-

Short-term investors’ profitability fell but could be a price support for BTC.

The SSR decreased, indicating that buying power in the market was solid.

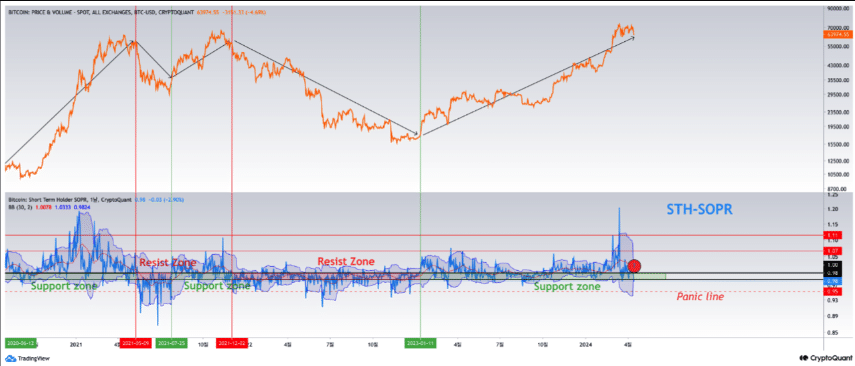

If Bitcoin‘s [BTC] drop in price presents an opportunity for investors, it could be a fleeting chance. However, this may hold true only if the past pattern of the Spent Output Probability Distribution (STH-SOPR) continues to unfold.

An acronym named STH-SOPR, or Short-Term Holder Spent Output Profit Ratio, signifies the ratio of profits reaped by short-term crypto investors when they sell their holdings. When this metric increases, it indicates that these investors are earning profits and market conditions have become more lucrative.

In the past, a decreasing trend in the STH-SOPR (Spent Output Profit Ratio) has indicated intense selling pressure and fear in the market. Currently, this metric is dropping, which supports the belief that sellers are panicking.

BTC has enough strength in waiting

Pseudonymous analyst CoinLupin from CryptoQuant shared his perspective on a current Bitcoin trend. In his opinion, Bitcoin could be going through a period of stability.

Additionally, CoinLupin acknowledged that the decline had negatively impacted investor earnings. However, he pointed out that this metric could potentially bolster the coin’s value.

Mild setbacks have noticeably impacted the earnings of short-term investors. This might mean that sufficient reduction of financial obligations has occurred, potentially signaling a “floor” in market prices.

Bitcoins have been referred to as being in a bull market for quite some time now. According to AMBCrypto’s observation, this condition presents an excellent chance for purchasing.

Although it’s unclear whether the profits from this opportunity will materialize before or after the Bitcoin halving, which is currently scheduled to occur, the cryptocurrency is now priced at $64,392 – representing a 2% decrease in value over the past day.

