- Bitcoin’s $90k support remains strong after December sell-offs, signaling underlying market resilience

- Institutional profit-taking has cooled, with Bitcoin ETF inflows dropping from $14B to $6.6B monthly

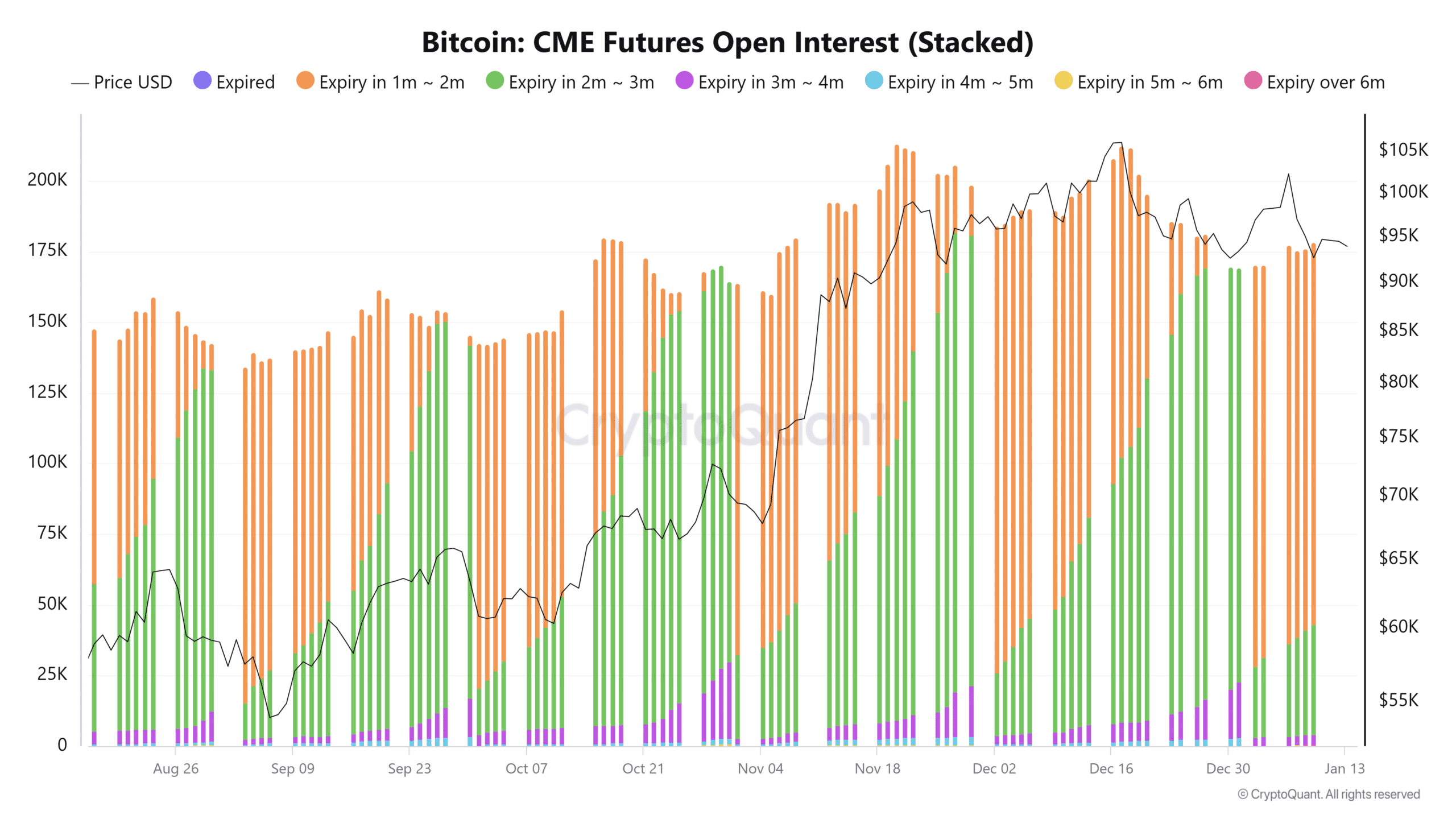

Late December historically hasn’t been favorable for Bitcoin [BTC]. The downward pressure from selling tends to persist into January, and 2025 appears to be following this trend. Institutional selling has contributed significantly, causing a decrease of 13% in Open Interest on CME contracts. Similarly, ETFs have experienced a drop in inflows, going from $14 billion per month to $6.6 billion, as institutions take profits.

