-

Bitcoin’s price has increased by over 12% in the last seven days.

Metrics suggested that BTC might turn bearish even before retesting its ATH.

As a seasoned researcher with extensive experience in studying Bitcoin and other cryptocurrencies, I have witnessed countless price swings and market corrections throughout my career. The recent surge in Bitcoin’s price has been nothing short of remarkable, with its 12% increase in the last seven days and breaking past the psychological resistance of $60k. However, as someone who has seen the market’s volatility firsthand, I am not blind to the potential risks that lie ahead.

Bitcoin’s price has broken through the significant barrier of $60,000, signaling a potential rebound. This uptrend may lead Bitcoin back to its record-high value in the near future.

As a researcher studying the cryptocurrency market, I’ve observed that following an all-time high (ATH), a coin may encounter a significant obstacle due to a substantial increase in liquidations.

Bitcoin to retest its ATH?

According to CoinMarketCap’s latest findings, Bitcoin experienced a significant price surge of approximately 12 percent over the past week.

Over the past day, the value of the cryptocurrency coin surged by more than 4%. Currently, Bitcoin is being bought and sold at the price of $62,543.73, and its total market worth exceeds one trillion dollars.

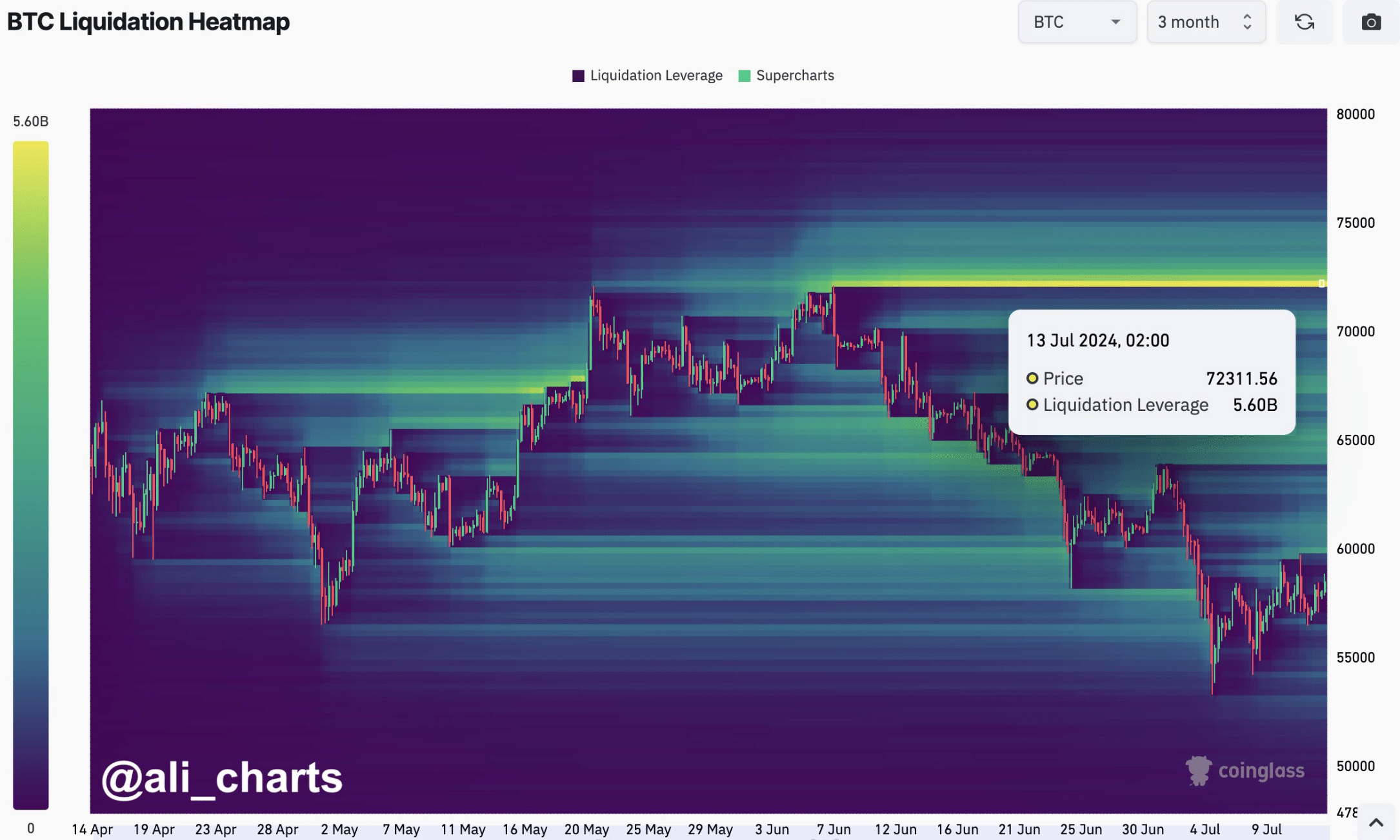

Currently, well-known cryptocurrency expert Ali has drawn attention on Twitter to a significant occurrence. According to his post, a massive short position amounting to $5.6 billion would be forced to close should Bitcoin rebound and reach the price level of $72,300.

