-

BTC made significant gains in the past day, rising by 2.08%.

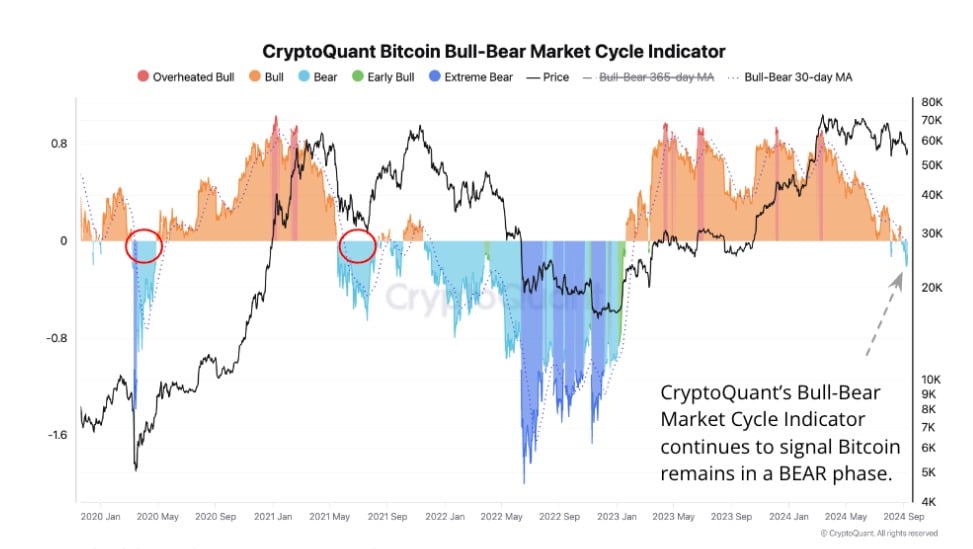

Despite the recent gains, Bitcoin remained stuck in a sustained bear phase.

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a mix of optimism and caution when observing the recent BTC price movements. The 2.08% rise over the past day is certainly encouraging, but I remain cautious as Bitcoin remains stuck in a sustained bear phase.

In the past 24 hours, Bitcoin (BTC) has experienced substantial growth, climbing from its recent low of $55,554 to $58,038 as we speak. This represents an approximately 2.08% rise compared to the previous day.

These gains are coupled with weekly gains of 1.83% a recovery from a sharp decline to $52546.

Under the present market scenario, it’s worth considering if Bitcoin will undergo a prolonged rebound or just a temporary adjustment preceding another decline. At the moment, the general market outlook is negative, with analysts predicting a possible drop.