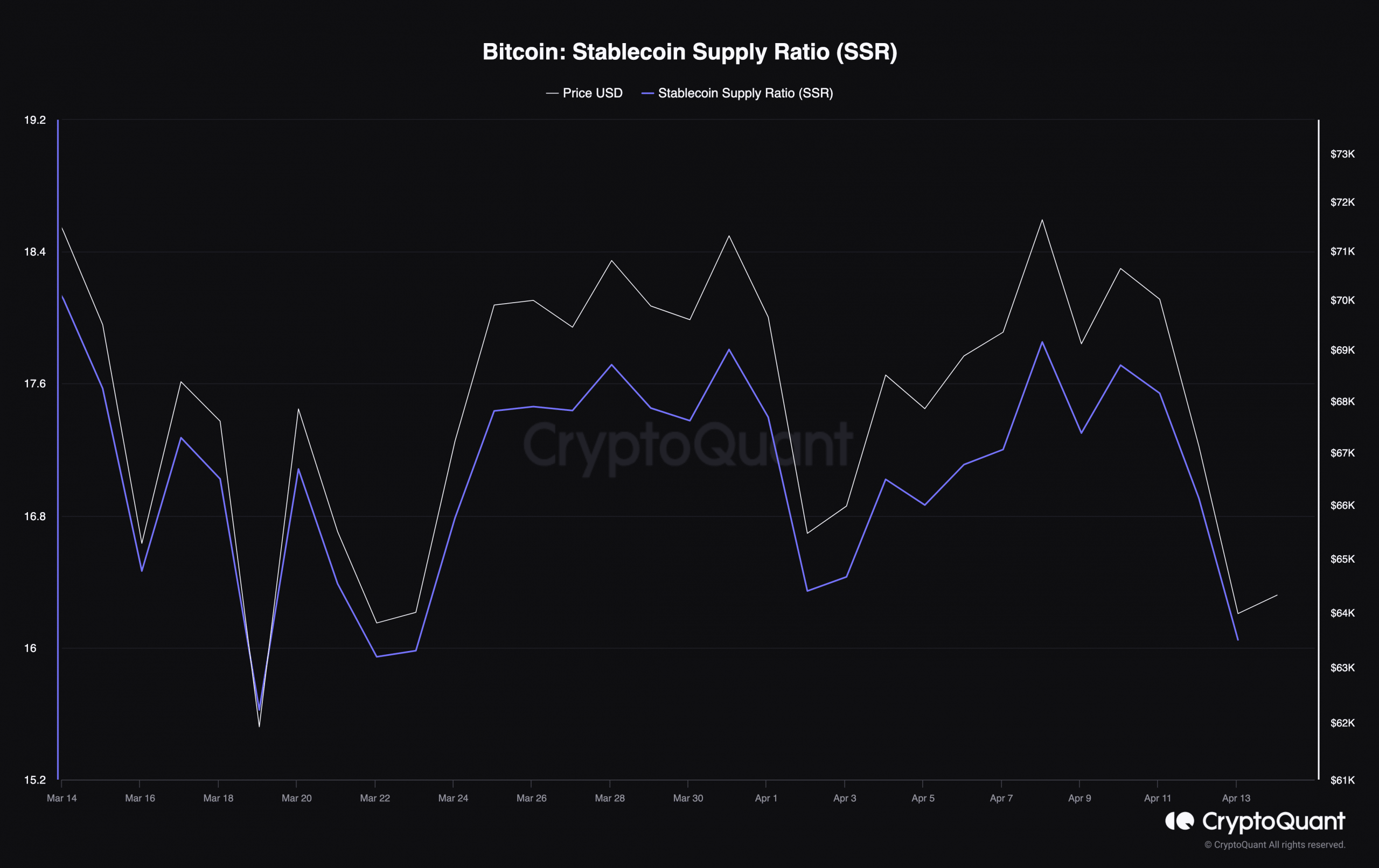

Although the decrease was observed, the Stablecoin Supply Ratio (SSR) gave indications suggesting a potential price rise. Normally, larger values of the SSR signaled potential sell-offs and an impending price drop.

At present, the Stock-to-Flow Ratio (SSR) of Bitcoin has decreased to 16.04. This could be an indication that investors are gearing up for purchasing, leading to potential price increases. If market players employ their stablecoin resources prior to the upcoming halving event, Bitcoin’s value might surge back towards $70,000.

If they choose not to participate, Bitcoin’s price could stabilize. Yet, it’s nearly guaranteed that significant volatility will occur around the upcoming event and afterward, as historical trends suggest.

