In a twist of irony that would make even the most seasoned time-traveling hitchhiker raise an eyebrow, investment giant Vanguard has become the largest backer of Strategy Inc., a company led by the notorious bitcoin evangelist Michael Saylor, after years of dismissing the cryptocurrency as a mere speculative asset.

Vanguard: “Bitcoin? Pfft. No thanks.” Also Vanguard: “Hold my beer, I’m buying $9 billion worth of Strategy Inc.”

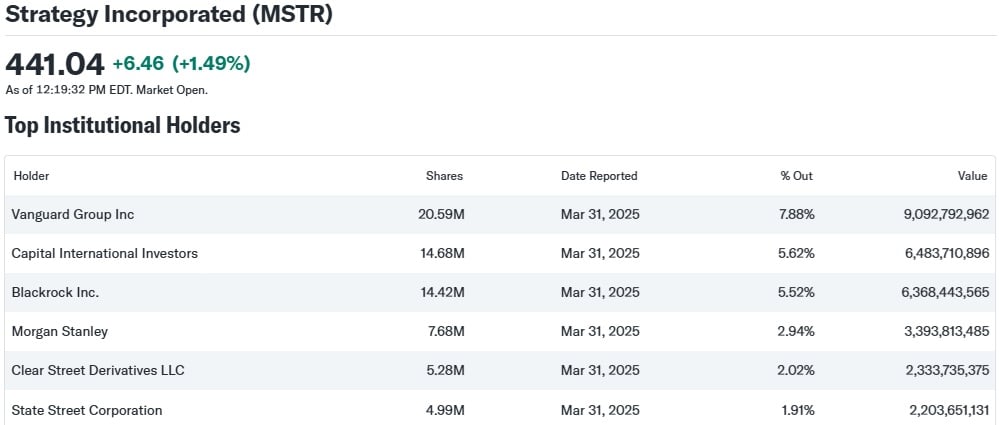

The world of finance is known for its contradictions, but this one takes the cake. Vanguard Group, one of the world’s largest asset managers, has emerged as the top shareholder of Strategy Inc. (also known as Microstrategy)—a company widely associated with bitcoin advocacy.

While the firm has consistently criticized cryptocurrencies as speculative assets lacking fundamental value, Vanguard currently holds more than 20 million shares of Strategy (Nasdaq: MSTR), representing an estimated $9.26 billion in exposure. These shares are distributed across both index-tracking and actively managed funds. Although the positions arise primarily from passive index mandates rather than discretionary investment decisions, they underscore a clear divergence from the investment giant’s public stance on digital assets.

Senior leadership at Vanguard, including Chief Investment Officer Duncan Burns, has repeatedly emphasized the firm’s skepticism regarding bitcoin. Executives have described the crypto asset as volatile and unsupported by intrinsic fundamentals, reinforcing Vanguard’s refusal to offer crypto-related investment products. Moreover, CEO Salim Ramji reiterated the firm’s position in August 2024, stating that it would not pursue a crypto ETF and reaffirming its commitment to “client-focused innovation, not mimicking competitors.”

The inconsistency has drawn criticism from market participants. Matthew Sigel, head of digital assets research at Vaneck, commented on social media platform X on July 14:

Vanguard: Bitcoin is immature and has no value. Also Vanguard: Buys 20M shares of MSTR, becomes top backer of bitcoin’s loudest bull. Indexing into $9B of what you openly mock isn’t strategy. It’s institutional dementia.

The contradictions extend beyond Strategy. Vanguard also ranks as the largest institutional investor in Gamestop Corp., with 39.24 million shares, representing approximately 8.77% of the company’s free float. On May 28, 2025, Gamestop disclosed a $513 million allocation to bitcoin as a treasury reserve. Strategy’s executive chairman, Michael Saylor, opined: “It reflects the increasing acceptance of bitcoin as a legitimate reserve asset within the traditional financial community.”

Read More

- Best Controller Settings for ARC Raiders

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Holy Hammer Fist, Paramount+’s Updated UFC Archive Is Absolutely Perfect For A Lapsed Fan Like Me

- Shonen Jump Cancels Its Weirdest Series in Just a Year

- Emily in Paris soundtrack: Every song from season 5 of the Hit Netflix show

- 40 Inspiring Optimus Prime Quotes

- Gandalf’s Most Quotable Lord of the Rings Line Hits Harder 25 Years Later

2025-07-15 03:57