-

BTC dropped 3.5% on Monday following Powell’s remarks on Fed rate cuts.

The asset held above key short-term support at $63K, but will it continue to hold?

As a seasoned researcher with years of experience navigating financial markets, I find the recent volatility in Bitcoin and the broader stock market quite intriguing. The 3% drop in BTC following Jerome Powell’s remarks on Fed rate cuts is a testament to the interconnectedness of these markets.

On the 30th of September during the trading day, both Bitcoin (BTC) and U.S stocks saw a decline. Bitcoin specifically fell by 3% to reach approximately $63,000. This decrease came at around the same time as comments made by Federal Reserve Chair Jerome Powell regarding potential interest rate cuts.

At the National Association for Business Economics conference in Nashville, he made it clear that he didn’t lean towards either quicker or slower adjustments regarding the decrease in interest rates.

He foresaw another two interest rate cuts, each 25 bps (basis points), before the end of the year.

As an analyst, I anticipate that if economic developments proceed according to our projections, we could see another two interest rate reductions by the end of the year. This would amount to a further 0.5 percentage points in total reduction.

Market reprice Fed rate cut expectations

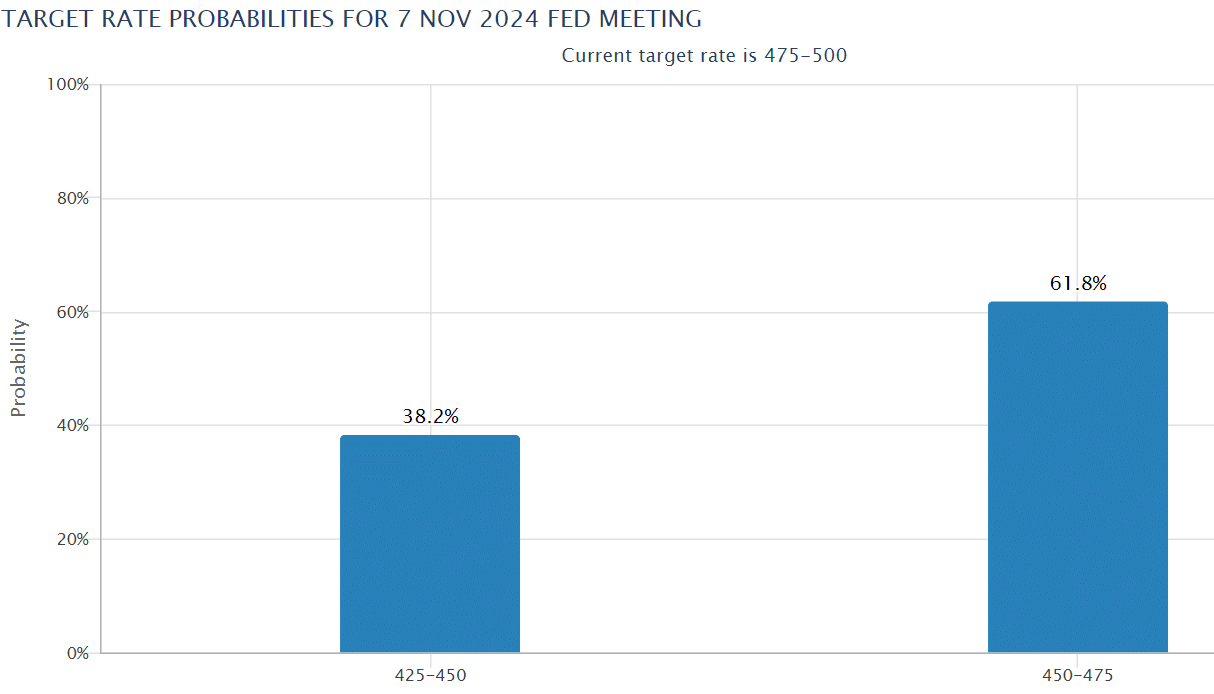

Last week, there was a prediction that the market would see a more significant reduction of 0.5 percentage points in interest rates during November, much like the adjustment made in September.

At the moment when the news was published, traders estimated a 61.8% chance that interest rates would rise by 0.25 percentage points, based on Powell’s comments.

Instead, the likelihood of a 0.50% reduction decreased from 53%, as observed on Friday, 27th September, to 38.2%.

