One cannot help but observe with a certain degree of amusement the latest trend in the world of finance: Bitcoin, once the darling of the crypto-curious and the libertarian-leaning, is now being hoarded by the very institutions it was meant to circumvent. By mid-2025, the great unwashed masses of retail investors find themselves increasingly priced out of the market, as institutional investors tighten their grip on the cryptocurrency, capturing a staggering 20% of its circulating supply.

Institutional Bitcoin Holdings Barrel Toward 20% Of Supply

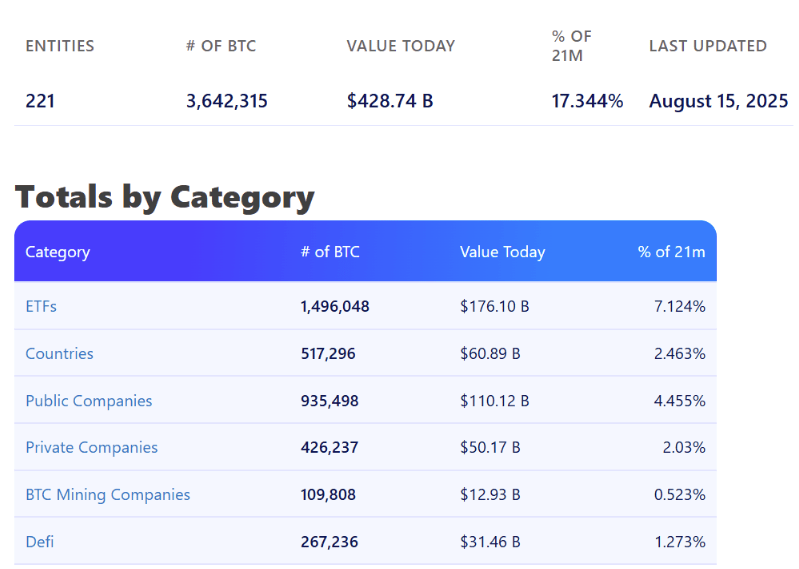

Data from the ever-reliable Bitbo reveals that a motley crew of ETFs, public and private companies, governments, and even the odd DeFi protocol, now control more than 3.642 million BTC, or 17.344% of the total supply. At current market rates, this amounts to a cool $428 billion worth of Bitcoin, safely ensconced in institutional treasuries where it can do little more than inflate the egos of its custodians.

ETFs lead the charge, with over 1.49 million BTC under their belt, followed closely by public companies such as the enigmatic Strategy and the tech titan Tesla, who together account for 935,498 BTC. Strategy, in particular, has made a name for itself with a relentless accumulation strategy that would put Scrooge McDuck to shame, amassing 628,946 BTC, or about three percent of the entire circulating supply. One can almost hear the cackles of glee from the boardroom.

Private companies, not to be outdone, hold 426,237 BTC, worth a modest $50.17 billion, and about 2.03% of the total circulating supply. BTC mining companies, those modern-day prospectors, own 109,808 BTC (0.523% of the total circulating supply), while DeFi protocols, the digital upstarts, own 267,236 BTC (1.273% of the total circulating supply). It’s a veritable feast of financial feudalism.

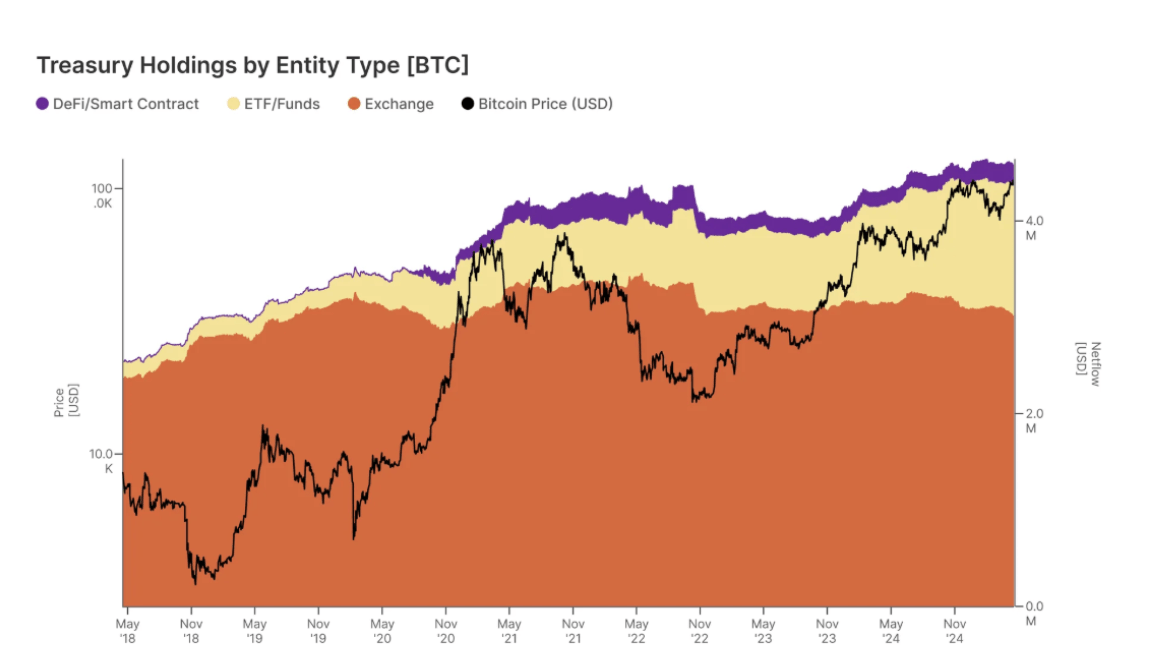

Chart Image From Gemini: Bitcoin treasury holdings by entity type

Is Bitcoin The New Wall Street Playground?

The early days of Bitcoin were marked by a charming naivety, a blend of retail investor enthusiasm and the long-term conviction of early adopters. Alas, the balance of power has shifted, and Bitcoin is increasingly becoming a playground for large Wall Street institutions, much to the chagrin of the common man.

Institutional demand for Bitcoin has not been limited to corporations and ETFs; governments have also begun to flex their muscles. The United States, ever the pioneer, established a Strategic Bitcoin Reserve in March 2025, filled with seized and forfeited digital assets. Other nations, such as El Salvador and Bhutan, have also joined the fray, further reducing the available supply and driving up the price. It’s enough to make one wonder if Bitcoin will soon be the exclusive domain of the elite.

Analysts, those modern-day soothsayers, predict that this concentration of Bitcoin could either stabilize its price and support long-term growth or, conversely, undermine its decentralization and natural price dynamics. Whatever the outcome, one thing is clear: Bitcoin has become the latest toy in Wall Street’s vast playground.

At the time of writing, Bitcoin was trading at $117,460, a sum that would make even the most jaded financier blink.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

- These Are the 10 Best Stephen King Movies of All Time

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Best Werewolf Movies (October 2025)

- USD JPY PREDICTION

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

2025-08-16 21:43