Oh, the glamorous world of cryptocurrency – nothing like a multi-billion-dollar liquidation event to get your adrenaline pumping. It seems the crypto market recently decided to host one of its livelier downturns. Over the course of a mere 24 hours, a jaw-dropping $1.7 billion in crypto was liquidated, making thousands of traders spill their virtual coffee in bemusement and horror. Ethereum, Ripple (XRP), Solana, oh my! Each took a nosedive of about 8%, while Bitcoin, ever the drama queen, temporarily slipped into double-digit losses. 😱

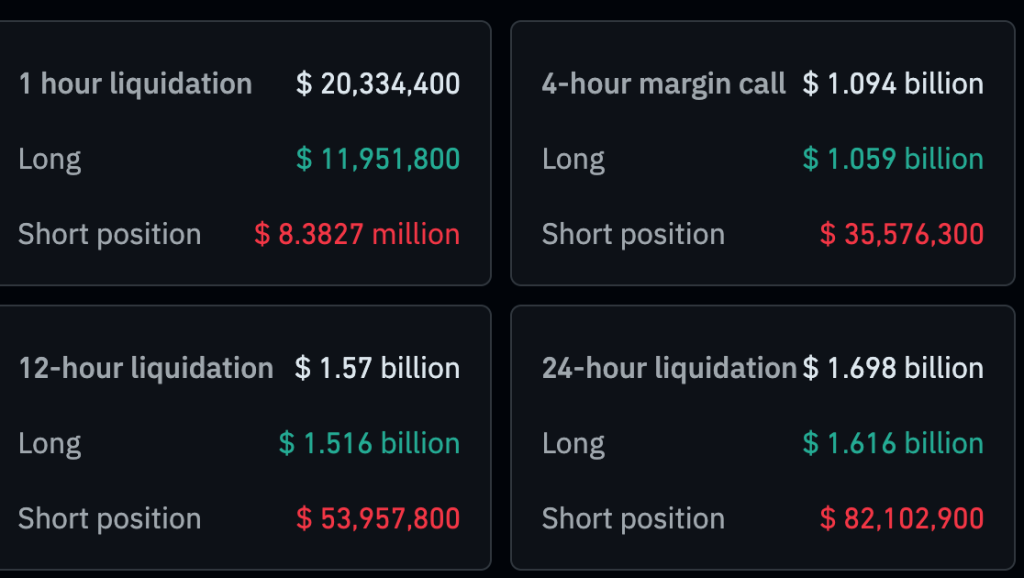

The tipping point? High-leverage futures traders were left scrambling, liquidating their positions like they were clearing out an overstocked attic in spring. In just 10 minutes, over $1 billion vanished from the market. How’s that for a rapid shift in sentiment? Talk about fast-paced action! 🔥

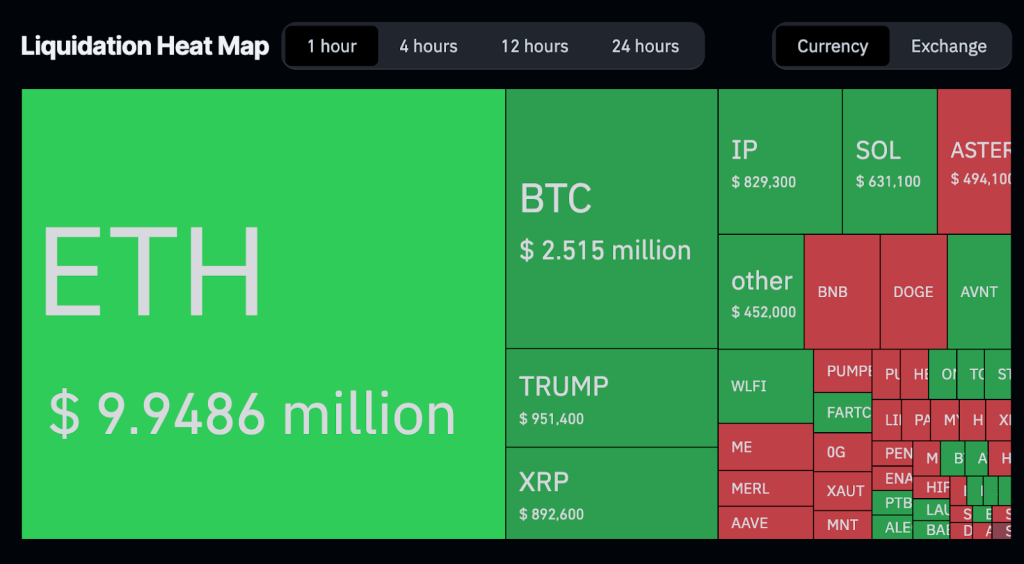

According to those folks over at Coinglass, the $1.7 billion was split into $1.615 billion worth of longs and a comparatively modest $85.88 million in shorts. By the way, Ethereum waved goodbye to $483 million and Bitcoin bid farewell to $276 million. These figures paint quite the picture of how speculative bets can face the music.

