- Bitcoin might just decide to throw a party above the $90K-108K range. 🎉

- The choppiness index and a sudden lack of panic from long-term holders are giving us hope. 🙏

So, here we are, folks. Bitcoin [BTC] is strutting around like it owns the place, with key on-chain indicators whispering sweet nothings about a breakout from the $90K-108K range. It’s like waiting for your favorite show to return after a cliffhanger—will it be a triumphant return or a total flop? 📺

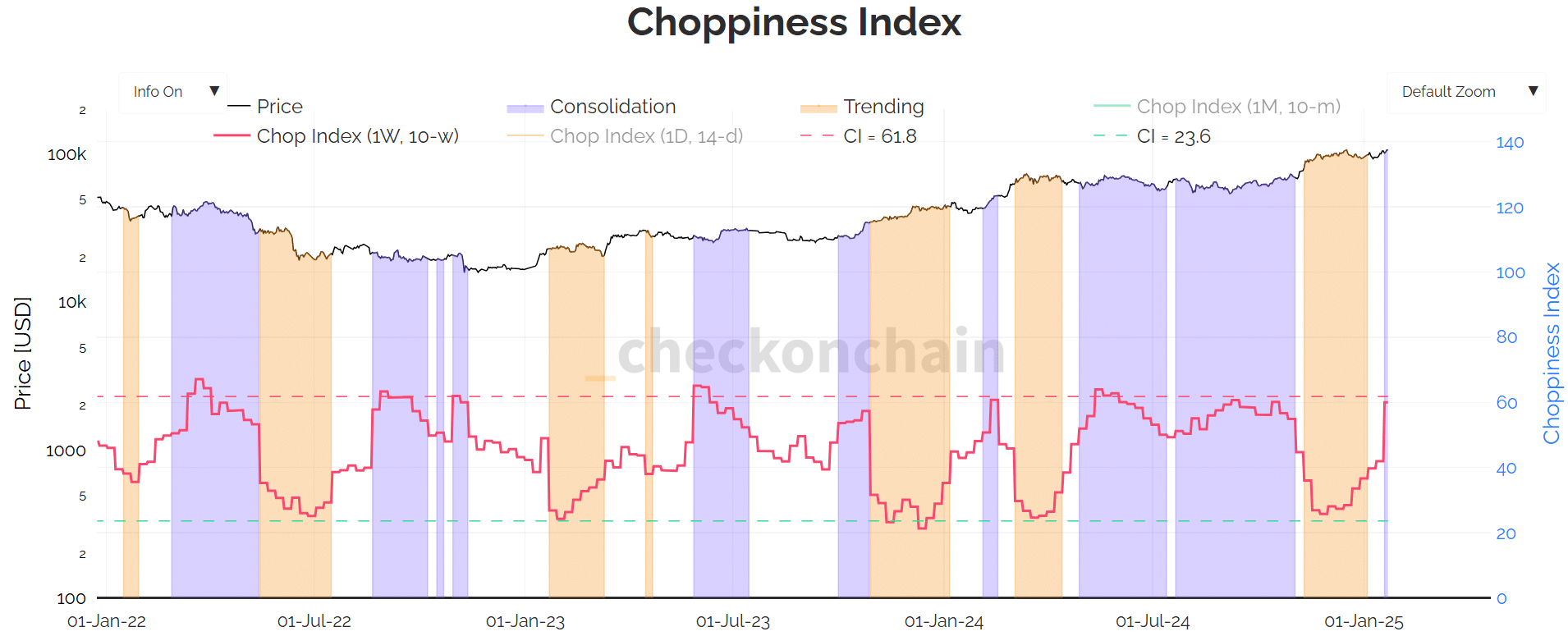

One of the metrics, the choppiness index (CI)—which sounds like something you’d find in a bad sci-fi movie—suggests that this sideways shuffle is about to end. I mean, who doesn’t love a good plot twist? 🎬

In fact, on-chain analyst Checkmate, who sounds like he moonlights as a chess master, reinforced this outlook and stated,

“The #Bitcoin Choppiness Index is fully gassed, and ready to trend. As covered back in late-Nov, the thesis was we likely had several weeks of chopsolidation before properly trending away from the $100k level. We’re there.”

