- MATIC lacked a trend on the higher timeframes.

A revisit to the mid-range level could serve as a buying opportunity.

As an experienced analyst, I’ve witnessed Polygon [MATIC] struggle to gain momentum despite the broader market’s positive sentiment. The lack of a clear trend on higher timeframes leaves me concerned about potential false breaks or prolonged sideways action.

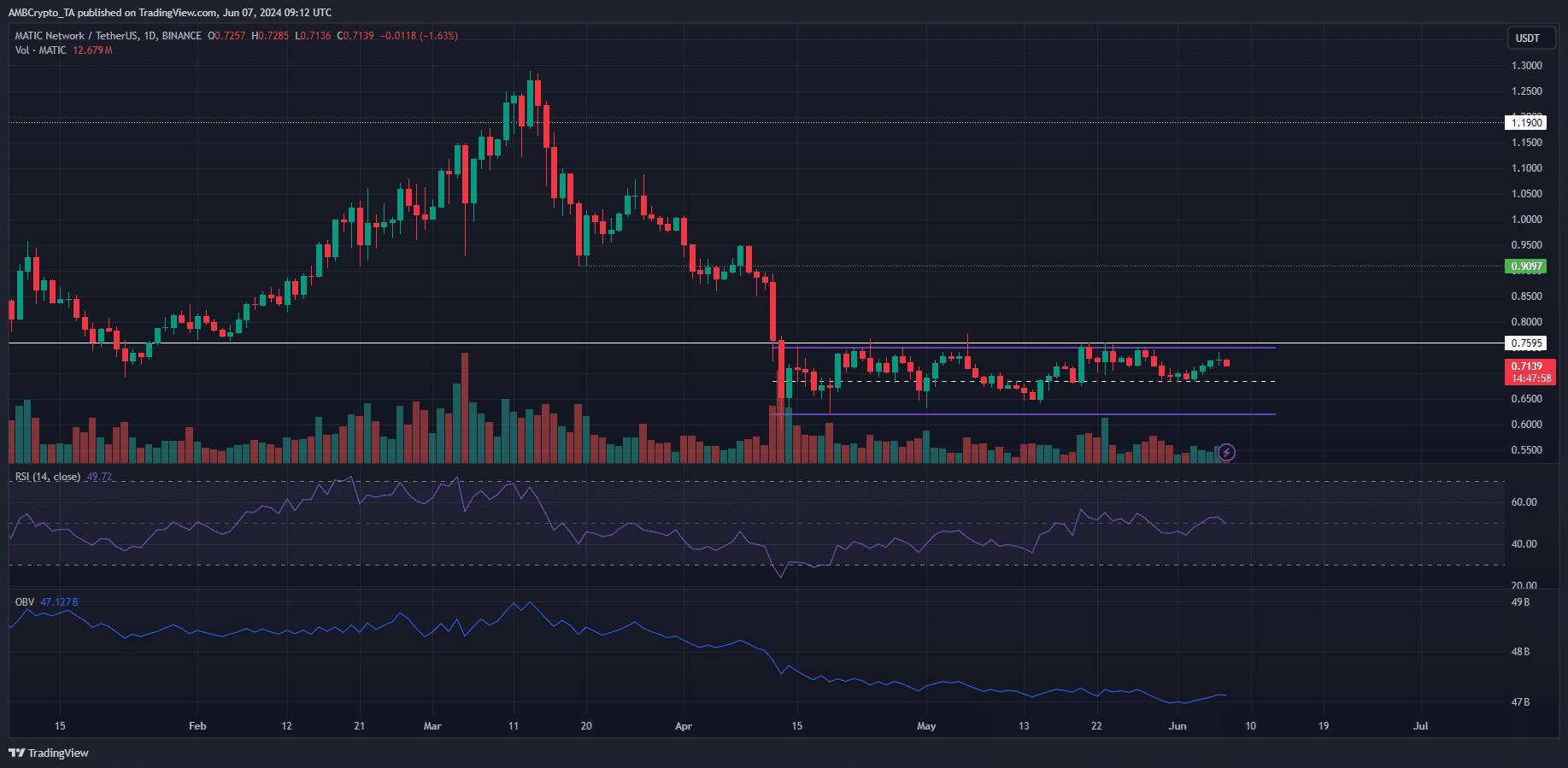

Despite the bullish mood pervading the broader market, Polygon [MATIC] persisted in its downward trend, with the price remaining confined within a two-month price range.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing shift in sentiment following Bitcoin‘s [BTC] ascent above $70,000. Having held firm at the $67,000 support level, a sudden surge was not guaranteed for either Polygon (MATIC) nor Bitcoin. In the context of MATIC traders, here is what you might anticipate in June:

More boring price action to follow?

In the initial half of March, the $1 level, previously acted as resistance during February’s robust advance, transformed into a source of support. Nevertheless, the buying power failed to sustain this level.

As a crypto investor, I’ve noticed that despite their efforts, they weren’t able to prevent MATIC from plummeting down to the $0.6 mark, which is even lower than its previous low in January at $0.69.

