-

ADA’s priced sitting above a critical support.

Funding rates, open interests and active addresses surge.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of Cardano (ADA). The technical setup, coupled with recent developments and increased activity on the platform, paints an optimistic picture for ADA’s future price movements.

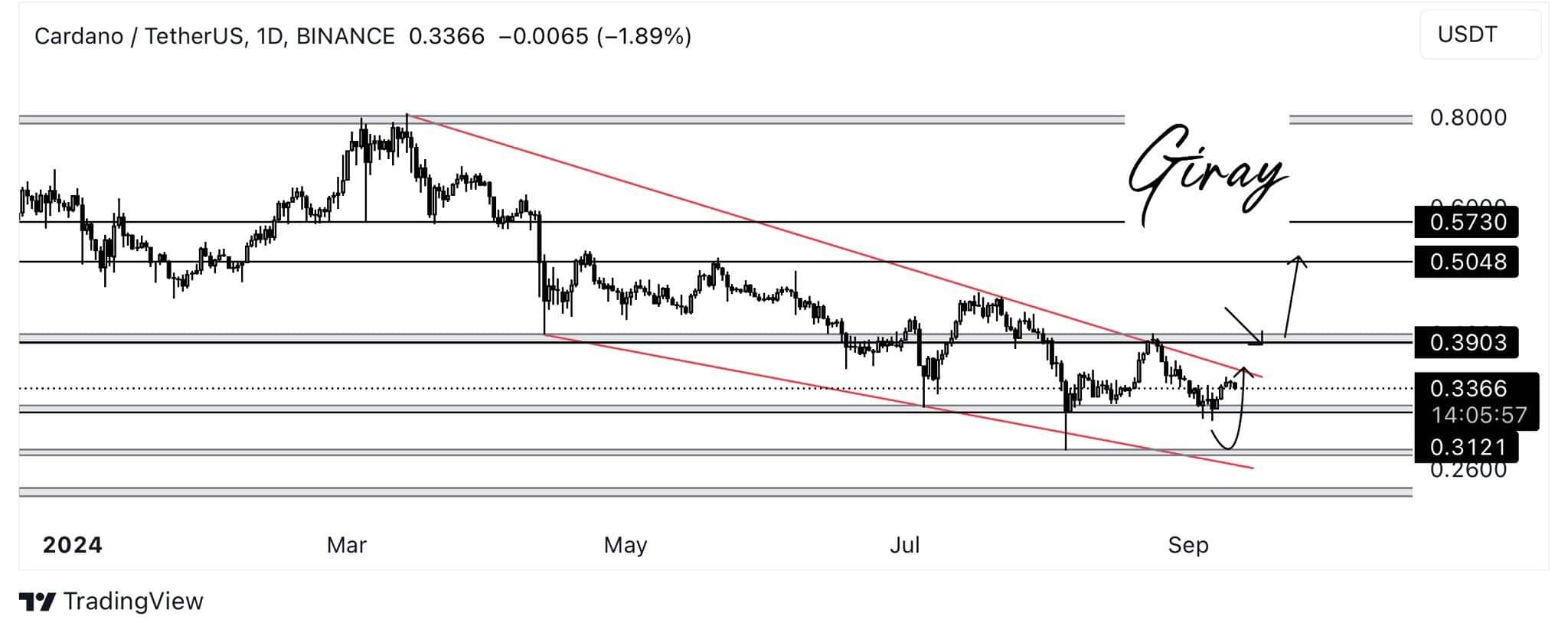

On the daily chart, the value of Cardano (ADA) surpassed a significant support area approximately $0.30. A possible rebound might propel its price beyond the resistance at around $0.39.

ADA has been trading within a descending channel since the end of the March bull run.

In contrast, a recent double bottom at the $0.31 mark implies that Cardano might have reached its lowest point and is potentially poised for growth exceeding 70%, given a potential rally in the altcoin market following an anticipated cut in interest rates by the Federal Reserve around mid-September.

Investors could potentially look for suitable entry points within the vicinity of $0.30. Should Cardano (ADA) break through the falling trendline from its channel, additional evaluation will be necessary to predict future price fluctuations.

On three separate occasions, the price level of approximately $0.30 has been examined. Notably, on August 5th, the day’s trading dip momentarily fell beneath the downward slope of the trendline.

