- Bitcoin has a key level at $59.4k from both the technical and liquidity standpoints

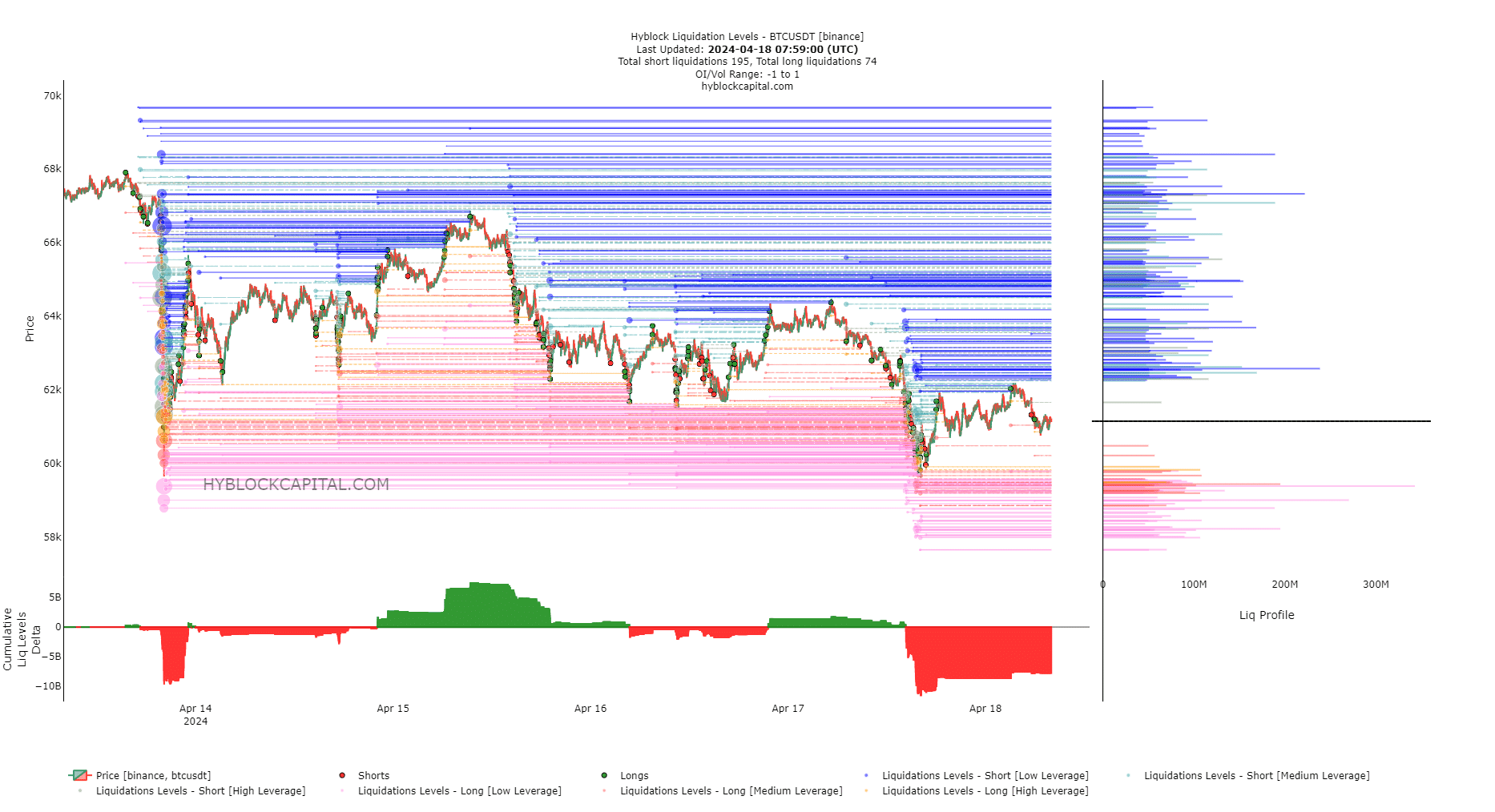

- The one-sided sentiment in the futures market might see late bears trapped shortly

The decrease in Bitcoin [BTC] demand and withdrawal from ETFs indicated a significant price drop was imminent for the cryptocurrency market.

Some ETF platforms saw zero flow days, but this was normal for exchange traded in any sector.

