- Volume of large transactions by whales and investors surged by 7.85%, indicating a bullish outlook

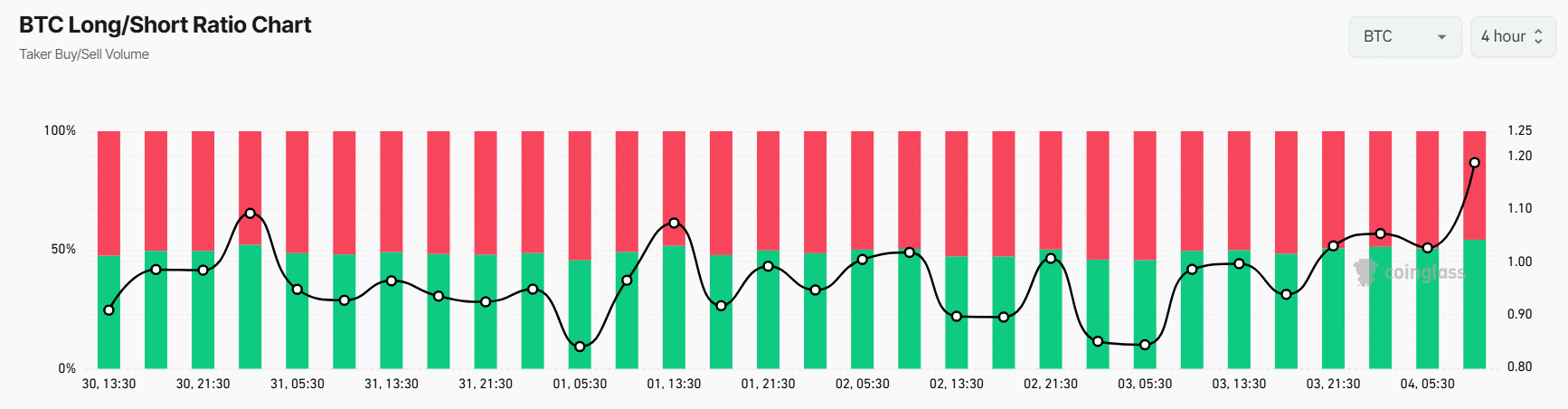

- At press time, 55% of top BTC traders were holding long positions, while 45% held short positions

As a seasoned crypto investor with a knack for reading market trends, I must say that the current state of Bitcoin looks promising. The surge in large transactions by whales and investors, coupled with the majority of top traders holding long positions, is a bullish sign that we haven’t seen in a while.

In simple terms, following a 8% drop in value over the past few days, it looks like Bitcoin (BTC), the most valuable digital currency globally, could be ready for a surge upward.