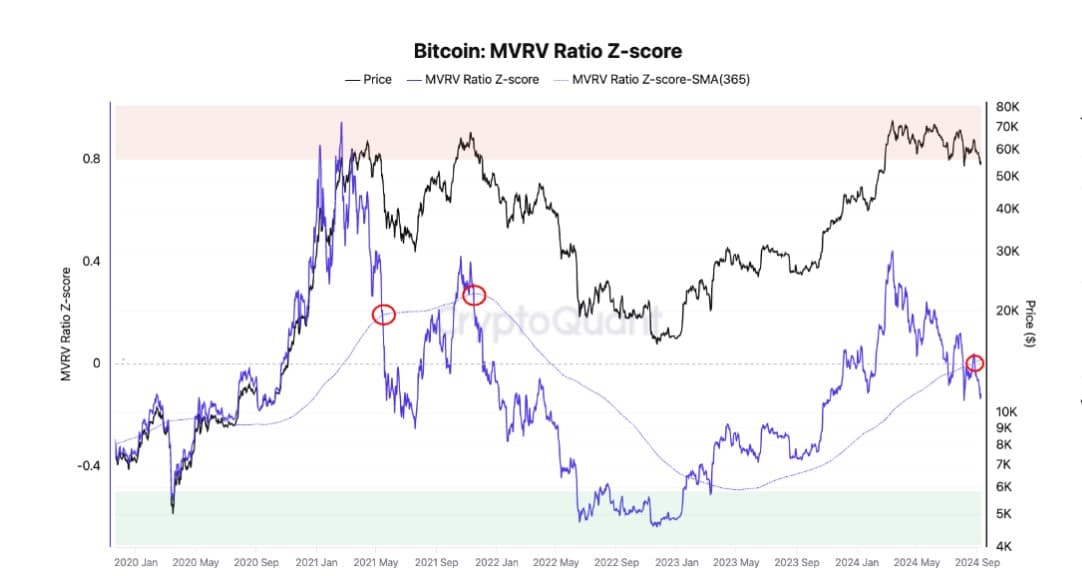

As a researcher, I’ve arrived at a similar conclusion after my analysis, suggesting that Bitcoin appears to be in a bear market. This observation is supported by two key indicators: the 365-day moving average and the MVRV (Mempool Value Ratio) ratio.

BTC stuck in bear phase

As per CryptoQuant’s analysis, we’ve been experiencing a bear market for the last fortnight.

Over the past few days since Bitcoin was last traded at $62,000, it has been in a bearish market and has reached its lowest point of $52,000 during this stretch.

So far, since it’s still in this stage, a major upswing seems unlikely and there might be more room for adjustments or decline.

To put it simply, it’s been noted that Bitcoin’s MVRV ratio has stayed under its average from the 26th of August until now. This pattern could indicate a possible drop to follow, much like what happened in May 2021.

During the 2021 cycle, BTC declined by 36% in two months — this reoccurred in November 2021.

