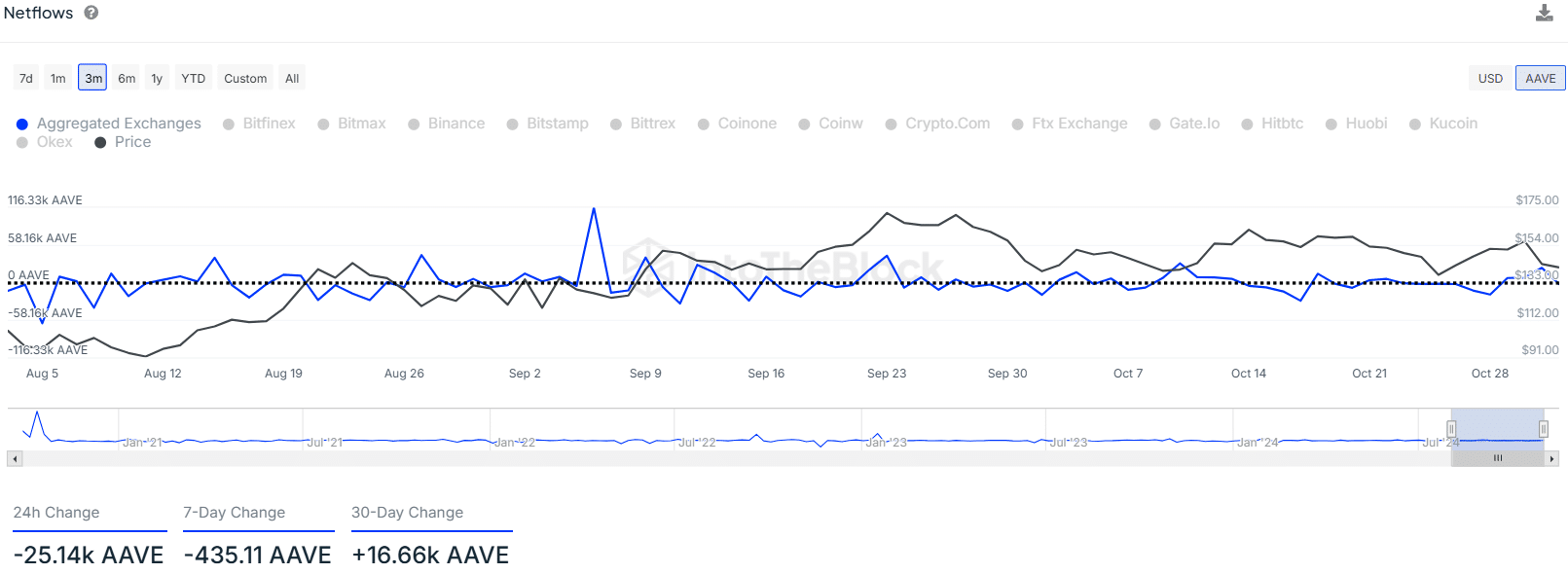

- AAVE saw lackluster exchange netflows OVER the past month

- The weekly bullish market structure break was a powerful signal

As a seasoned crypto investor with over 7 years of experience under my belt, I find myself closely monitoring the movements of Aave [AAVE]. Despite the lackluster exchange netflows over the past month and the weekly bullish market structure break being a powerful signal, I remain optimistic about AAVE’s potential.

As a researcher, I’ve been closely monitoring the performance of AAVE [AAVE] and I must say, its bulls have shown remarkable resilience in holding the $140 support level for the past two months. Yet, the longer-term price charts suggest that this altcoin could potentially reach a target of $200, with the potential for even more significant gains.

