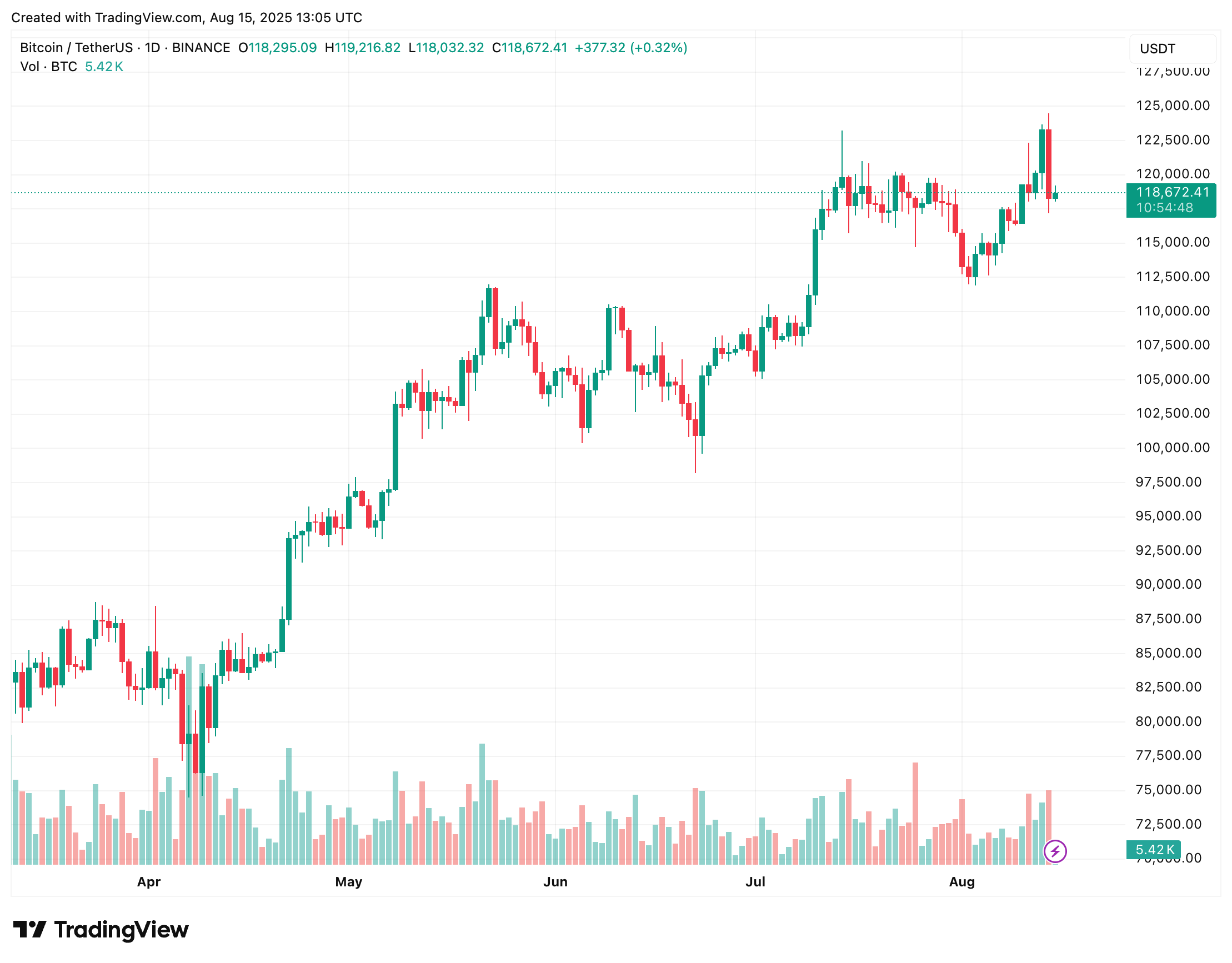

Amidst the tempest of the financial world, where the winds of inflation howl with a ferocity that would put any storm to shame, Bitcoin (BTC) found itself in a peculiar position. It had staged a mild, almost hesitant, rebound from yesterday’s dramatic plunge to $117,180, now hovering tantalizingly close to the $119,000 mark. This subtle ascent, akin to a dancer pausing mid-twirl, was not without its own intrigue. The declining leverage ratio, a metric that even the most seasoned traders might find as enigmatic as a riddle wrapped in a mystery inside an enigma, suggested that the digital currency’s bullish momentum might yet continue, perhaps even leading to a new all-time high (ATH) in the near future. Oh, the suspense! 🕵️♂️✨

