-

BNB rose to an all-time high on 6th June.

It may trade above $750 if buying pressure is sustained.

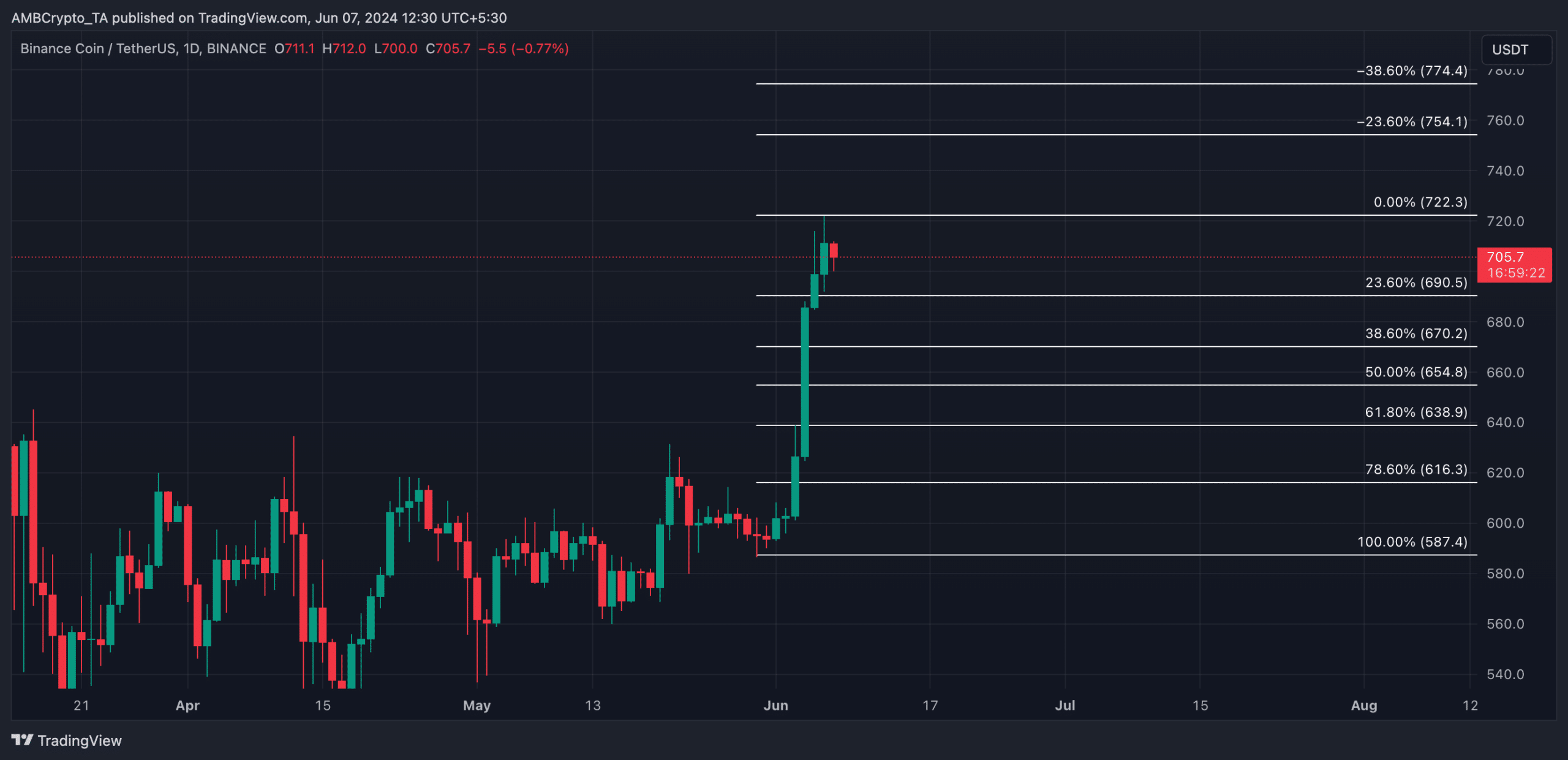

As a seasoned crypto investor with a keen eye for market trends, I’ve witnessed the meteoric rise of Binance Coin (BNB) in recent weeks. The altcoin reached an all-time high of $720 on June 6th, marking a significant milestone for this popular cryptocurrency.

On June 6th, Binance Coin (BNB) reached a new peak price of $720 during trading, but then experienced a small decline afterwards.

At the current moment, according to data from CoinMarketCap, the altcoin was traded at a price of $706, which is a 2% decrease from its peak value.

