-

BNB was up by more than 8% in the last seven days.

Most metrics and indicators looked bullish on the coin.

As a seasoned crypto investor, I find BNB‘s recent bullish trend to be an exciting development. The coin’s price surge of over 8% in the last seven days has caught my attention, and the bull pattern that emerged on its chart is a promising sign. If BNB successfully breaks above this pattern, we could see its price volatility increase, potentially leading to significant gains.

Last week, Binance Coin (BNB) displayed a noteworthy surge in value with a gain of more than 8%. Concurrently, this price trend gave rise to a bullish formation on the coin’s price chart. If BNB manages to surmount this pattern, its price could experience significant volatility and potentially head northward.

Bull pattern on BNB’s chart

Following a smooth upward trend over the past week, the coin’s volatility lessened, with only minor fluctuations observed on its final day of trade. As reported by CoinMarketCap, Binance Coin (BNB) experienced a decrease in value amounting to 0.5% within the preceding 24-hour period.

As I pen down these words, BNB is currently priced at around $608.62, boasting a market capitalization surpassing $89.8 billion. Nevertheless, I foresee the potential for heightened volatility in BNB’s price action in the near future.

As a dedicated cryptocurrency researcher, I’ve recently taken notice of Captain Faibik’s insightful tweet. In this observation, he highlights the emergence of a bullish symmetrical triangle pattern on Binance Coin’s (BNB) price chart. A convincing breach above this technical formation could potentially fuel BNB’s price growth by over 40%.

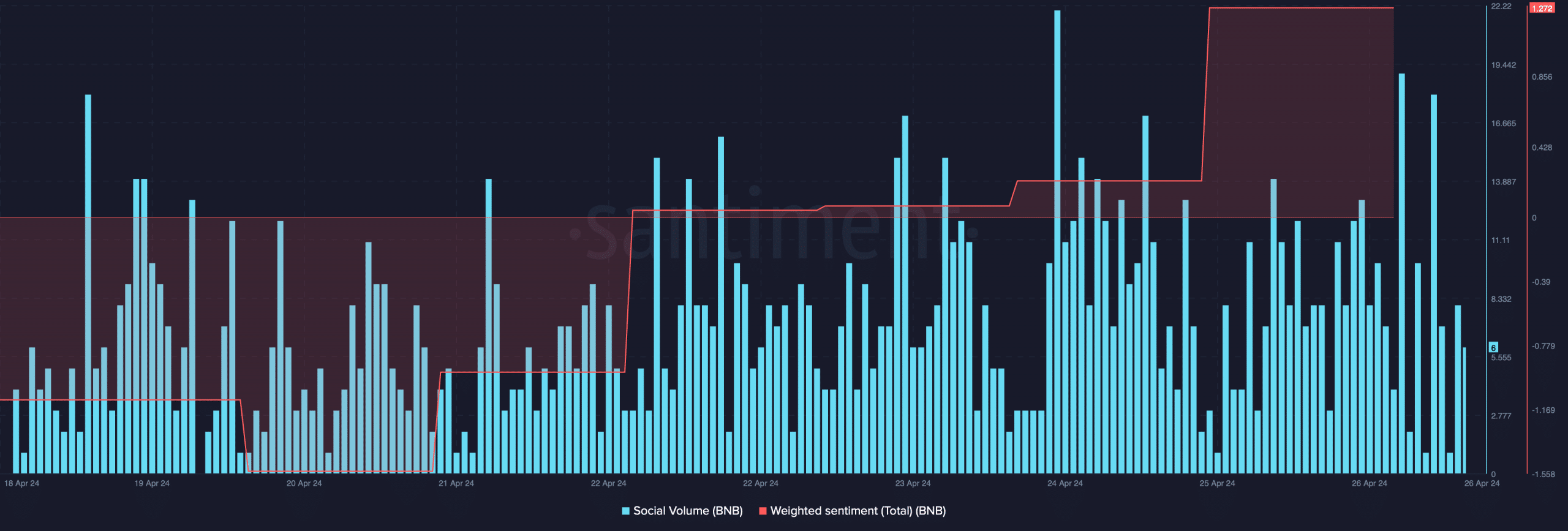

As a crypto investor, I noticed a surge in confidence among investors regarding Binance Coin (BNB) around the 25th of April. This optimism was reflected in the coin’s weighted sentiment, which indicated a significant positive shift.

