The venerable Bitcoin, that most capricious of digital monarchs, now finds itself in a situation of considerable gravity. After months of parading about with the swagger of a bull market on a Saturday night, it has now retreated to a realm where the ghosts of 2018, 2020, and 2022 still linger like unwelcome guests at a tea party. The price, once aloft at $126K with the arrogance of a Bond Street bon viveur, now wobbles toward a support zone between $68K and $70K, where the crypto masses hope to find respite. Alas, the signs of distribution are as clear as a foghorn in a London pea-souper: profit-taking has surged, whales are migrating to exchanges with the urgency of a man late for a train, and momentum, that fickle mistress, is beginning to yawn.

With volatility tightening like a corset and sentiment as cautious as a mouse in a cat’s drawing room, the market teeters on the precipice of a momentous decision. The price’s behavior near $65K and $68K is of such import that one might think it were the outcome of a duel between two dueling duellists. Will it hold? Will it falter? Only the omniscient market gods know, but the suspense is as thick as a treacle tart at a village fete.

What, pray tell, lies ahead for our beleaguered BTC? Has it struck the bottom of its well-or is there yet more pain to be wrung from the loom of fate?

Bitcoin Nears Its Ascending Support, Much Like a Man Nearing a Lifeboat

Bitcoin’s chart, once a symphony of bullish bravado, now resembles a symphony orchestra tuning its instruments-awkwardly. The price, after scaling the dizzying heights of $126K, has begun its descent toward a support zone that has, in years past, served as the crypto equivalent of a life preserver. Between $68K and $70K, the stage is set for a dramatic confrontation between hope and despair.

The retracement, dear reader, is proceeding with the solemnity of a funeral march, while higher-timeframe momentum dwindles like a candle in a gale. It is not a collapse, but neither is it a rally. One might say the market is engaged in a delicate dance of indecision, tiptoeing around the question of whether this is a pause for breath or a prelude to a deeper dive.

Volume and on-chain indicators whisper that the large holders, those shrewd speculators with the patience of a cat waiting for a mouse, are taking profits and eyeing the horizon with the wariness of a man who’s just noticed the tide receding. Yet, structurally, BTC clings to its long-term support lines with the tenacity of a terrier with a bone. Should this zone hold, it could propel the price skyward with the vigor of a rocket. Should it fail? Well, the market may yet take a scenic detour into the abyss before resuming its upward climb.

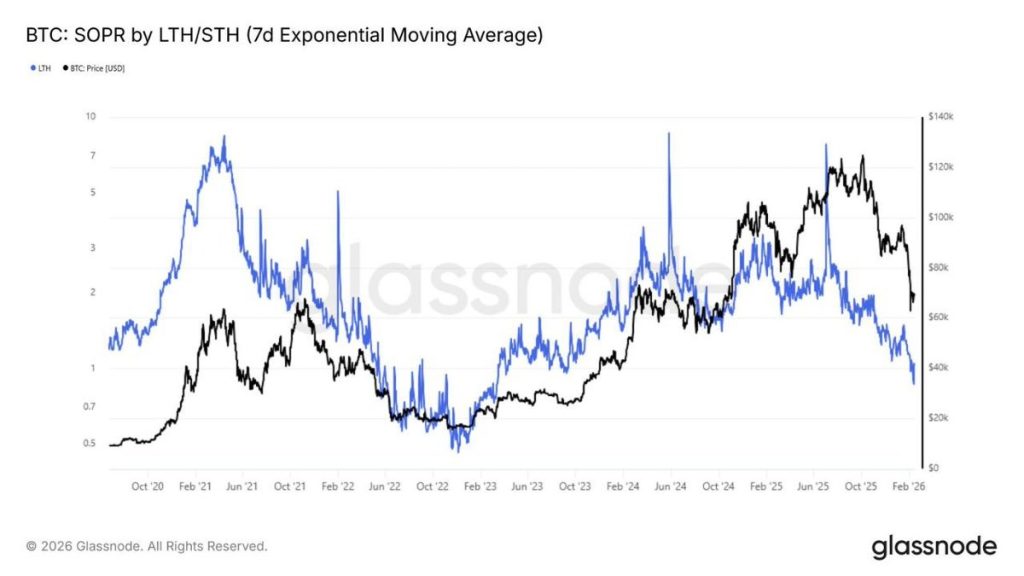

SOPR’s Sulk: Profit Compression and Holder Stress, Oh My!