The price touch of $72.3k for Bitcoin indicated a strong likelihood of a correction.

When the rate of bitcoin being sold exceeds the rate of new buyers, leading to liquidation, this trend can cause a temporary decrease in price. As such, investors may observe a deceleration or even a significant drop in BTC‘s value following its retest of the all-time high within the forthcoming weeks.

BTC’s road to $72k

Due to the potential for Bitcoin’s price to experience a correction around the $72,000 level, AMBCrypto decided it was important to examine their metrics carefully and identify if any additional obstacles might exist before that point.

As a cryptocurrency analyst, I have examined the latest data from CryptoQuant’s platform. Notably, I observed an uptick in Bitcoin’s exchange reserves. This trend implies an upward shift in selling pressure for Bitcoin.

The as-reported (aSORP) being red implies that a greater number of investors were cashing in their profits. In the midst of an uptrending market, this could be a signaling moment, potentially indicating a market peak.

Furthermore, the NULP indicated that investors found themselves in a stage of faith, holding substantial unrealedized gains.

At the current moment of reporting, Bitcoin’s fear and greed index stood at 69%. This figure implies that the market is exhibiting “fear” tendencies, as indicated when this value reaches this threshold. It’s important to note that such readings may foreshadow a price adjustment in the cryptocurrency market.

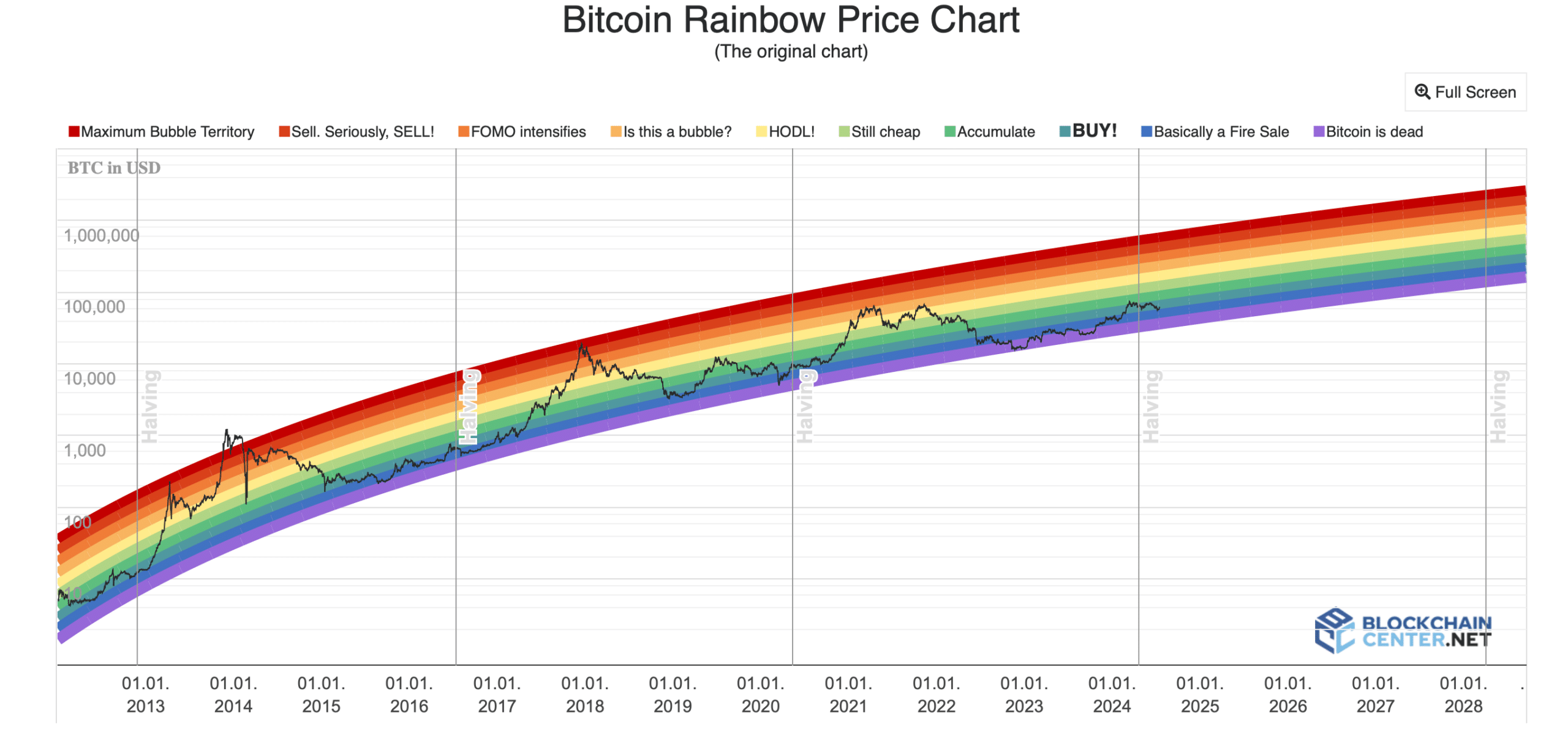

The Rainbow Chart for Bitcoin signaled a purchase opportunity. According to this indicator, Bitcoin was in the “accumulation” stage, implying that investors still had a chance to acquire Bitcoin at current prices before its value potentially increases further.