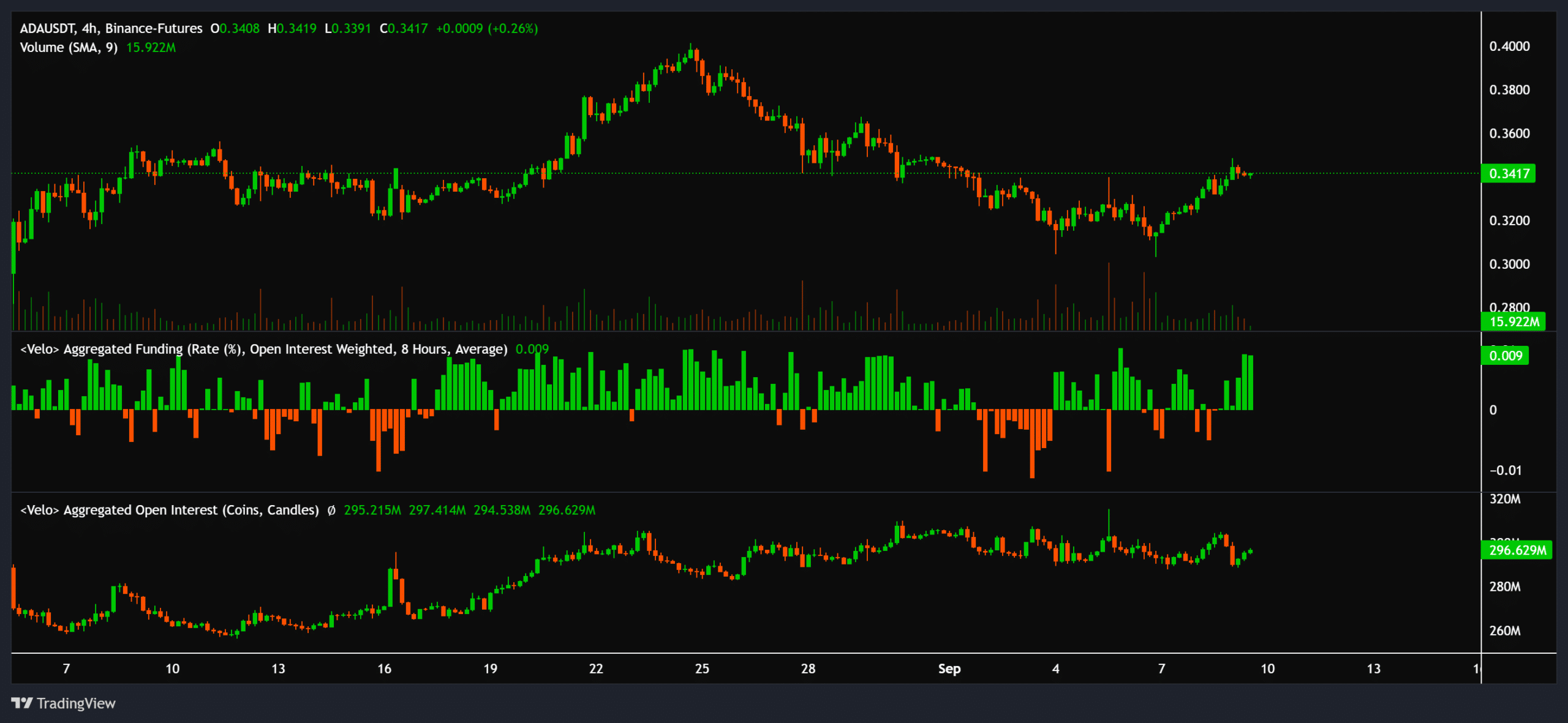

Funding rates & open interest

Alongside the technological configuration, the deployment of the FET token by the Artificial Superintelligence Alliance onto its platform led to a 9% surge in Cardano’s price.

Interest in Cardano (ADA) stays robust, demonstrating an upward trend on larger timeframes, suggesting a positive forecast for increased price levels.

Moreover, lower interest rates on green investments could contribute significantly to a possible increase in the price of Cardano, especially considering that the entire altcoin market appears ready for an upward trend.

With artificial intelligence-backed cryptocurrencies growing increasingly popular, the presence of FET on the Cardano blockchain may have a long-term positive impact on the price of ADA.

