- Dormant Bitcoin whales have awakened, with decade-old addresses reactivating.

- Now, FOMO could spark a push to $73K, but there’s a catch!

As a seasoned researcher with over two decades of market experience under my belt, I can’t help but feel a sense of intrigue and anticipation as dormant Bitcoin whales resurface, awakening from their decade-long slumber. The parabolic rally we’re witnessing today has been fueled by a perfect storm of macro factors that have catapulted Bitcoin to unprecedented heights, and the reactivation of these long-dormant wallets adds an exciting layer to this already captivating narrative.

An extraordinary combination of large-scale influences – such as the post-halving growth spurt, the excitement surrounding “Uptober,” the impending end of the election period, and Fed interest rate reductions – has ignited a dramatic upward trend, propelling Bitcoin [BTC] to reach $69K in merely 10 trading days.

Contrary to past events, these recent rallies see the bulls actively disregarding bearish resistance. Notably, the lowest points of each day are only marginally surpassing a 1% decrease.

Instead of causing panic among traders due to its swift rise, which may prompt them to secure profits and vacate their holdings, the market is currently waiting for a critical trigger – probably the confidence of major investors, or “whales” – to perceive the present level as an optimal opportunity to invest.

A long-dormant Bitcoin whale resurfaces

On the platform known as X (previously Twitter), it’s been disclosed that an old Bitcoin wallet, which hadn’t been used for more than ten years, has suddenly become active. This wallet is holding approximately 25 Bitcoins, currently worth roughly $1.7 million.

It’s important to look at the timeline of this movement. The reactivated wallet has held its 25 BTC since 2013, when Bitcoin’s price ranged from $100 to $266.

Due to Bitcoin’s remarkable surge recently, the holder of this digital wallet now owns a highly valuable resource. Interestingly, it’s worth noting that this is the second appearance of an older ‘Bitcoin whale’ in merely two days.

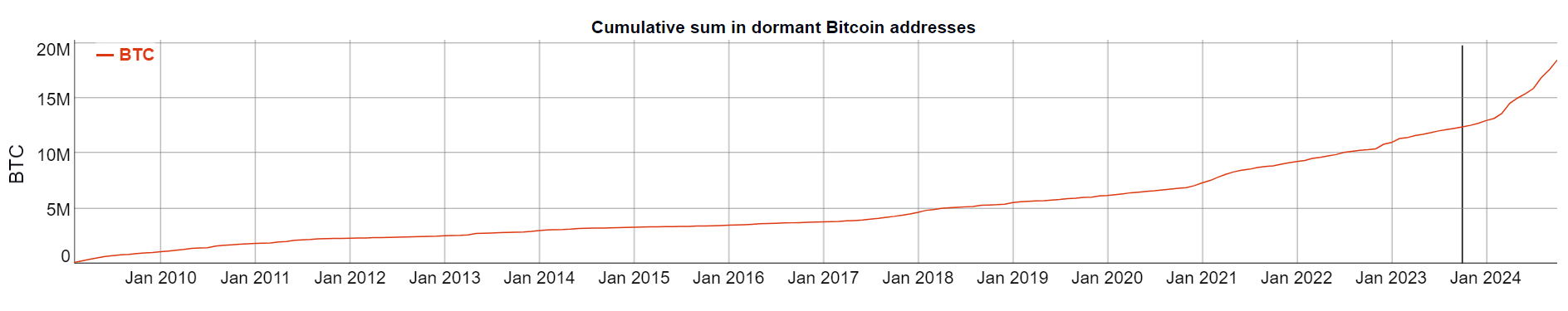

Source : BitInfoCharts

Over the past decade, the amount of BTC stored in dormant wallets has reached an ATH of 19 million BTC. At a price of $69K, this translates to approximately $1.311 trillion.

An increase in unused Bitcoin wallets often indicates a positive market trend, as owners prefer to hold onto their Bitcoin in anticipation of price growth rather than selling. But this accumulation also implies a significant amount of Bitcoin might enter the market if those holding it decide to sell, which could potentially influence prices downwards.

Keeping tabs on wallet activity is essential now that these wallets have resumed activity. If their users perceive the present price as an opportunity to sell, it could attract more buyers and stir up fear of missing out in the market. Conversely, if they believe there’s limited potential for growth, a substantial decrease might occur.