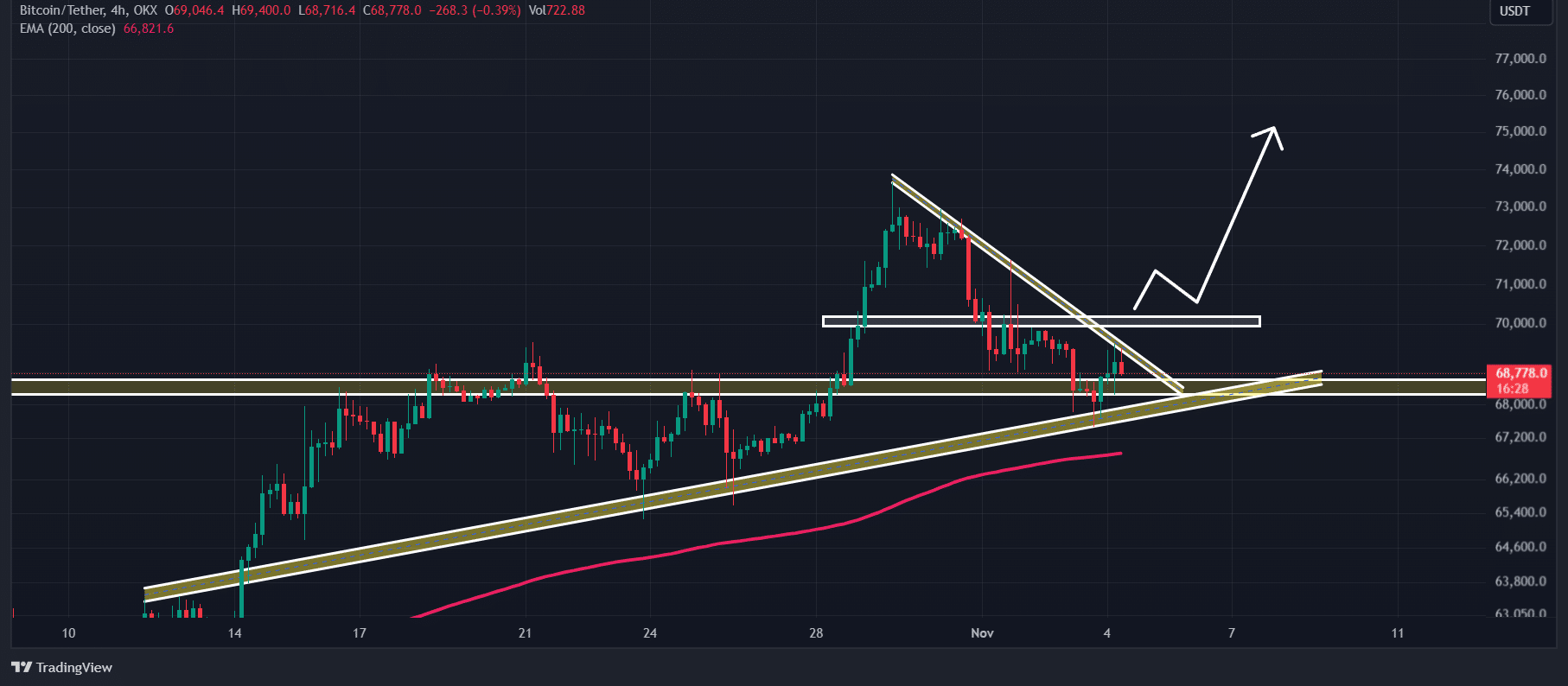

After a surge beyond the falling trend line on October 28, Bitcoin jumped over 8%. This latest drop in price seems to be a temporary adjustment, which could signal a promising upswing in the near future.

Bitcoin price analysis and key levels

As per AMBCrypto’s technical assessment, it appears that the cryptocurrency is encountering resistance due to a downward trendline in the four-hour chart. If Bitcoin experiences an upward surge, it’s likely that it might overcome this stated obstacle.

If Bitcoin surpasses the given trendline and ends a four-hour trade above $70,000, it’s quite likely that the value will experience a substantial increase. There’s even a chance it could reach a record high once more within the next few days.

But for this positive outlook on Bitcoin to hold true, it must continue to be supported at a price above $67,500. If it doesn’t, there’s a chance it could fall short.

Currently, as I’m typing this, Bitcoin appears to be transacting over its 200 Exponential Moving Average (EMA), a pattern visible not just in the four-hour but also the daily charts. This suggests that the price trend is moving upward.

BTC’s bullish on-chain metrics

Based on a bullish perspective, it seems that both whales and investors have become more active in recent times. As reported by the analytical firm IntoTheBlock, there’s been a 7.85% increase in large Bitcoin transactions over the last day. This surge could potentially push up the asset’s value further.

Furthermore, the Long/Short ratio for BTC was at 1.20, suggesting a robust positive outlook amongst traders due to their bullish sentiment. Simultaneously, there was a 2.9% increase in its Open Interest over the past 24 hours, implying growing curiosity and the creation of fresh positions by traders.

Approximately 55% of the leading traders took a bullish stance (long positions), compared to 45% who took a bearish stance (short positions) according to Coinglass data analysis.

Price performance

As a crypto investor, I’m thrilled to report that at this very moment, Bitcoin is worth an impressive $69,100. Over the past day, it’s experienced a noteworthy increase of almost 1.1%. Moreover, the trading volume has surged by an astounding 45%, suggesting a significant uptick in engagement from traders and investors alike. This could be a promising sign for further growth!

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-04 17:13