To gain a clearer perspective on whether the coin would correct first and potentially rebound toward $72k, we decided to examine its daily price chart next.

Read Bitcoin (BTC) Price Prediction 2024-25

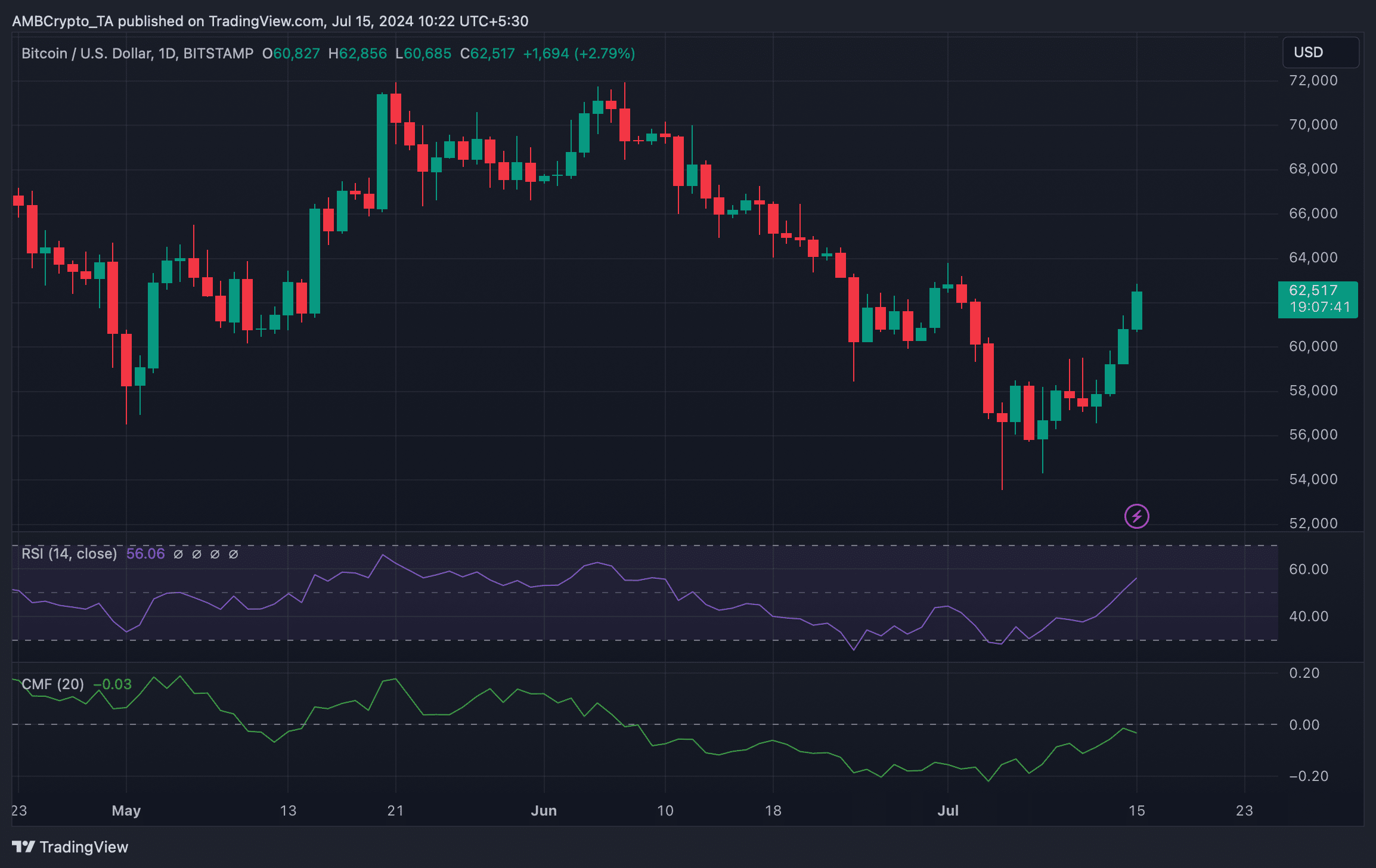

We found that the Chaikin Money Flow (CMF) registered a decline, hinting at a price correction.

Despite this, the Relative Strength Index (RSI) continued to trend upward, lying north of the neutral threshold.

Read More

- CTXC PREDICTION. CTXC cryptocurrency

- DGB PREDICTION. DGB cryptocurrency

- GFI PREDICTION. GFI cryptocurrency

- RIF PREDICTION. RIF cryptocurrency

- TNSR PREDICTION. TNSR cryptocurrency

- I’m a Celebrity voting figures revealed after Danny Jones crowned winner

- OKB PREDICTION. OKB cryptocurrency

- WRX/USD

- TRU PREDICTION. TRU cryptocurrency

- ZIG PREDICTION. ZIG cryptocurrency

2024-07-15 12:16