a significant increase of 11.47% in the number of active Bitcoin addresses involved in transactions on the blockchain, with approximately 798,140 addresses participating.

A surge in market action, coupled with rising prices and trade volume, frequently indicates the possibility of a prolonged market upswing. The momentum of Bitcoin might pick up even more as investors adjust to market conditions.

Korean investors drive BTC surge

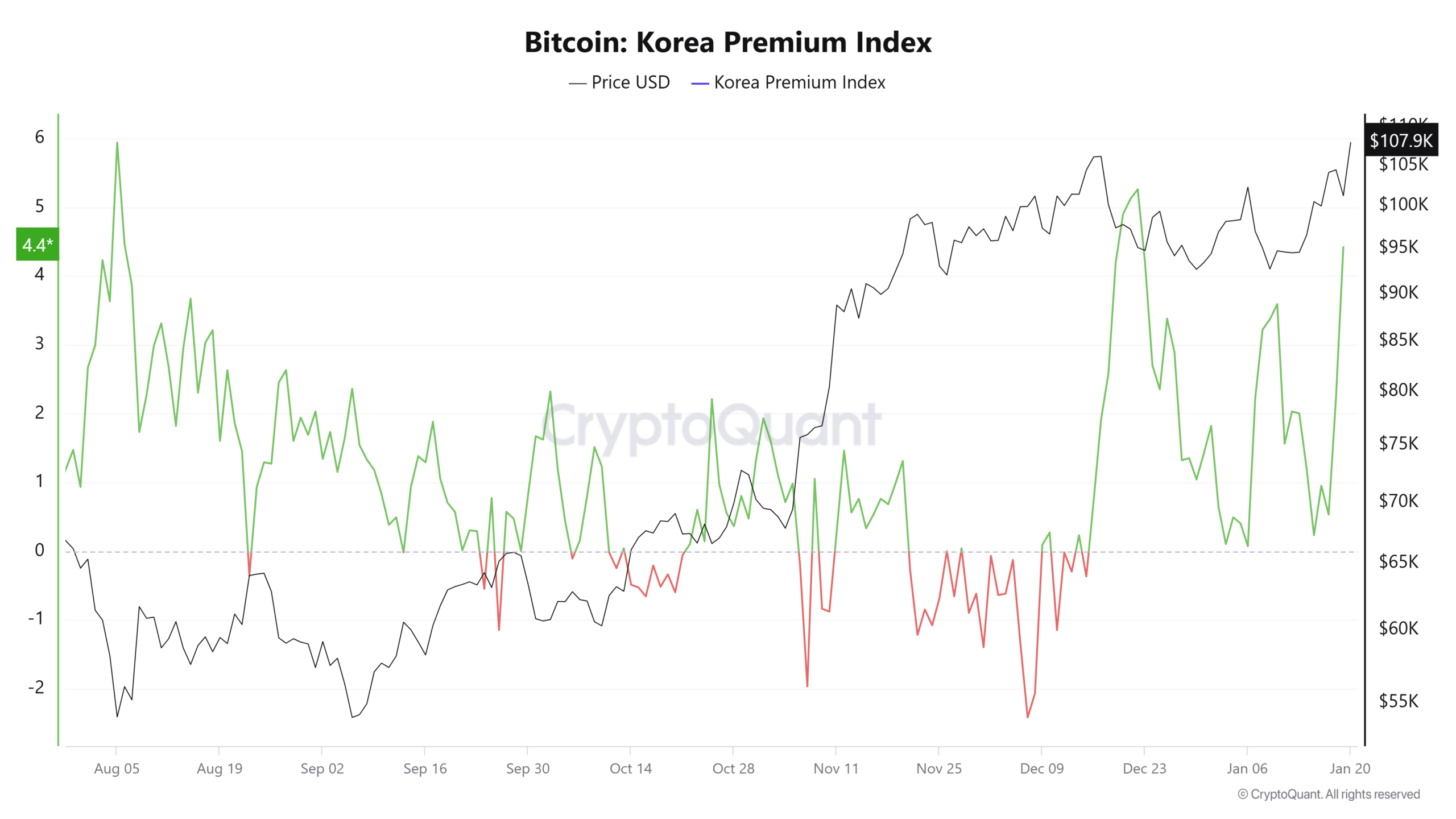

Information from CryptoQuant shows that Bitcoin’s recent peak may be associated with an increase in the Bitcoin: Korea Premium Index – a tool that assesses the influence of Korean retail investors by comparing the price difference between South Korean trading platforms and others.

The index indicates investors’ overall attitude towards the market. Numbers greater than zero indicate a generally optimistic outlook (bullish), while figures below zero suggest pessimism or negative trends (bearish) among Korean investors.

Currently, the index reads 4.42, suggesting a substantial gap in Bitcoin prices across South Korean trading platforms and robust buying interest among investors.

In simpler terms, the U.S. Premium Index, which measures the difference between Coinbase’s Bitcoin pricing and that of other exchanges, is showing a value of -0.1189. This implies that at present, American investors are more likely to be offloading Bitcoin rather than buying it.

Even though it may appear pessimistic, this fact underscores a potential for additional price increases. American investors, who carry significant sway in the market, haven’t jumped on board with the current rally just yet.

If individuals start buying Bitcoin after Trump’s inauguration, there’s a possibility that the price of Bitcoin may surge again.

On November 5th, a pattern emerged as heightened U.S. involvement caused Bitcoin to reach its former peak value of $108,353, coming in the wake of Donald Trump’s presidential win.

BTC and ETH market cap gap hits record high

The difference in total value (market capitalization) between Bitcoin (BTC) and Ethereum (ETH) has soared to a record-breaking $1.75 trillion, signifying the biggest disparity ever seen in these two cryptocurrencies.

It shows a major change in investor interest towards Bitcoin (BTC), as it’s currently receiving more investment than Ethereum (ETH), the second most valuable cryptocurrency based on market capitalization.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

As a researcher, I find myself observing an intriguing trend: the expanding disparity between Bitcoin (BTC) and Ethereum (ETH). This divergence might present an opportune moment for investors to strategically augment their Bitcoin holdings or perhaps consider reallocating some focus from Ethereum.

The current trend supports the general optimism about Bitcoin, which might cause its value to rise even more. Experts predict that Bitcoin could exceed $110,000 during future trading periods as long as this positive momentum continues.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-20 14:35