- POPCAT’s price has grown by over 200% in the last seven days.

Its key indicators have hinted at the possibility of a further price rally.

As a researcher with experience in analyzing cryptocurrency markets, I find Popcat’s recent price surge and the bullish signals from its key indicators to be quite intriguing. The altcoin’s 205% gain in just seven days is noteworthy, especially considering that it ranked second among meme assets with the most significant price increases during this period.

As a crypto investor, I’ve noticed an impressive surge in the price of Popcat (POPCAT), which is built on the Solana (SOL) blockchain. In just the last week, this meme coin has skyrocketed by over 200%. Based on my analysis of key market indicators, it seems that Popcat may continue to climb in value in the near term.

Based on current market conditions, I observe that the altcoin is trading at a price of $0.4385. Notably, this cryptocurrency has experienced an impressive 205% price increase over the last week. Consequently, it holds the second position among meme assets in terms of price growth, according to the latest data provided by CoinMarketCap.

POPCAT has more to offer

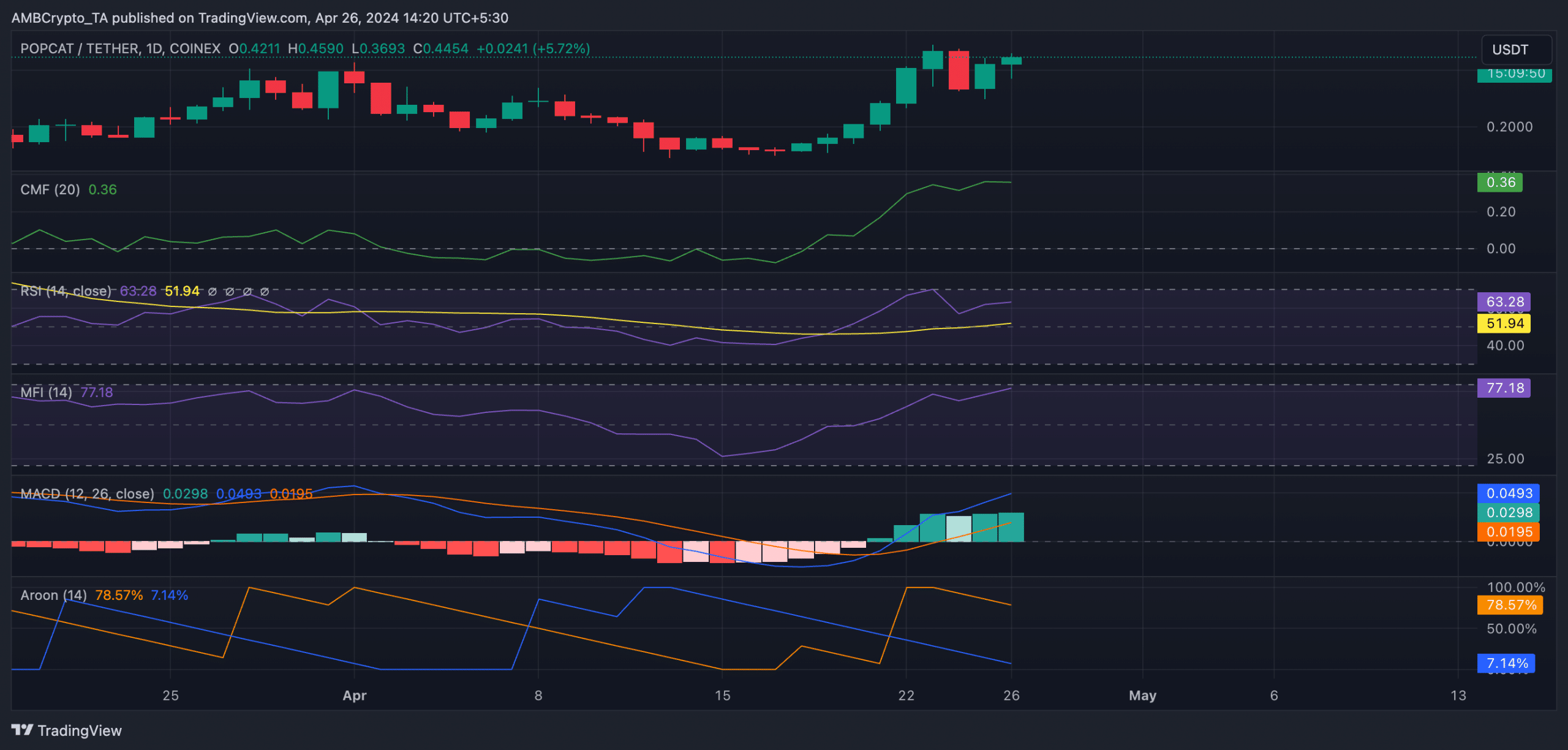

The Aroon Up Line by POPCAT, represented by the orange line on the chart, signaled strong buying sentiment in the market with a current value of 78.57%.

This metric evaluates the power of a trend in an asset’s price fluctuations and identifies possible turning points. When the Up Line nears 100, it signifies a robust uptrend, suggesting that the latest peak was achieved not long ago.

As a researcher examining cryptocurrency market data from CoinMarketCap, I discovered that POPCAT reached its peak price of $0.4984 on the 23rd of April. Following this achievement, there was a subsequent decrease of approximately 12% in its value.

On the 21st of April, the MACD line of POPCAT‘s meme coin surpassed both its signal and zero lines, indicating a noteworthy increase. This occurrence signified that the token’s short-term moving average was climbing more rapidly than its long-term moving average, suggesting a bullish trend for POPCAT.

The trend turned positive, with this event serving as a notable marker, suggesting that the price surge is likely to persist.

As an analyst, I’ve observed that the meme coin, specifically POPCAT, has been experiencing strong buying pressure based on its current momentum indicators. The coin’s Relative Strength Index (RSI) stood at 63.43, which is above the center line of 70, indicating a bullish trend. Similarly, its Money Flow Index (MFI) was reported at 77.06, surpassing the neutral value of 55 and suggesting that money is flowing into the coin’s market with strength.

The values of these indicators showed that market participants favored accumulation over sell-offs.

Additionally, the Chaikin Money Flow (CMF) for the token was rising at the current moment. With a value of 0.36, this indicator indicated a noticeable increase in buying power within the POPCAT market.

Read Solana’s [SOL] Price Prediction 2024-25

In simpler terms, a commodity momentum factor (CMF) greater than zero implies a robust market condition since investors are actively buying more of the asset compared to selling it.

Because of the sharp increase in POPCAT‘s value, short sellers in its futures market have experienced substantial losses, as evidenced by data from Coinglass. Since the 21st of April, the number of short liquidations for this meme coin has surpassed the number of long liquidations.

Read More

- PHB PREDICTION. PHB cryptocurrency

- VINU PREDICTION. VINU cryptocurrency

- BRETT PREDICTION. BRETT cryptocurrency

- Top gainers and losers

- SUPER PREDICTION. SUPER cryptocurrency

- Dogecoin’s price forecast – How will Bitcoin’s halving impact this altcoin?

- GST PREDICTION. GST cryptocurrency

- MFER PREDICTION. MFER cryptocurrency

- T PREDICTION. T cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

2024-04-27 07:03