- Pepe in profit drops below 400 trillion.

PEPE has declined by over 9% in the last 48 hours.

Pepe [PEPE] was experiencing significant growth a few weeks ago, but it was now losing steam.

The profit from its sales has been dwindling over the past few weeks, and some crucial indicators suggest a sluggish market that might lead to an upcoming revival.

More Pepe goes underwater

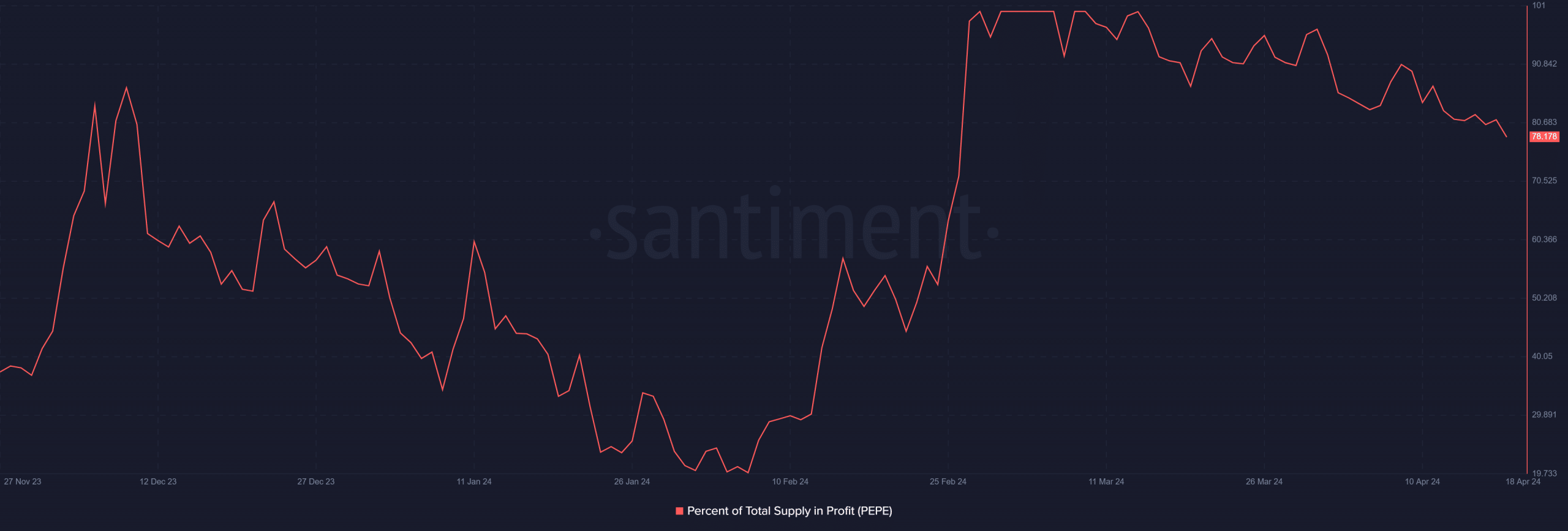

In February, there was a substantial jump in Pepe’s supply generating profits, rising from about 19% to a stunning 100%. This remarkable growth resulted in an increase in the total profitable supply from roughly 84 trillion units to over 420 trillion units.

Starting in March, the supply generating profits dropped significantly, down to approximately 96%, which equates to about 409 trillion dollars.

The downturn continues, causing the amount of PEPE in profit to decrease. Currently, about 78% or around 330 trillion units are in profit.

Enough volume and active addresses for PEPE?

