In the current market drama, darling, U.S. spot Bitcoin ETFs are stumbling along with less gusto than a rushed cabaret act, while the crypto sun sulks and investors tread carefully.

Over the past few days, Bitcoin ETFs have failed to record any fresh capital intake. Rather, some of the funds have either logged zero inflow or see notable withdrawals from investors.

Following the persisting negative trend, the Bitcoin ETFs have recorded another massive outflow during their last trading session, marking their fifth day of consecutive outflows.

$103.57 million exit spot Bitcoin ETFs

Latest data from SoSoValue shows that the total daily ETF flows logged by all Bitcoin funds has remained negative as they have seen a massive $103.57 million in outflow as of Jan. 23.

This negative performance extends the persisting bearish trend seen across the market and other ETF products, including Ethereum-related products.

Amid the consistent daily outflow, the cumulative total net inflow across the U.S. Bitcoin spot ETFs have plunged mildly, yet it remains strong at $56.49 billion as surging market fears continue to outweigh demand.

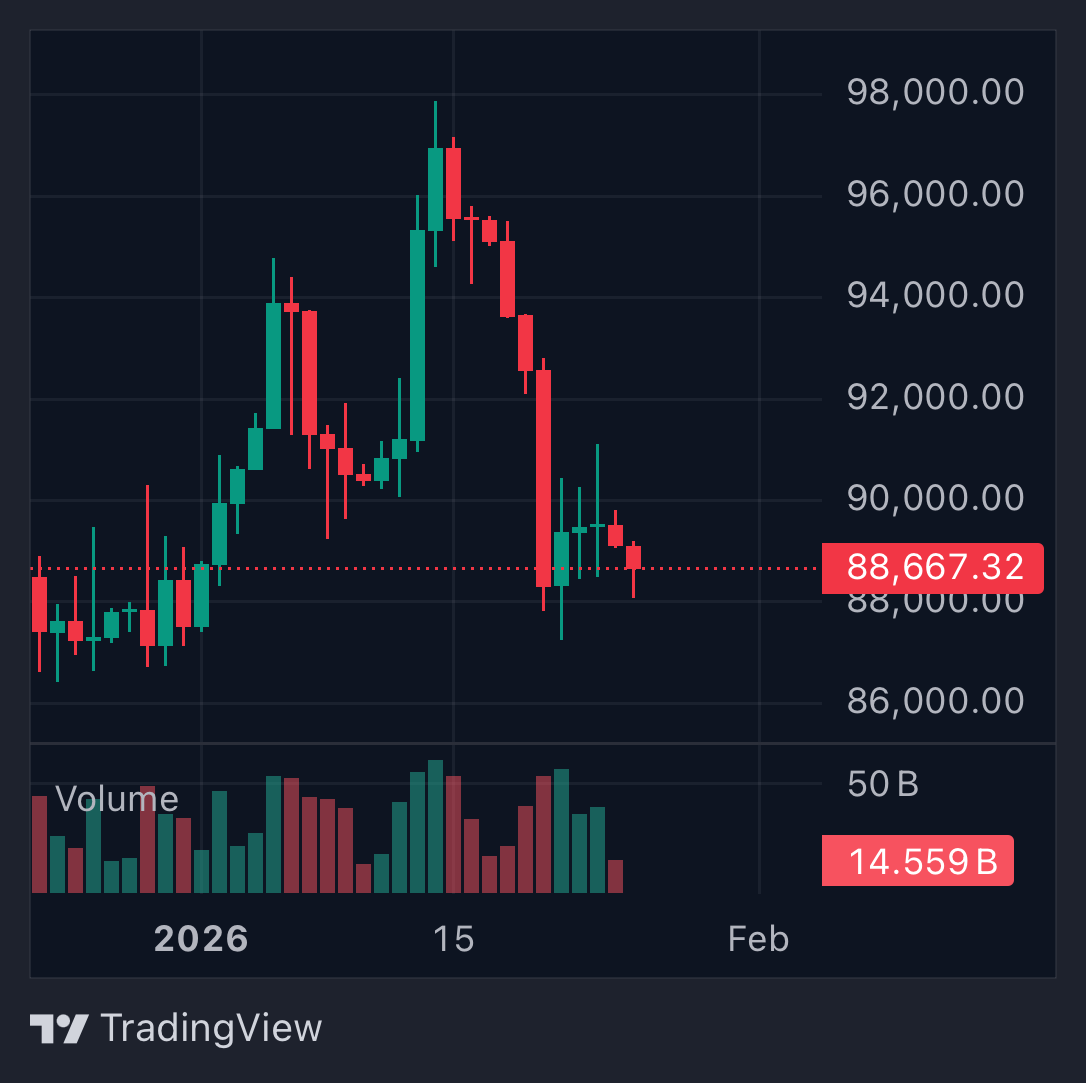

Bitcoin retests $87,000

The current Bitcoin price correction, which has come shortly after the strong rally witnessed earlier this year, has seen Bitcoin retreat from a high near $98,000 to a low of $87,000 in just a few days.

Following the sharp price decline, Bitcoin has remained in the red zone for the past days, and investors are beginning to trade with caution as optimism begins to grow weak.

While selling pressure has continued to rise, Bitcoin is currently trading around $88,646, showing a decline of 0.83% over the last 24 hours, according to data from TradingView.

Nonetheless, BlackRock has continued to lead the Bitcoin ETF market even in times of weakness, and it has solely contributed to over 99% of the outflow recorded on the day.

During the last trading session, the BlackRock Bitcoin ETF saw $101.62 million in outflow.

Read More

- When Is Hoppers’ Digital & Streaming Release Date?

- Sunday Rose Kidman Urban Describes Mom Nicole Kidman In Rare Interview

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Best Thanos Comics (September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Top 10 Heroes from the Future

- Amelia Finally Breaks Grey’s Anatomy’s Romance Curse In Season 22

2026-01-25 20:27