- ApeCoin has a firm bearish structure and momentum in the 12-hour timeframe

- The spot and futures markets were in agreement about one thing- bulls remain sidelined

The token named ApeCoin [APE] is linked to the Bored Ape Yacht Club’s [BAYC] community on Ethereum [ETH]. According to AMBCrypto’s findings, the trading volume for NFTs was decreasing on the Ethereum network but dramatically increasing on Bitcoin.

The dropping prices for BAYC floor value lessened APE‘s significance in the marketplace. With a prevailing market bias towards selling, could the rebound to $1.3 be an early sign that buyers are regaining control?

The bearish breaker block posed a threat to APE bulls

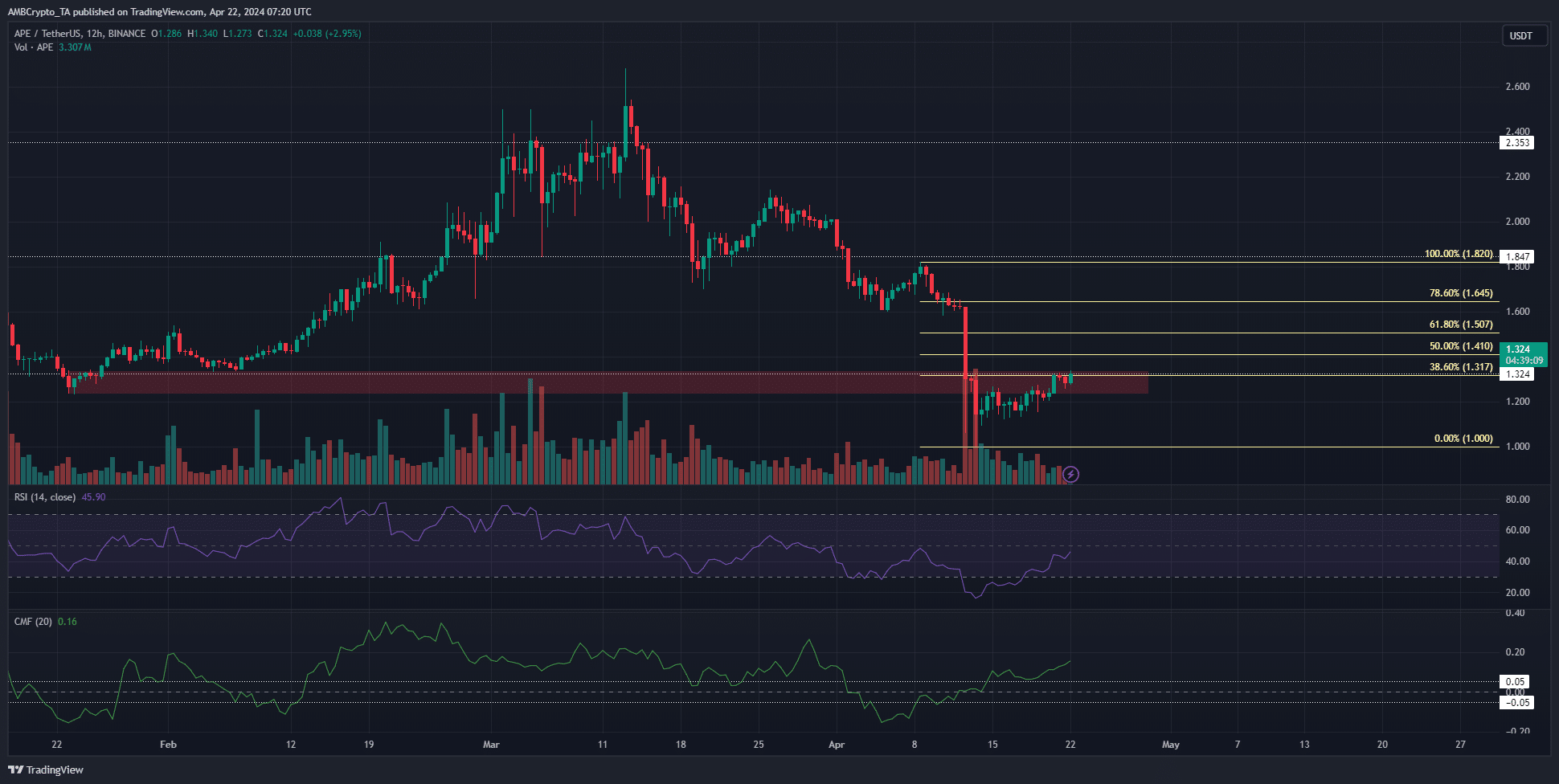

On the 12-hour chart, the market outlook showed bearish signs. Over the past week, the price dipped below the previous low at $1.233, marking the start of the February rally. The Fibonacci retracement lines from the recent downward trend revealed potential resistance points on lower timeframes.

