- Bitcoin’s hash rate showed resilience, while BTC struggled to cross the $70k mark.

European regulatory response targets potential market abuse risks associated with MEV.

As a researcher with a background in cryptocurrencies and blockchain technology, I find the recent developments in Bitcoin’s hash rate and European regulatory response to Maximum Extractable Value (MEV) quite intriguing.

In contrast to past occurrences, the most recent Bitcoin (BTC) halving event brought about a notable shift. The miner’s reward for each block mined has been decreased from 6.25 BTC to 3.125 BTC. However, these miners can still generate extra revenue through transaction fees on each mined block.

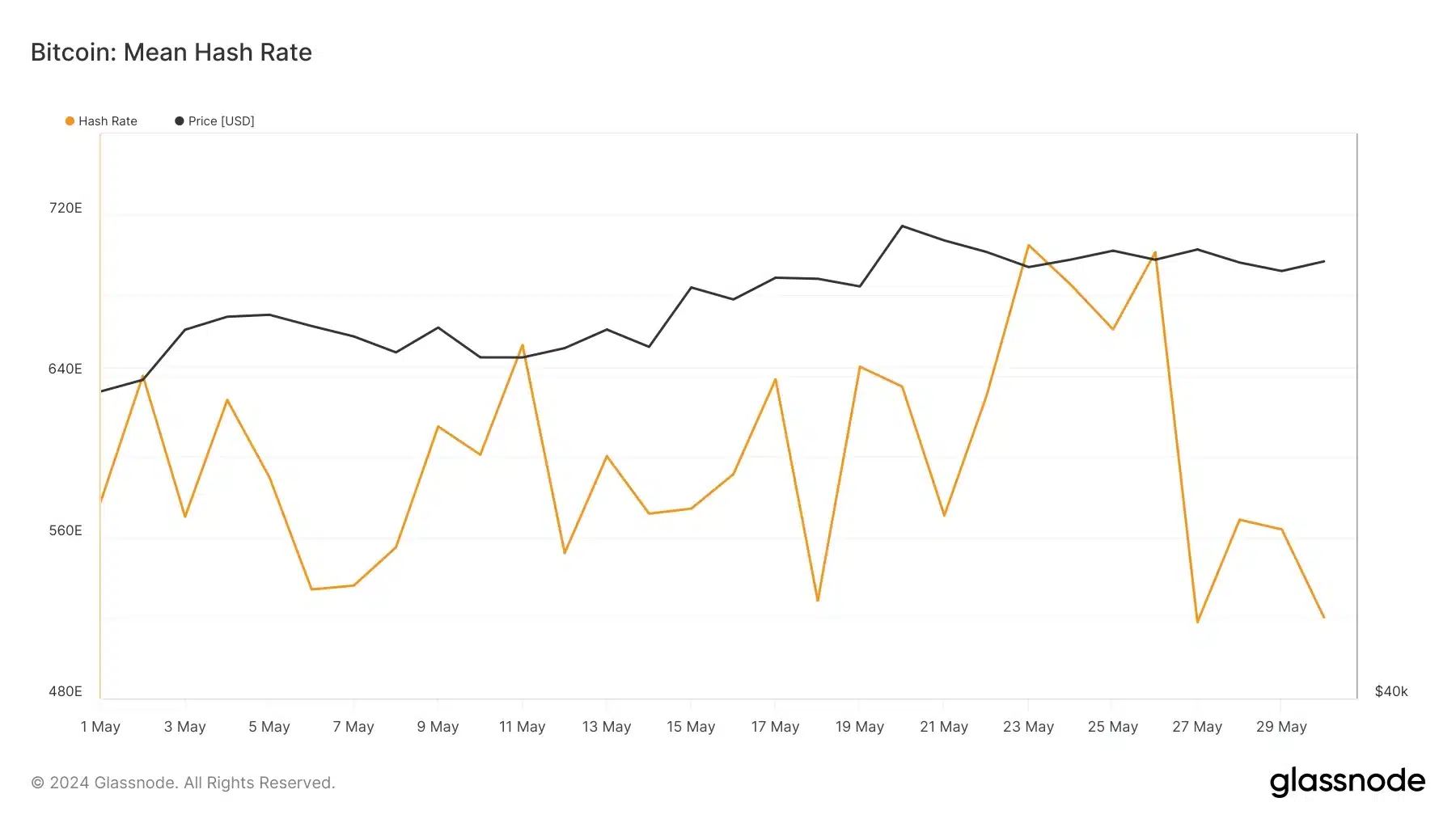

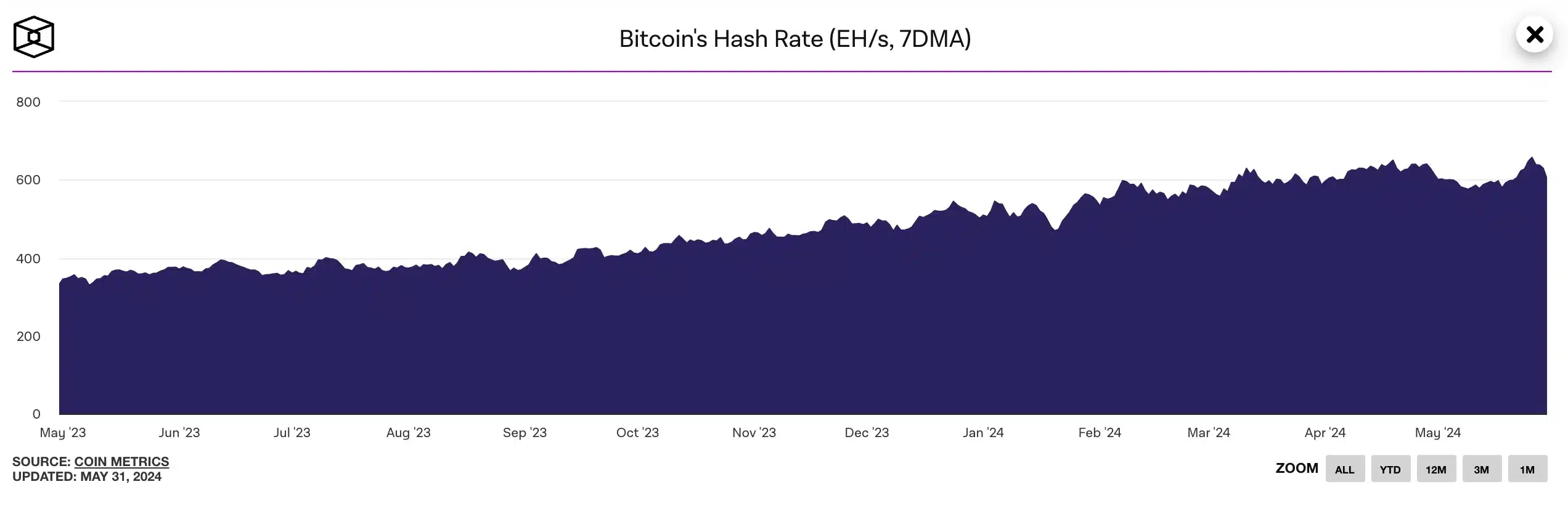

As a researcher studying Bitcoin’s halvings, I have observed that in past events, the hash rate dropped due to insufficient transaction fee rewards. However, during the most recent halving, something interesting happened. Instead of declining, the hash rate remained close to its all-time highs, increasing from 630 EH/s to 640 EH/s post-halving. This surge can be attributed to the heightened transaction fee rewards that encouraged miners to maintain and even boost their operations.

However, at the time of writing, it dropped back to 602 EH/s.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s hash rate has demonstrated remarkable strength in recent times. However, contrary to this, its price has faced challenges in surpassing the $70,000 threshold.

What metrics suggest about Bitcoin mining

Based on The Block’s on-chain analysis, Bitcoin’s mining hash rate has been decreasing since May 26th. This trend could pose challenges for miners as they may find it difficult to make a profit from their mining activities.