Regardless of recent challenges, Bitcoin has managed to maintain its position near the significant $90,000 support level. The intense selling pressure experienced in December, totaling approximately $200 million daily outflows, has noticeably diminished, placing January in a more neutral stance. This stability suggests underlying robustness, but we’re left wondering if it’s sufficient for Bitcoin to buck the trends?

$90,000 support holds firm

Following a turbulent December, characterized by continuous selling and daily withdrawals reaching $200 million, the market began January with increased tranquility. The important $90,000-support level, established by institutional investments, now symbolizes strength as volatility decreases.

Currently, at this moment, the Open Interest – which decreased by 13% since its high in November – indicates that institutional investors are cashing out their profits. The significant decrease in contracts about to expire throughout late December coincides with the market downturn, suggesting an increased caution as market unpredictability grew.

Furthermore, the gradual reduction in longer-term futures investments suggests a cautious outlook going beyond the short term. This decrease in activity hints that institutions are taking steps to protect their positions, rather than making bold moves to capitalize on potential gains.

The price of Bitcoin seems to indicate that $90,000 serves as a significant mental barrier. If it falls below this point, it might ignite renewed selling pressure. However, its current strength hints at backing from institutional hedgers and individual investors alike. Despite a decrease in outflows, the market remains balanced because optimism is not yet strong enough to drive substantial upward movement.