Why Cryptos Tumbled – Beyond Just Market Whimperings

This financial fiasco wasn’t solely a wild, crypto-specific casino moment. A number of factors lined up, combining forces like a storm brewing over a calm sea:

- Worldwide. Recession. Fears combined with disappointing macroeconomic data threw global risk assets into a frenzy. 📉

- Let’s talk liquidity – or the lack thereof. When there’s not enough cash to go around, even a slight hiccup can cause a whole lot of mayhem.

- Out went the large leveraged long positions, reminiscent of someone cancelling a dinner reservation at a five-star restaurant after seeing the bill. 🍽️💸

- A parallel sell-off in the global stock markets whispered its ominous tune, making sure the melody spread through crypto lanes as well.

Perhaps, just perhaps, all this chaos came hot on the heels of some “rumored big crypto announcement.” Go figure – maybe those traders did grasp something that regular folks don’t.

A Look Beneath the Surface: On-Chain Data Whines about Weakening Activity

The on-chain activity subplot has been thin on the ground for weeks, betraying a trend of weakening momentum. Analysts keep mumbling about unsustainable leverage levels and insecure liquidity. Seems like every rally is more like a sputtering gasp than a sprint, swiftly giving way to periods where the market just… sits. Post-FOMO-C (Federal Open Market Committee) forecasts painted a high-risk landscape, which today’s events have graciously validated.

Its Implications for Bitcoin, Ethereum, and the Altcoins’ Existential Dread

This crypto liquidation cascade is no small storm in a teacup:

- Systemic Risk Elevator Musings: Investors might start eying Bitcoin or stablecoins as if they were quirky Mr. Wilson, the neighbor on “Bob’s Burgers,” for whom only a select few would venture out.

- Oversold Feel-Good Quality: A relief bounce might make an appearance if macroeconomic conditions find some semblance of peace.

- Influences from Policy and Regulations: Looming decisions by the Fed and their fellow central banks are poised to be the puppet masters of the next cryptocurrency adventure.

Crypto Investors: Now What?

Yes, the market shock was scarring, but hold on tight – this rollercoaster of volatility is as common in the crypto universe as snapping fingers in the dark. Traders must stay wary of leveraging more than the number of carbohydrates they can count at Thanksgiving, especially in environments with liquidity dry as a desert. With seasonal holidays on the horizon, we’re probably in for another round of consolidating signals before the next major escapade. Meanwhile, eyes are peeled for whether the promised crypto announcement might recalibrate sentiments – or usher in yet another legion of liquidations. 🕰️

Don’t Miss the Crypto Beat!

Engage your neurons with breaking news, unparalleled expert analyses, and real-time updates catering to Bitcoin buffs, altcoin aficionados, DeFi devotees, and the NFT enthusiasts.

Frequently Asked Coin Quandaries

What sparked today’s crypto meltdown?

A tempest of recession fears, scarcity of liquidity, and an $1.7 billion liquidation fiesta unleased a chain reaction of selling from overleveraged positions.

How much cash hit the crypto dustbin?

Some $1.7 billion in assets got axed over a day, mainly long positions ($1.6B worth). Ethereum took the early lead extinguishing $483 million, with Bitcoin hot on its heels at $276 million.

What’s the secret sauce for a liquidation event?

Liquidations appear when traders with too much leverage go bust, leading to a chain reaction of sell-offs spiced by falling prices.

Safe to nibble the dip now?

Caution is your best pal. Prices may be inviting, yet lurking system risks mean that market volatility is still more capricious than a cat on a caffeine binge. Ease into it with a preference for Bitcoin for the wary soul.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- These Are the 10 Best Stephen King Movies of All Time

- 10 Movies That Were Secretly Sequels

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- USD JPY PREDICTION

2025-09-22 10:39