- An analyst predicted a notable rise in Bitcoin’s price.

- Recent market indicators suggested an impending bullish surge.

As an experienced analyst, I have closely monitored the crypto market and have paid particular attention to Bitcoin’s [BTC] price trends. While recent market indicators suggested a notable downtrend, I remain optimistic about a potential bullish surge in the near future. Renowned crypto analyst Lark Davis shares this sentiment, pointing to an influx of institutional investments and upcoming Bitcoin exchange-traded funds (ETFs) as catalysts for the rally.

Although Bitcoin’s [BTC] price has dropped recently, dipping to $60,790 following a momentary surge above $63,000 during the week, there are indications that a substantial price increase could be imminent.

The past day’s 2.8% decline has not deterred market analysts from predicting an imminent surge.

Indeed, well-known cryptocurrency analyst Lark Davis is leading the way with his prediction that Bitcoin’s value may experience a significant surge in the upcoming weeks.

A path to the rally

Lark Davis, a well-known figure in the cryptocurrency world, expresses positivity regarding Bitcoin’s imminent development due to a surge of institutional investors preparing to make their entry into the market.

Davis harmonized his bitcoin forecasts with Standard Chartered Bank’s estimate that the cryptocurrency could touch $100,000 by August.

Although, he adjusted expectations to a more conservative $90,000 by this year’s end.

As a researcher, I’ve come across Davis’ revelation that the incoming institutional investment via Bitcoin ETFs might help offset any selling pressure caused by large-scale Bitcoin disposals or government purchases.

Davis emphasizes the importance of Bitcoin surmounting the $72,000 barrier as a prerequisite for potentially igniting a robust bull market during the last quarter of the year.

This surge, he posited, could extend beyond Bitcoin, amplifying gains across the altcoin market.

Beyond Bitcoin, Davis extended his bullish outlook to Ethereum [ETH] and several altcoins.

As an analyst, I would anticipate a significant surge of investment capital flowing into Ethereum, primarily fueled by the upcoming launch of spot Exchange-Traded Funds (ETFs). This influx could potentially lead to a notable increase in Ethereum’s market value.

I, as an analyst, am equally enthused about Ethereum as Davis, but I also recognize Solana’s significance in the blockchain landscape. Solana holds a promising position in both development and market dynamics.

As a crypto market analyst, I’m continually investigating emerging trends within the digital asset landscape. I hold confidence in several promising projects: Polkadot [DOT], Helium [HNT], and even some lesser-known contenders like Arweave [AR] and Fetch.ai [ASA].

As an analyst, I believe that each of these platforms brings distinct offerings and advances that could significantly contribute to the expansion of the cryptocurrency market.

Is Bitcoin ready for the surge?

It’s important for Davis to carefully examine Bitcoin’s underlying factors before assuming a strong price increase in the near future.

According to AMBCrypto’s interpretation of Glassnode’s statistics, there was a notable surge in the number of new Bitcoin addresses. This figure rose significantly from approximately 250,000 in early June to a high of 432,000 on July 1st.

As a seasoned cryptocurrency analyst, I, Ali, have advocated for this viewpoint, emphasizing that the outdated investment advice “Sell in May and go away” no longer holds weight. Instead, retail investors are reaping substantial returns, with a notable surge in new Bitcoin addresses reaching a four-month peak.

The trend was mirrored by a rising interest among Bitcoin whales.

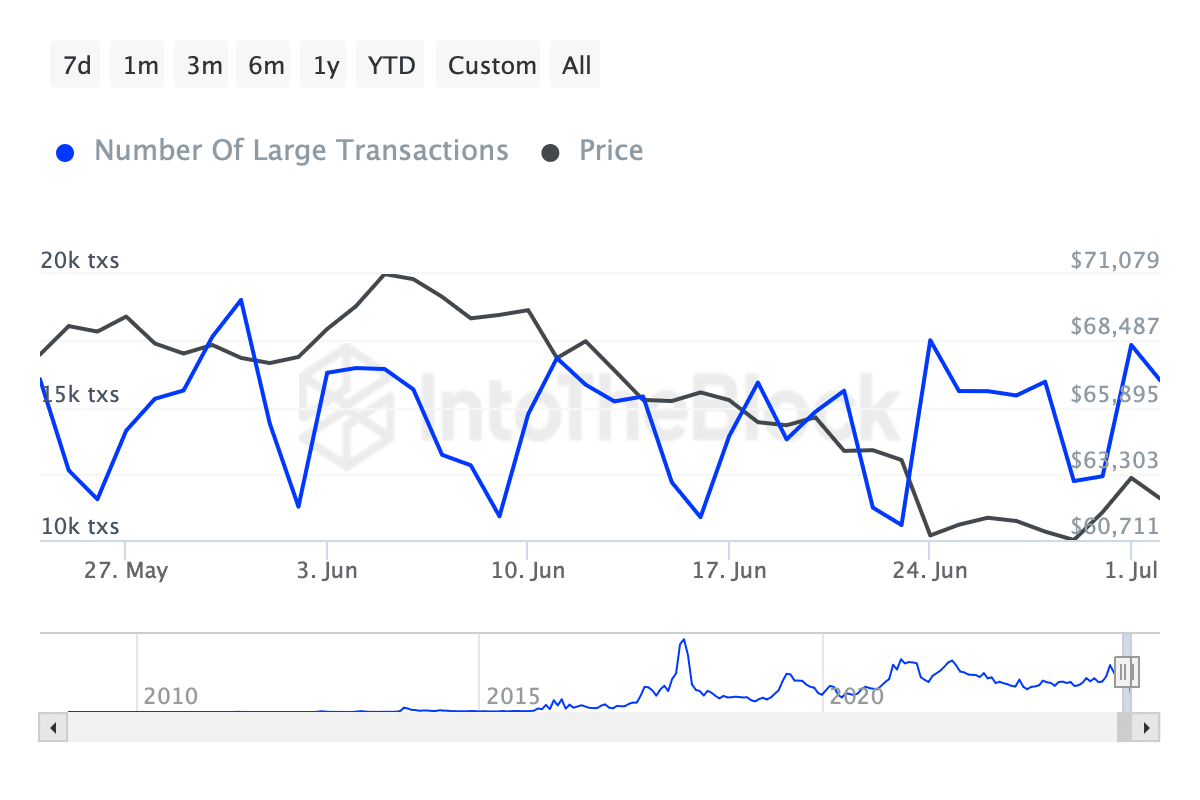

According to a recent analysis by AMABCrypto using data from IntoTheBlock, the number of Bitcoin transactions valued above $100,000 has significantly increased. In early June, there were fewer than 12,000 such transactions. By contrast, this figure had risen to over 17,000 by the beginning of July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated heightened market activity and potential accumulation by large-scale investors.

Instead of “In contrast,” you could use the phrase “On the other hand” or “However.” So, “On the other hand, AMBCrypto noted a significant decrease in Bitcoin’s hash rate in the past few days, which might indicate an imminent period of miner surrender.”

Read More

- EUR JPY PREDICTION

- Doctor Strange’s Shocking Return in Marvel’s Avengers: Doomsday Revealed!

- USD MXN PREDICTION

- OM PREDICTION. OM cryptocurrency

- FIL PREDICTION. FIL cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- DF PREDICTION. DF cryptocurrency

- How to watch A Complete Unknown – is it streaming?

- CRV PREDICTION. CRV cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

2024-07-04 04:08