Leverage Ratio Takes a Dive, Bulls Break into a Smile 😁

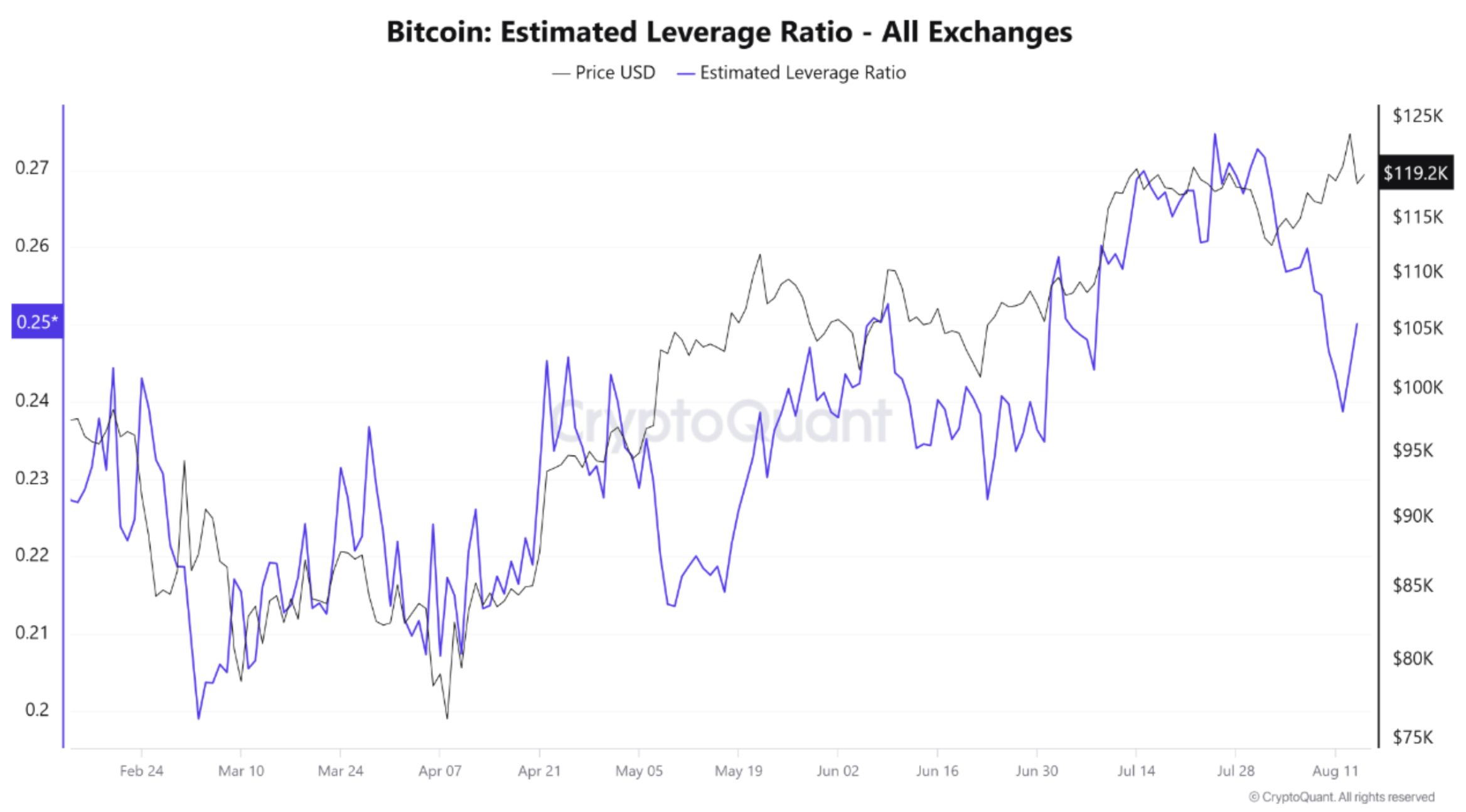

According to a CryptoQuant Quicktake post by the insightful Arab Chain, Bitcoin’s leverage ratio across all cryptocurrency exchanges has experienced a precipitous decline from its lofty heights in late July and early August, when it stood at a robust 0.27. By early August, the ratio had dipped to 0.25, only to make a slight recovery. This period contrasts sharply with the months of May to late July, where both the price and leverage ratio ascended in a harmonious dance, a clear indication of traders opening larger positions, much like a chorus line perfectly synchronized.

However, this time, the decline in leverage has not been accompanied by a corresponding fall in price-a phenomenon that suggests the risk of a sharp correction has diminished. Arab Chain posits that this may be due to the liquidation of high-risk positions or traders opting to exit the market amidst the volatility. With BTC steadfastly holding around $119,000, the lower leverage ratio is a beacon of hope for the bulls, indicating that the recent price gains are more a product of genuine liquidity rather than the frothy speculation that often precedes a market crash. 🚀🌊

A continued decline in leverage could further reduce the likelihood of a sharp correction. Conversely, a sudden spike in leverage alongside a price rally would raise the specter of a pullback. The analyst opines:

If leverage remains at moderate or low levels while the price remains stable, this could provide a stable base for a new uptrend. An estimated leverage ratio (ELR) holding between 0.24-0.25, coupled with a gradual price break above 120K, could signal a spot-supported upside and a possible extension toward the July highs, with moderate funding and slowly rising open interest.

However, a swift rise in the leverage ratio above 0.27 before or during a test of the $120,000-$124,000 range could herald high liquidation risk and the potential for a sharp downward “shakeout,” a scenario that would no doubt send shivers down the spines of even the most stoic investors. 💀📉

On-Chain Data: A Cautionary Tale 🚧📊

While the lower leverage is a boon for Bitcoin bulls, the on-chain data tells a different story-one that whispers of potential selling pressure. Rising exchange reserves and whale transfers, phenomena that are as ominous as a dark cloud on the horizon, hint at the possibility of a sell-off.

For example, Binance’s BTC reserves have surged to 579,000, a development that has raised eyebrows and sparked concerns about profit-taking after Bitcoin’s recent rally to a fresh ATH. Similarly, more BTC miners are transferring their holdings to Binance, possibly preparing to cash out. This movement, like a gathering storm, adds a layer of uncertainty to the market’s otherwise bullish narrative.

Compounding these concerns, some analysts warn of a potential pullback to $110,000 to fill outstanding fair value gaps. At the time of writing, BTC trades at $118,672, down a mere 0.1% over the past 24 hours-a testament to the market’s delicate balance between hope and fear. 🌬️💥

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- USD JPY PREDICTION

- These Are the 10 Best Stephen King Movies of All Time

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

- Best Controller Settings for ARC Raiders

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

2025-08-16 01:19