Trust from big players is vital

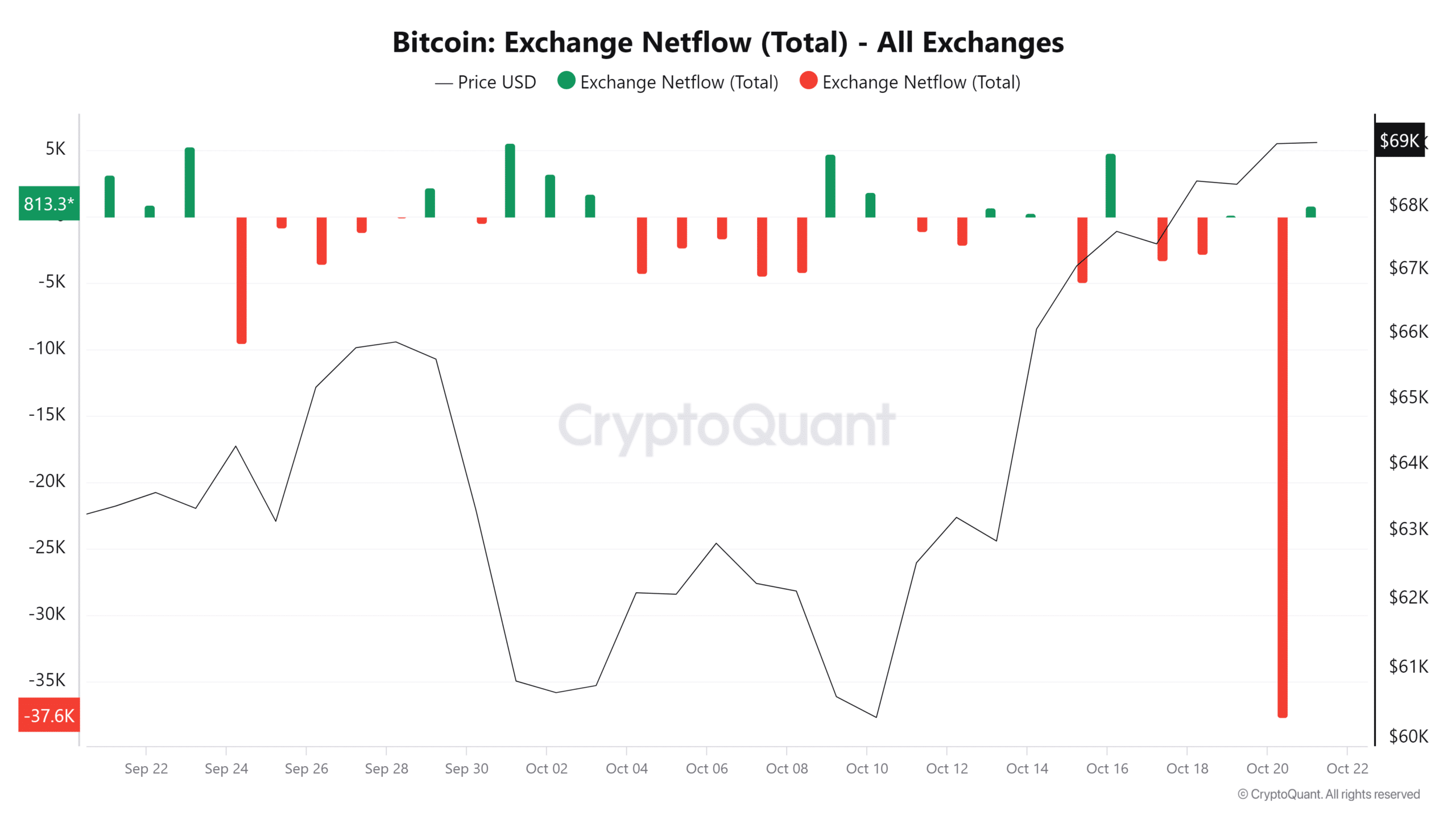

It’s worth noting that AMBCrypto has discovered an intriguing pattern which might indicate increasing market volatility.

Yesterday, I noticed a significant increase in the number of Bitcoin (BTC) being transferred to exchanges, as evidenced by the large red candlestick on the chart. This inflow caused a substantial rise in exchange reserves, indicating a potential shift in market sentiment or increased trading activity.

Source : CryptoQuant

Nevertheless, even with the intense selling pressure, Bitcoin’s price movements remained quite steady. The closing price of over $69,000 was significant as it had not been attained for around four months previously.

It’s highly probable that this anomaly occurred due to the involvement of whales, who seem to have taken up a significant amount of selling pressure. This isn’t merely conjecture; it’s supported by solid evidence. In fact, as the data demonstrates, approximately 40,000 BTC were bought by large investors on that very day, as indicated in the chart.

In essence, whales are crucial players in maintaining balance within the market. Without their presence, the market might become too heated, potentially indicating a peak and leading to widespread selling off.

However, if their confidence wavers, a retracement could be imminent.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-10-21 17:12