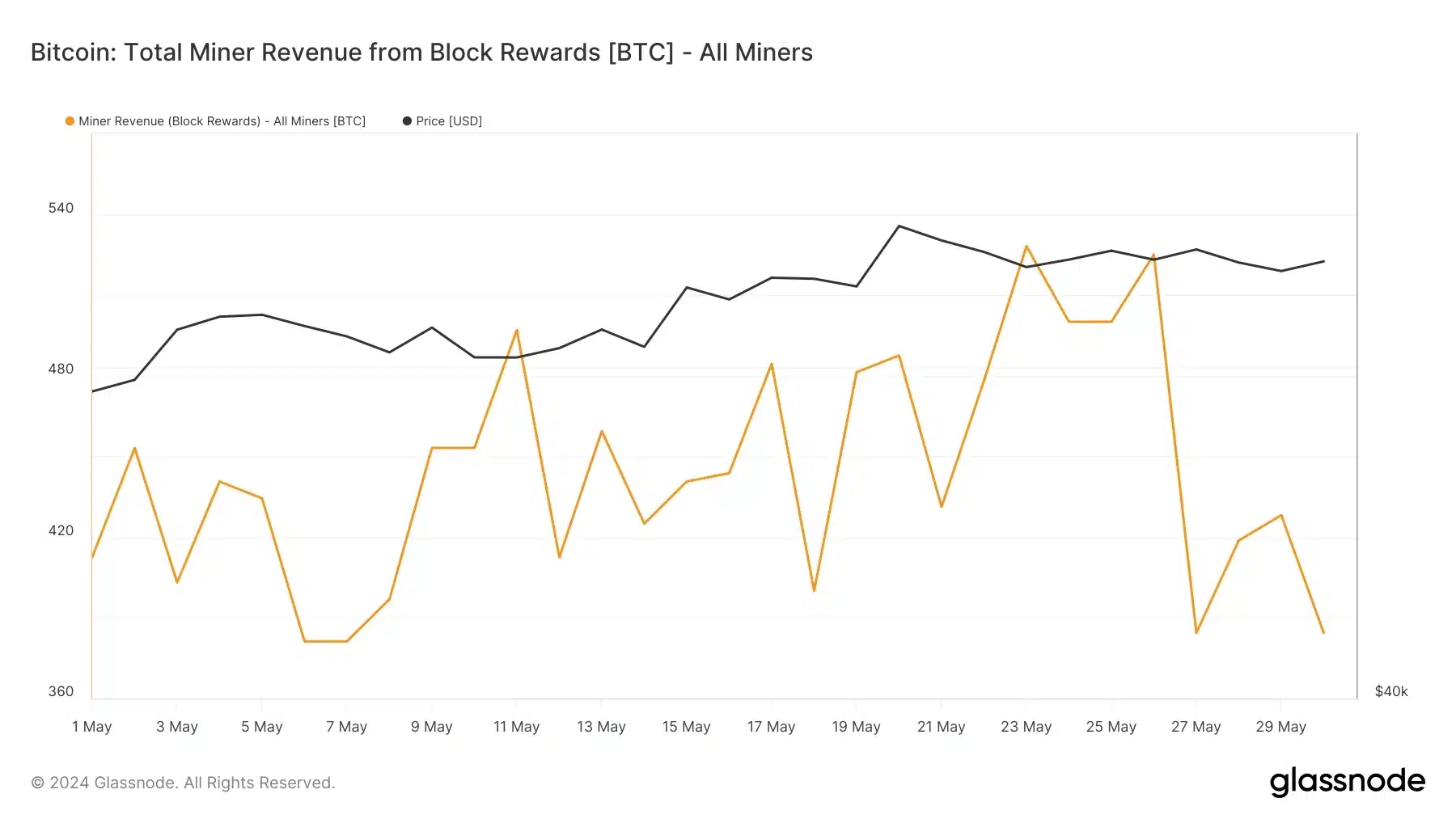

The findings from Glassnode’s analysis of block data were reinforced by the decrease in miner revenue. According to the most recent information, the miner income has dropped noticeably to 384.375 BTC, which is a considerable decline from the 525 BTC recorded on May 26th.

Despite this perspective, some continue to see the current state of affairs as a beneficial development for Bitcoin, as evidenced in a recent InvestAnswers broadcast.

Miners usually don’t join Bitcoin mining unless its price is increasing significantly and can support their extensive operations.

Examining the Bitcoin mining complexity data reveals the considerable computational effort required to discover the correct hash for each block. It is essential to emphasize that this complexity level does not directly influence the value of the mined Bitcoin. Instead, the price of Bitcoin significantly impacts miner profitability.

What’s the matter around MEV?

Miners have alternatives to earning solely from block rewards. The term “Maximum Extractable Value” (MEV) represents the additional profits miners can secure through tactics such as frontrunning and sandwich attacks. These methods enable miners to manipulate transaction orders within a block, generating revenue beyond the standard block reward.

As a financial analyst, I would express it this way: I’ve identified Market Value Extraction (MEV) as a potential threat to investors. In response, the European Securities and Markets Authority (ESMA) has announced its intention to limit MEV used by miners and validators. ESMA views this practice as a form of market abuse that requires regulation.

At this point, the draft proposal welcomes feedback from stakeholders by the last day of June. If eventually endorsed, its implementation may bring about substantial consequences for validators and miners on a global scale.

Read More

- SQR PREDICTION. SQR cryptocurrency

- PUPS PREDICTION. PUPS cryptocurrency

- NEON PREDICTION. NEON cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- TON PREDICTION. TON cryptocurrency

- HI PREDICTION. HI cryptocurrency

- EVA PREDICTION. EVA cryptocurrency

- CLOUD PREDICTION. CLOUD cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- LINK PREDICTION. LINK cryptocurrency

2024-06-01 09:11