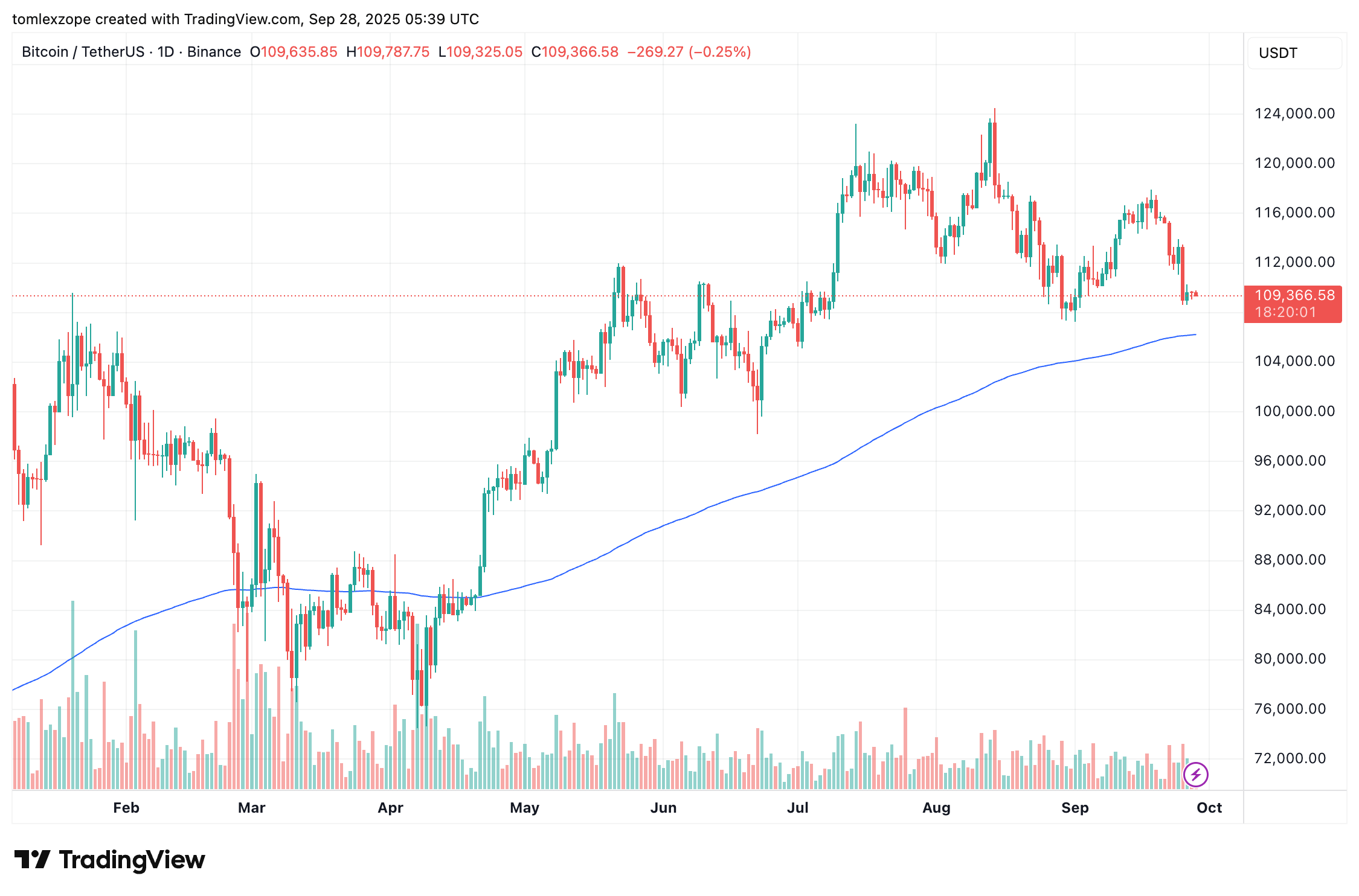

The past week felt less like a market and more like wandering into a coffee shop where the espresso machine is auditioning for a revenge drama. Bitcoin pretended to sprint from a ridiculous cliff of $116,000 down to a neighborly $108,600, like a gym-goer suddenly spotting a donut and deciding the treadmill is optional. Some folks whispered “bearish rally,” as if that were a flavor of yogurt, but the on‑chain data murmured something closer to: maybe we’ll just sit here and pretend we’re adults. 😅

LTHs’ Selling Pace On The Decline

On X, that feeds-that-never-forgets-your-password platform, a user named Alphractal posted something that could be good news for Bitcoin’s most loyal audience. The gist: the mighty long-term holders-the ones who still pretend “HODL” isn’t a secret code for personal fortitude-might be shifting their vibe, or at least slowing their pace to something that resembles a polite stroll through a cash register aisle. 🪙

This “on-chain revelation” rides on the Coin Days Destroyed (CDD) Multiple Metric, which is basically a fancy way of counting how many ancient coins decide to go out for a walk and never come back. In other words, it tracks when old coins finally decide to spend themselves into a new chapter, like a retiree cashing in their frequent‑buyer punch card. 😂

Alphractal notes that while the elder statesmen of crypto have kept moving their old coins, they’re doing so at a noticeably slower tempo. Relative to 2024, the activity of Bitcoin’s long-term holders has been more of a polite saunter than a sprint over a finish line. The dip in the CDD Multiple is being read as a sign that selling pressure from these weathered investors might be easing up. 😌

What This Means For Price

As of now, Bitcoin is skimming along a volatile edge just above a swing low around $108,500. The pros aren’t sprinting to offload, but they’re not cuffed to the sofa either-holding steady, like a lifetime supply of ambition you bought on sale. Instead of selling madly, the older hands seem to be hoarding, waiting for a bigger, louder move that would justify them not losing face in the club of “investors.” 💹

“This decline in coin day destruction activity suggests that many experienced investors are choosing to hold their positions, waiting for stronger market moves,” the analytics firm hooks us with a quote that sounds less like a prophecy and more like a patient sigh at a family reunion. 😏

Historically, this kind of behavior among Bitcoin’s earliest holders has preceded stretches of accumulation, where their confidence acts like a ballast, keeping the price from tumbling further and, frankly, giving the rest of us something to talk about at brunch. If history is a decent teacher, the smaller CDD Multiples might be laying the groundwork for Bitcoin’s next grand expansion, or at least a more interesting week than the one we just had. Watch last week’s swing low and the CDD activity like a pair of suspicious neighbors peering through blinds before investing decisions are made. 🔎

At the moment of writing, Bitcoin hovers around $109,630, with not much movement in the last 24 hours-which is to say, the drama has not yet learned to scream. 🫠

Read More

- Epic Games Store Giving Away $45 Worth of PC Games for Free

- 10 Movies That Were Secretly Sequels

- When Is Hoppers’ Digital & Streaming Release Date?

- Sunday Rose Kidman Urban Describes Mom Nicole Kidman In Rare Interview

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 40 Inspiring Optimus Prime Quotes

- 7 Best Animated Horror TV Shows

- Best Werewolf Movies (October 2025)

- 5 Best Superman-Centric Crossover Events

- All The Howl Propaganda Speaker in Borderlands 4

2025-09-28 23:19