-

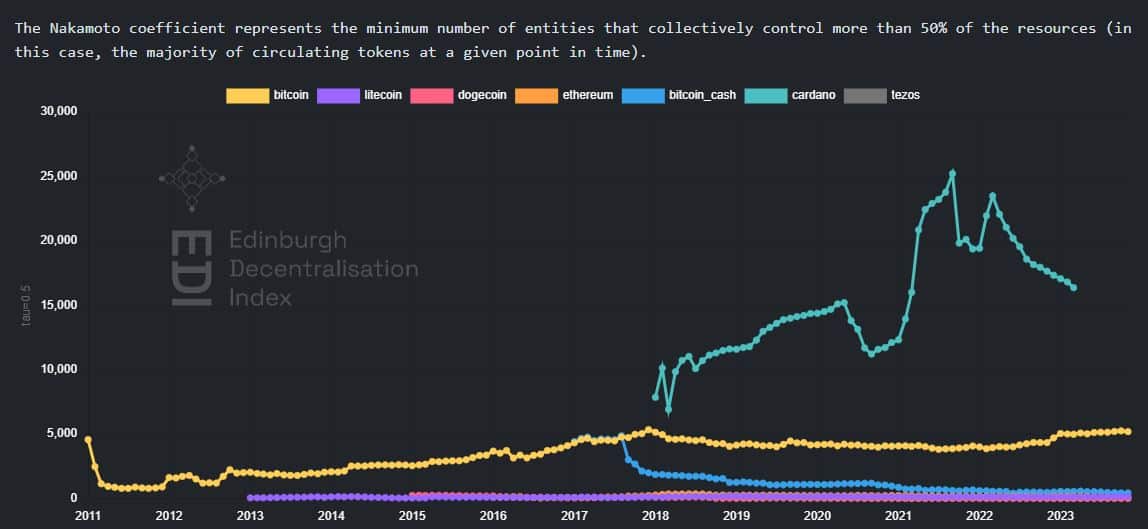

Cardano has the highest Nakamoto co-efficient among all chains, indicating higher levels of decentralization

Sentiment around ADA remained unaffected though as prices fell

As a long-term crypto investor with experience in analyzing blockchain networks, I find Cardano’s high Nakamoto coefficient an impressive achievement. Decentralization is a critical aspect of any cryptocurrency project, and Cardano’s commitment to maintaining a decentralized network is commendable. However, it seems that the price action of ADA has not been influenced by this positive news.

As a Cardano investor, I’ve noticed that over the past few months, there have been several aspects where our beloved cryptocurrency, Cardano [ADA], hasn’t been able to outshine other Layer 1 platforms. Yet, in one significant area, Cardano has reigned supreme with its unmatched dominance.

Will decentralization bring users to the yard?

Based on current data, Cardano boasts a greater Nakamoto coefficient than most other altcoins in the market. This figure represents the approximate number of entities needed to control half of the blockchain’s hashrate. A larger Nakamoto coefficient signifies a more decentralized network.

As a crypto investor in Cardano, I can tell you that one of the advantages of this network is its decentralization. This means that no single entity or group can control or manipulate the Cardano network easily. The high Nakamoto coefficient of Cardano adds to this strength. In simpler terms, it makes the network less susceptible to being dominated by a few large entities. Additionally, a higher Nakamoto coefficient enhances the perception among crypto enthusiasts that Cardano is a decentralized and trustworthy platform. This positive sentiment can attract more users to the network, increasing its potential for growth.

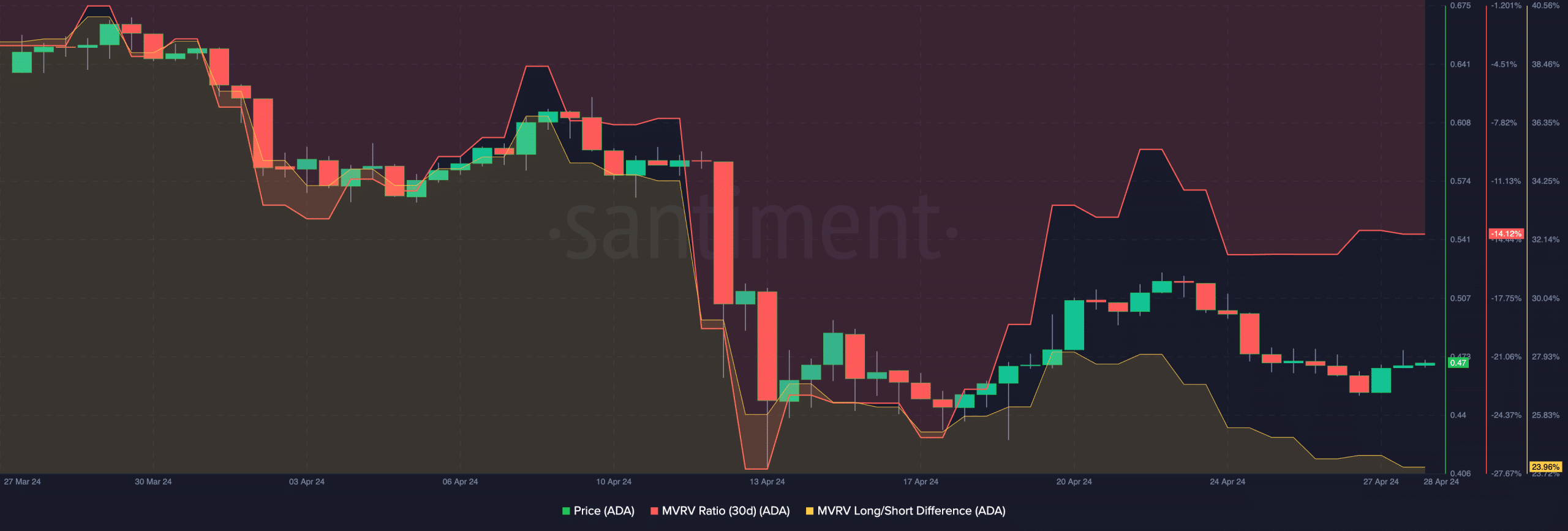

As a researcher studying the cryptocurrency market, I’ve noticed that the Nakamoto coefficient didn’t help me acquire ADA during the past week. Unfortunately, the value of ADA decreased by approximately 3.82% within this time frame. At present, its price is hovering around $0.4503. Additionally, the trading volumes for ADA declined by a similar percentage over the same period.

As a researcher examining the ADA address landscape, I’ve uncovered some intriguing insights. Although these addresses house the tokens of one of cryptocurrency’s most decentralized networks, a significant portion remains unprofitable. This revelation stems from AMBCrypto’s analysis of Santiment’s data which indicated a negative MVRV (Market Value to Realized Value) ratio for ADA. Furthermore, the Long/Short difference has been on a downward trend. This decline signifies that the number of long-term holders of ADA has been waning.

The high number of investors holding ADA for a short period of time may increase the risk of the asset experiencing significant price drops during market fluctuations, as these investors are more likely to sell their holdings in response to volatile market conditions.

How are traders doing?

Over the past few days, Bulls have faced the most impact as cryptocurrency prices took a dip. According to Coinglass data, there was a substantial increase in the number of long positions being closed out over the last week. Specifically, during the previous 24 hours, $99,870 worth of long positions for ADA were liquidated.

Because of these influences, the opinion towards ADA became more critical. The majority of traders adopted a pessimistic outlook recently, leading to an increase in the number of short positions on ADA.

Since 1 May, the percentage of short positions against ADA has grown from 49% to 53.8%.

Realistic or not, here’s ADA’s market cap in BTC terms

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-04 07:03