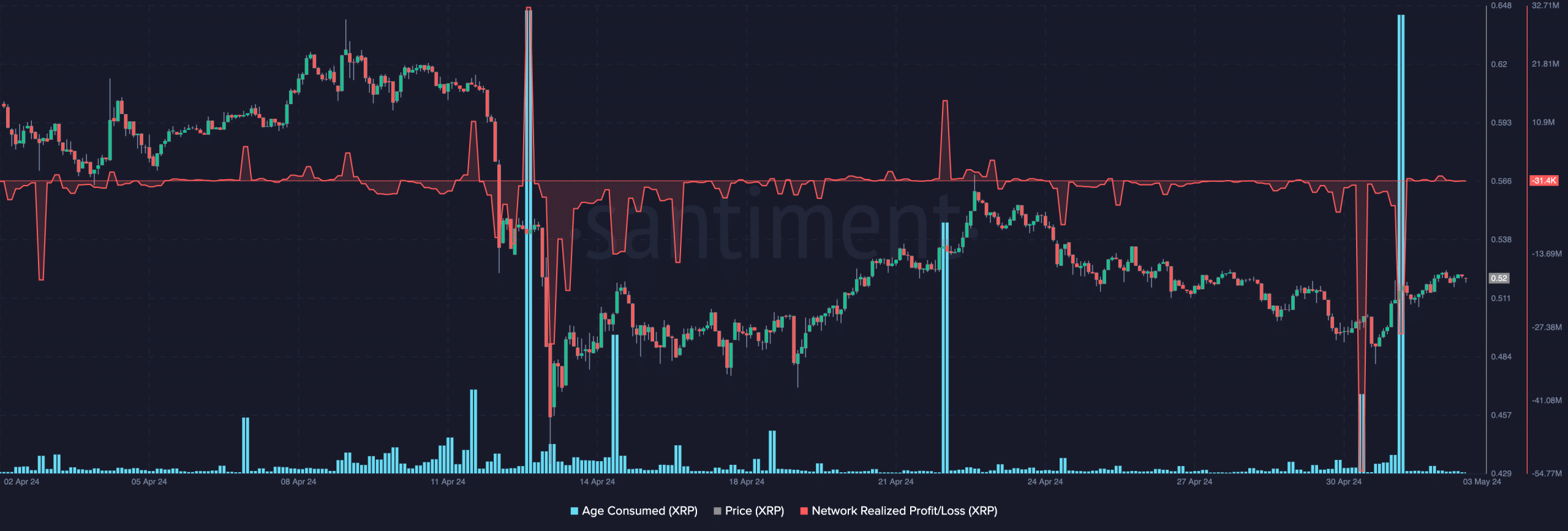

- XRP’s Age Consumed rose to an all-time high on 1 May

This suggested that a local price bottom had been reached on the charts

As an analyst with extensive experience in cryptocurrency markets and metrics analysis, I find the recent surge in XRP‘s Age Consumed metric and subsequent price rally intriguing. The data from Santiment indicating a significant movement of dormant tokens on May 1st suggests that long-term holders may have initiated a shift in market trends.

The Age Consumed metric for XRP has gained attention lately as it reached its peak during the daily market transactions on May 1st, based on information provided by Santiment.

As an analyst studying the XRPLedger, I’ve noticed an intriguing trend. A significant number of dormant tokens have been transferred to active accounts in May. Our Token Age Consumed metric reveals that this surge in token movement bears a striking resemblance to the spike we observed on April 13th. Prior to that event, the markets took a turn for the worse and XRP experienced a steep decline of approximately -16%.

— Santiment (@santimentfeed) May 2, 2024

The metric “Age Consumed” for an asset keeps tabs on the transfer history of its inactive tokens. This information is valuable as it provides insights into the actions of long-term investors. These investors typically leave their tokens untouched, but when they decide to move them, it can lead to significant changes in market patterns.

As a researcher studying cryptocurrency markets, I’ve observed that an increase in the metric implies a significant number of coins or tokens have been traded after long periods of inactivity. Conversely, a decrease in the metric suggests that coins or tokens have remained idle for extended durations without being transacted.

The metric serves as a reliable indicator of an asset’s local price peak or trough, based on its price behavior following these price shifts.

Is a rally in the books for XRP?

Based on Santiment’s data, approximately 130 billion XRP tokens became active on May 1st. Following this event, there was a surge in XRP’s value. The current worth of XRP, according to CoinMarketCap, is $0.52, representing an 8% price increase within the past two days.

Reading the surge in XRP‘s Age Consumed metric along with its subsequent price increase could indicate that the token’s price bottomed out on May 1 when it hit a low of $0.48. Subsequently, XRP began an upward trend on the charts.

On that very day, there was a notable decrease in XRP‘s Network Realized Profit/Loss (NPL), implying that the price at which XRP tokens were previously transacted was lower than their current market value. This metric calculates the distinction between the transaction prices and the current market prices.

When this metric experiences a noticeable drop, it indicates that anxious investors, or “paper hands,” are selling off in large numbers. Simultaneously, new buyers are entering the market in greater numbers. This pattern frequently signifies that a price floor has been established, as dips in NPL (non-performing loans) often correspond with temporary rebounds and stages of market recovery.

On 1 May, XRP’s NPL fell to a low of -54 million, its lowest level since December 2022.

Realistic or not, here’s XRP’s market cap in BTC’s terms

XRP sees sustained demand

As a researcher studying XRP‘s price behavior, my analysis of the 1-day chart indicated a promising sign for an imminent price increase. At present, I observe that the token’s crucial technical indicators are surging, reflecting a significant uptick in investor interest and demand.

As a financial analyst, I’ve been closely monitoring XRP‘s Chaikin Money Flow (CMF) indicator. This particular technical metric is designed to measure the buying and selling pressure in an asset by calculating the difference between the nine-day exponential moving average of the accumulation and distribution lines. At that time, the CMF value for XRP was trending upwards at 0.28. When the CMF indicator is positive and above zero, it signals a strong market condition. This finding implies that there’s a significant inflow of capital into the asset, suggesting a reduced likelihood of investors looking to sell or “flee” the market.

Read More

- BRETT PREDICTION. BRETT cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

- UK gov’t calls for action on AI copyright, market competition

- AVAX PREDICTION. AVAX cryptocurrency

- GFT PREDICTION. GFT cryptocurrency

- Nigerian fintechs crack down on crypto, users face account blocks

- BTC PREDICTION. BTC cryptocurrency

- FEG PREDICTION. FEG cryptocurrency

- Top gainers and losers

- OP PREDICTION. OP cryptocurrency

2024-05-04 06:15