In simpler terms, the stock’s price rebounded from $1, causing the Moving Average Convergence Divergence (MACD) indicator to rise above 0.05, indicating significant buying activity. However, the Relative Strength Index (RSI) was still below the neutral threshold of 50 on the 12-hour chart, suggesting that the momentum has not yet turned positive.

The red-marked $1.3 resistance level on the chart is significant because it’s a potential barrier for APE‘s price increase, acting as a bearish threshold. Should APE manage to surpass $1.32, its next notable target would be $1.64 – representing a 78.6% Fibonacci retracement level.

On the higher timeframes, a move past $1.82 would switch the market structure bullishly.

The lack of capital inflows showcased bearish caution

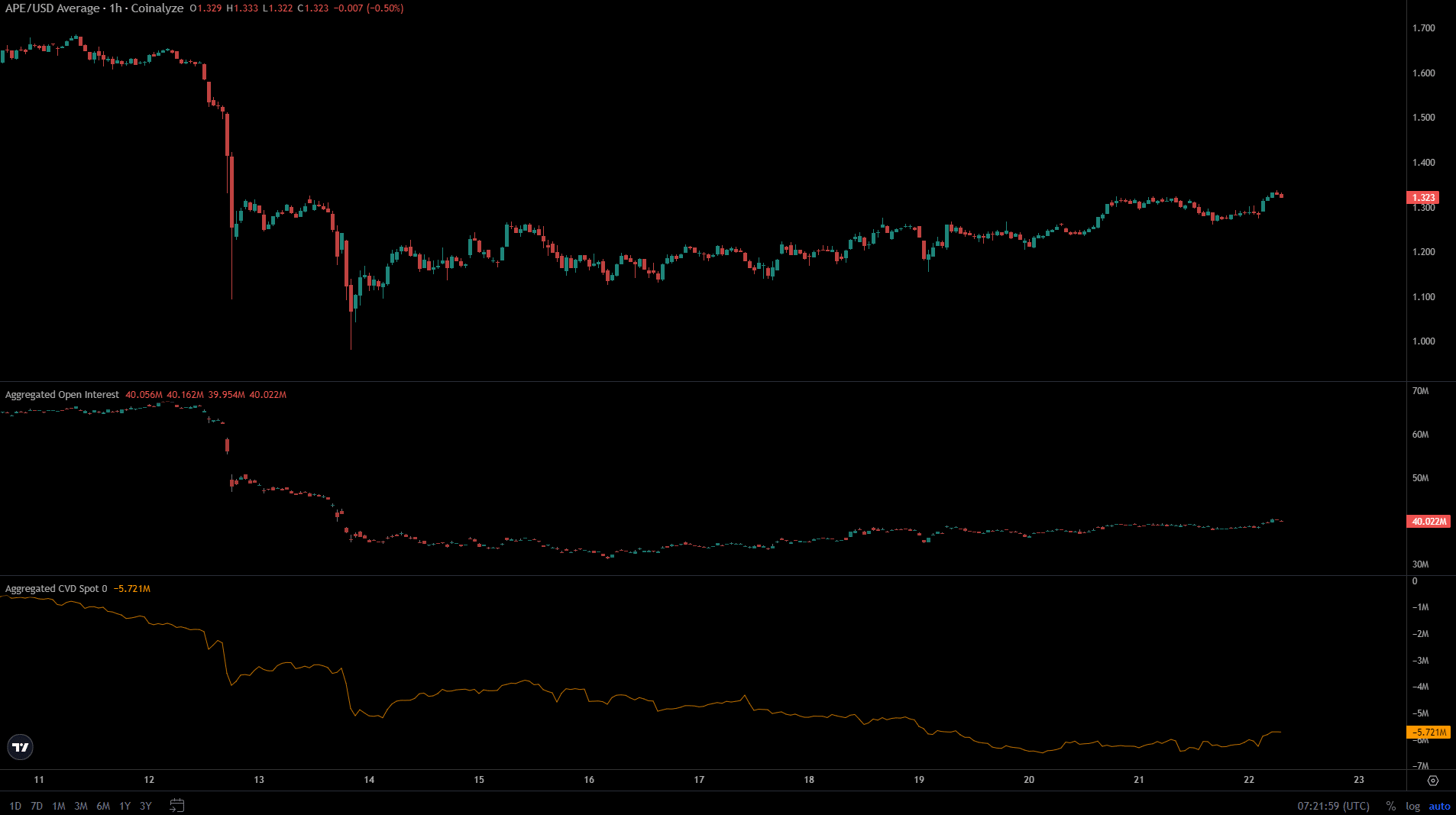

Based on Coinalyze’s data, the bulls faced an unfavorable situation last week. The CVD in the spot market kept declining, and although there was a significant 30% increase in the past two days, the demand remained insignificant.

Is your portfolio green? Check the ApeCoin Profit Calculator

At the current moment, the Open Interest grew in tandem with the prices, yet it didn’t suggest strong bullish sentiment among traders. Neither the futures nor the spot market players seemed optimistic about a potential comeback for ApeCoin based on the available information.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-22 15:03