Historically, per the attached chart, a sharp uptick in the weekly CI (red) signaled consolidation (purple blocks). It’s like a traffic light for Bitcoin—red means stop, and green means go, but who really knows what yellow means in crypto? 🚦

On the contrary, a drop in CI coincided with sharp uptrends or downtrends (orange blocks). With the CI at an inflection point after a recent surge, a retreat would imply a renewed BTC uptrend or downtrend. It’s like watching a soap opera—will they break up or get back together? 💔

Given the new pro-crypto Trump administration, the market seems to be leaning towards the former (likely uptrend). Because nothing says “let’s invest” like a reality TV star in charge, right? 🤷♂️

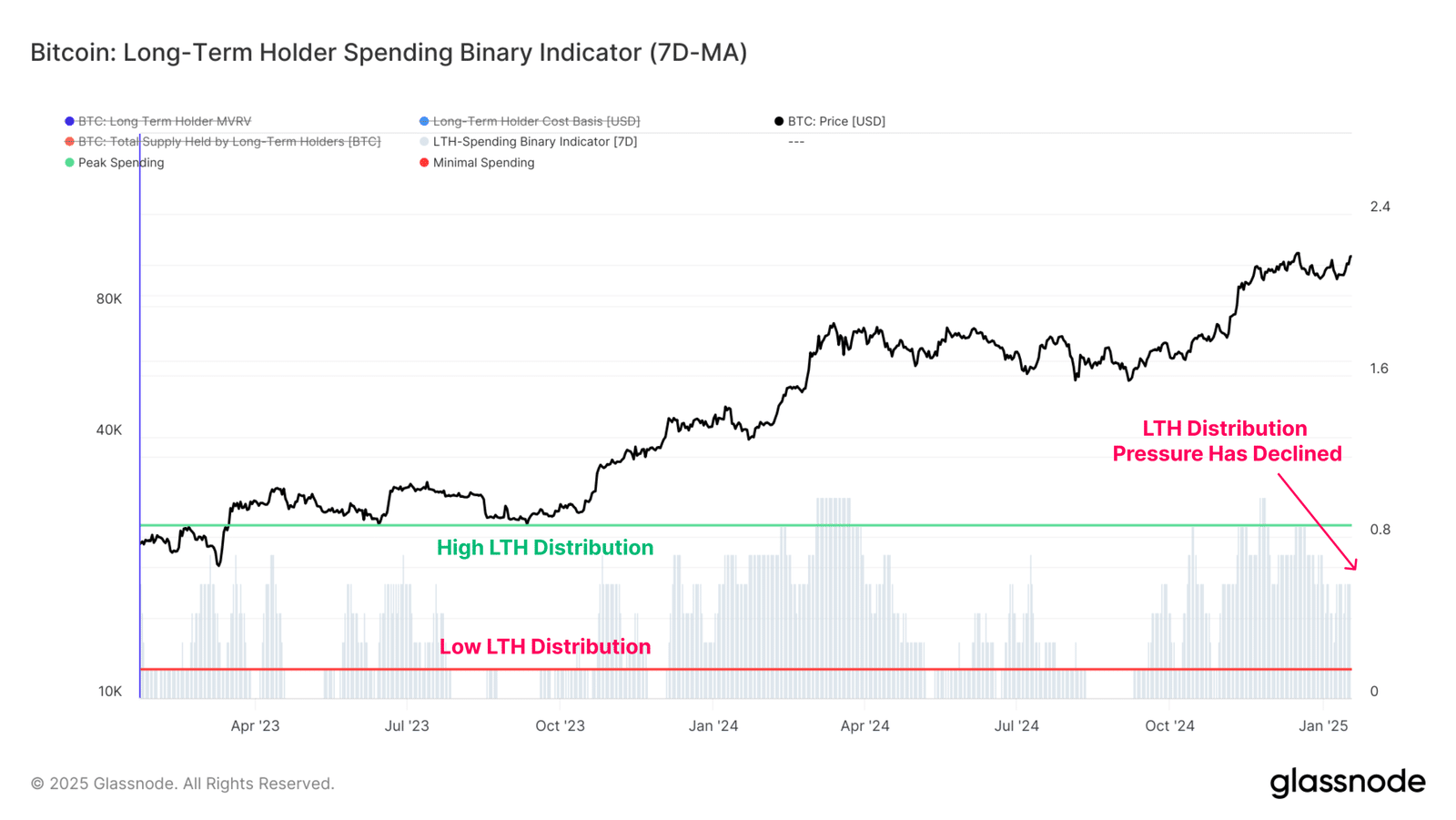

BTC supply pressure eases

Another key bullish indicator was the easing BTC supply pressure from long-term holders (LTH). In its latest “weekly on-chain” report, Glassnode highlighted that selling pressure from LTH has significantly decreased. It’s like they finally decided to stop hoarding their Beanie Babies. 🧸

“Sell-side pressure from long-term investors has also declined, alongside volumes deposited to exchanges for sale.”

The analytics firm noted that profit-taking from this cohort hit $4.5B in December but has dropped to below $400M in January. So, it seems like they’re holding onto their coins tighter than I hold onto my last slice of pizza. 🍕

“Currently, the total LTH supply is starting to show signs of growth back to the upside, suggesting that accumulation and HODLing behavior is now larger than distribution pressure for this cohort.”