Its social volume also remained high, reflecting its popularity in the crypto space.

Is a bull run inevitable?

After examining AMBCrypto’s initial analysis, I looked into other relevant data sets to assess the likelihood that the cryptocurrency coin in question would pass the bullish trend test.

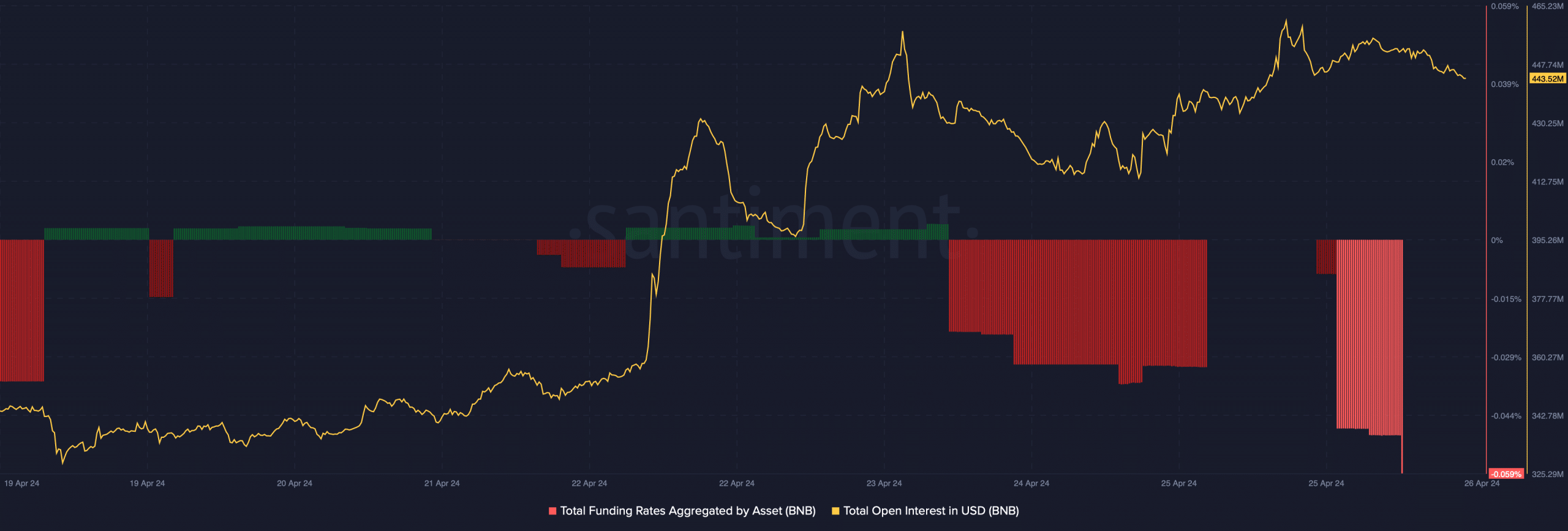

Based on Santiment’s findings, it was observed that the open interest for BNB rose in tandem with its rising price. This observation implied a potential prolongation of BNB’s bullish trend.

As a crypto investor, I’ve noticed that the funding rate for the market has taken a significant downturn recently. Historically, price trends have tended to go against the direction of the funding rate. Given this pattern, it seems plausible that we may be on the brink of a bull rally in the near future.