The Spent Output Profit Ratio (SOPR), that fickle indicator of market sentiment, is currently sulking near the neutral 1.0 zone, where coins are spent with the apathy of a man at a buffet who’s already overindulged. Historically, such a reset has been the prelude to grander things, much like a yawn before a nap. It signifies:

- Profit-taking, reduced to the barest essentials

- Speculative excess, now as rare as a rainy day in the Sahara

- Holder reset conditions, where even the boldest investors pause to sip their tea

Should SOPR dip below 1, however, the market may find itself in a state of full capitulation, where coins are sold at a loss with the desperation of a man auctioning his grandmother’s teacups. For now, the ratio remains in a transitional phase, neither confirming a bottom nor a breakdown-merely dithering.

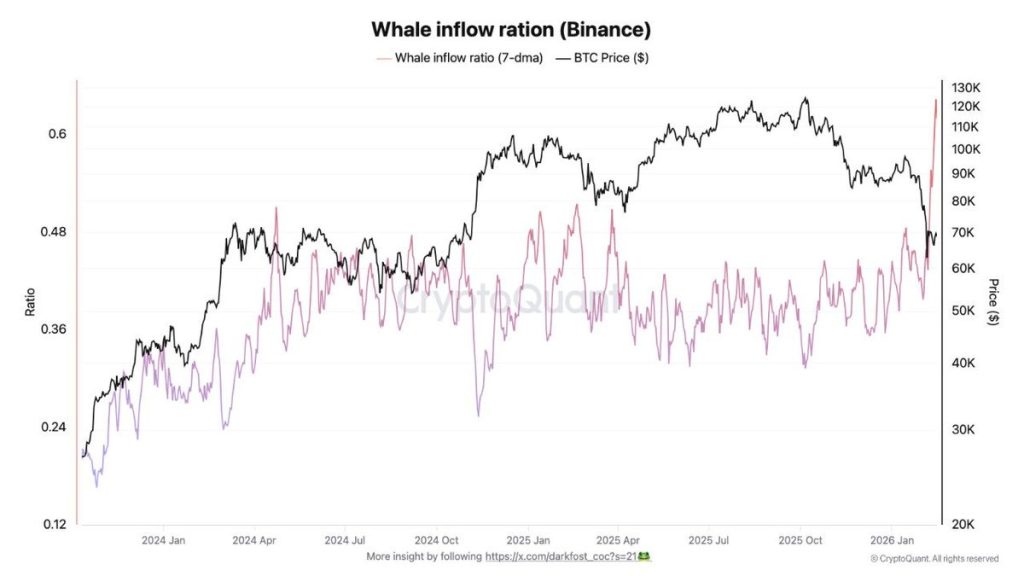

Whale Inflow Ratio: A Symphony of Uncertainty

The whale inflow ratio on Binance, that grand conductor of market liquidity, has seen a recent surge as price declines with the grace of a man in a too-tight waistcoat. This suggests that the great whales, those leviathans of liquidity, have been seen lumbering towards the exchanges with the alacrity of a man heading to a dentist. Such behavior is often observed during:

- Distribution phases, where coins are passed about like gossip at a garden party

- Volatility expansions, where the market’s nerves are as frayed as a silk stocking in a bear pit

- Pre-capitulation events, where even the boldest investors begin to whisper of retreat

These inflows may herald a local breakdown or a final flush before a reversal. The true test lies in whether these inflows persist or normalize as support holds. For now, the market is left in a state of bewilderment, much like a man trying to solve a crossword with half the clues missing.

What Lies Ahead for BTC’s Rally? A Game of Chicken With the Abyss

The Bitcoin price, dear reader, has yet to confirm a bottom or a breakdown. It is merely compressing, like a spring wound too tight. Profitability tightens, momentum cools, yet the large players remain as active as a school of piranhas in a river. The upcoming breakout may yet decide the fate of this rally, for should the price stabilize above $70K, it could form a new higher low with the elegance of a ballerina on a tightrope.

Conversely, a decisive breakdown below this range may drag the SOPR below 1 with the inevitability of a man sliding down a greased pole. Should the whale inflow remain elevated, the price may yet visit the lower support range between $55K and $60K, where a market reset could occur. One imagines the crypto masses clutching their pearls, hoping for a recovery as fervently as a Victorian matron hoping for a miracle.

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- 10 Most Memorable Batman Covers

- Best X-Men Movies (September 2025)

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

2026-02-17 15:17