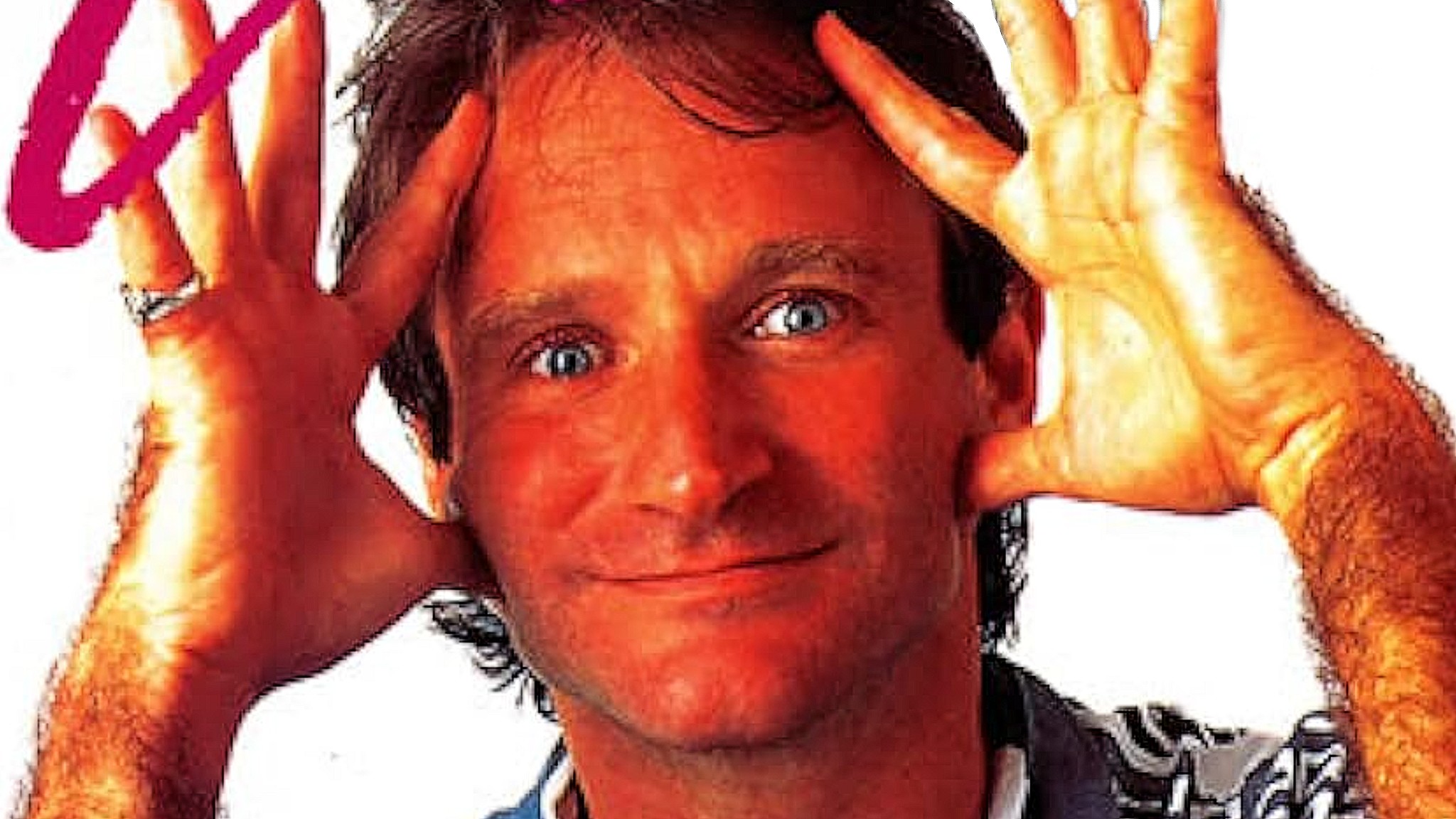

One of Robin Williams’ Best Movies of All Time Is Streaming Free

In various roles, from the suspenseful movie “One Hour Photo” to a groundbreaking voiceover in Disney’s animated “Aladdin”, and even tackling Shakespeare as he portrayed the corrupt courtier Osric in Kenneth Branagh’s “Hamlet”, this versatile actor has shown no boundaries. One of his finest works, “Jumanji”, is now available to stream for free on Tubi.