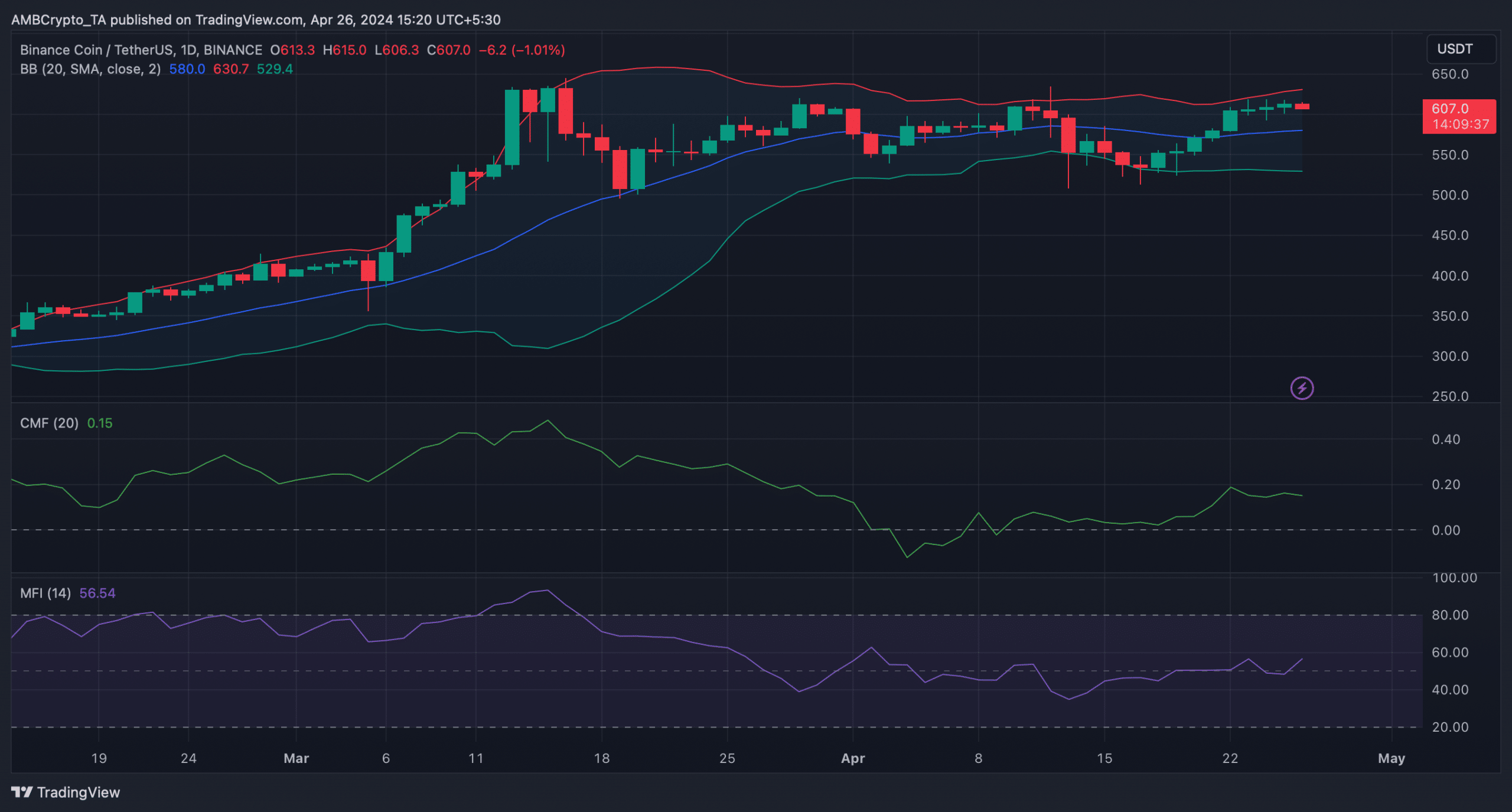

In simpler terms, the technical analysis showed promising signs based on the indicators. For example, the Chaikin Money Flow (CMF) was positioned comfortably above its zero threshold, currently at 0.15.

It was promising news that the Money Flow Index (MFI) showed a significant surge, boosting the potential for an upward price trend.

As an analyst, I’ve noticed that according to the Bollinger Bands analysis, BNB‘s price is currently in a less volatile range. This implies that we may not see an unexpected or extraordinary price increase in the short term for this cryptocurrency.

Realistic or not, here’s BNB’s market cap in SOL’s terms

After examining Hyblock Capital’s information, AMBCrypto identified potential price targets for Binance Coin (BNB) should it initiate another upward trend.

Based on our examination, it’s essential for BNB to surpass $620 because a significant increase in liquidations would occur at that point. An uptick in liquidations typically leads to a market correction. If BNB manages to exceed this level, its price could potentially reach $650 and beyond.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-04-27 08:07