- Institutional investors have accumulated over 67,000 BTC in the last 30 days, while retail traders continue selling off.

- BTC was trading at over $67,000 at press time.

As a seasoned researcher with years of experience tracking cryptocurrency market trends, I find the recent dynamics between institutional and retail investors intriguing. The fact that institutional wallets are quietly accumulating Bitcoin while retail traders continue to sell off is a classic case of the hare and the tortoise, albeit in digital form.

Over the past few days, Bitcoin (BTC) has seen an upward price movement, yet this hasn’t prevented individual investors from unloading their cryptocurrency stocks.

Despite the price increase, retail traders continue offloading their BTC, while institutional investors have been quietly accumulating.

Bitcoin whales continue accumulating

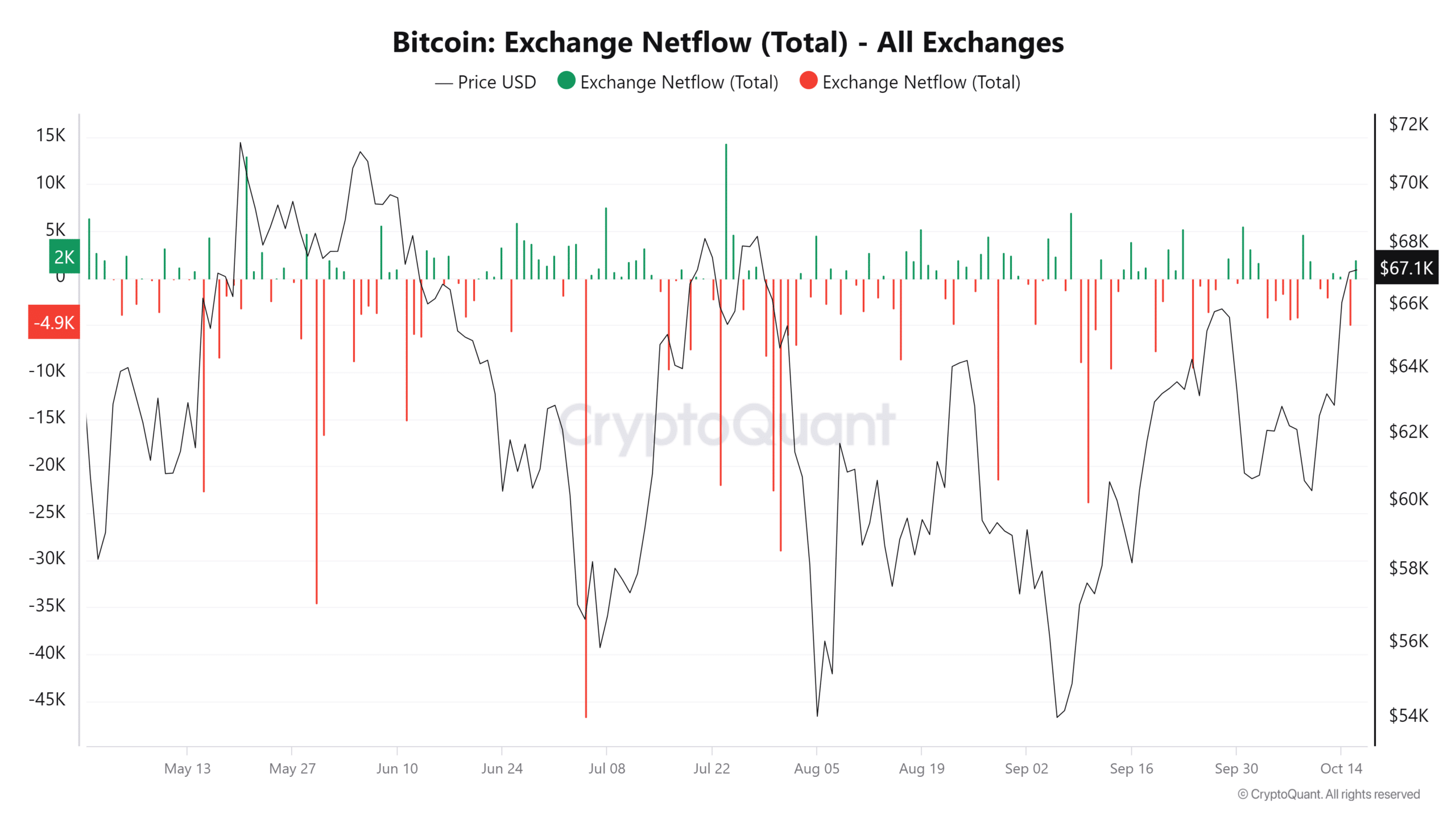

Lately, information from CryptoQuant shows that individual investors are offloading Bitcoin, whereas large-scale investors have been amassing it.

In the last month, institutional investors have gathered approximately 67,000 Bitcoins, increasing their overall possession to more than 3.9 million Bitcoins.

It seems like the drop in Bitcoin ownership by individual investors might be because of the lack of clear direction in its price movement over the past few weeks, followed by the recent upward trend.

Price stagnancy frequently causes retail investors to doubt and decide to offload their assets, hoping to repurchase them later when the market mood has turned positive and prices have risen.

Conversely, institutions that amass Bitcoin during market downturns are likely to sell their BTC as prices rise.