Demand for BNB surges

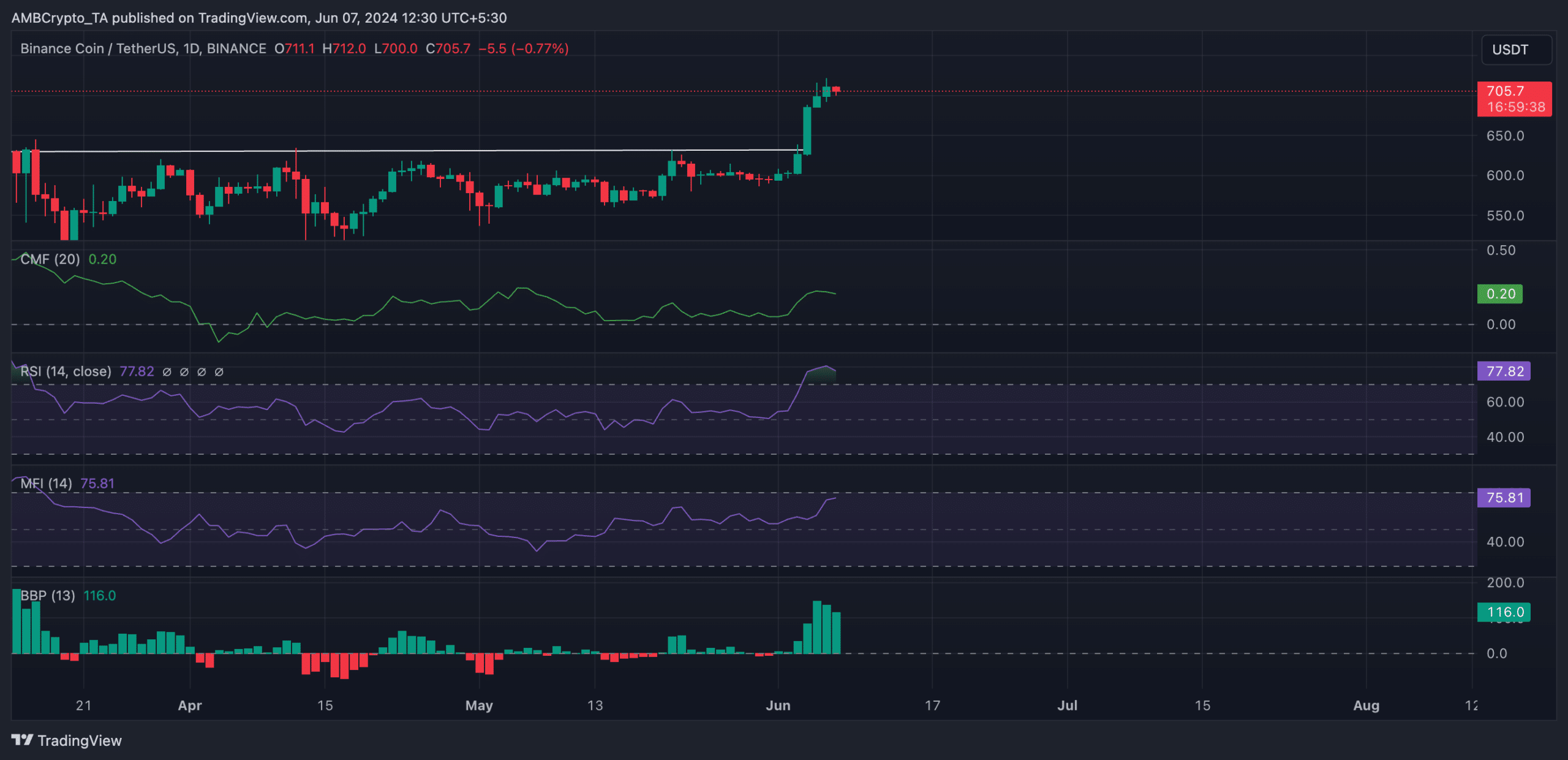

Before the 3rd of June, I observed that Binance Coin (BNB) had been trading within a horizontal price range. Horizontal channels emerge when an asset’s price remains consolidated within a specific band for an extended duration. The upper boundary of this channel acts as a resistance level, while the lower boundary functions as a support level.

From my perspective as a researcher studying Binance Coin (BNB), I’ve observed that bearish market conditions established a resistance level around $632. On the other hand, bullish forces managed to protect the coin’s value at the price of $518, which subsequently functioned as a significant support level in the long term.

The significant increase in purchases during the past month caused Binance Coin (BNB) to climb above the upper boundary of its horizontal trading range and finish at $686 on the 4th of June.

I, as an analyst, have observed that the bullish trend in the Binance Coin (BNB) market has been sustained over the last few days due to stronger buying momentum compared to selling activity.

I analyzed the coin’s momentum indicators through my readings and found that its Relative Strength Index (RSI) stood at 77.82, while its Money Flow Index (MFI) was at 75.91 as of the moment I penned this down.

At these levels, the buying actions from BNB traders surpassed the profit-realization actions.

As a financial analyst, I can confirm that the coin’s demand has significantly increased, as indicated by its Chaikin Money Flow (CMF) hovering above the zero line at 0.20.

As a researcher studying financial markets, I would describe this indicator as follows: This metric represents the rate of change in money flowing into and out of a given asset’s market. A positive Cumulative Moving Average (CMA) value signifies a strong market condition. In simpler terms, this means that more coins are being bought than sold, resulting in a net inflow of liquidity into the market.

Moving forward, the Elder-Ray Index for BNB signaled bullish strength with a value of 115.7. Following its break above resistance on June 4th, this indicator has consistently displayed positive readings.

As a market analyst, I would describe this indicator as follows: I examine the balance of buying and selling pressure in the market through this metric. A positive reading signifies that buyers hold more influence, indicating a bullish market trend.

Realistic or not, here’s BNB’s market cap in BTC terms

BNB might rally to exchange hands at $754 if buying pressure is sustained.

If the current situation proves to be incorrect and profits from selling BNB increase significantly, its price could potentially dip down to around $690 from its current level of approximately $700.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-08 04:07