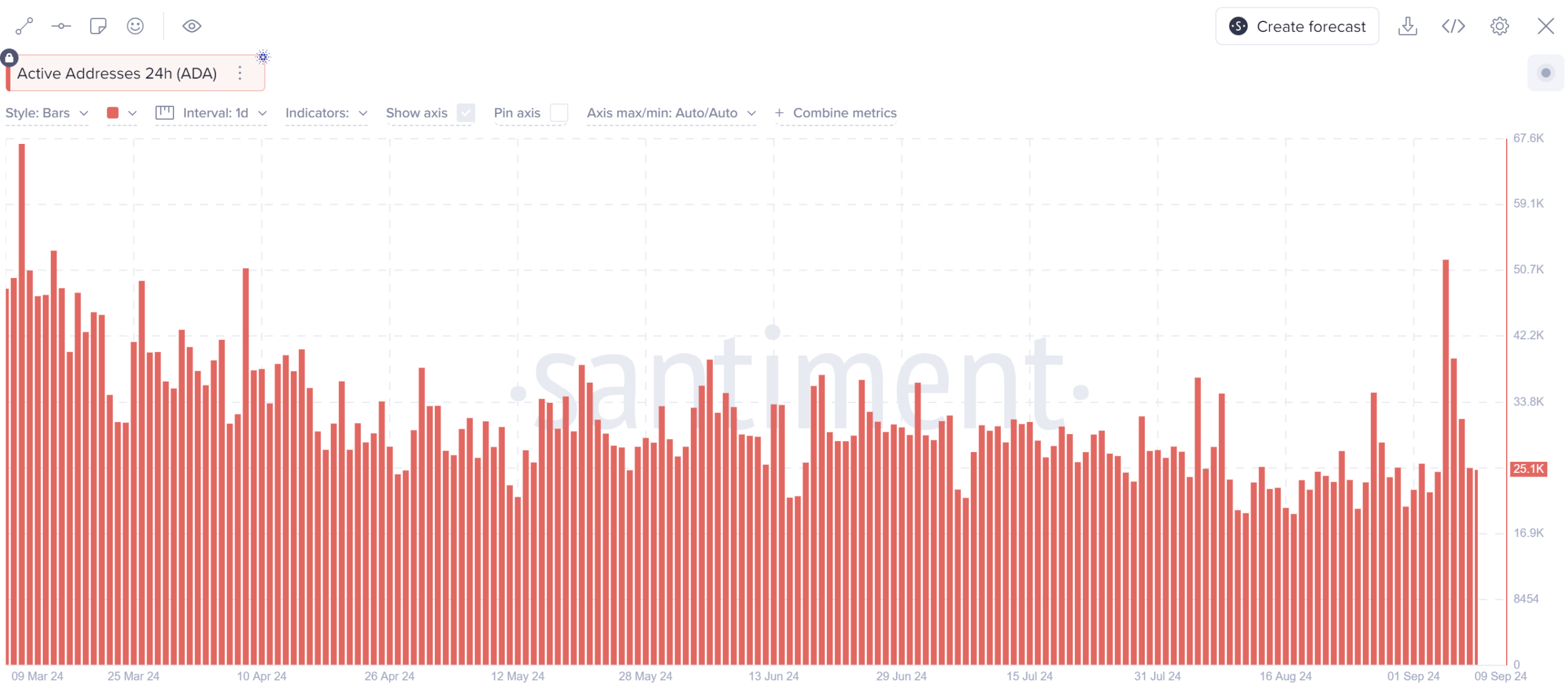

Cardano’s active addresses

Employing FET has further spurred action on the Cardano blockchain, as the number of active ADA addresses hit a peak in the past five months.

The increased activity suggests a rising curiosity, which might potentially boost ADA‘s value as more people interact with the platform.

Investigating the number of ADA‘s actively used wallets indicates a steady involvement, punctuated by occasional peaks. One significant rise was noticed around August 5th, which coincided with the market collapse.

This growing activity points to an increasingly bullish sentiment around ADA.

