- Crypto continues to have its little meltdown. Welcome to the new week, folks!

- Don’t worry, Bitcoin might still get its act together—at least according to Bernstein analysts.

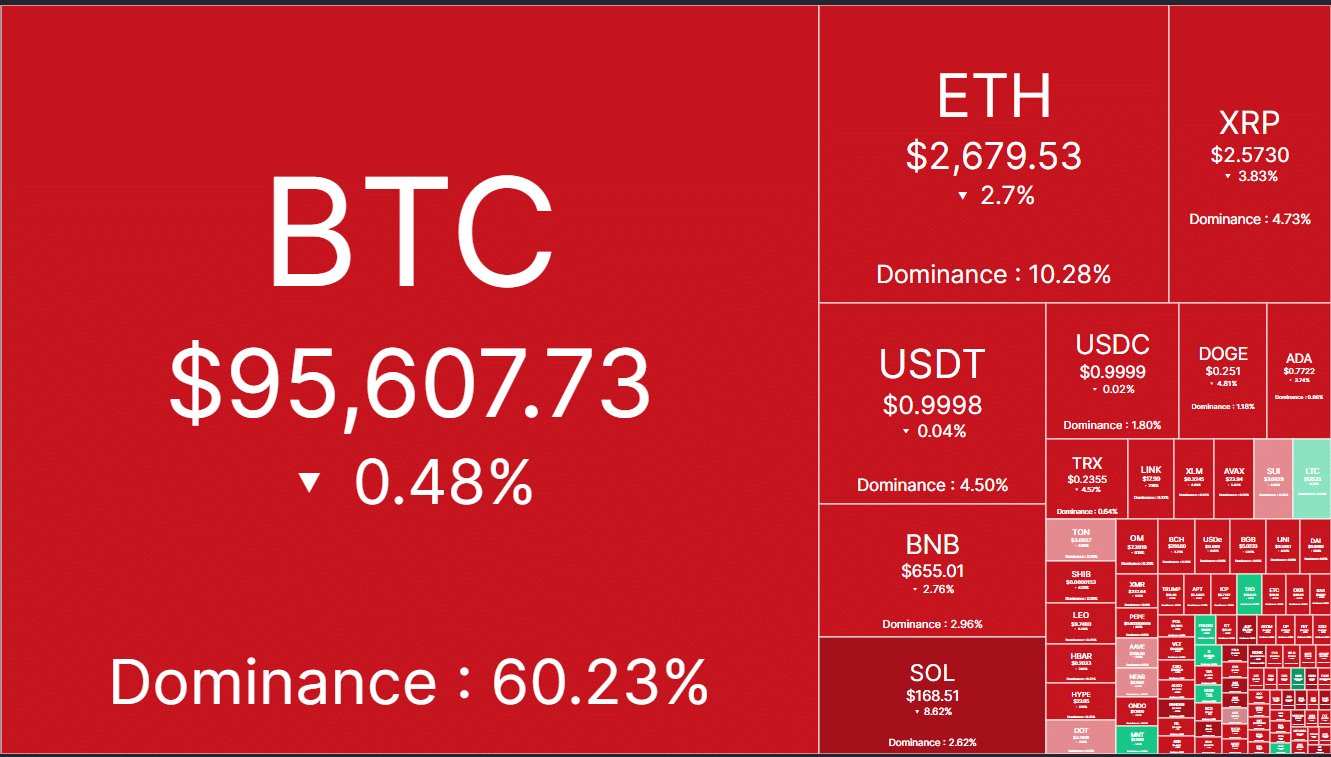

So, crypto started the week in style—by dragging its weekend losses right along with it. The market cap dropped from $3.3T to $3.15T, which is like losing a small country in three days. Oops, $150 billion—bye bye.

During this fabulous downtrend, Solana (SOL) seemed to have gone into full-on panic mode, shedding a whopping 15% and slipping below $170. Meanwhile, XRP followed suit with a not-so-glamorous 8% drop, still hanging above $2.5 (barely).

But hey, Bitcoin (BTC) only dropped by less than 3%, and Ethereum (ETH) retracted by a modest 2%. Not exactly running for the hills, are they? Look at them, showing a bit of resilience in all this chaos!

LIBRA Meme-Coin Drama: The Gift That Keeps on Giving

The crypto market was already in a bad mood thanks to macro uncertainty, but then—surprise!—the LIBRA meme-coin “scam” showed up to make things worse. Thanks, guys.

QCP Capital, the crypto options trading desk that knows how to call out drama, commented:

“BTC dominance has shot up to 60%, the highest in four years. Meanwhile, #ETH and other altcoins are just… not doing well. And let’s not even get started on the $LIBRA ‘rug pull’ scandal involving Argentina’s President Javier Milei. Ugh, altcoins and memecoins have had it.”

Also, for those wondering why Bitcoin’s upside is practically on lockdown—it’s the Fed. The January interest rate pause from them wasn’t exactly what we hoped for.

Fed governor Patrick Harker has been keeping that hawkish tone alive, reminding us all that rates will stay put until inflation “gets its act together.” Which, honestly, is a bit like waiting for the next season of your favorite show to be announced—forever in limbo.

This bearish pressure means Bitcoin has been stuck under $100K for nearly two weeks. Not a great look. However, Bitcoin dominance (BTC.D) has surged above 60%, which is effectively blocking any altcoin rebound. Sorry, altcoins!

But, hold on—some analysts, like Realvision’s Jamie Coutts, are saying there might be one more painful “flush” before Bitcoin bounces back. And by flush, we mean another round of market devastation.

“Some solid protocols are down 50-80%. We’ve had a good ‘flush’ already, but it seems like we might get another one. Ugh, sentiment is terrible right now. Probably one more decent flush coming our way.”

Despite all this gloom, there’s a sliver of hope. Bernstein analysts (yes, those optimistic folks) are betting big on Bitcoin in the medium term. They’re predicting that the next leg of the Bitcoin bull market is ready to roll in, thanks to some “positive catalysts”—whatever those are.

“The next Bitcoin bull market is coming, and it’s bringing some solid catalysts with it. We believe the Crypto Task Force (led by David Sacks) is focused on delivering the National Bitcoin Reserve, just like the President wants. Because who doesn’t love a good national reserve, right?”

They’re even talking about the US Sovereign Wealth Fund (SWF) potentially adding Bitcoin and other cryptos as reserve assets. So, maybe not all hope is lost, after all!

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-02-19 01:15