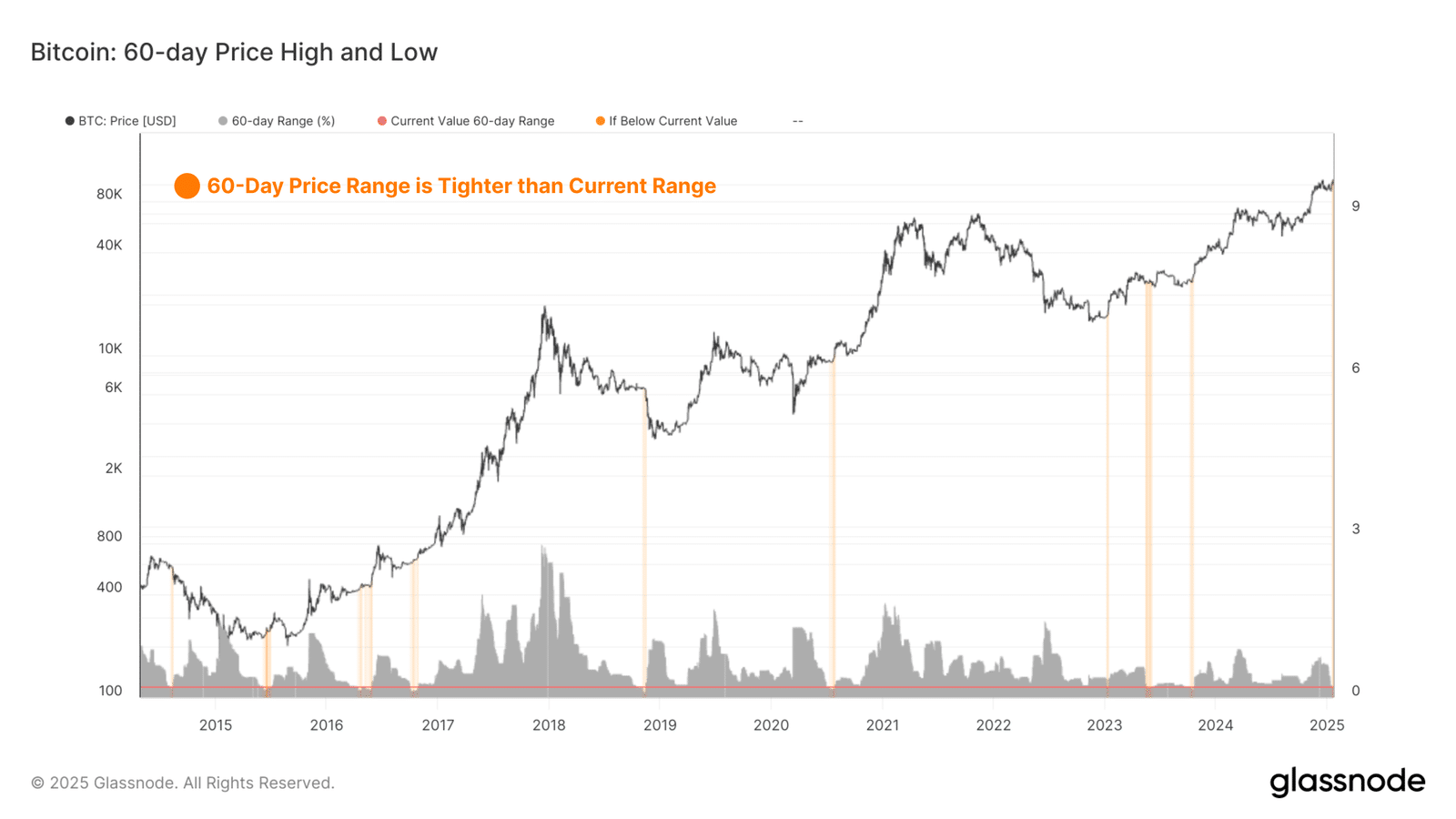

Finally, the average price range for a 60-day period also signaled a potential breakout. It’s like the calm before the storm, or the moment before you realize you’ve eaten an entire pint of ice cream. 🍦

Glassnode added that the current sideways structure was tighter than the historical 60-day price range, which always precedes bullish breakouts. It’s like a rubber band ready to snap—let’s just hope it doesn’t hit us in the face. 🤕

“The chart highlights periods which have a tighter 60-day price range than the current trading range. All of these instances have occurred prior to a significant burst of volatility, with the majority being in early bull markets, or prior to late-stage capitulations in bear cycles.”

Taken together, the above metrics reveal that a strong uptrend above $100K

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-22 11:35