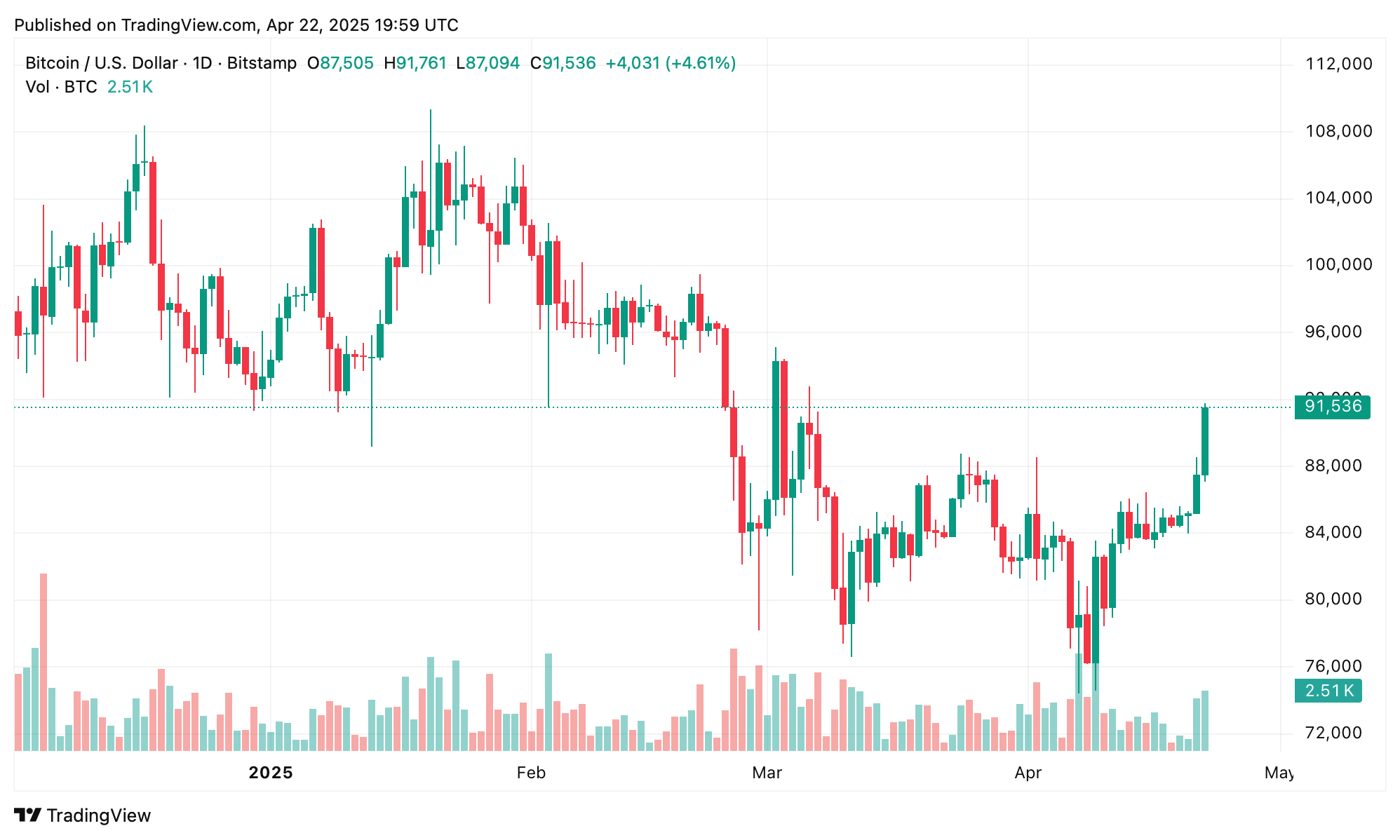

On Tuesday, the global crypto market decided to pretend it actually knows where it’s going, surging 4.94%, with bitcoin flirting with an intraday peak of $91,761. That’s right—a 5.1% pop in 24 hours, and the crypto economy puffed itself up by a whopping $130 billion since Monday evening, as if trying to convince you it’s not just Monopoly money. 🤑

Bitcoin’s Like That Overachiever Sibling While Wall Street Shows Off Tuesday Gains

Bitcoin and its unruly gang, the crypto economy, decided to shine brighter than your laptop’s “update required” notification. By 4 p.m. EDT on April 22, there was $103.64 billion waltzing through global trade volume, up 16.6%—which sounds impressive until you realize no one knows who’s actually holding the tickets. Bitcoin’s own sales floor buzzed with $45.73 million, trading at $91,536 per coin as I typed this, for whatever that’s worth.

While bitcoin took a modest 5.1% elevator up, ethereum (ETH) decided to sprint, bouncing 7.64%. Solana (SOL) strutted its stuff with a 6.25% rise, and dogecoin (DOGE)—because why not—jumped 8.75%. The top hit list of bitcoin’s dance partners includes tether (USDT), USD, USDC, FDUSD, EUR, and KRW—proving that crypto appreciates a little international flair. Meanwhile, meme coin turbo (TURBO), apparently fueled by pure optimism and caffeine, rocketed 36.63%, with POPCAT and FARTCOIN also making loud entrances, up 27.06% and 21.36%, respectively. Because, of course.

Not everyone got an invite to the party. IP took a nosedive of 5.93%, WEMIX got a 4.9% slap, GAS slipped 4.47%, FET dropped 2.63%, and CORE eased back 2.16%. The crypto derivatives market was bloodier than a reality TV reunion—$347.12 million shredded, including $128 million of bitcoin shorts vaporized. Ethereum shorts tried their luck but lost over $54 million. A grand total of 108,069 traders found themselves liquidated, with the star disaster on HTX where someone’s single BTC position evaporated into $3.65 million worth of regret. Oops. 💸

Meanwhile, the stock market decided not to be left out of the fun. Thanks to whispers of U.S.-China trade détente, equities bounced like they had a triple espresso. The Nasdaq soared 2.41%, adding 383.55 points, closing at 16,254. NYSE followed with a respectable 2.08% gain. The Dow Jones decided to flex hard, vaulting an eye-watering 1,005 points (+2.63%) to finish at 39,175, and the S&P 500 wasn’t shy either, climbing 2.37% to 5,280. So yes, Tuesday was basically the global markets’ equivalent of a group hug after a messy breakup. 🤷♂️

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Kidnapped Boy Found Alive After 7 Years

- Silver Rate Forecast

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Oblivion Remastered – Ring of Namira Quest Guide

2025-04-22 23:29