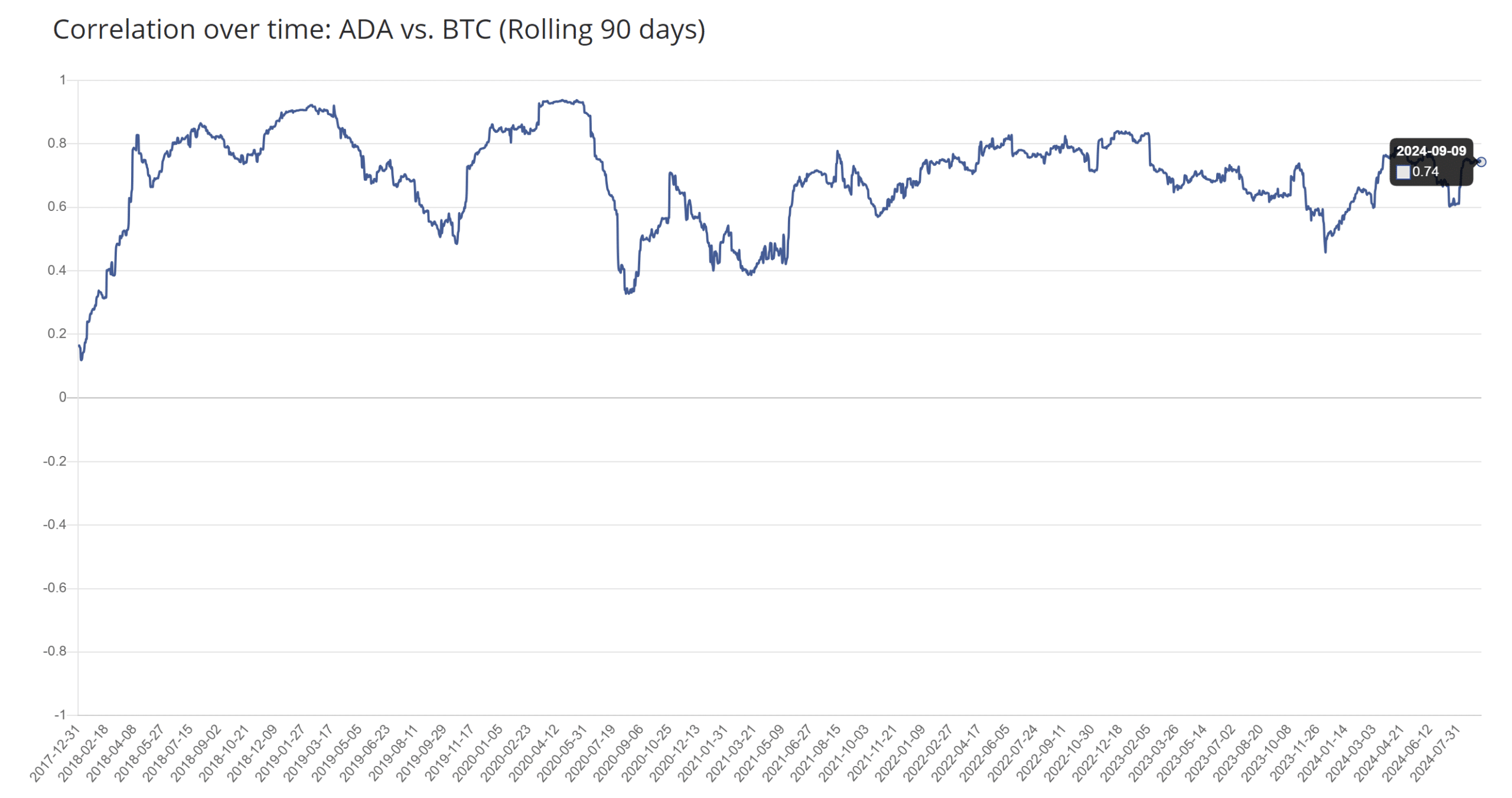

ADA vs BTC correlation

Cardano’s strong correlation with Bitcoin further supports the expectation of a price rally.

In simple terms, Bitcoin continues to significantly influence the prices of many well-known cryptocurrencies like ADA, and an increase in Bitcoin’s value often leads to a comparable jump in Cardano’s price as well.

At present, the connection between ADA and Bitcoin is showing a stronger bond, with the correlation coefficient rising from 0.6 to 0.74. This suggests that the relationship between these two cryptocurrencies has become more robust over time.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Should this trend persist, the correlation between ADA and its historical high (0.96) might be reached, given the increasing pace of development on its blockchain.

With these factors in play, ADA seems well-positioned for higher prices in the near future.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Silver Rate Forecast

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2024-09-12 12:40