-

Bitcoin spot ETF sees zero netflow.

GBTC holdings continue to decline.

Since the successful authorization and debut of the Bitcoin [BTC] spot ETF, Grayscale’s Bitcoin assets have seen a decrease in value. For the first time since its inception, many platforms have reported no new investments following the ETF’s launch.

Grayscale’s Bitcoin holdings halves

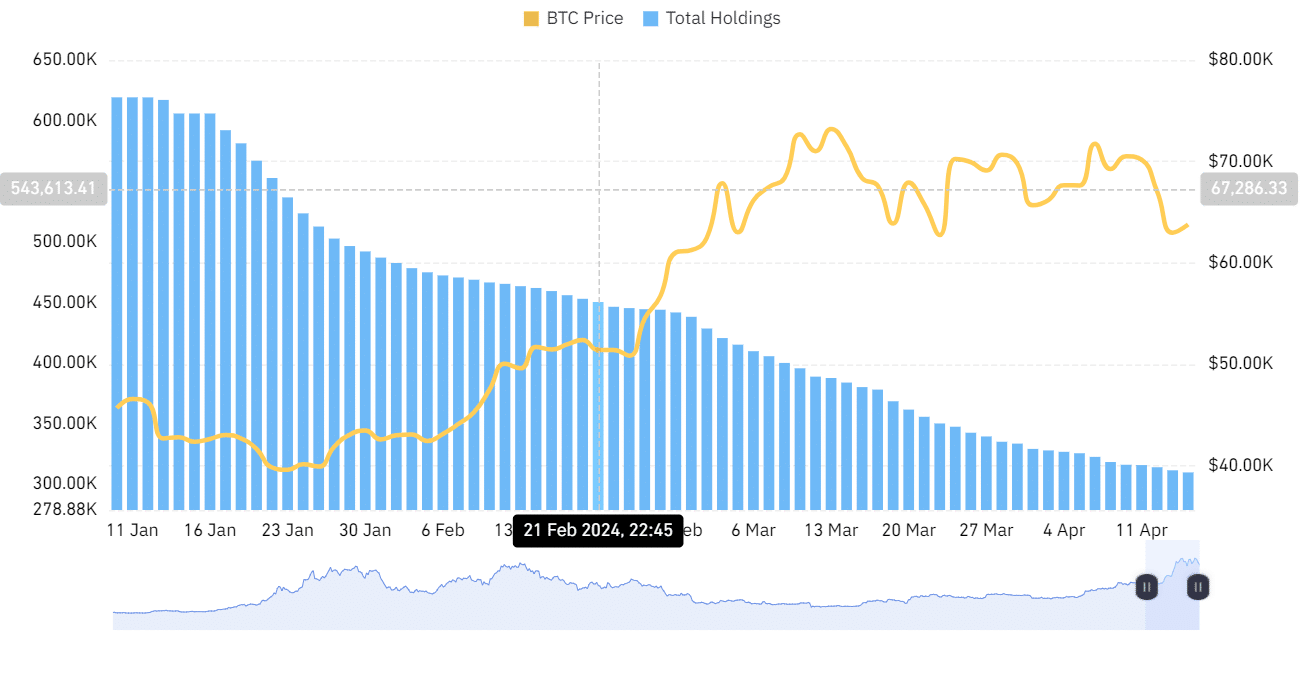

A look at the institutions that have recently gained approval for Bitcoin ETFs found that Grayscale currently has the largest market value in Bitcoin.

Yet, upon examining the data more closely, it was found that Grayscale had been holding less Bitcoin than before in the past few months.

According to Coinglass data, Grayscale owned approximately 619,000 Bitcoin as of January’s start. However, their current Bitcoin holdings are estimated to be roughly 310,000 Bitcoin as of now.

Instead of starting a new Bitcoin ETF from scratch, Grayscale’s existing Bitcoin Trust, GBTC, was transformed into an ETF.

Although Grayscale’s holdings have gone down, there has still been a notable amount of trading activity in the form of ETF transfers. However, some specific ETF platforms dealing with spot transactions have more recently seen no inflows or outflows at all.