Some players are scared

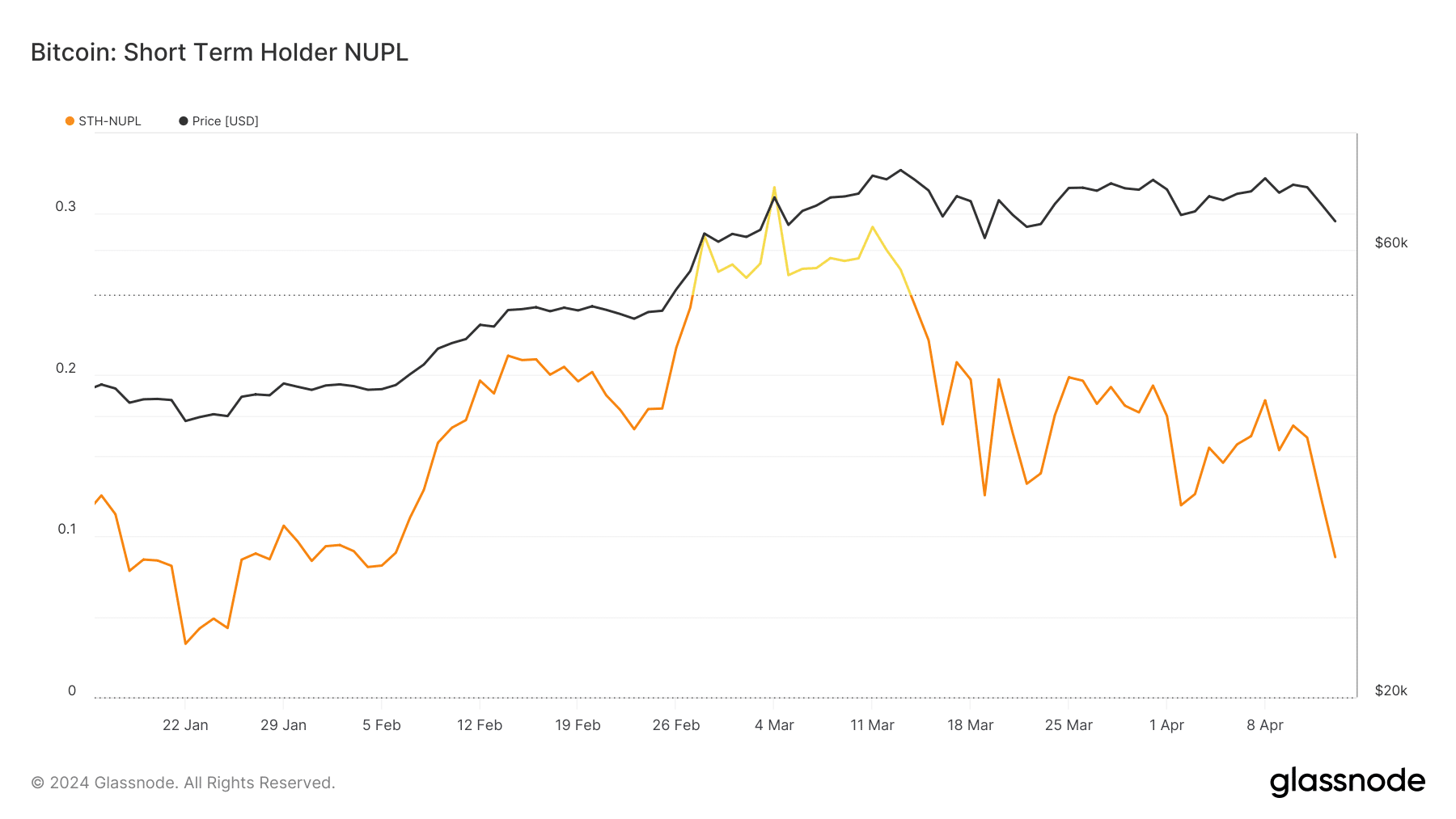

During this period, AMBCrypto discovered a shift in public feeling towards the coin. This became apparent upon examining the Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) figures.

The STH-NUPL index examines unspent transaction outputs (UTXOs) that are less than 155 days old to gauge the attitude of short-term investors towards Bitcoin’s price trend. With an STH-NUPL value of 0.24, the market sentiment among short-term investors was optimistic, reflected by a yellow color on the index.

But it was no longer the case as the sentiment has moved to fear (orange).

Is your portfolio green? Check the Bitcoin Profit Calculator

If history repeats itself, the sentiment could be great for Bitcoin’s price.

The metric stayed roughly identical, and within a week, the price shifted from $51,569 to $62,547. It remains to be seen if this trend repeats itself in the coming days.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-04-15 09:11