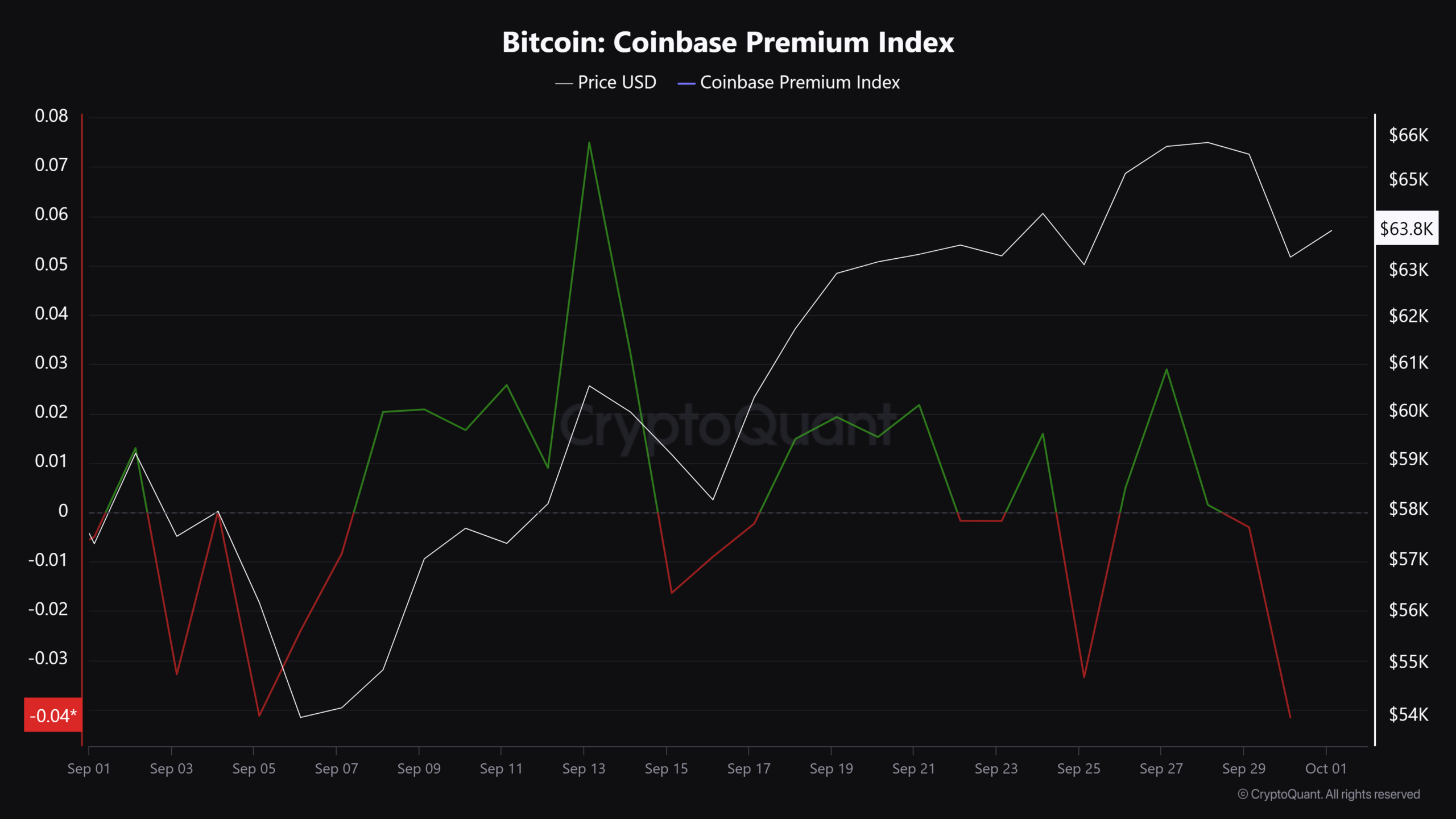

This event has caused a change in overall feeling as we move into the upcoming week, with significant U.S. employment data looming. It’s worth noting that the demand for Bitcoin in the U.S. decreased from a positive level on Friday to a negative one on November 1st, according to the Coinbase Premium Index.

On Friday, U.S. spot Bitcoin ETFs received approximately $498 million each day. However, these products saw a significant decrease in inflows on Monday, 30th of September, with just $61.3 million being netted instead.