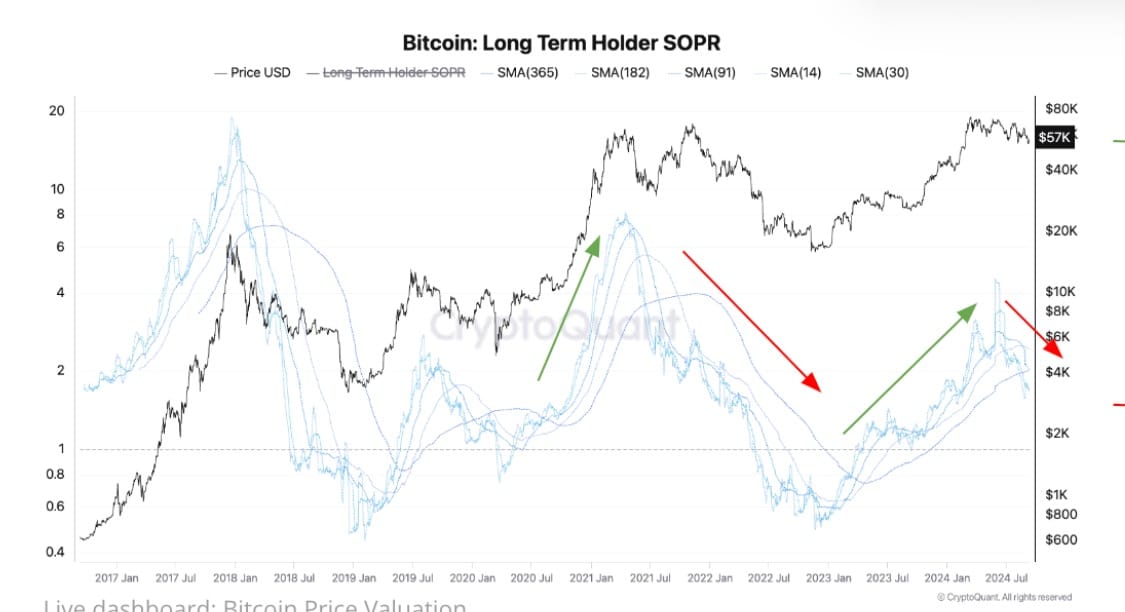

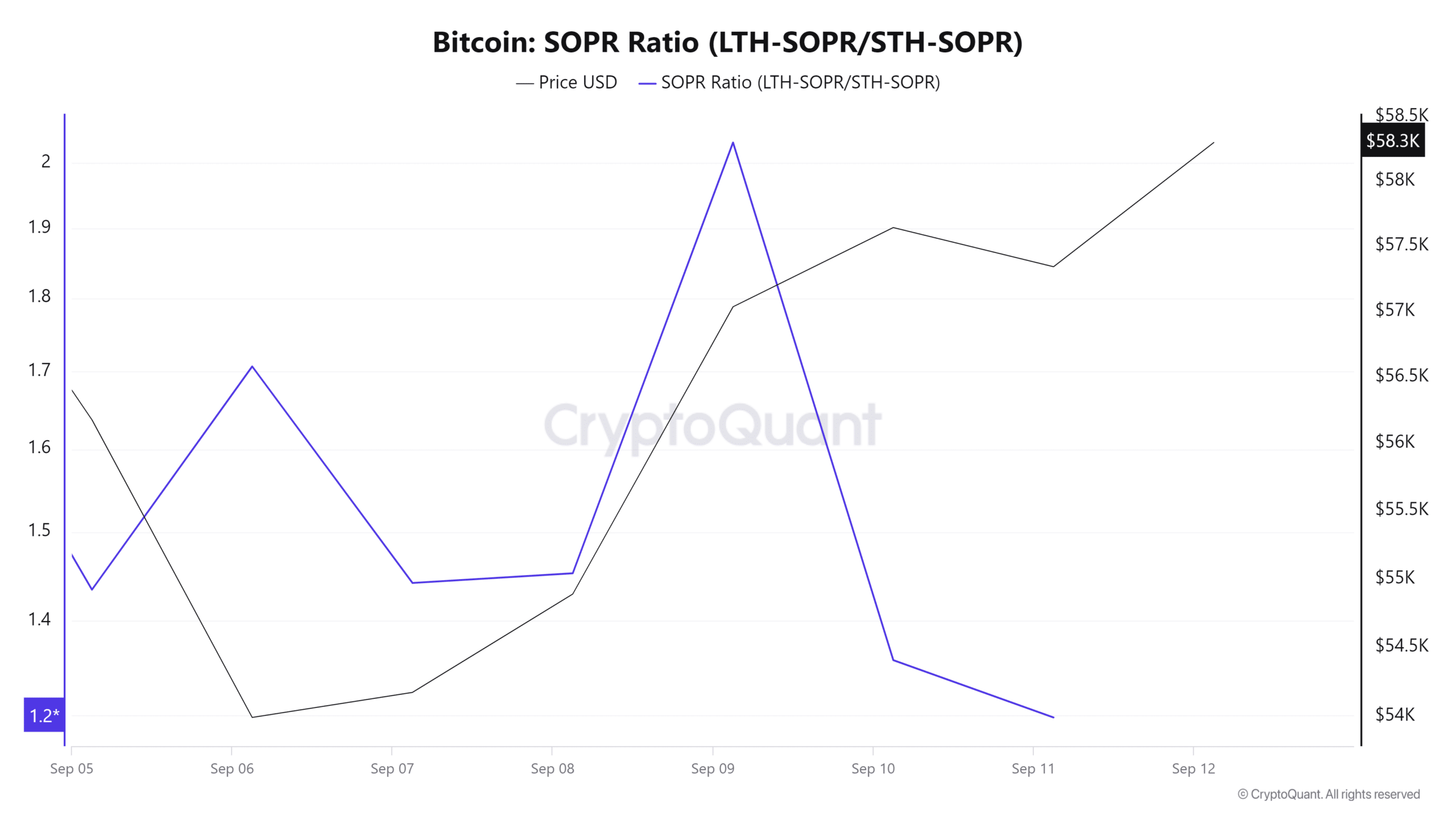

A key market signal suggesting a downtrend is the Long-Term Holder’s Spend Profit Ratio (SOPR). As per CryptoQuant, this ratio has been decreasing since July, indicating that long-term holders are spending their cryptocurrencies at reduced profit levels.

If Large-Scale Bitcoin Hodlers (LTHs) continue to operate at reduced profit levels, this could indicate decreased demand for Bitcoin in the market. A potential buy signal for Bitcoin would arise once the Long-Term Holder Spent Output Profit Ratio (SOPR) charts associated with LTHs begin an upward trend.