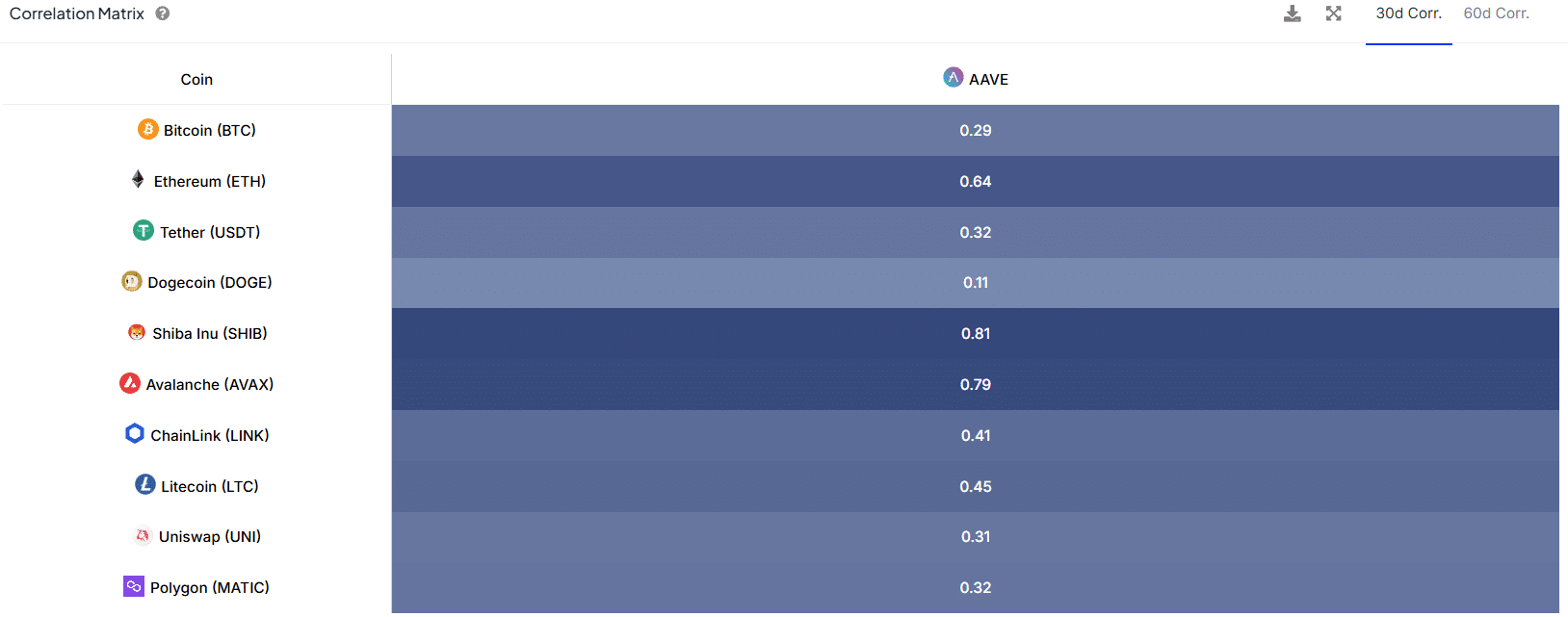

It wasn’t all that shocking that its 30-day correlation came in at +0.29. Over the last six weeks, while AAVE struggled to maintain $140 and regain $150 as a support level, Bitcoin has been consistently climbing higher.

However, long-term investors have little reason to be dejected just yet.

Signs of a sustained uptrend are yet to present themselves

According to AMBCrypto’s analysis, the data from the past week and month suggests a rather discouraging trend. The total outflow of AAVE over the last seven days was approximately $61,000, which equates to -435 AAVE. However, there has been a significant increase in AAVE inflows over the past 30 days, amounting to about $2.3 million, or +16.66k AAVE.

