-

Clearance in Dubai and a likely return to India helped improve BNB’s sentiment

Bullish traders in derivatives market increased sharply in the last 24 hours.

In simpler terms, the native cryptocurrency of the Binance platform, called BNB, showed impressive growth within the past day based on CoinMarketCap’s data.

Despite the majority of well-established cryptocurrencies and newer ones experiencing significant losses, Binance Coin (BNB) fared relatively better, registering a decrease of only 0.35% compared to the previous day.

An in-depth look at the price movement over the past day revealed that the value of the fourth largest digital currency reached a peak of $554 around 4:30 AM UTC on April 18th. But it quickly reversed course and was currently valued at $541 as of the press report.

The good news in Binance’s community might have helped soften the blow for BNB, preventing it from falling further.

BNB helped by these developments

Binance, the biggest cryptocurrency trading platform globally, reportedly obtained approval from Dubai’s regulatory authority to offer its services to local retail investors.

Binance had previously catered to institutional investors, but obtaining the latest clearance expanded its customer base to include a wider range of traders in the economic center.

Newly emerging good news continued to surface from Asia, with the Economic Times of India suggesting that Binance was planning to re-enter the Indian market following its ban in early January.

In addition to the previously mentioned regulatory successes, Binance made an announcement about the successful implementation of the BSC Feynman hardfork. This update allows for native staking and governance capabilities on the Binance Smart Chain.

The cumulative effect of these news likely helped in boosting BNB’s prospects.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Derivatives traders go bullish on BNB

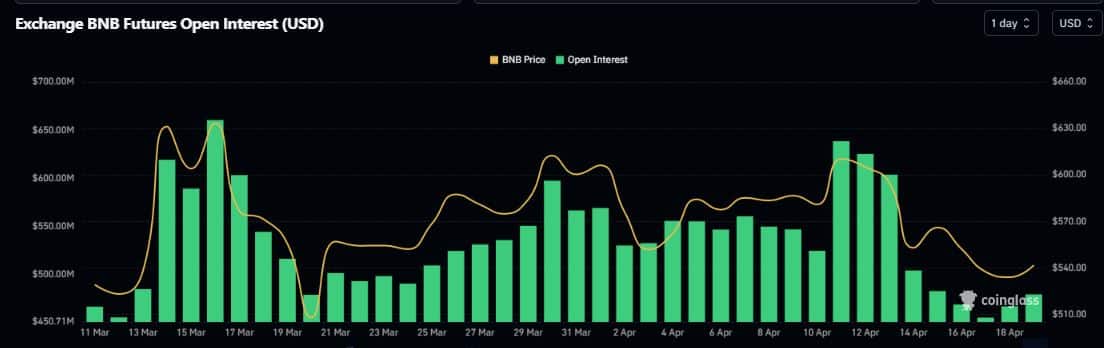

Concurrently, derivatives traders significantly increased their wagers on Binance Coin (BNB). Based on AMBCrypto’s examination of Coinglass’ statistics, the Open Interest (OI) for BNB futures contracts grew by almost 10% within the previous 24 hours, reaching a total of $525 million.

In addition, there were more traders taking positions for BNB‘s price rise than there were for a price drop, according to the Longs/Shorts Ratio data.

Read More

2024-04-18 23:03