Key indicators: MVRV and sell-side risk ratio

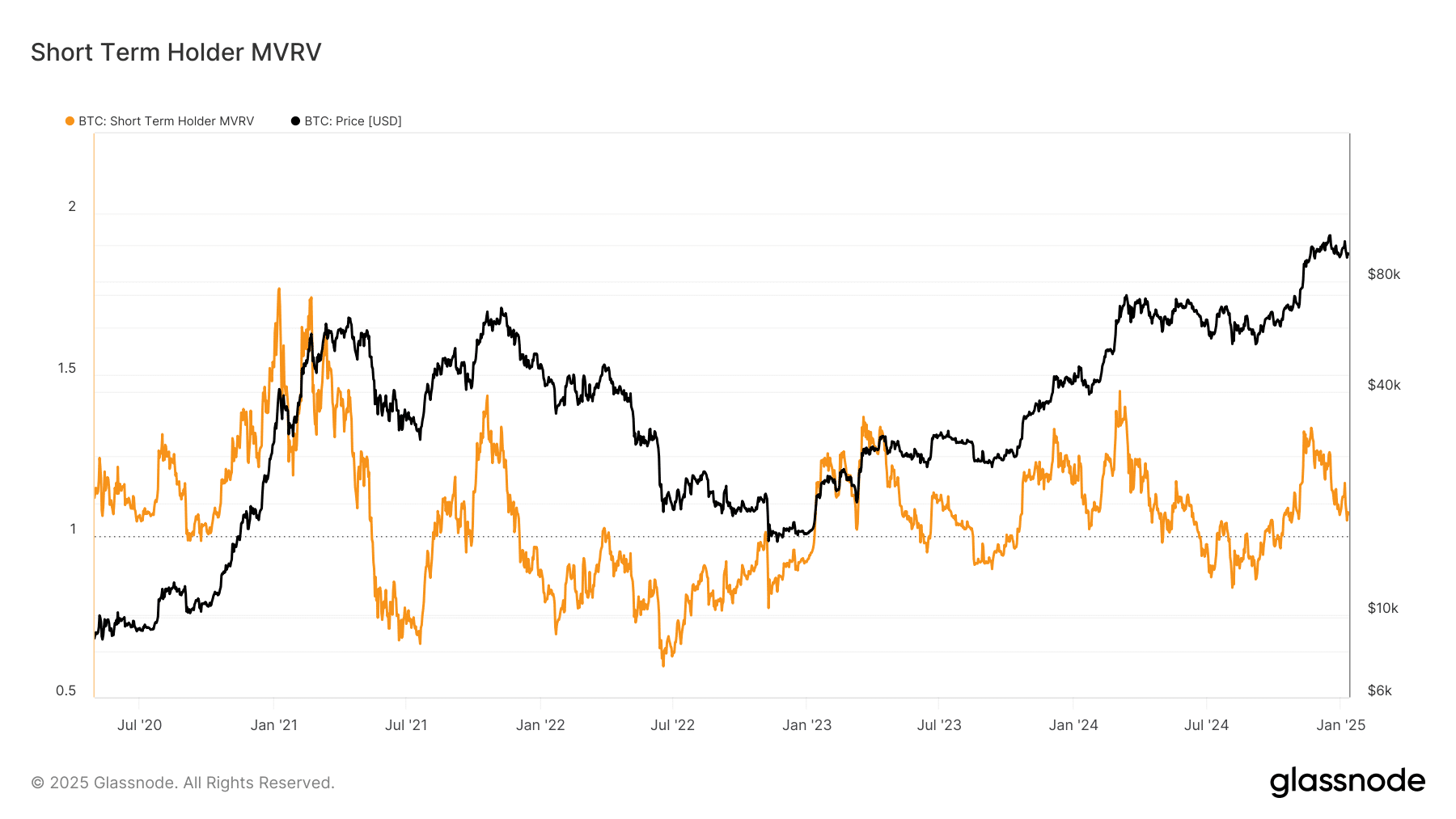

According to the STH MVRV ratio, a fascinating trend is emerging. Holders who typically bought at about $88,000 (short-term holders) have not yet experienced substantial losses they can’t handle.

If Bitcoin breaks through its $90k support level, it could tip the balance from neutral to bearish. Conversely, if it manages to close the gap above $1, this could serve as a launchpad for further price increases.