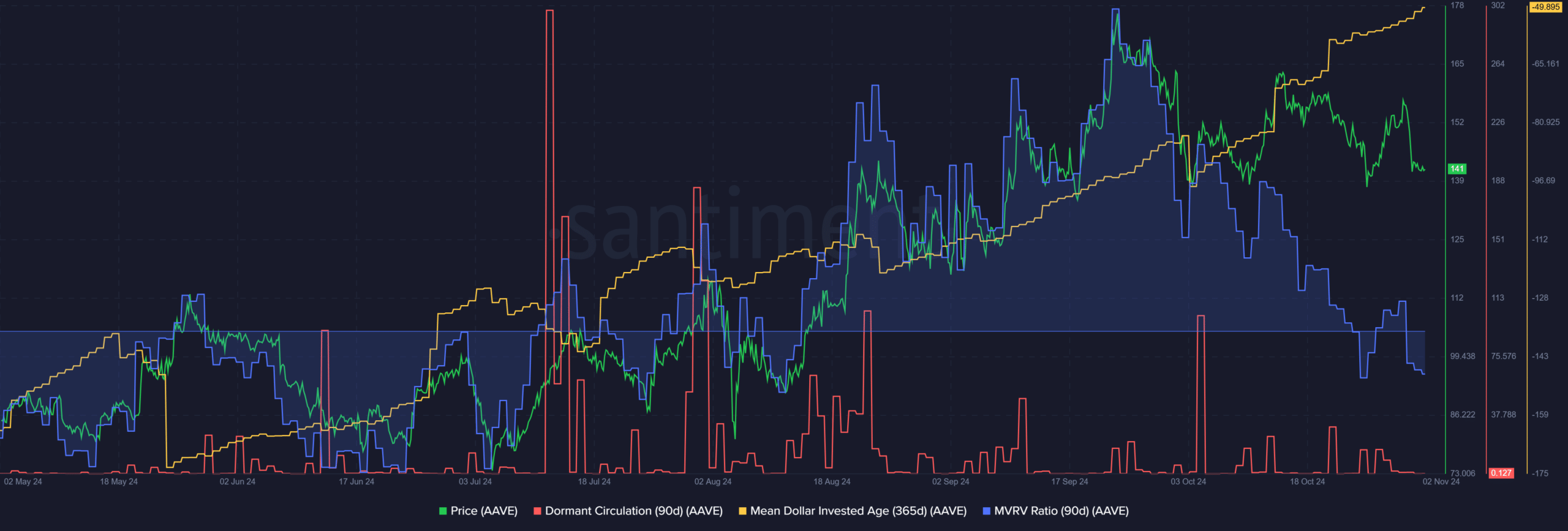

As an analyst, I’ve observed from Santiment data that there’s been a relative lull in token circulation over the last month. This quiet period stands in stark contrast to the surge of selling activity we witnessed around mid-July, indicating a decrease in token movement between addresses.

Hence, there likely isn’t a threat of high selling pressure in the next few days.

The drop in the MVRM ratio indicated that individuals who held for three months were, on average, experiencing losses. This circumstance might lead to a slight increase in selling as the price approaches $160. Moreover, it seemed to suggest that profit-taking wouldn’t halt the bullish momentum.

As a crypto investor, I’ve noticed that the bullish momentum is starting to take shape, but it might be more apparent on a weekly basis. For example, the continuous uptrend of the Mean Dollar Invested Age (MDIA) suggests a period of stagnation. A decline in MDIA could indicate increased activity and new buyers entering the market, which could potentially trigger a lasting uptrend.

AAVE gives strong clues on the higher timeframes

For the latter part of 2021 and all through 2022, there was a noticeable decline in the stock’s trend as depicted on the weekly chart. Furthermore, the region between $100 and $120 served as a persistent resistance zone that couldn’t be convincingly breached for approximately 805 days.

Read Aave’s [AAVE] Price Prediction 2024-25

In mid-September, the prolonged period of price stability for AAVE was disrupted as it surpassed its previous high of $153 in a weekly trading session, closing above that level. Following this, AAVE encountered resistance at $180 and took defensive positions around the $140 region.

As a researcher studying market trends, I observed six weeks ago that the weekly market structure break was a hint of potential bullish momentum. In the upcoming months, possible bullish targets could include $290, $400, and even reaching the all-time high of $661. A dip in the MDIA might serve as an early indication that the altcoin is gearing up for a significant surge upward.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

2024-11-03 07:03