-

Bitcoin might wait till Q3 or Q4 before the bull run continues

BTC’s price could hit $101,500 before the end of 2024

As a researcher with a background in cryptocurrency analysis, I believe that Bitcoin’s bull run may take longer to continue than anticipated. Based on recent on-chain metrics and market trends, it seems that Bitcoin is currently in a period of accumulation rather than selling.

As a researcher studying Bitcoin’s [BTC] price trends, I have observed that the path to higher values on its charts may be more drawn out than initially anticipated based on my analysis of several key on-chain metrics with AMBCrypto.

As a researcher observing the Bitcoin market at the current moment, I’ve noticed a downward trend in the number of Bitcoins in circulation. This decrease might indicate a strong inclination among Bitcoin holders to buy and hoard more coins rather than sell them.

Has the big money chase taken a break?

It’s important to note that the decrease in Bitcoin reserves is indicative of a bull market. Yet, this data point implies that Bitcoin could be around 50% below its maximum value during this market cycle before reaching its peak.

As I pen this down, Bitcoin’s value stood at an impressive $67,937. However, it is important to note that this figure represents a significant drop from its all-time high in March. The current situation of dwindling reserves and decreasing price raises concerns that Bitcoin could be seeking out liquidity in the market.

As a crypto investor, I’m always on the lookout for opportunities in the market, including liquidity hunting. When prices are fluctuating within a narrow range, like Bitcoin’s recent movement between $64,000 and $68,000 as assessed by AMBCrypto, it can be an ideal time to search for low liquidity pockets where I might be able to buy or sell at potentially better prices than in more heavily traded areas.

The pricing instability could indicate that Bitcoin may not experience a substantial price surge before the end of the second quarter (Q2) of this year. Consequently, the bull market might take a break and resume its advancement during Q3, potentially extending into the final months of Q4.

According to the insights of CryptoQuant’s analyst, XBTManager, we find a consensus in his perspective as well. In his discourse, he expounded upon,

Bitcoin is building momentum for its next significant increase. Once it accumulates sufficient power, a pronounced surge may ensue. It’s plausible that we’ll experience more uptrends reminiscent of the ones seen in Q3 and Q4.

As a crypto market analyst, I’ve come to recognize that my perspective aligns with the Crypto Fear and Greed Index. This valuable tool assesses the current emotional state of the crypto market by analyzing various factors, such as market volatility and social media trends. By doing so, it provides insights into whether Bitcoin and other cryptocurrencies are fairly priced or if they’re experiencing fear (underpriced) or greed (overpriced) from investors.

Bitcoin’s price can double

At the moment of publication, the metric registered a value of 60. This figure is a signal that market greed was not excessive at that point. Consequently, Bitcoin appeared reasonably priced based on its chart analysis. Nevertheless, this observation implies that there could be another substantial increase in the future mid to long-term.

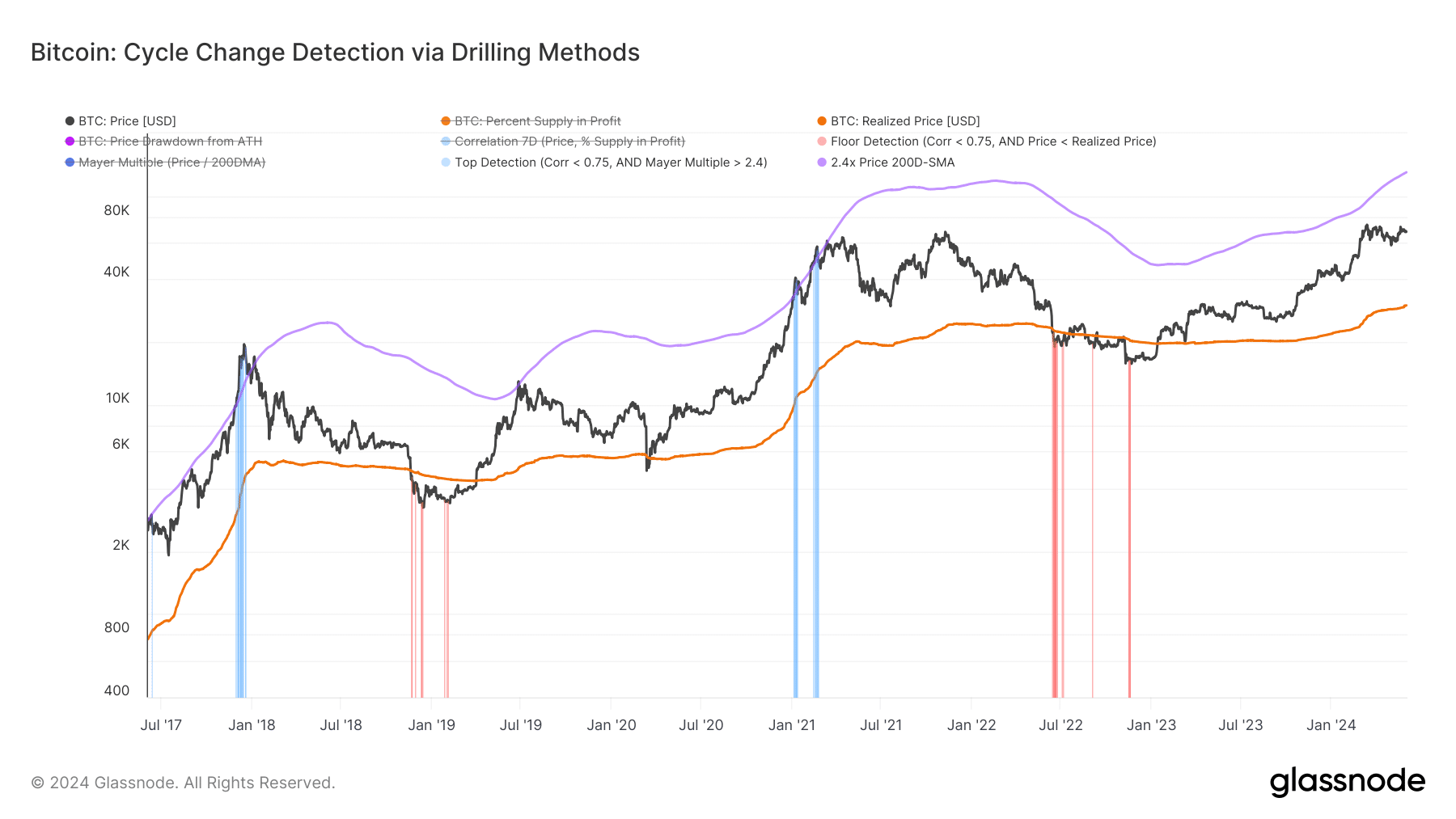

As a researcher examining Bitcoin’s price trend, I utilized the Cycle Change Detector to provide additional evidence for my optimistic forecast. This valuable metric indicates whether Bitcoin has shifted from a bearish to a bullish market condition.

This metric takes into account the relationship between Bitcoin’s price and supply in calculating profits. On the provided chart, a light blue line would become visible once Bitcoin reaches its maximum price.

As a financial analyst, I would interpret a light red line on the chart to mean that Bitcoin’s price was near its lowest point. At the moment of reporting, however, Bitcoin had already surpassed this mark and was moving upwards.

Is your portfolio green? Check the Bitcoin Profit Calculator

Despite not seeing a blue light from the top detector just yet, based on the preceding indicators, Bitcoin’s price could reach $101,500 by the end of Q3 or Q4 in 2024.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Thief Build

- Ludicrous

- Gold Rate Forecast

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-06-03 02:15