- Stablecoins outperformed the overall market in April and posted a 4.7% growth.

- USDT, FDUSD, and Ethena’s USDe shined, but USDC stalled.

As a researcher with extensive experience in the cryptocurrency market, I’m particularly intrigued by the recent surge of stablecoins in April. Despite the overall market retracement due to inflation data and geopolitical tensions, stablecoins defied the trend and posted a 4.76% growth, surpassing $158 billion in market cap.

In April, while the wider market experienced a downturn, stablecoins bucked the trend and continued to climb higher, achieving a seven-month streak of uninterrupted growth.

According to the CCData report, the sector experienced a growth of 4.76%, resulting in a market capitalization of approximately $158 billion. As for Year-to-Date figures, stablecoins have amassed an additional $27.1 billion.

As a researcher studying the cryptocurrency market, I’ve observed an unexpected yet significant shift in the stablecoin sector’s dominance. In March, this sector accounted for 5.43% of the total market share. However, recent events have led to a surge in demand for stablecoins, resulting in an increase of their dominance to 6.30%. This trend marks the first instance of such a rise amidst an overall market downturn.

In April, as markets retreated due to unexpectedly high inflation figures in the United States and heightened geopolitical tensions, stablecoins saw their first significant gain in market share, according to this data.

It’s intriguing to note that the expansion of April was primarily driven by two entities: Tether, a US company with its stablecoin USDC, and First Digital Labs, based in Hong Kong, and their stablecoin FDUSD.

USDT and FDUSDT dominate market share

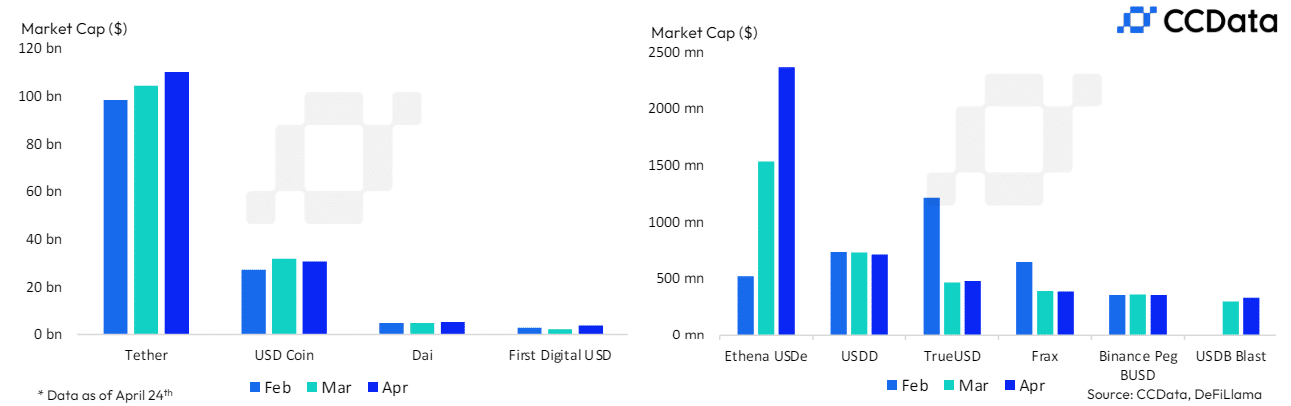

The market capitalization of USDT on the Tether platform grew by 5.58%, reaching an all-time high of $110 billion. This significant expansion further solidified USDT’s position as the leading stablecoin, representing a 70% market share.

Despite standing out as the exception among USD-backed stablecoins, FDUSD experienced a significant surge in value. By the 24th of April, its market capitalization had grown by an impressive 77.6%, reaching a total of $3.88 billion, as indicated in the report.

The analysis conducted by AMBCrypto on DeFiLlama’s data revealed that FDUSD experienced remarkable monthly expansion. Currently, its market capitalization has reached an impressive milestone of $4 billion, representing a significant surge of 79.4% compared to the previous month.

Furthermore, the market value of Ethena’s USDe surged past $2.36 billion, representing a notable increase of more than 74%. This significant growth propelled it into the top five rankings by market capitalization.

Despite the growth and excitement surrounding the digital currency market during this period, Circle’s USDC experienced a setback. Its market share decreased by 3.97%, amounting to $30.7 billion. Notably, USDC’s decline in April stood out, as mentioned in the report.

“The market capitalization of USD Coin (USDC) fell for the first time in five months”

As a researcher investigating trading volume data on centralized exchanges (CEXs), I’ve discovered that USDT, among all stablecoins, was the most frequently used.

In March, the trading volume of stablecoins on cryptocurrency exchanges nearly doubled, reaching an impressive $2.15 trillion, marking a significant 98.9% increase. This surge occurred during a period of extreme market volatility, with Bitcoin reaching a new record high of $73.7K. Among the total trading volume, USDT held approximately 77.5% of the market share.

In the latest CEX market statistics, FDUSD came in second place with a 14.6% market share, while USDC took the third position with a 7.14% dominant presence.

Gold moves and crypto summer

In April, the prices of Tether Gold (XAUT) and Pax Gold (PAXG), both pegged to gold but not denominated in US Dollars, were higher than their actual gold values.

As a crypto investor with an interest in gold-backed assets, I’ve noticed a significant increase in their market capitalization. This growth can be attributed to Gold reaching a new record high and heightened tensions in the Middle East, as reported.

As a financial analyst, I’ve observed noticeable gains in the stablecoins backed by gold, Tether Gold (XAUT) and Pax Gold (PAXG), which rose by 4.20% to reach $573 million and 4.77% to hit $425 million respectively. This upward trend came as gold itself surpassed its previous record-high price due to escalating geopolitical tensions in the Middle East.

It’s encouraging to note that the sector continues to exhibit signs of growth. Notably, Stripe recently declared its intention to restart global crypto payments as of this summer, initially focusing on stablecoins.

As a crypto investor, I believe that if international markets widely adopt cryptocurrency payments, the use and demand for stablecoins could significantly increase. Stablecoins are digital currencies that maintain a relatively stable value by being pegged to assets like the US dollar or gold. With more widespread acceptance of crypto payments, the need for reliable and consistent value storage and transfer solutions would drive greater growth in the stablecoin market.

Read More

- PHB PREDICTION. PHB cryptocurrency

- VINU PREDICTION. VINU cryptocurrency

- BRETT PREDICTION. BRETT cryptocurrency

- Top gainers and losers

- SUPER PREDICTION. SUPER cryptocurrency

- Dogecoin’s price forecast – How will Bitcoin’s halving impact this altcoin?

- GST PREDICTION. GST cryptocurrency

- MFER PREDICTION. MFER cryptocurrency

- T PREDICTION. T cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

2024-04-27 06:16