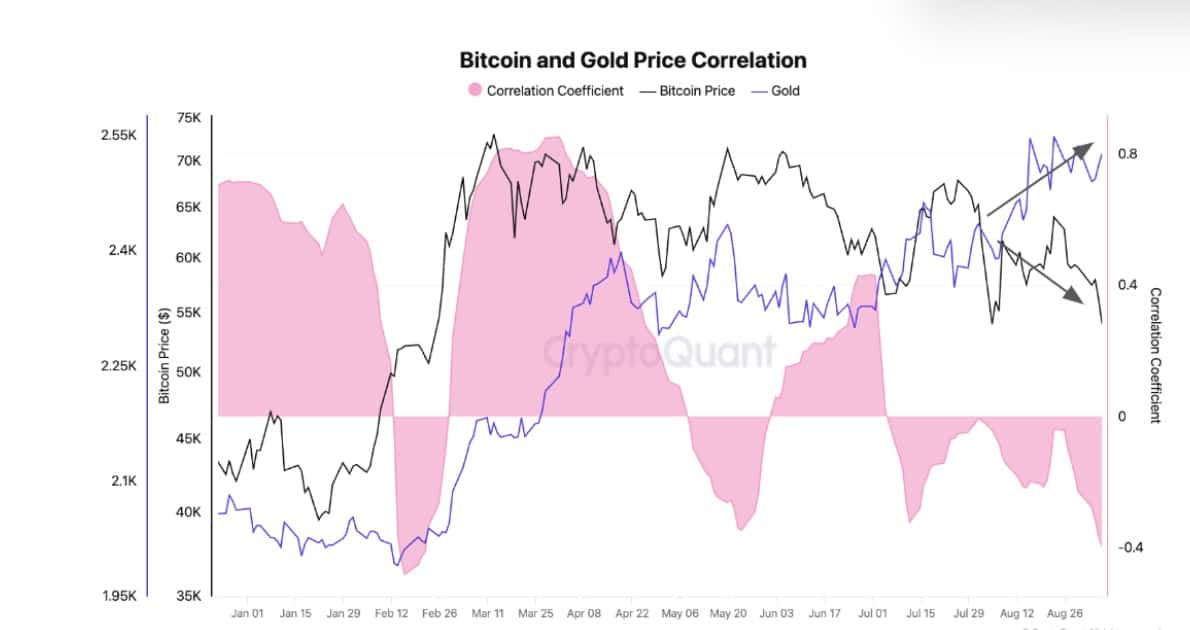

To put it simply, Bitcoin (BTC) is no longer following the trend of gold as its value decreases while gold’s worth escalates to record-breaking heights. Consequently, the relationship between these two assets has shifted to a negative correlation; when the price of gold rises, that of BTC falls.

This suggested that investors were becoming risk-averse as they turned to traditional assets as a safe haven, thus avoiding volatile assets.

What Bitcoin’s charts suggest

Moving forward, we’ve observed a decrease in both Long-Term Holder’s Spent Output Profit Ratio (LTH-SOPR) and Short-Term Holder’s Spent Output Profit Ratio (STH-SOPR) over the last week. A drop in LTH-SOPR indicates that long-term holders might have been selling their cryptocurrency at a loss more frequently.

When the Short-Term Holder SOPR decreases, it suggests that these investors are selling off their coins at a loss, likely driven by panic (Fear, Uncertainty, Doubt) and concerns about potential price drops.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

