- BONK saw signs of a bullish reversal at a key support level

- Metric underlined growing interest and potential bullish momentum on the charts

As a seasoned crypto investor with a few battle scars from past market swings, I’ve learned to read the signs carefully before making any major investment decisions. In the case of BONK, I see some promising indicators that could signal a potential bullish reversal.

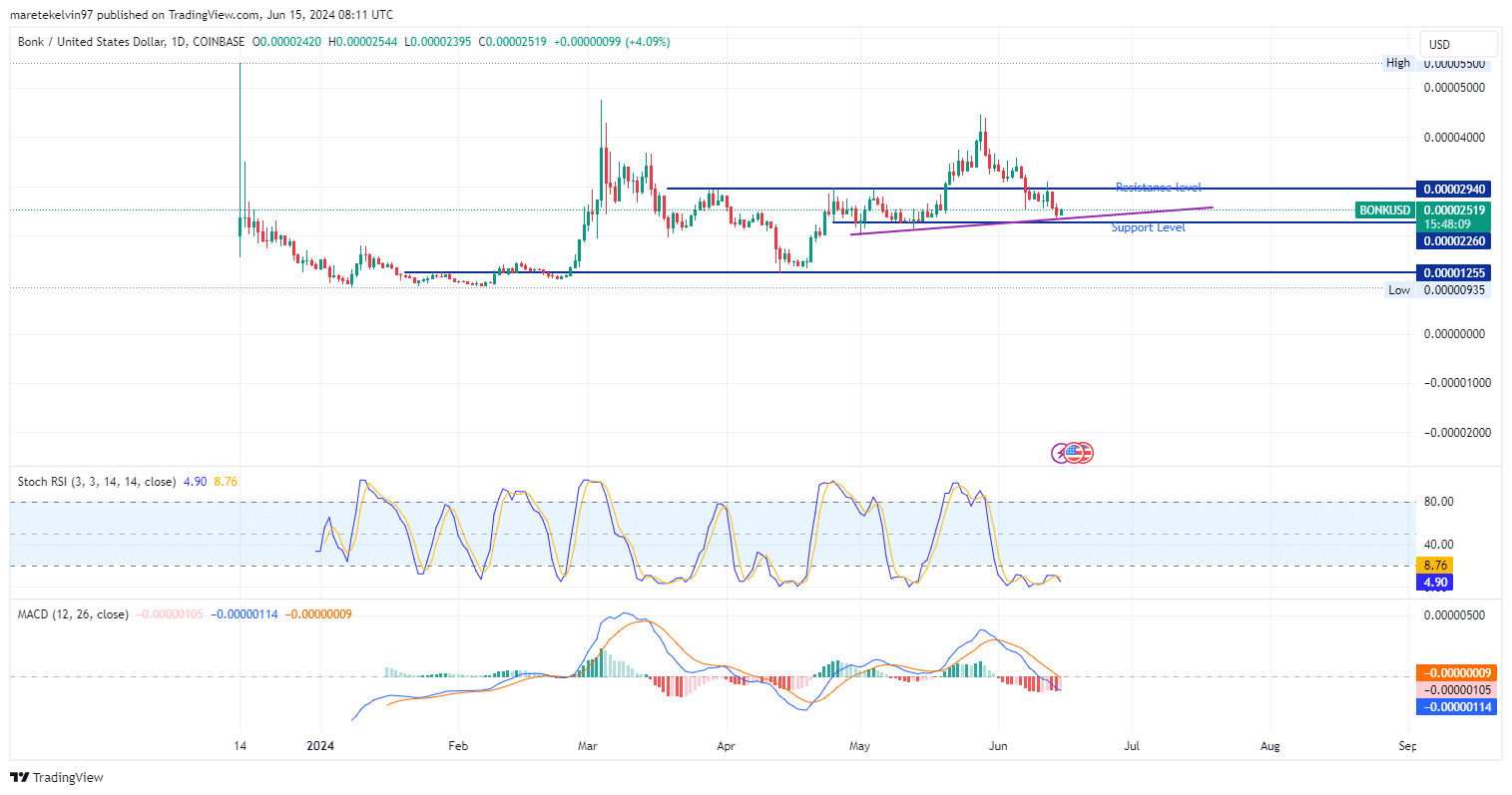

As an analyst, I’ve been closely monitoring BONK’s price movement and it’s been quite the wild ride. The altcoin has experienced notable ups and downs, resulting in a 47% decrease in value since May 28th. Currently, its price hovers around a pivotal support level at approximately $0.00002260 – a level it has revisited multiple times within the past three months.

The price appeared to follow an upward trendline, which intersected with $0.00002206. This indicates that BONK might have been building up bullish energy, potentially reaching the next resistance at $0.00002940, before bursting through its resistance level once it had gained sufficient momentum.