As an analyst, I’ve observed that the range of the purple line on the chart spans from a low of $0.62 to a high of $0.75, with the midpoint being at $0.685. Over the past month, this support level has proven significant in halting price declines, making it a likely candidate for prices to rebound should they test it once more.

As a researcher studying market trends, I’ve noticed that the one-day Relative Strength Index (RSI) for MATIC has been lingering around the 50 mark, indicating a lack of clear momentum in the price action. However, if the On-Balance Volume (OBV) can manage to surpass its previous resistance levels, it could be an early indication that MATIC is gearing up for a potential breakout.

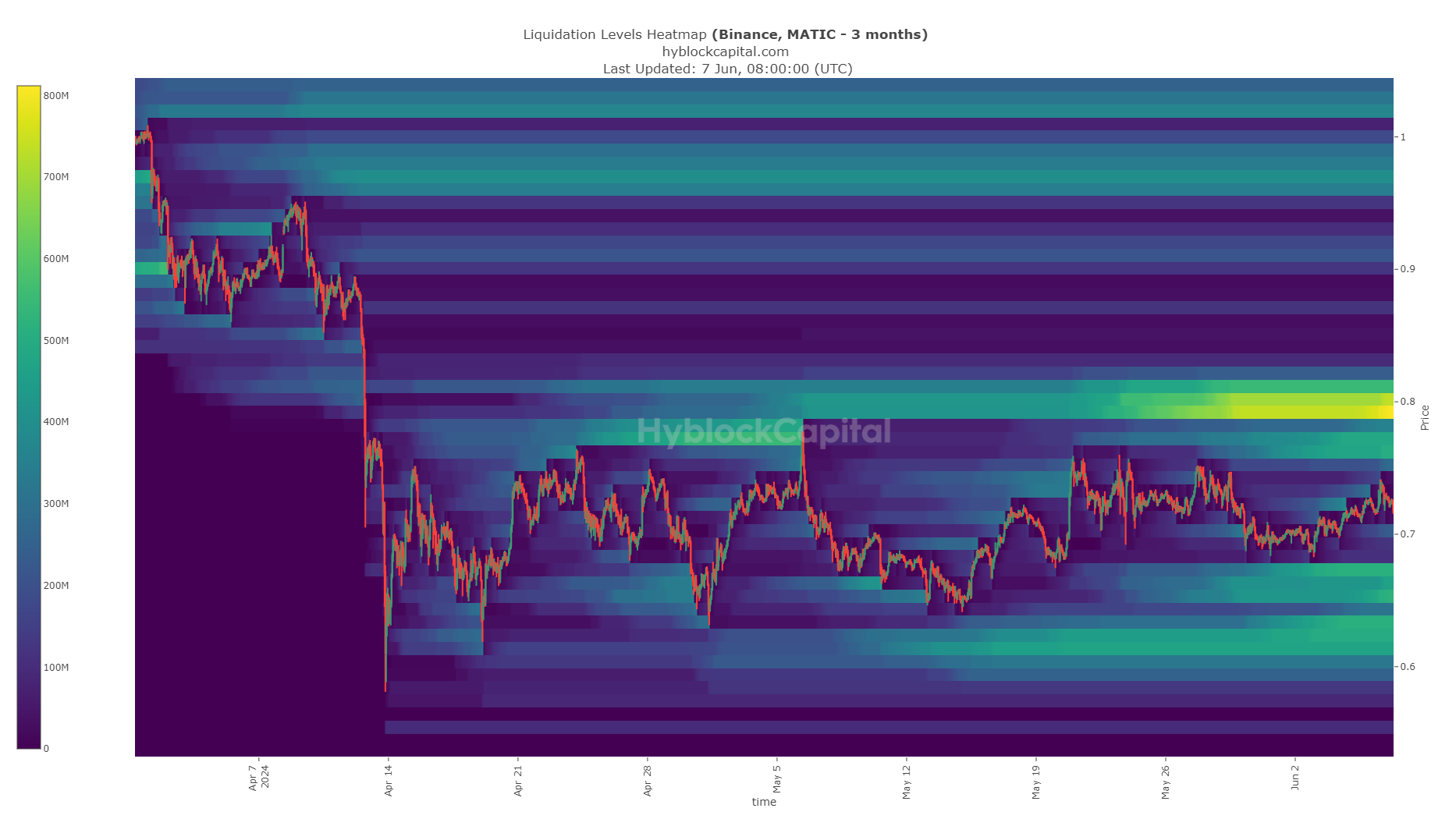

The liquidity pockets show a bullish breakout might be perilous

At a price of $0.75, the highest bid or ask lies. A concentration of prolonged sell orders can be found at $0.8, with another such grouping present at $0.762.

Is your portfolio green? Check the Polygon Profit Calculator

If prices exceed the two-month price range, they may encounter a reversal around the $0.8 mark.

Based on current market conditions, investors should exercise caution. For traders, it may be prudent to view the $0.75-$0.8 range as a potential resistance area and adjust their strategies accordingly.

Read More

- JASMY PREDICTION. JASMY cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-06-08 03:03