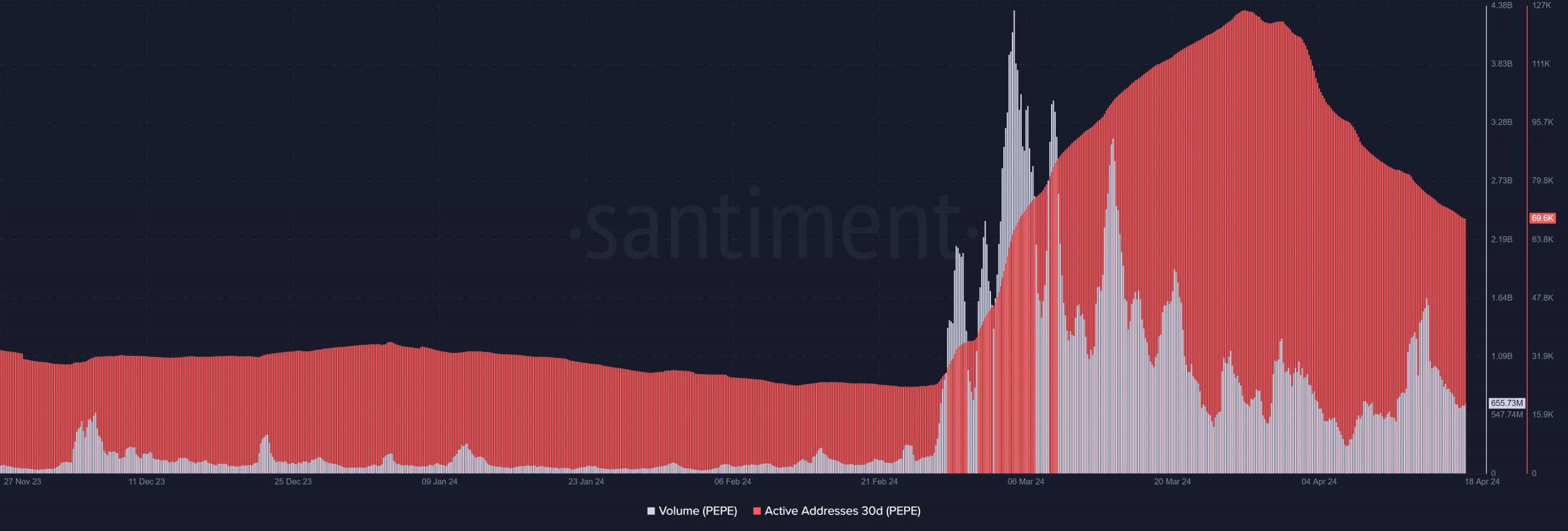

Approximately four weeks ago, there was a noticeable surge in the number of Pepe’s daily active addresses, rising from roughly 24,000 to more than 126,000.

The number stayed above 10,000 until the beginning of April, but then it started to drop.

Starting from early April, there has been a significant decrease in the number of active cryptocurrency addresses, which was around 69,000 when the article was published.

Additionally, Pepe’s volume saw a significant decrease in recent weeks.

Between February 28th and March 15th, the volume reached its highest point and exceeded $1 billion on the 13th and 14th of April. However, the volume has decreased since then.

Currently, the market value is approximately $650 million according to my present research. However, the experts propose that increased action is necessary to boost the price further.

Consequently, the supply in profit is likely to continue dropping, at least for now.

Read Pepe’s [PEPE] Price Prediction 2024-25

PEPE close to flipping support

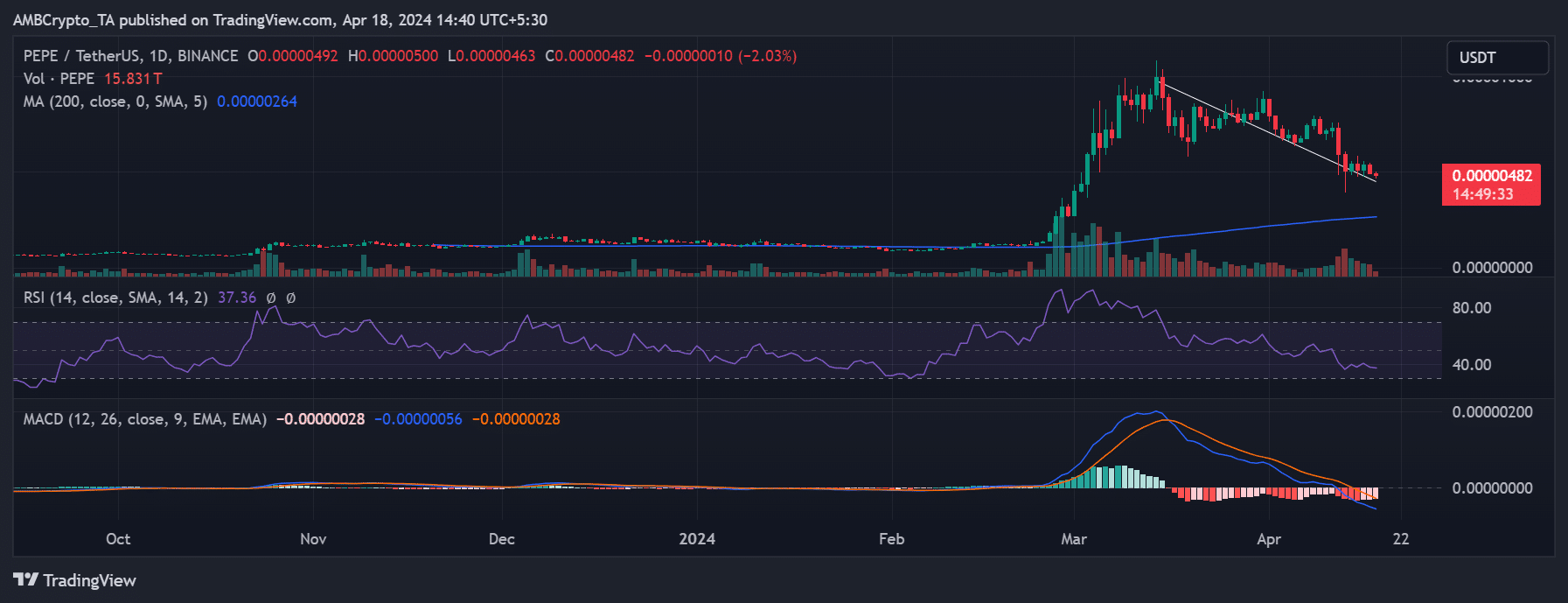

On Pepe’s daily chart, there have been noticeable price drops in the last week. By the close of business on April 17th, the price had fallen more than 8% compared to the beginning of that period.

The graph shows that as the downtrend continues, the trendline now functions as a support level for Pepe, which was priced at approximately $0.0000048 with a decline of over 1.6% when this was written.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-18 21:12