As I pen down this text, BONK’s total market capitalization stands at approximately $297 million. In just the past day, this altcoin has experienced a decline of more than 3%.

According to the stochastic RSI reading of 4.90 on the graph, BONK appeared to be overbought, potentially signaling a good buying chance following a probable price rebound.

As a crypto investor, I keep a close eye on technical indicators like the moving average convergence divergence (MACD). Recently, the MACD line with a threshold of -0.00000009 showed signs of potential convergence. This convergence could suggest that the bearish momentum may be shifting towards bullish momentum.

What tale do the metrics tell?

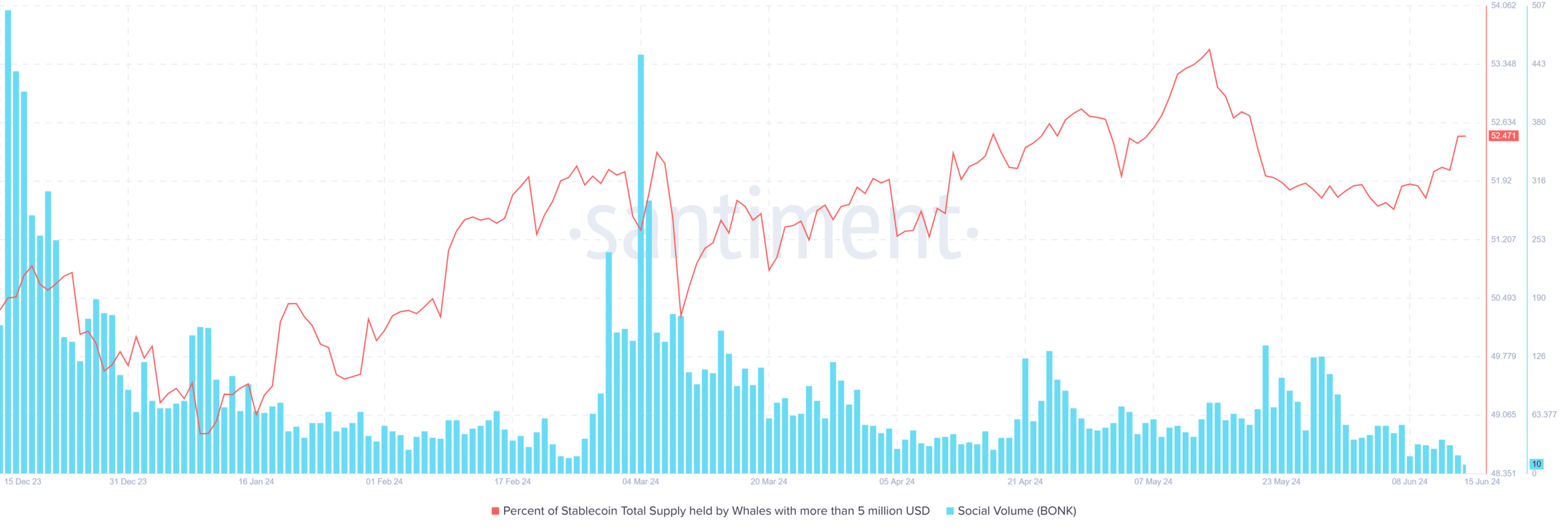

According to AMBCrypto’s interpretation of Santiment’s findings, there has been a rising pattern in the proportion of stablecoin wealth controlled by high-net-worth individuals, specifically those with over $5 million in assets. This upward trend signifies increased confidence among these substantial investors, potentially foreshadowing upcoming price changes.

