-

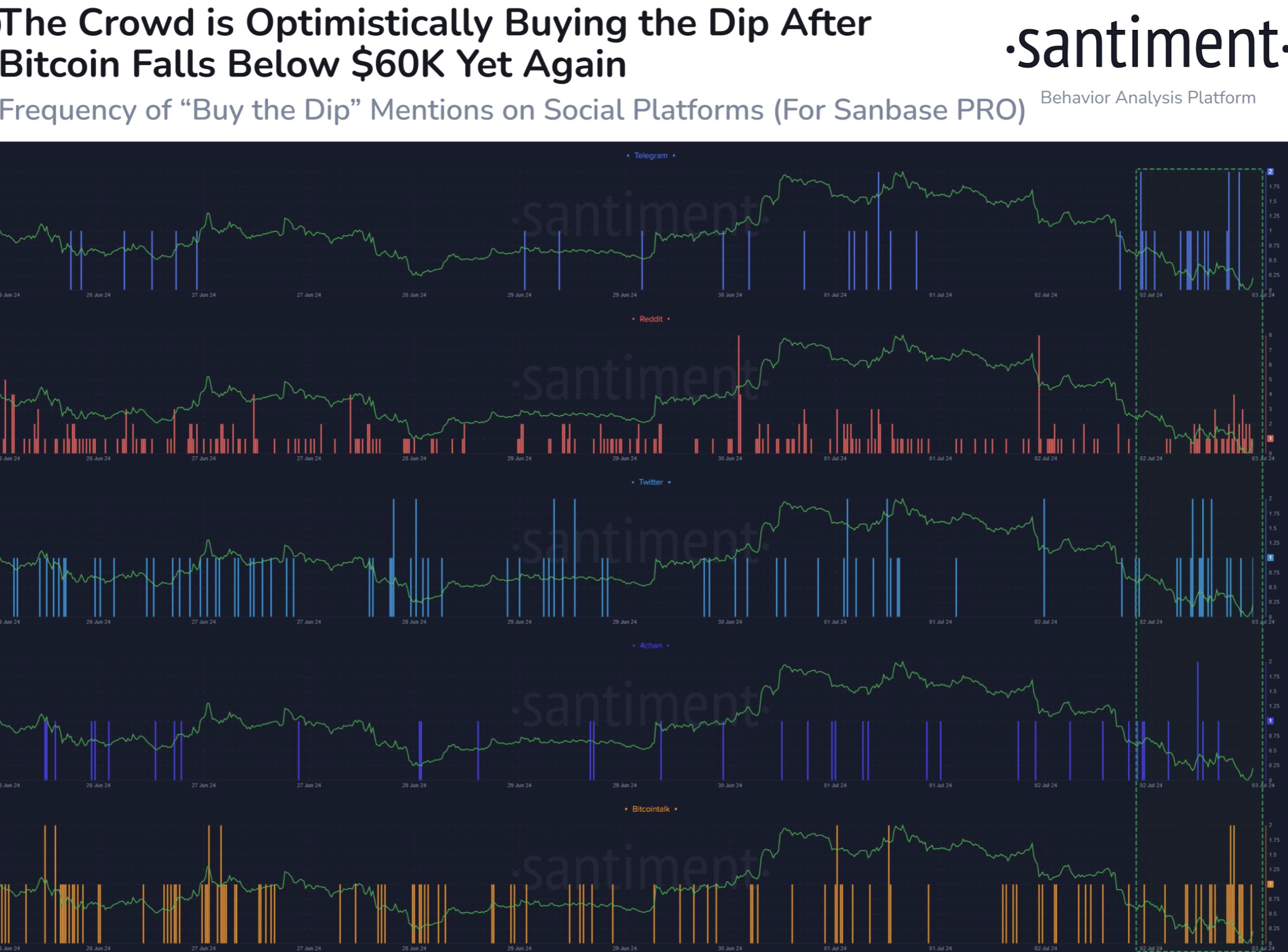

Social media was agog with “buy the dip” calls, signaling market confidence in a rebound.

