So, Ethereum ($ETH) just pulled off a magic trick and defended the oh-so-psychological $1,700 support level. It’s like watching your friend finally get off the couch after weeks of binge-watching to reclaim their dignity at the $2,000 range.

And guess what? This move has everyone in the derivatives market feeling all warm and fuzzy inside. After a dramatic winter of capitulation fears-thanks, post-ETF stagnation-our dear second-largest cryptocurrency is flexing its muscles, showing signs that it might actually want to reverse its bad behavior. With global rate cut expectations softening the economic blow, it looks like the road ahead is finally leaning toward the sunny side.

But hold on to your wallets, folks! This recovery isn’t just a pretty face; it’s got the structural integrity of a luxury car. On-chain data reveals that exchange reserves for Ethereum are at multi-year lows. If that doesn’t scream “supply shock,” I don’t know what does. It’s like the market is gearing up for a party, and institutional demand is bringing the chips and dip.

Now, traders have their eyes glued to the $2,850 resistance zone-basically the financial version of the “Do Not Enter” sign. If Ethereum breaks through that barrier, we might just witness a liquidity cascade that sends prices skyrocketing toward $3,000 faster than you can say “to the moon.”

But let’s be real; markets are about as predictable as a cat on catnip. As Ethereum grinds through these major hurdles, savvy traders are diversifying into high-beta utility plays, because why not make things even more complicated?

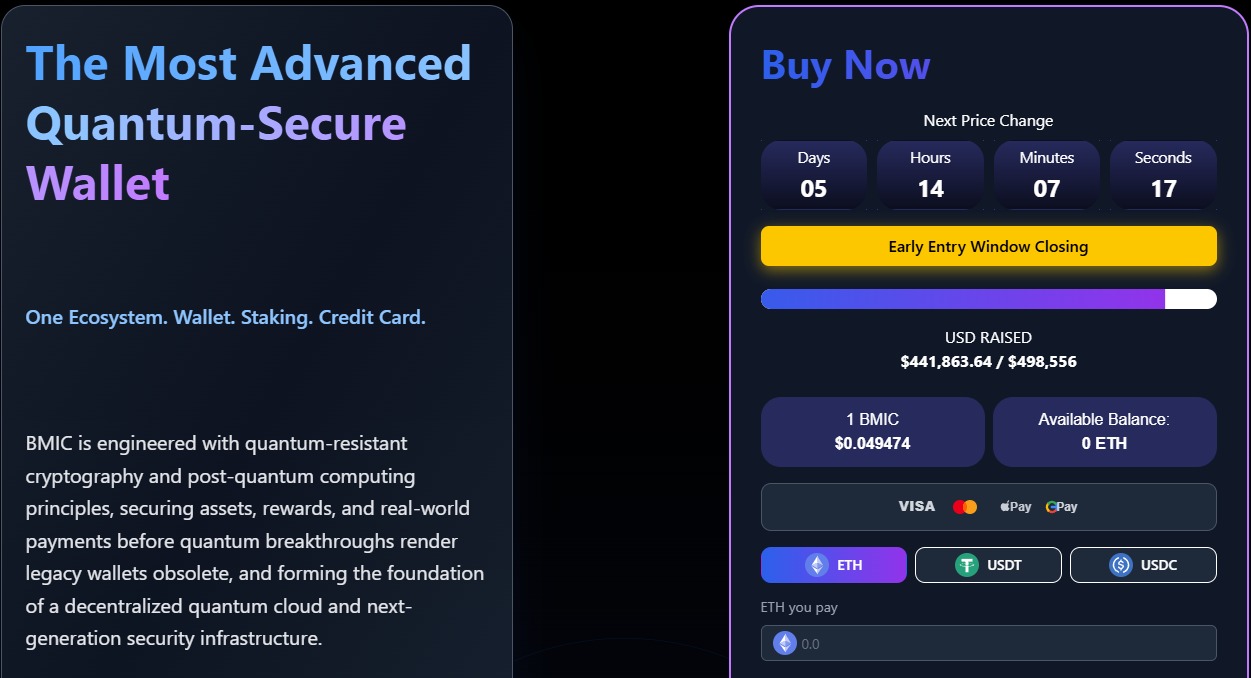

Enter BMIC ($BMIC), the new kid on the block that investors are flocking to like moths to a flame. It’s all about hedging against potential security threats while riding the wave of quantum-proofing the blockchain stack. Because who doesn’t love a little science fiction in their investments?

