- HYPE dancing within a bullish flag pattern, hinting at a potential leap towards $50.

- Key indicators, like the rising Total Value Locked (TVL), whispering a gathering storm of momentum.

In the last 24 hours, Hyperliquid [HYPE] experienced a significant price jamboree of 14.67%, reclaiming the $26 range—a sight not seen since early January. This followed a brief monthly dip of 6.09%.

The current market trends and strong bullish alignment point to further upward momentum, positioning HYPE for continued gains in the ensuing weeks.

HYPE’s final curtain call

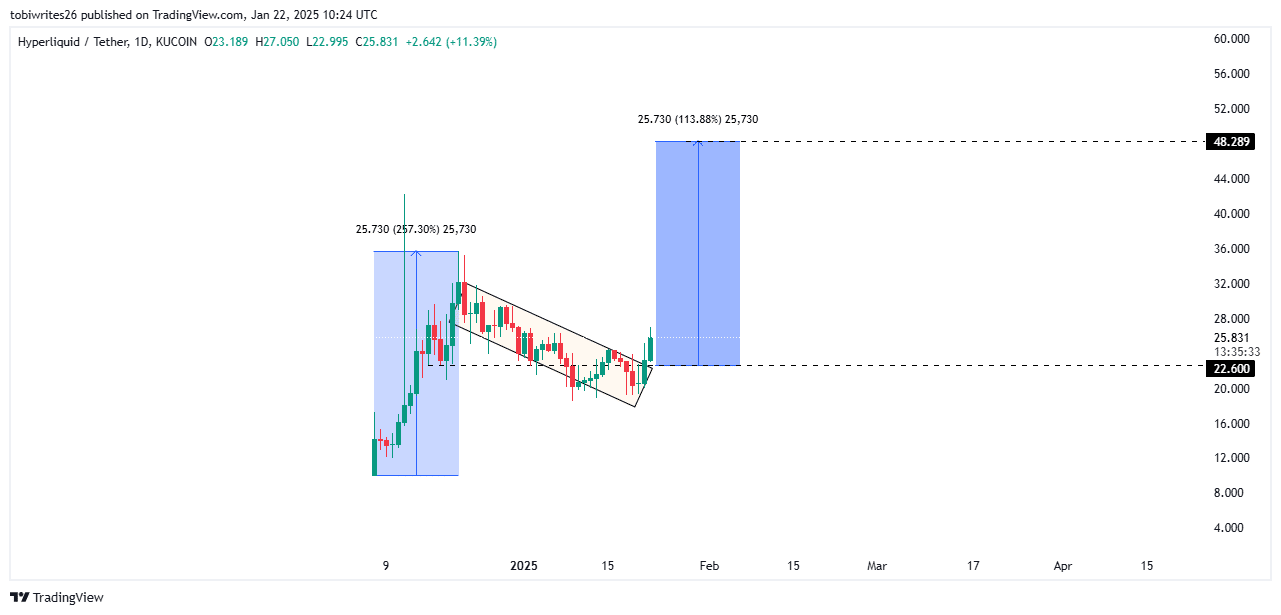

The final act of the bullish flag pattern—a rally, consolidation, and a climactic price surge—has begun unfolding for HYPE. This classic technical pantomime sets the stage for a potential breakout.

Since its inception, HYPE has skyrocketed by 257.03%, followed by a consolidation phase within well-defined support and resistance levels. Recently, HYPE broke out of this range, stepping into the final act of the pattern.

If the pattern holds, HYPE could mirror its initial rally, soaring another 113.8% to approximately $48.3, setting a new all-time high.

Early signs of this upward move have already emerged as HYPE breaches its consolidation level, indicating bullish momentum.

However, if HYPE fails to form higher highs and higher lows, it may tumble back into its consolidation phase.

AMBCrypto’s analysis highlights strong market sentiment and positive metrics, suggesting HYPE is more likely to maintain its upward trajectory and continue making higher highs.

The tide turns as key indicators go bullish

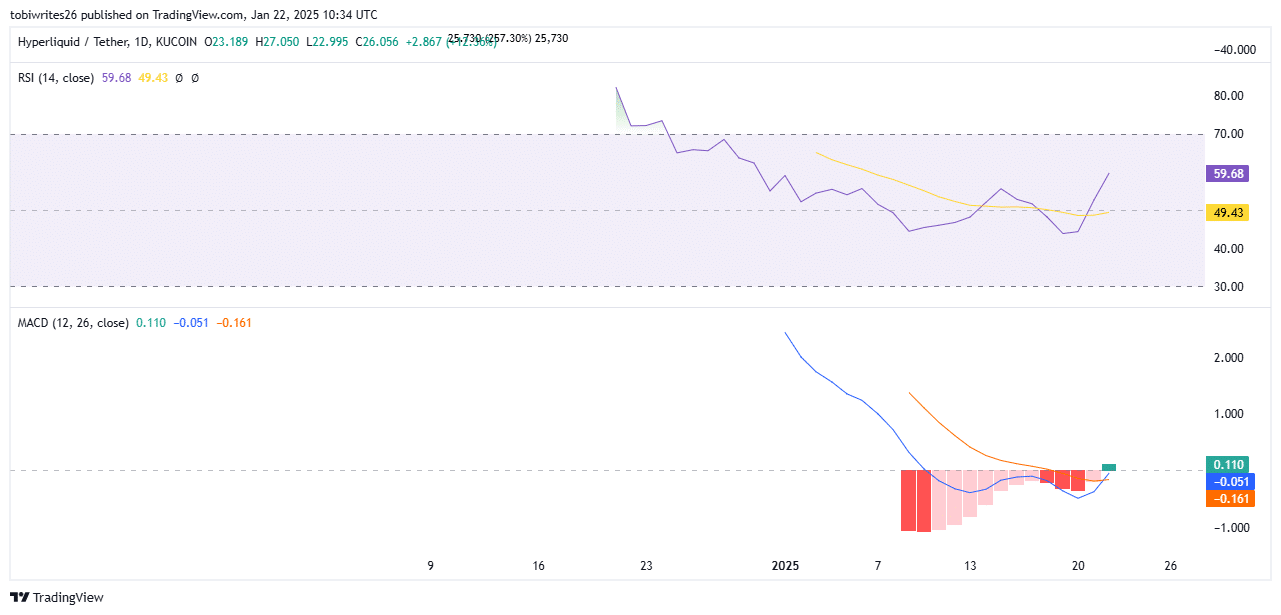

Key technical indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), now show a bullish trend for HYPE.

The RSI, measuring the speed and magnitude of price changes, has returned to the positive region above 50 for the first time since the 13th of January.

When the RSI holds above this level, it usually indicates increased buying pressure and the potential for continued price growth.

Meanwhile, the MACD has formed a golden cross—a bullish pattern that occurs when the blue MACD line crosses above the orange signal line.

This development, as seen on the chart, suggests strengthening upward momentum.

Should both lines cross into the positive region (at -0.051 and -0.161 at press time), the bullish wave could accelerate, supported by a rising green histogram.

On-chain metrics provide further confirmation of improving sentiment.

Total Value Locked (TVL), a key indicator of blockchain health and liquidity inflow, has risen to $1.795 billion, up from its low of $1.559 billion on the 19th of January.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-23 05:11