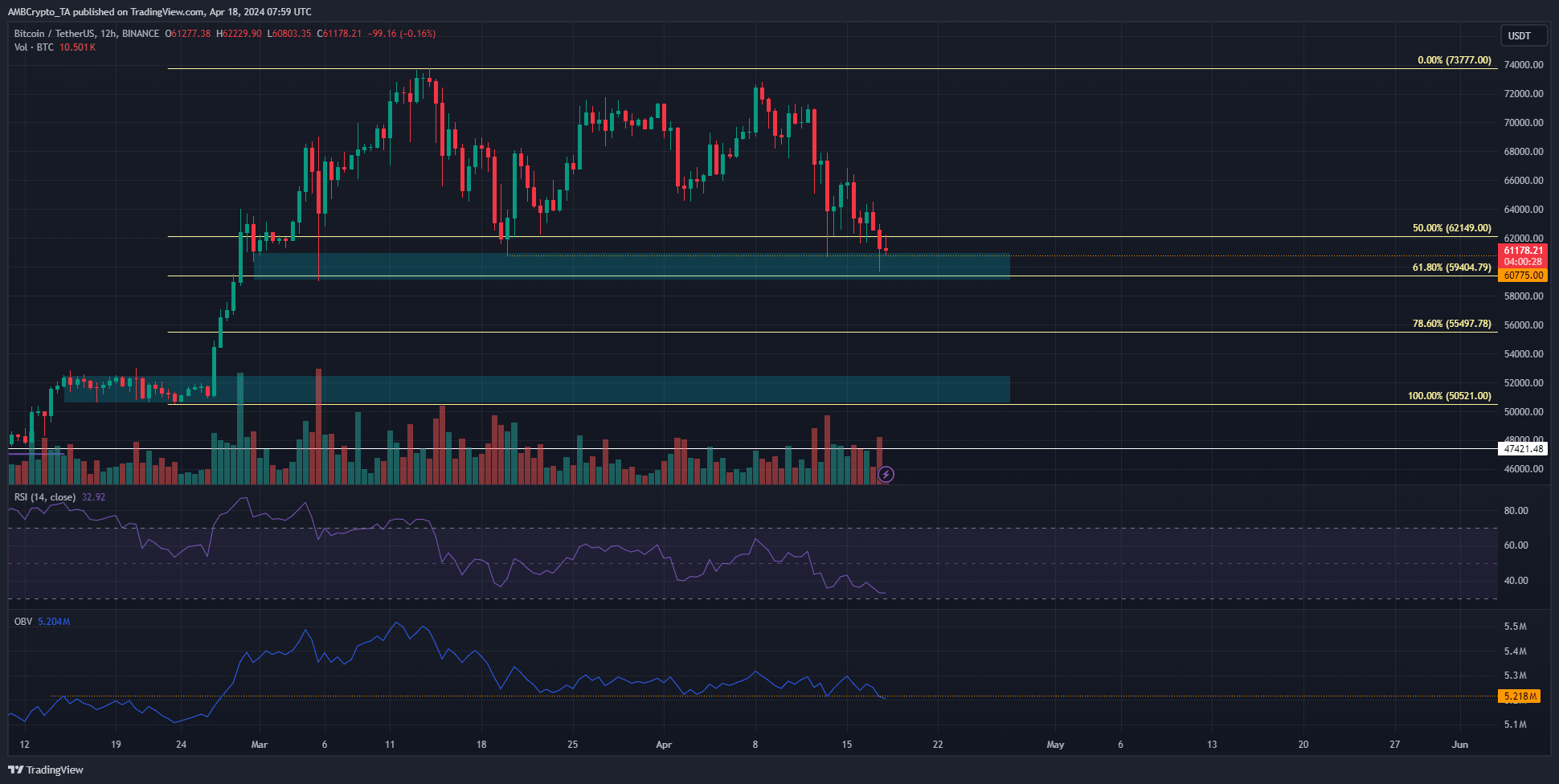

Bitcoin’s price has reached the $60k support level for the fourth instance starting from late February. According to technical analysis, it seemed uncertain if the bulls could keep control this time around.

The demand zone and liquidity at $60k

Over the past seven weeks, the buyers have persistently kept the price in the range of $59,200 to $61,000. Meanwhile, the On-Balance Volume (OBV) has created a support level, as indicated by the orange mark.

However, the recent selling volume drove the OBV below this key level.

The RSI indicated strong downward momentum, foreshadowing potential further price drops and perhaps a weaker defense of the $60k price level.

If the price falls below the $59,400 mark, which serves as a significant support level according to the Fibonacci sequence, then $55,500 and $50,500 become the potential points of focus in the larger time frame.

If the price falls below $60k during this week, investors and traders need to brace themselves for potential additional declines.

Short-term liquidation levels favor a sweep of this level before a bullish reversal

In simpler terms, more shorts (betting on a decrease) were being liquidated (closed) than longs (betting on an increase), resulting in a total net loss.

Since prices are attracted to liquidity pockets, a move upward was favored.

After making that observation, there was a significant pool of orders totaling $342 million waiting to be executed at $59.4k. The intersection of this price point with a key Fibonacci level suggested that the price might drop to hit these sell orders at around $59k.

Is your portfolio green? Check the Bitcoin Profit Calculator

After that, it’s possible that Bitcoin prices will increase significantly to draw in more buyers. Nevertheless, there has been strong demand from sellers in the past.

In these conditions, a rebound to $59.4k was not certain, even with such a large difference in total liquidation levels between the two sides.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-18 22:15