-

Daily revenue decreased as well as the coin’s price.

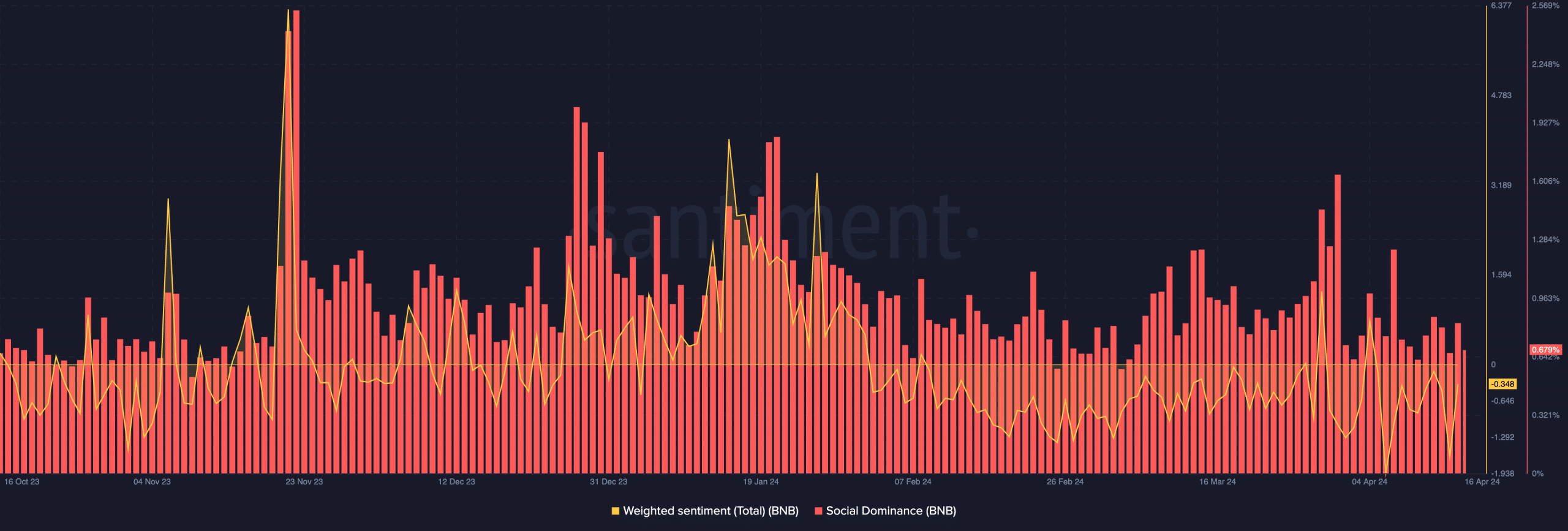

The sentiment and social data suggested that BNB could be set to recover.

The quarterly income of BNB Chain experienced a decline following its latest announcement of significant growth between quarters.

If you’re new to the scene, BNB Chain refers to the blockchain platform where developers can build and deploy smart contracts and decentralized applications (dApps).

The income reported on the 15th of April, as mentioned by Artemis, was $62,500. It’s important to note that this is different from Binance Coin [BNB], the cryptocurrency used in transactions on the Binance exchange platform.

This figure was one of the lowest the chain had hit since February.

Network activity drops

The primary method the network generates income is through trading fees. However, the amount of these fees can change based on trading volume. An uptick in demand for BNB results in a boost in revenue.

In simpler terms, the reason for the recent drop could be attributed to a decrease in usage of the decentralized protocol. The evidence of this decline was clear in the low trading volume on Decentralized Exchanges (DEXs), which fell below $1.5 billion.

During the majority of March, the trading volume exceeded $2 billion at various points. According to CoinMarketCap’s data, Binance Coin experienced a 6.72% price drop over the past 24 hours.

The price drop mirrored the pessimistic market sentiment and waning interest in the BNB coin. If BNB’s price keeps declining, it could be difficult for the chain to experience a significant increase in earnings.

If the prices rebound, BNB Chain could potentially maintain its revenue growth rate similar to that of March.

At the same time, information from the blockchain indicated a pessimistic attitude towards the cryptocurrency’s community.

Is everyone overlooking the coin?

At press time, the metric was -0.34, suggesting a broader bearish perception around the coin. However, one thing, AMBCrypto observed was that the sentiment trended higher.

If the reading improves and moves upward, BNB‘s price may have a chance to bounce back. But if it fails to reach positive territory, this could challenge the optimistic outlook.

Santiment’s analysis indicated that the text’s social dominance decreased. A rise in social dominance could potentially mean heightened interest in BNB from traders.

If this was the case, then the coin would have been close to a local top.

In other words, the decline indicates that Binance Coin had relatively little talk surrounding it among the leading 100 coins. Consequently, Binance Coin approached its lowest point.

In historical context, this represents a potential purchasing moment. Lately, though, the market has shown significant price swings.

In other words, traders should aim for tranquil market conditions to avoid being taken by surprise.

Moving ahead, the cost of BNB could potentially rise. Consequently, earnings may follow suit. However, this prediction is heavily influenced by market conditions as a whole.

Thus, participants should be on the lookout.

Read More

2024-04-17 08:07