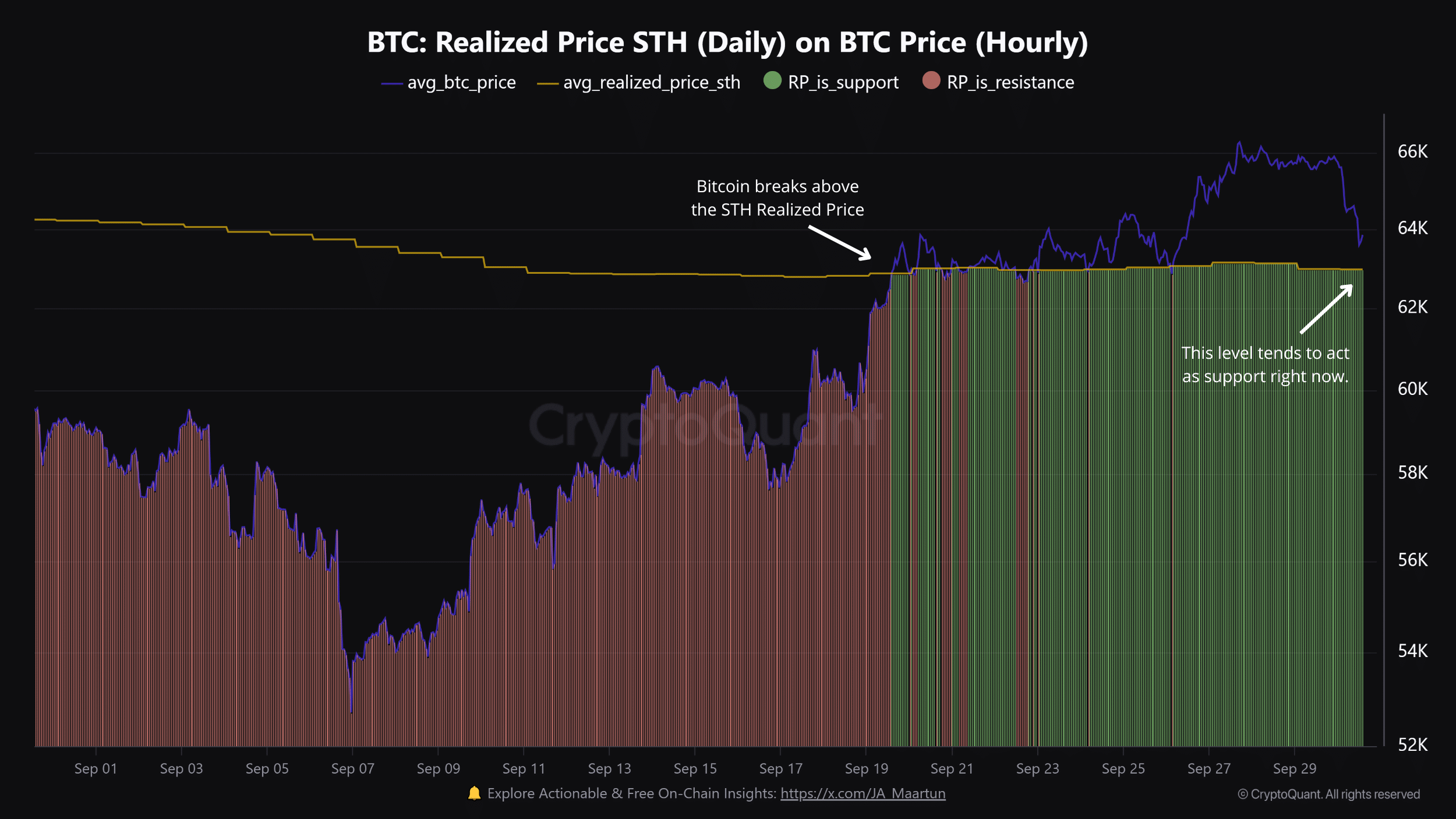

In the near future, the $63K mark might serve as significant support for the market. According to CryptoQuant’s analysis, this price point corresponds to the short-term holders’ average purchase price, and it has shown resilience in providing support since mid-September.

At press time, BTC was valued at $63.9K ahead of crucial US labor updates.

Another potential positive catalyst was an increasing signal towards an end to the Fed’s quantitative tightening (QT) as more institutions tap into the Fed’s Repo facility. This could inject more Fed liquidity and boost risk assets.

On the other hand, escalating geopolitical conflicts in the Middle East might pose a threat to Bitcoin’s anticipated uptrend during October, making it an important issue to monitor.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Gold Rate Forecast

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-10-01 15:03