The moonlit courtroom of cryptocurrency sentiment has slipped to a depth that Will Taylor, fledgling prophet of CryptoinsightUk, laments as “historical lows.” As the loss of hope drips into the charts, even the most obstinate indicators that usually remain mute begin to shiver.

In a manuscript dated the 14th of February, Taylor mused that the market is no longer simply “collapsing” but has slid into the abyss of a late‑stage drawdown. He highlights one of the clearest signposts: a subtle duet between XRP and gold.

He coined the week “another painful week in crypto,” stressing that timing, like a great opera, matters. On Bitcoin’s weekly score, he noted that the “just hit oversold levels” note appears only thrice in recent history. The previous occurrences marked either the valley of the bear market or a point “very close to it.” With this intense mood paired with a statistically rare cue, he leans toward market exhaustion rather than a fresh wave of doom.

The thrust of his argument hinges on anticipating a burst of volatility in Bitcoin dominance. He sees Bollinger Bands on dominance as “extremely compressed,” a state unstable by definition: “Compression leads to expansion; expansion leads to volatility. In simple terms, volatility is inbound.”

Where to go is the real debate. Taylor presents his base case as a decline in dominance to below 36%, a scenario that, if Bitcoin price stays sturdy or rises, signals not just new money flowing into crypto but a rotation across the risk curve. In November 2024, when dominance collapsed by roughly ten points, “XRP saw a subsequent move of around 490%,” he says, christening it a “vertical expansion.”

Supporting this rotation hypothesis, Taylor points to the OTHERS/BTC ratio, the market outside the top ten relative to Bitcoin. In the monthly view, RSI has just crossed bullish, the chart lies “on the verge of printing” a second green monthly MACD volume candle after a bullish cross near the lows. In his view, the market’s hands dance to a single rhythm: altcoins reclaiming relative strength as dominance’s volatility compresses.

XRP Against Gold: A Historic Zone Setup

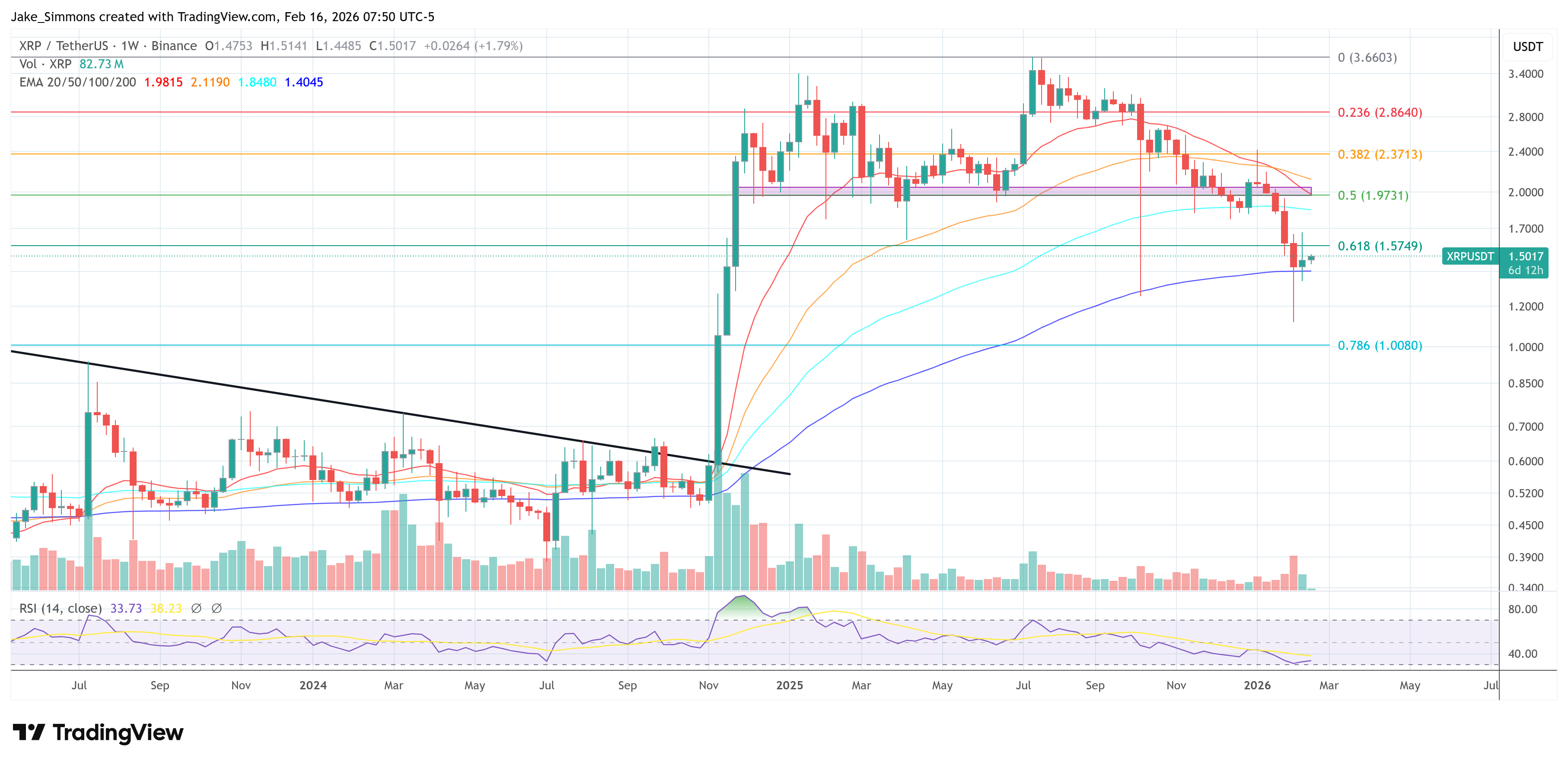

Expectations crystallize when Taylor turns to XRP priced against gold-a pairing he claims remains largely ignored yet structurally illuminating. “When you look at XRP priced against gold, what you’ll notice is that we’ve pulled back into an extremely strong historical support region,” he writes. “Meanwhile, the monthly RSI has reached levels we’ve seen only once before-right before the 2017 parabolic burst.”

From this pedestal, Taylor sketches a scenario rather than a prophecy: if XRP clings to that support and accomplishes a 4.236 Fibonacci extension “from this structure,” the move could reach “around 20x against gold.” He reminds readers that relative performance doesn’t translate cleanly to the dollar pair: “That does not automatically mean 20x against the dollar,” he says, noting gold could weaken and macro conditions may shift.

Still, he holds the relative signal as the real story. In his model, sustained outperformance versus gold suggests capital “aggressively rotating into risk,” a context where altcoins normally lead.

Taylor adds a second relative‑strength angle: XRP versus Ethereum. He proposes an Elliott Wave interpretation where XRP may have finished waves one and two against ETH, setting the stage for a potential wave three-the “most aggressive, most explosive leg.” Although he calls Elliott Wave “a framework, not a certainty,” he underscores a momentum detail: monthly RSI holding above 50 through consolidation, which aligns with continuation rather than breakdown.

At press time, XRP traded at $…

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- 10 Most Memorable Batman Covers

- Best X-Men Movies (September 2025)

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- Disney OpenAI Deal Stuns Hollywood: $1 Billion Investment, Sora Licensing, and a New Era of Fan-Created Disney Content

2026-02-17 06:53