Ongoing selling pressure

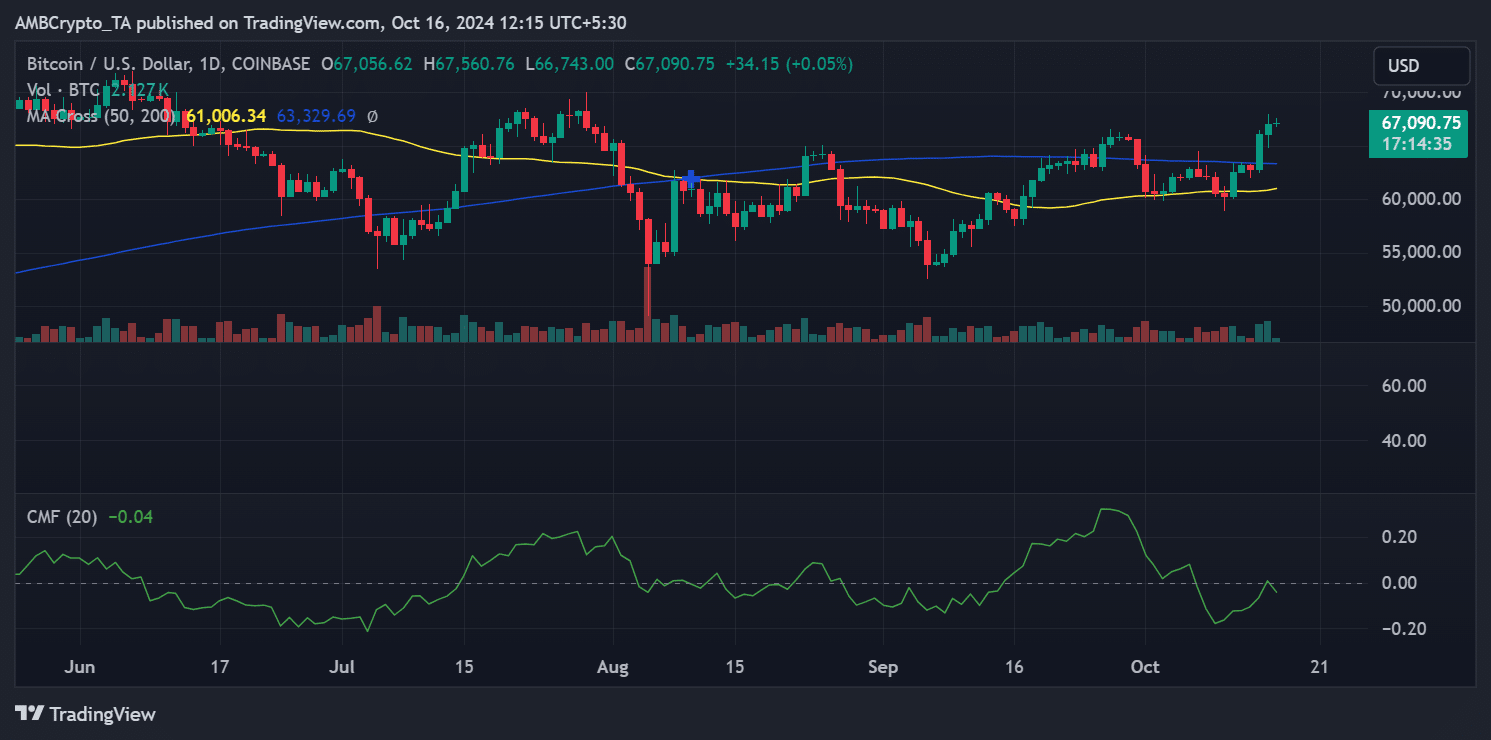

According to AMBCrypto’s examination, the Bitcoin Chaikin Money Flow (CMF) indicates a persistent seller’s advantage, even though there’s been an uptick in Bitcoin prices recently.

Currently, the CMF is approximately -0.04, suggesting that there is a slight tendency towards selling rather than buying.

A low Market Maker Ratio (MMR) implies that there are currently more individuals selling Bitcoin than buying it on the market.

When the Cumulative Moving Average (CMF) falls below zero, it indicates a higher volume of sellers compared to buyers. This imbalance may lead to a decrease in the asset’s price due to increased selling activity.

As an analyst, I find myself observing a situation where a return of the Capital Movement Facility (CMF) to positive territory could be indicative of strengthening buying activity. Such a development might serve as a positive signal for continued price advancement.

If the Change in Money Flow (CMF) stays negative or drops more, this might suggest decreasing buyer enthusiasm, potentially resulting in price stabilization or even a minor reversal in the near future.

Mixed Bitcoin exchange flows as price picks up

For the past day, Bitcoin’s value has been moving upwards while experiencing varying transactions between buyers and sellers.

In the last trading day, it appears that Bitcoin saw an outflow of close to 5,000 coins, indicating a net decrease in its circulation.

This implies that Bitcoin is being transferred off exchanges at a greater rate compared to the amount going on, often suggesting a positive outlook among investors. As they remove their BTC for storage or trading purposes elsewhere, it could be seen as a sign of optimism.

In the current state of my research, there’s been a reversal in the trend I’ve been tracking, as approximately 2,000 Bitcoins have been moving back into exchanges, marking an increase in their flow.

The back-and-forth trading pattern indicates that investors are adjusting their strategies based on shifting market opinions, maintaining a delicate equilibrium between keeping and selling Bitcoins, as its value trend persists.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-16 14:16