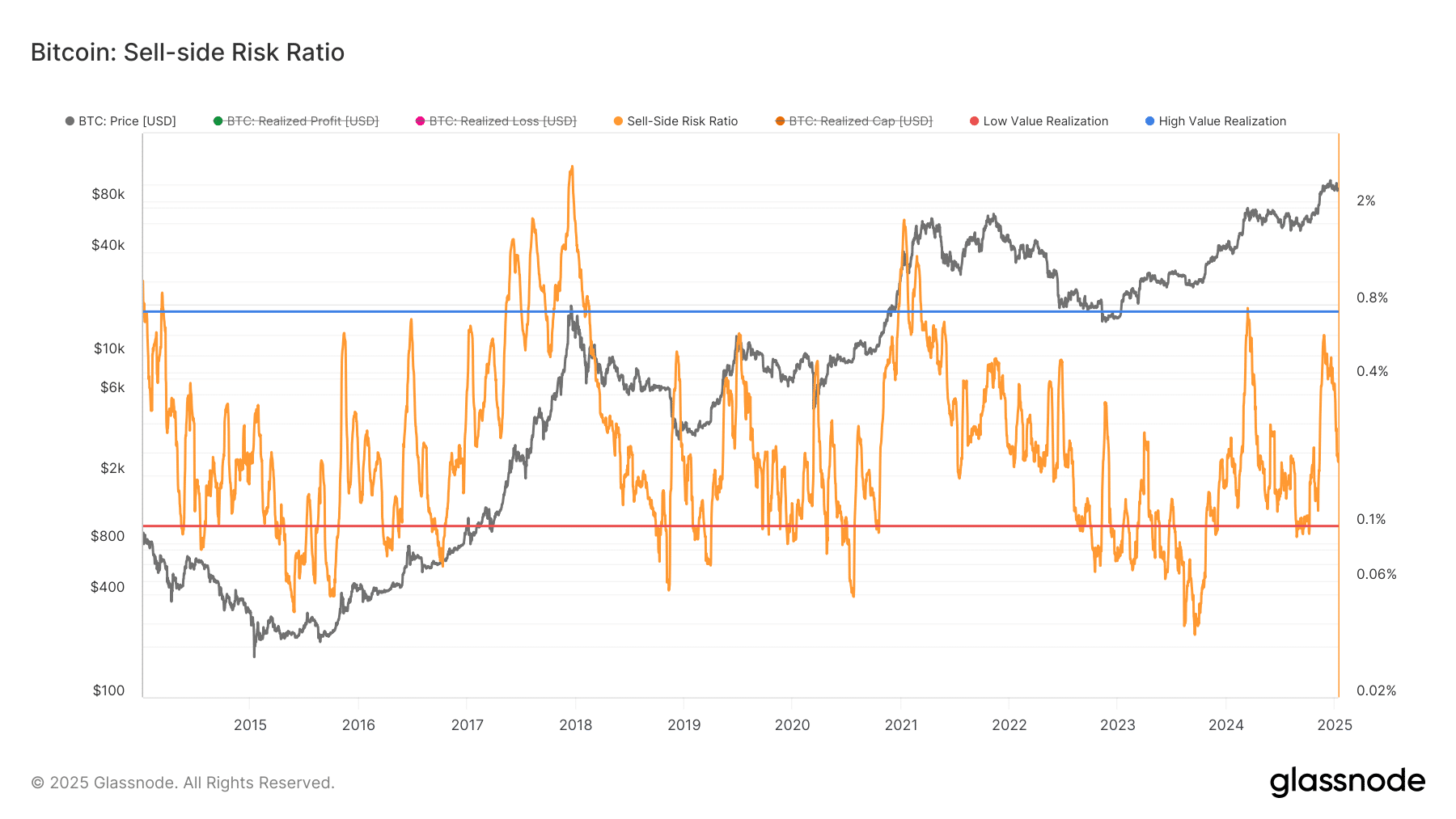

The chart showing Sell-side Risk Ratio for Bitcoin indicated a potentially vulnerable position. Historically, when the sell-side risk is high, it has often coincided with increased volatility and negative market sentiment, especially during times when institutions are selling to secure profits. Recently, a decrease in this ratio mirrors the reduced sell pressure seen in January, suggesting a possible lessening of the urge to sell.

If the support at $90,000 becomes vulnerable, Bitcoin might become more sensitive to further price drops due to its close proximity to a lower threshold. On the flip side, if it shows strong resistance, this could fuel renewed bullish momentum as short-term holders may feel motivated to sell at prices above their purchase price, thereby reducing their cost basis gap.

Is Bitcoin waiting for a catalyst?

It seems that Bitcoin is currently maintaining its position, hovering around levels of support, waiting for a strong momentum to drive it forward. Important factors like economic reports, changes in monetary policies, or significant statements from institutions might influence its next action.

Based on the STH MVRV ratio, it seems that short-term holders are approaching their initial investment price, potentially opening up an opportunity for a positive influence to drive Bitcoin prices above $90k. Simultaneously, the Sell-side Risk Ratio indicates a decrease in selling pressure. However, Bitcoin could still be at risk if demand doesn’t manifest quickly.

Investors maintain a guarded optimism, with daily trading volumes fluctuating around $12 billion, providing a steady level of liquidity. However, Spot ETFs seem to be lacking the necessary push to trigger a significant surge or breakthrough.

Currently, Bitcoin is treading a delicate balance. It may dip down to around $88k to rebalance the market’s outlook, or it could encounter renewed interest to climb further. The upcoming weeks will be crucial in determining its trajectory.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-13 16:07