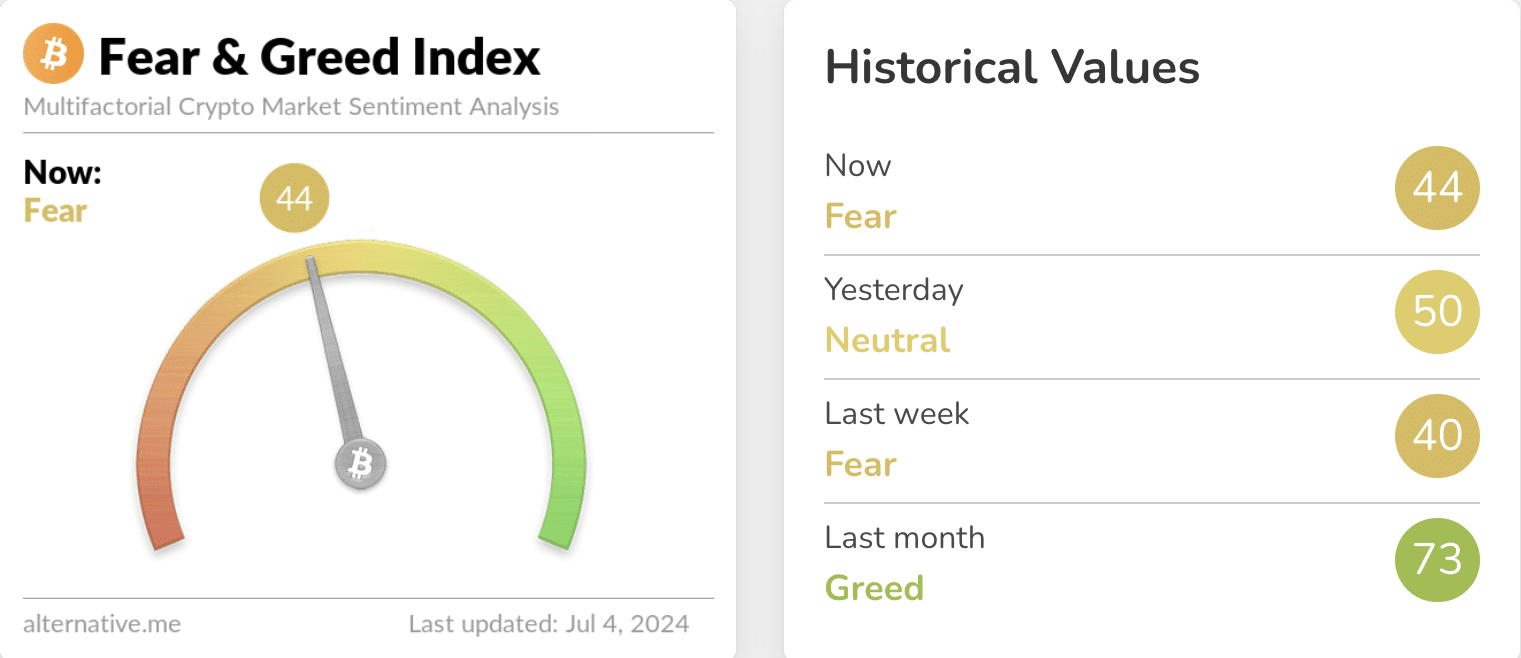

While the Fear and Greed Index suggested an accumulation phase, on-chain data showed that BTC risks a further fall.

As a researcher with experience in cryptocurrency markets, I find the current situation intriguing. The calls for buying the dip after Bitcoin’s price drop below $60,000 are widespread on social media, indicating market confidence in a rebound. However, there are signs of potential further falls based on on-chain data.

As a market analyst, I’ve noticed an uptick in calls for investors to buy the dip on July 3rd, following Bitcoin [BTC] falling below the $60,000 mark. Interestingly, this decline wasn’t limited to Bitcoin alone. Ethereum [ETH], among other cryptocurrencies, also experienced a significant drop, effectively pulling down almost the entire market with it.

As of the current moment, the price for one Bitcoin was $57,598. This marked a 4.88% drop in value over the past 24 hours. However, many traders in the market appeared optimistic about this decline, viewing it as a chance to purchase at reduced costs.

According to Santiment, an on-line analytics tool for cryptocurrencies, there has been a significant surge in the number of “buy the dip” references across various platforms. As reported by AMBCrypto, using Santiment’s social volume metric, this trend has rapidly gained traction.

Is the fear enough for a bounce?

Yet, not all calls result in success. Particularly, a bounce transpires when a significant segment of the cryptocurrency market harbors doubts about price growth.

Santiment, in its post on X, also agreed with this thesis, saying that,

“The crowd seems to be interpreting this situation as a chance to purchase at a discount. It’s best to hold off and observe as their excitement subsides. The optimal moment to invest usually arises when they become restless and doubtful.”

One way to rephrase this in natural and easy-to-read language: To gauge whether the broader market is expressing skepticism or confidence, we looked at the Crypto Fear and Greed Index. This index assesses the emotional responses and sentiments of crypto market participants.

As a researcher studying market behavior, I’ve observed that people often exhibit fear when market values drop within a range of 0 to 100, and prices start displaying red numbers. This fear is a natural response to potential losses. On the other hand, during periods of significant price increases, people may experience greed, driven by a desire to capitalize on these rising figures and avoid missing out on potential opportunities.

If the index indicates an extreme greed condition, it could signal that Bitcoin and the wider market are overdue for a price correction. Conversely, when the index reflects an extreme fear state, it may present a buying opportunity, often referred to as “buying the dip.”

As a market analyst, I’d interpret the current reading of the Fear and Greed Index at 44 as an indication that the market is experiencing fear. This situation might present an opportunity for cautious investing by gradually accumulating assets. However, it’s essential to keep in mind that the market could still reach new lows despite this potential buying opportunity.

As a crypto investor, I believe that if the market exhibits signs of excessive fear, it might offer an excellent opportunity to buy at lower prices. Therefore, keeping an eye on market sentiment and being prepared to take advantage of potential dips is crucial.

Bitcoin continues to face pressure

I recently analyzed the data from blockchain analytics platform IntoTheBlock, which indicated that Bitcoin surpassed a significant resistance level at $60,000. Consequently, the next substantial demand area is located between $40,000 and $50,000. According to their findings.

Bitcoin has broken through its crucial support level of $60,000. Approximately 16% of Bitcoin owners are now facing losses as a result. Historically, the demand for Bitcoin has been feeble in the region just below $60,000. This trend implies that downward pressure may continue. The next substantial support level is situated between $40,000 and $50,000.

If Bitcoin keeps declining and potentially drops below $56,000, it may reach the previously mentioned price range, which could result in significant losses for many investors. To prevent this outcome, supporters of Bitcoin need to work diligently to keep its price above $55,000.

But that could be difficult to achieve as institutions continue to sell BTC.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve come across some intriguing news from Lookonchain. They’ve revealed that an approximate total of 249.5 million US dollars in Bitcoin has been transferred from the German government to three popular exchanges: Coinbase, Kraken, and Bitstamp.

When such events transpire, a coin experiences heavy selling pressure, making it challenging for its price to bounce back. Consequently, market players may find themselves compelled to purchase dips persistently until the prices attain a stable state.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Gold Rate Forecast

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Solo Leveling Season 3: What You NEED to Know!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

2024-07-05 05:12