In the bustling carnival of digital coins, Canton network price today bobbing near $0.189, as fresh institutional wonders knock on the door. The sparkler? Fireblocks strapping on a new integration with the Canton Network, a trick that polishes regulated settlement access and makes CC/USD glance at a crucial crossing like a curious cat at a canary cage.

Fireblocks Integration Alters Canton’s Institutional Narrative

Meanwhile, Fireblocks, a favorite of more than 2,400 enterprises and guardian of over $5 trillion in annual digital asset transfers, has announced a shiny new integration with the Canton Network. The move expands Fireblocks’ regulated infrastructure for tokenization, settlement, and institutional digital asset flows, like a big, friendly door opening onto the grown-up side of the playground.

The @CantonNetwork is now supported on Fireblocks.

Financial institutions can custody Canton Coin and build on Canton’s privacy-enabled infrastructure with the same security and policy controls they use across our platform.

Private settlement. Governed flows. Institutional…

– Fireblocks (@FireblocksHQ) February 3, 2026

And what does that mean in plain English, friend? It means custody and operational support for Canton Coin (CC) now live inside Fireblocks’ platform. Banks and funds get a governed, privacy-friendly stage to settle assets on Canton, using Fireblocks’ enterprise-grade policy controls and workflow automation.

Interest from traditional finance is already speeding Canton’s momentum. The network is being seen as a proper infrastructure layer for regulated tokenization-tokenized securities, deposits, and settlement workflows-closer to real-world deployment than a mere speculative kite in the wind.

Regulated Custody Strengthens Market Confidence

Custody for Canton Coin will be provided through Fireblocks Trust Company, a qualified custodian chartered by the New York State Department of Financial Services (NYDFS). Call it a sturdy, rule-bound cradle designed for the fiduciary and risk management standards of large firms.

And the update leans on Fireblocks’ MPC security architecture and governance controls. Institutions on Canton now enjoy protections apt for institutional-scale uptake, including key management safeguards and governance oversight. These features are becoming the bread-and-butter for regulated digital finance participation.

From a market view, such moves often nudge participants to judge network credibility, even when the broader crypto weather remains patchy.

Canton Network Price Chart Shows Improving Structure

Looking at the chart, CC/USD has been climbing from a snug support zone. On the daily view, $0.177 stands as immediate support after the price hopped over the $0.160 hurdle like a meandering frog.

The price shape looks like an ascending parallel wedge and a budding cup-and-handle-nice and tidy. The rally stays within the growing channel, more plan than pandemonium.

If price stays true to the script, the upper edge near $0.220 could become a bit of a standing invitation for the bears to yawn, possibly pulling back toward the lower line near $0.140. Either way, the longer-term plot remains constructive. A sustained leap beyond $0.220 could nudge the Canton price into a wider re-think.

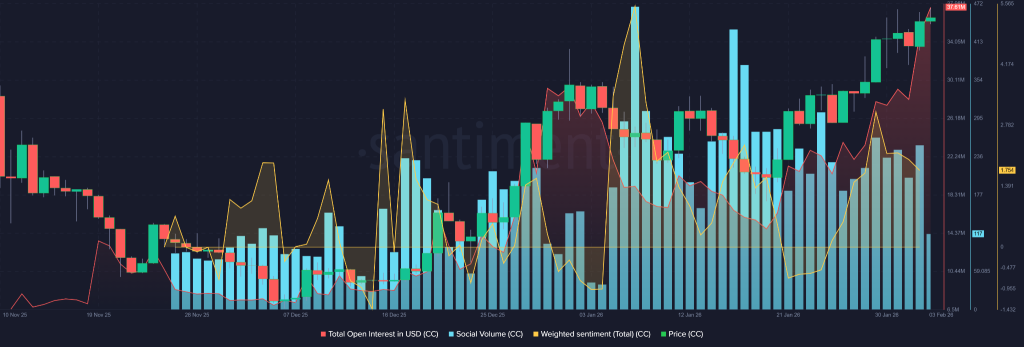

Derivatives and Sentiment Data Add Context

Derivatives data shows total open interest for CC/USD at an all-time high of $37.61 million. The numbers shout participation, even as price action keeps its cardigan neatly buttoned.

Social volume is climbing into Q1 2026, hinting at more chatter around Canton network crypto. Weighted sentiment tilts more positive than negative, nudging engagement toward chatter with a pragmatic grin rather than frothy hype.

All told, these signals suggest the Canton network price is leaning toward infrastructure-driven interest rather than frantic momentum, hinting at a higher drift for a longer spell.

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Resident Evil Requiem cast: Full list of voice actors

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Best Shazam Comics (Updated: September 2025)

- Disney+: Everything Being Added in December 2025

2026-02-03 18:22