Ah, Bitcoin, that digital gold medalist, has taken a nosedive of nearly 30% from its lofty October peak of over $126,000. Currently prancing around the $86,500 mark, it seems to be caught in a bit of a sideways shuffle, much like Aunt Agatha’s knitting – going nowhere fast after a jolly good tumble.

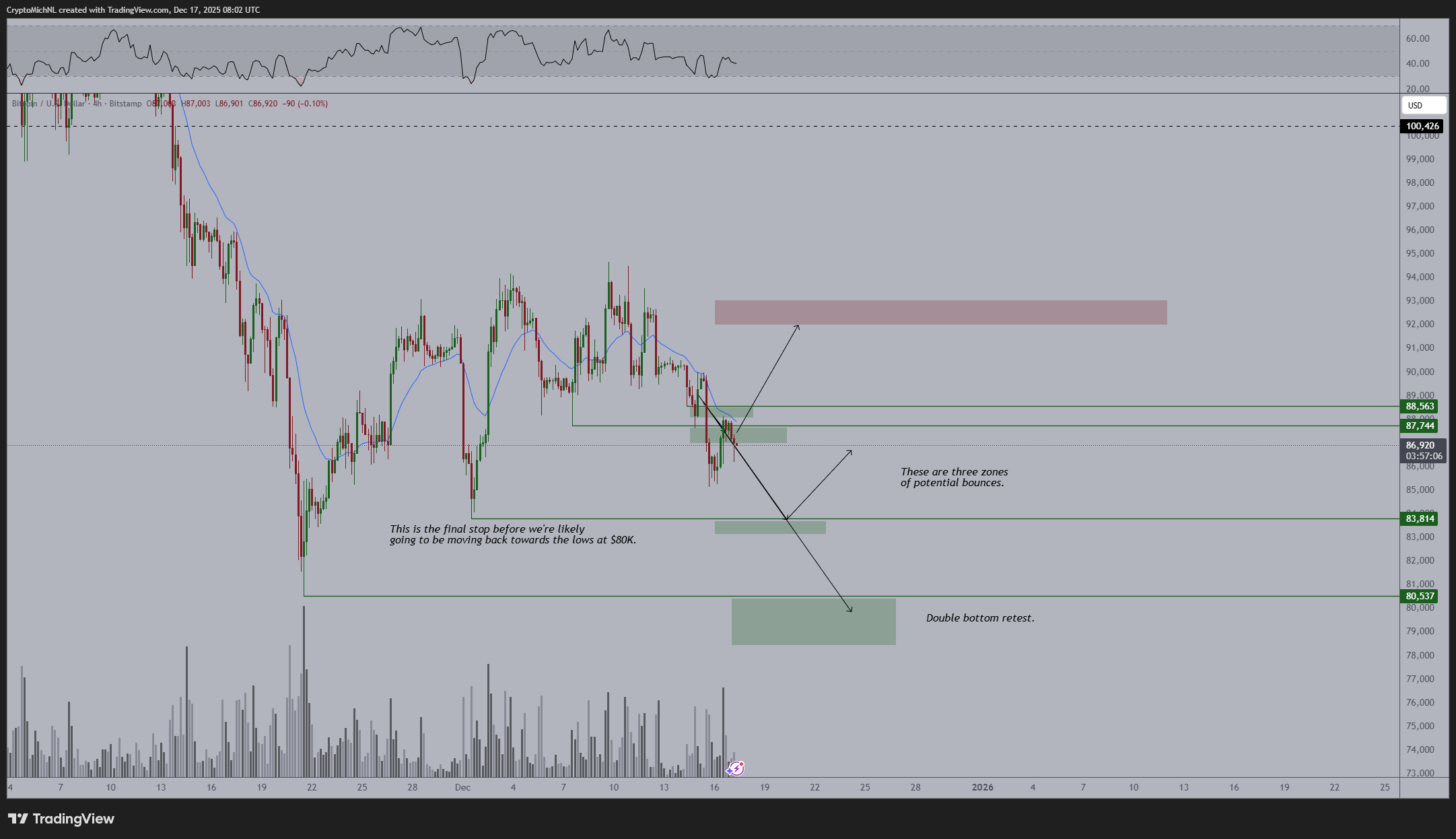

Despite a few hopscotch bounce-backs, there’s no sign of the trend turning on its head, much like trying to find a clean spoon in the Jermyn Street Cutlery. The stage now is set for a showdown at the mighty $88,000 barrier. Cross that, and we might just see the old girl back on her feet. Fail, and it’s downhill all the way, with the occasional stop for a fortifying gin at the bottom.

$88K: The Impossibly Tedious Line in the Sand

Analyst Michaël van de Poppe, a man whose job it is to tell us what we already suspect, remarks that Bitcoin is as undecided as a cat in a room full of rocking chairs. It’s bobbing between support and resistance, just waiting for a decisive shove.

“Trend remains to be down, and in order to adjust the trend, a breakout above $88K is required,” he proclaimed on X – because nothing screams excitement like a target of eighty-eight thousand dollars, eh? 🎯

This week, Bitcoin flirted momentarily with the $88,000 mark before retreating to a more modest $87,500. The wild 7-day range from $85,100 to $93,000 suggests a teenaged dance – uncertain, unpredictable, and just a tad embarrassing. With no sign of a breakout, the lower realms of $83,000 and possibly $80,000 are casting their tempting shadows.

Enter Kamran Asghar, another expert-more of a whip-smart fellow-who claims Bitcoin is on a hunt for a new resting place after breaking below what was once a trusty support line. He’s hedging his bets at $86,500 as a short-term floor but warns that the descent might continue, perhaps all the way down to the elusive $72,000-$75,000 territory-a zone that’s not been seen since last year’s breakout bash.

This much-coveted ‘demand zone’ might be the parachute if things get too dicey. Fail to hold here, and it’s off to the lower ranges, with all the drama that implies.

Oh, the Tragedy: A Long-term Trend of Woe

Bitcoin has just punched a giant hole through the Supertrend support on its weekly chart – a first since January 2023, mind you. According to the sage wisdom of Bitcoinsensus, this marks the first major structural break since the bull cycle’s heyday, turning the sentiment as bearish as a rainy Bank Holiday.

“Long-term holders are now selling $BTC at their fastest pace in 7 years,” said Ted, a man who clearly has his finger on the pulse and a cup of tea in the other hand.

This pandemonium of selling is adding fire to the already smoldering blaze and smothering any hope of a quick bounce-back.

Further adding to the gloom, recent days’ price drops are largely due to liquidations – those reckless over-leveraged positions going kaboom, rather than genuine spot sales, as Bitcoin Duniya points out. It’s a classic case of excess leverage choking the life out of the market, and as CryptoPotato reports, demand is still playing a distant second fiddle to these frantic dumps.

Until the demand side gets its act together, we’re likely to see Bitcoin tiptoeing further downhill, with the possibility of more nifts and sniffs of downside lurking just around the corner.

Read More

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Best Members of the Flash Family

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- ‘Crime 101’ Ending, Explained

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Ashes of Creation Mage Guide for Beginners

- Legendary photographer Martin Parr looks back on his work and recalls the way we were

2025-12-17 13:04