Spot Bitcoin ETFs see consecutive outflows

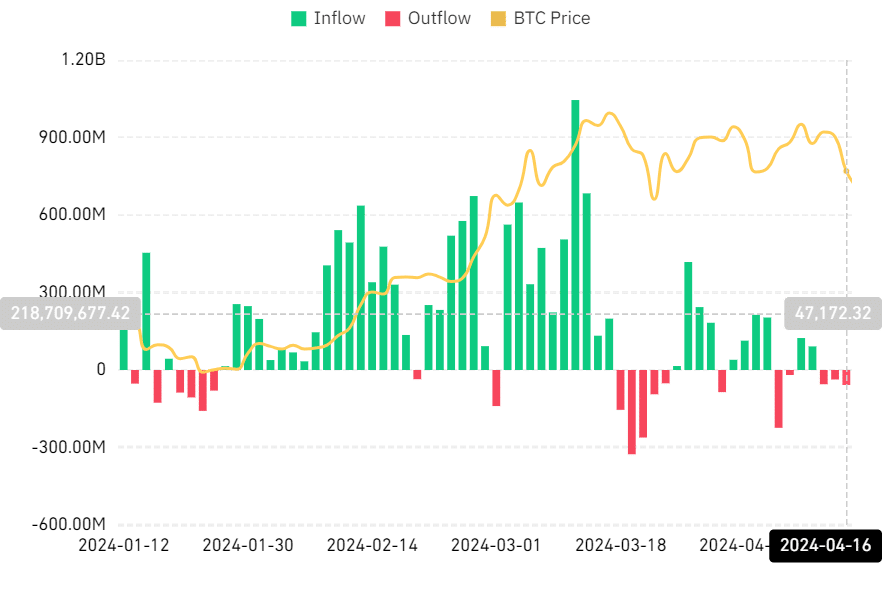

Based on data from Coinglass, the Bitcoin spot ETF has seen continuous withdrawals in recent days. Specifically, there were withdrawals of $26.7 million on the 15th and $58 million on the 16th of April.

In March, we saw a series of five successive days with negative cash flows in the data. This isn’t an unusual occurrence; the most occurrences on record happened back then.

Among U.S. spot Bitcoin ETFs, only BlackRock’s IBIT and Grayscale’s GBTC have attracted investments this week.

Zero flows dominate ETF flows

On April 15th and 16th, there were significant withdrawals from the Grayscale Bitcoin Trust (GBTC), totaling $266.5 million. These withdrawals represented successive outflows from the ETF.

Instead, IBIT experienced a distinctive pattern in its cash inflows. On the 15th of April, there was an intake of approximately $76.23 million, followed by almost $26 million on the 16th.

Significantly, no transfers have occurred from other systems up until now. Yet, according to James Seyffart, this doesn’t necessarily mean that the product is flawed.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In his blog post, he noted that the majority of US ETFs typically have no new investments added to them each day, which is a common occurrence for ETFs within a specific market.

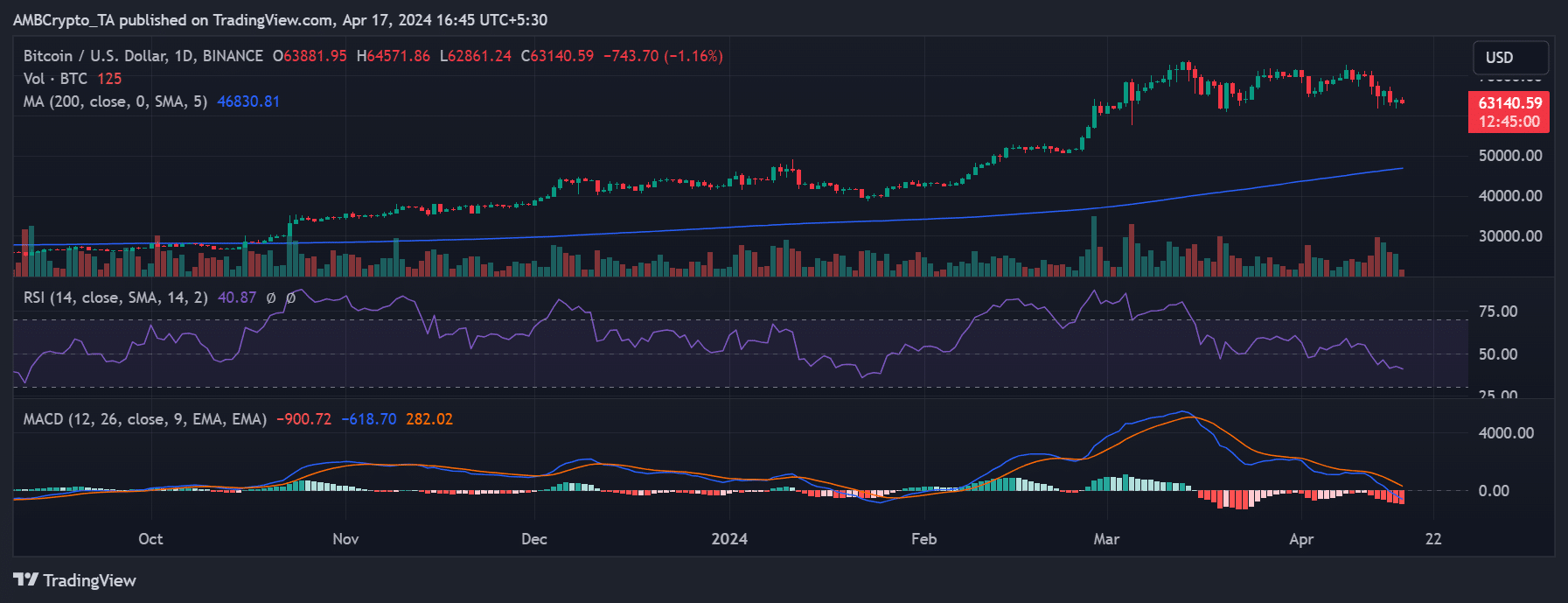

As of this writing, Bitcoin was trading at around $63,170, representing a decline of over 1%.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-04-18 01:11