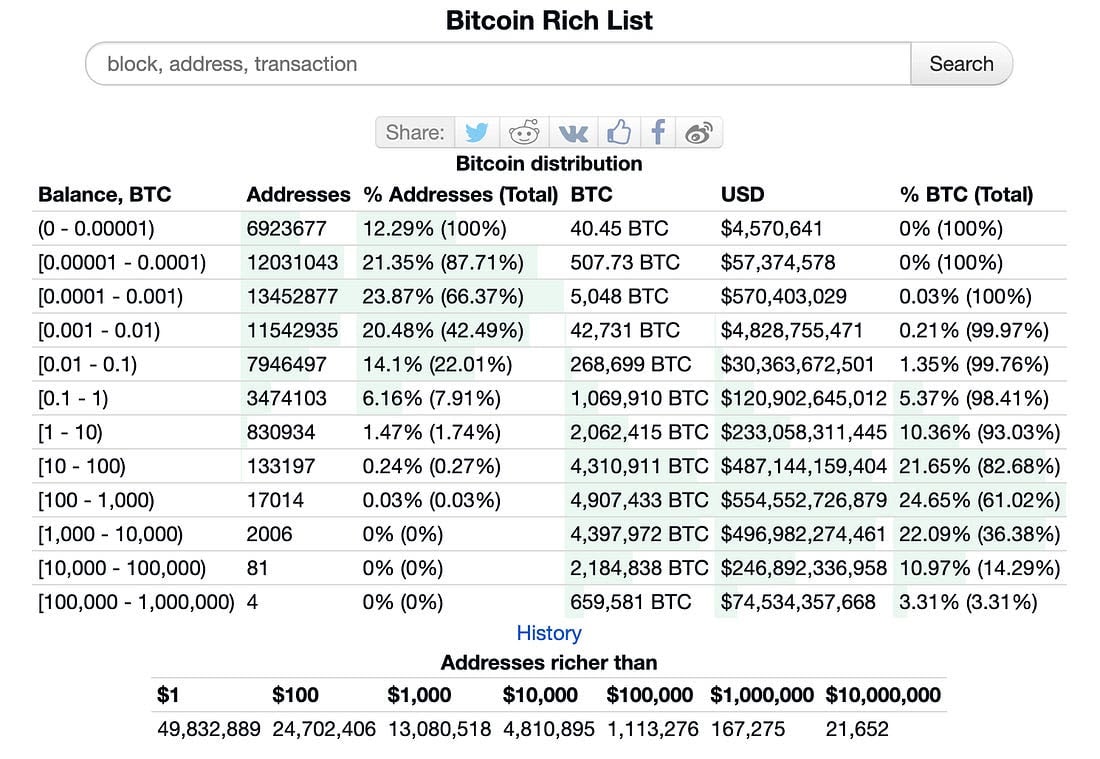

Scott Melker, that intrepid host of “The Wolf of All Streets” podcast-who, one suspects, howls at the moon while checking his portfolio-resurrected his “Bitcoin rich list” in his Aug. 29 newsletter. The table, much like a butler presenting a silver platter, reveals how BTC is divvied up among wallets of varying sizes. 🧐

Melker, who last compiled this riveting list in 2023 (a simpler time, when Bitcoin was merely expensive rather than eye-wateringly so), now offers a fresh snapshot of how ownership has evolved-or, more accurately, how some wallets have grown plump while others remain as thin as a dieting greyhound.

The Gist of It All

- Addresses clutching at least 1 BTC account for the top 98% of holders-a stat that makes one wonder if the other 2% are just squirrels hoarding digital acorns. 🐿️

- The most dramatic change? The number of addresses clutching up to 0.0001 BTC has doubled. Yes, doubled. Clearly, the peasants are storming the castle with pocket lint and spare change.

- The price of becoming a “wholecoiner” (a term that sounds like something a medieval knight would aspire to) grows yearly. Hardcore bitcoiners insist it’s never too late-much like how it’s never too late to regret not buying Amazon stock in 1997.

You Needn’t Be a Wholecoiner (Unless You Enjoy Flexing)

Melker asserts, with the confidence of a man who has never accidentally sent BTC to the wrong address, that owning a mere 0.1 BTC catapults one into the top 8% of holders.