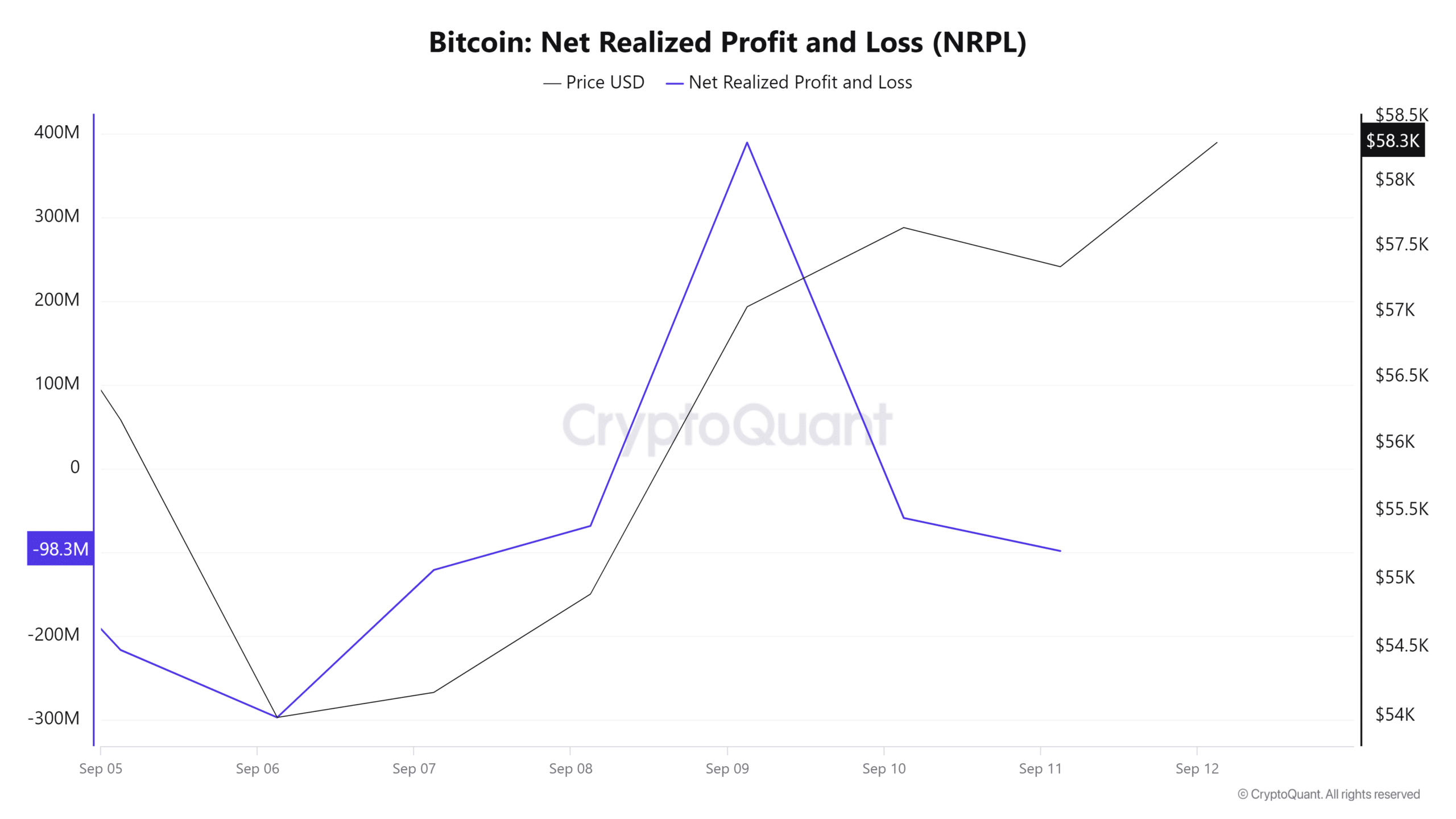

Moreover, Bitcoin’s Net Realized Price Loss (NRPL) has switched from a gain to a loss, signaling a period of capitulation. Essentially, this suggests that investors are no longer optimistic about the cryptocurrency’s future trajectory and are offloading it, even incurring losses.

Consequently, given our examination, it seems the downtrend in BTC‘s value is set to persist, with prices potentially experiencing further adjustments. If the bear market prevails, Bitcoin could fall to the $56k support point.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- How to Install & Use All New Mods in Schedule 1

- ETH PREDICTION. ETH cryptocurrency

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- `Kylie Kelce Spills the Tea on Travis Kelce and Taylor Swift’s Relationship`

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-09-12 23:36