-

BONK seems to have provided a buying opportunity between $0.000024 and $0.000027.

With low readings of the social metrics, BONK might jump to $0.000033.

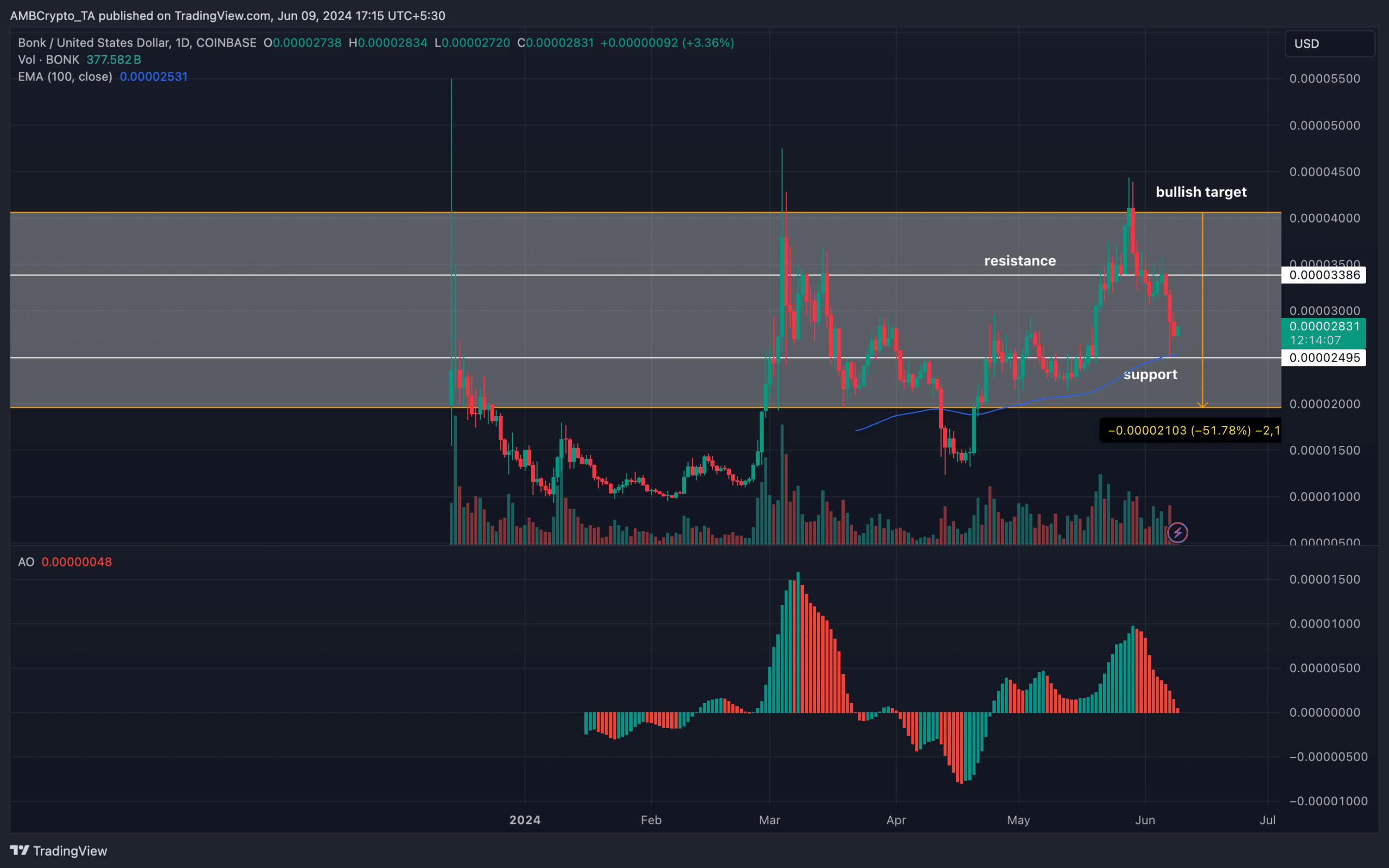

As a researcher with experience in analyzing cryptocurrency markets, I believe that BONK presented a potential buying opportunity between $0.000024 and $0.000027 based on its daily chart analysis. The token’s price staying above the 100 EMA at $0.000024 was an encouraging sign, as it suggested that BONK could be looking to approach resistance levels at $0.000033 while using $0.000024 as support.

According to AMBCrypto’s analysis of the daily chart, Bonk (BONK) is approaching a level that could lead to a price bounce-back. Currently, BONK is priced at $0.000027 and hovers above the 100 Exponential Moving Average (EMA).

Should the value of a cryptocurrency exceed its 100 Exponential Moving Average (EMA), this may signify an upward trend and a potential opportunity for investment. Conversely, if the value falls beneath this marker, it could suggest a significant sell-off or “capitulation.”

BONK stays above critical zone

As an analyst, I’ve noticed on the daily chart that the 100 Exponential Moving Average (EMA) was sitting at $0.000024. However, BONK managed to reach and even surpass that level. Yet, it didn’t take much time for this memecoin to reverse course and bounce back off that level.

If sustained, the token could be looking at approaching $0.000040.

I analyzed the chart provided by AMBCrypto and identified a comparable trend. For example, on the 21st of April, the 100 Exponential Moving Average (EMA) was situated at $0.000018. However, by the 26th of the same month, the price had surged to reach $0.000029.

In other words, BONK might consider focusing on the $0.000033 resistance level, while employing $0.000024 as a supportive foundation.

If the market conditions are extremely optimistic, there is a strong possibility that the token’s value may surge beyond its current level, potentially reaching $0.000040.

Instead, consider examining price movements through the lens of on-chain analysis. This involves focusing on social volume and market influence.

Everything looks set for the token

As a researcher examining on-chain data from Santiment, I’ve discovered that the Social Dominance of a particular token was registered at 0.294%. This metric signifies the proportion of conversations surrounding this token relative to the total discussions about the assets in the top 100.

As a crypto investor, I’ve noticed a decline in the engagement level surrounding the memecoin. The number of conversations and discussions about it has decreased significantly, indicating a potential lull in its popularity.

Regarding the cost, the decrease in interest for this memecoin suggests a potential buying opportunity prior to a future surge.

As an analyst, I would put it this way: The social volume trend mirrored the situation we observed. Social volume represents queries for BONK on various social media platforms. Consequently, the dip in this metric suggests a low level of interest or demand for BONK.

Therefore, the token still offered good entry points.

Furthermore, AMBCrypto observed a decrease in the token’s trading activity, which is signified by its volume. The volume represents the level of market appetite for a particular cryptocurrency.

As a crypto investor, I can explain it this way: When I notice an uptick in the volume of a token’s trades, it’s a sign that there’s been significant buying and selling activity. However, if the volume for BONK has decreased, it suggests that the level of interaction with the token has been relatively low.

Is your portfolio green? Check the Bonk Profit Calculator

When it comes to price, if the volume is declining while the cost remains low, it might lead to a rebound for BONK. The reason being is that the weak downtrend suggests an opportunity for potential price increase.

As a crypto investor, I’ve made my analysis and come up with a predicted price for this digital asset. However, I must caution that this forecast could be disproved if selling pressure intensifies. On the other hand, the current bearish trend seems to be losing ground, suggesting that another significant drop is unlikely but not entirely ruled out.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- POL PREDICTION. POL cryptocurrency

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Daredevil: Born Again Spoiler – Is Foggy Nelson Alive? Fan Theory Explodes!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- BERA PREDICTION. BERA cryptocurrency

2024-06-10 02:15