And fear not, dear reader-you needn’t be a “wholecoiner” (a person clutching at least 1 BTC like Gollum with his precious) to ascend to Bitcoin aristocracy. Why? Because at BTC’s current price of $108,500-give or take a latte-owning 0.1 BTC makes you richer in Bitcoin than 92% of holders. That’s right: you’re practically nobility. 🎩

Possessing a full Bitcoin? Well, then you’re in the top 2%, rubbing elbows with the crypto elite while the rest of us scrape together Satoshis like loose change in a sofa.

This data, mind you, includes holdings on exchanges-those digital casinos where fortunes are made and lost faster than you can say “margin call.” Of the 20 fattest BTC wallets (holding between 36,000 and a staggering 250,000 bitcoins), only eight belong to mysterious entities. The rest? Likely exchanges, hedge funds, or Elon Musk’s secret second Twitter account.

The shift between 2023 and 2025 isn’t exactly earth-shattering. Melker notes that Bitcoin addresses grew by a modest 10 million, reaching over 56 million-a number that suggests either mass adoption or mass delusion.

The most notable change? An influx of addresses clutching between 0.00001 and 0.0001 BTC, which ballooned from 3.5 million to 6.9 million. “That makes sense,” Melker muses, “as more people start small.” One imagines them whispering, “Someday, this will buy me a yacht.” 🛥️

“That stability is actually healthy. It shows Bitcoin ownership distribution is maturing.”

From Melker’s additional data, we learn that Bitcoin dust-those microscopic crumbs too small to transact-reached an all-time high in 2025 at 1.58 thousand BTC. Meanwhile, dormant wallets tell a tale of HODLers who could give Rip Van Winkle a run for his money:

- 12.5 million BTC (over half the supply) haven’t moved in a year.

- Over 10 million BTC have been gathering digital cobwebs for more than two years.

- Almost 8 million BTC haven’t budged in three years-presumably forgotten in a password-locked wallet or buried in a boating accident. ⛵

The curve of dormant BTC spiked sharply after the 2024 election, when President Donald Trump vowed America would never sell its bitcoins-a promise as binding as a pinky swear at a frat party.

Becoming a Wholecoiner in 2025: A Fool’s Errand or a Genius Move?

If holding 0.1 BTC makes one “Bitcoin rich,” then owning a full bitcoin-the illustrious “wholecoiner” status-is practically royalty. But the price of admission has soared like a caffeinated eagle. Buying 1 BTC in 2013 was akin to purchasing a sandwich; in 2025, it’s more like buying a small island.

Skeptics have bleated “It’s too late!” at every stage of Bitcoin’s ascent, much like how people once said the internet was a passing fad. Early adopters weep into their keyboards, lamenting sales made too soon. Take Greg Schoen, who in 2011 bought 1,700 BTC at $0.06 each, sold at $0.30, and then watched in horror as they hit $8. His tweet mourning this misstep became so legendary that he auctioned it as an NFT in 2022. Little did he know that by 2025, his 1,700 BTC would be worth over $180 million-enough to buy a small country or at least a very nice yacht. 🚤

You are never too late for Bitcoin

– Bitcoin Archive (@BTC_Archive) August 14, 2025

Today, only about 2,000 addresses hold more than 1,000 BTC. Whether Schoen is among them remains a mystery, but his tale serves as a cautionary fable: in Bitcoin, every era feels like the last good one-until the next one arrives.

I wish I had kept my 1,700 BTC @ $0.06 instead of selling them at $0.30, now that they’re $8.00! #bitcoin

– gregschoen.eth (@GregSchoen) May 16, 2011

The Bitcoin Elite: A Modest Club

The number of addresses clutching more than one Bitcoin sits just shy of one million-less than 2% of holders. For context, UBS reports that 18.1% of adults worldwide hold assets exceeding $100,000.

This means a “Bitcoin-rich” person isn’t necessarily swimming in fiat riches-just that they’ve bet heavily on digital gold while others cling to paper money like it’s 1929. Bitcoin’s top-tier bar is lower, proving it’s still early days for widespread adoption-despite governments, institutions, and your uncle Bob all piling in.

So, is Bitcoin the future or a speculative bubble? The answer, as always, depends on whether you’re holding or folding. 🎲

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- When Is Hoppers’ Digital & Streaming Release Date?

- Best Thanos Comics (September 2025)

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Samson: A Tyndalston Story Studio Wants Players to Learn Street Names, Manage Hour-to-Hour Pressure

- 10 Movies That Were Secretly Sequels

- Best Werewolf Movies (October 2025)

2025-08-30 15:49