Check out $BMIC here. Seriously, do it.

Technical Indicators Are So Hot Right Now: ETH Is Eyeing $3,000

Right now, Ethereum is coiling up like a spring ready to explode. Trading just above $2,000, ETH has established a ‘higher low’ structure on the weekly timeframe-a classic bullish setup. The Relative Strength Index (RSI) is playing dead on the daily chart, which isn’t exactly a good sign, but hey, at least we’re not crashing… yet.

While spot ETH ETF inflows have been as mixed as my feelings about pineapple on pizza, recent days have seen Grayscale’s ETHE outflows finally dry up, removing a major source of sell-side pressure. If we see net inflows turn positive for three consecutive days, history suggests we could be in for a wild ride.

Three distinct scenarios are currently in play:

- The Bull Case: $ETH flips the $2,250 resistance into support with high volume. This would validate the trend reversal and open a direct path to $3,200, courtesy of short liquidations. Bring on the confetti!

- The Base Case: Price hangs out between $2,550 and $2,750 for a few weeks. This gives moving averages time to catch up before the next leg up. It’s like waiting for the perfect moment to strike.

- The Invalidation: A macro shock forces a daily close below $2,000. That negates the bullish structure and risks a retest of the $2,100 liquidity pools. Cue the ominous music.

Keep your eyes peeled on the volume profile at $2,200; this is where the bears will likely make their last stand. Game on!

Get your $BMIC here. Trust me, it’s worth it.

Smart Money Is Doing the Cha-Cha: Why $BMIC Could Outperform in a Quantum Future

While Ethereum battles for every percentage point, smart capital is cha-cha-ing over to infrastructure projects that address existential threats. Because nothing says “fun” like worrying about the future of humanity.

BMIC ($BMIC) is stealing the spotlight by tackling the ‘harvest now, decrypt later’ vulnerability. That’s right, folks-bad actors might be hoarding all that encrypted data today, just waiting for quantum computing to mature so they can wreak havoc. But BMIC is here to save the day, offering utility that might just decouple from standard market correlation, potentially giving us asymmetrical upside if the broader market decides to rally.

BMIC stands alone as the only platform boasting a full quantum-secure finance stack. Think wallet services, staking, and payments protected by post-quantum cryptography. It’s like the superhero of crypto! They even use ERC-4337 Smart Accounts to eliminate public key exposure-because who needs that kind of drama?

Presale data shows growing confidence: the project has raised over $441K to date, with tokens currently priced at a cool $0.049474. So basically, it’s like finding a treasure map on a Tuesday.

For investors, the value proposition extends beyond security. The ecosystem features a ‘Burn-to-Compute’ model and AI-enhanced threat detection. But let’s be real; risks remain. Like any presale asset, BMIC carries higher volatility and regulatory uncertainty compared to established Layer-1s. It’s like a rollercoaster, but without the safety bar.

This is essentially a specific bet on when quantum supremacy hits-and the crypto industry’s frantic race to adapt. Spoiler alert: it’s going to be a wild ride.

Buy your $BMIC here. Seriously, don’t miss out on this!

This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies, particularly presales, are high-risk investments with significant volatility. Always conduct independent research and consult a licensed financial advisor before making investment decisions. No pressure!

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- JRR Tolkien Once Confirmed Lord of the Rings’ 2 Best Scenes (& He’s Right)

- 🚀 DOGE to $5.76? Elliott Wave or Wishful Barking? 🐶💰

- Holstin to be published by Team17

- Unleash the Seas: ‘Master and Commander’ Sets Sail on Stunning 4K Steelbook!

2026-02-09 11:46