As the stockpile of BONK whales grows, the market’s demand for purchasing may intensify, potentially leading prices upward.

What does liquidity add to the support level?

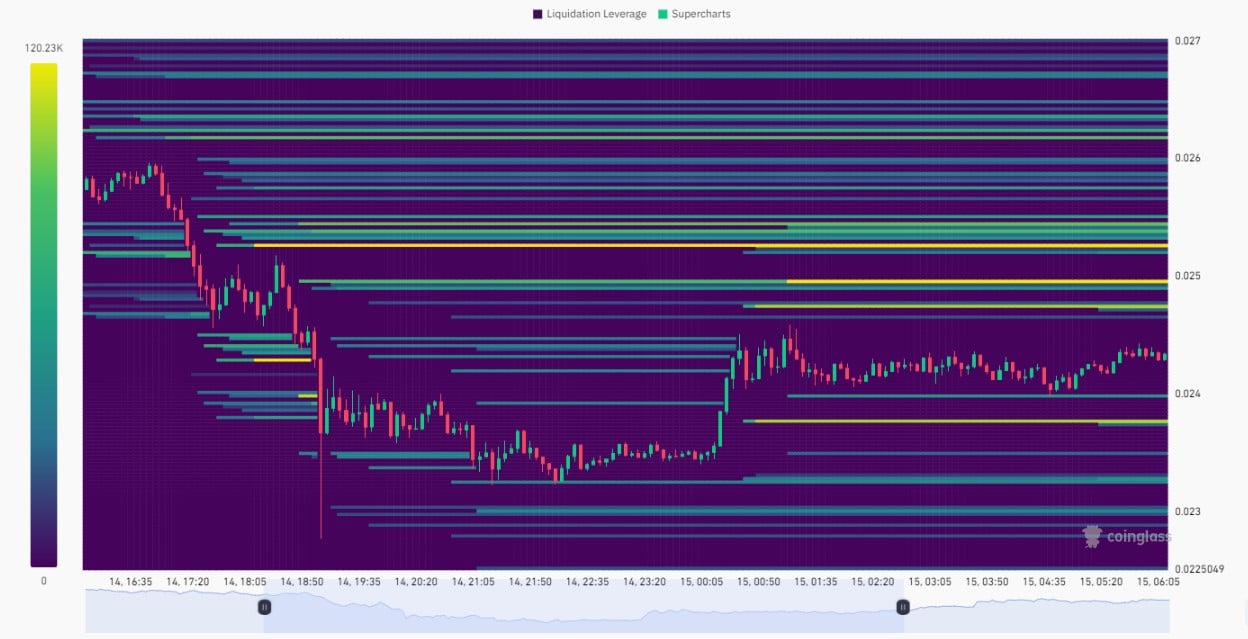

As a researcher examining the price trend and drawing insights from Santiment’s analysis, I turned my attention to evaluating the liquidity landscape of the asset in question. A thorough assessment of the liquidity map revealed key spots with significant leverage and notable liquidity points.

The map revealed two potential focal points for the cryptocurrency’s price movement around 0.0000238 and 0.0000247 cents, attracting significant trading interest.

Is it time to buy the dip?

Based on current market indicators such as price movements and on-chain sentiment, it seems that a bullish turnaround for BONK’s price could be imminent, making it an opportune moment to consider purchasing at the dip. Nevertheless, if the price breaches its crucial support level at $0.00002260, there is a risk that the token’s value may continue to decline.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Silver Rate Forecast

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Oblivion Remastered – Ring of Namira Quest Guide

2024-06-16 04:07