-

ADA’s price might retrace if holders keep their tokens from circulating.

Technical analysis identified a key support at $0.45 that might prevent a plunge.

According to an analysis by AMBCrypto, long-term investors holding Cardano‘s [ADA] tokens have generally kept them stashed away, as indicated by a high Mean Dollar Invested Age.

Based on data from Santiment’s analysis of Cardano’s blockchain, the 90-day moving average of MDAI (Maturity Driven Adjusted Investment) reached 269 on April 15th. A declining MDAI typically indicates an uptick in network activity.

Historically, this tends to be promising for ADA as holders move their assets into circulation.

Instead of an increase in metrics leading to a stagnation, on the contrary, stagnant investments can actually limit a rise. As of now, ADA has followed the general market trend by regaining its value above $0.49.

Challenges ahead

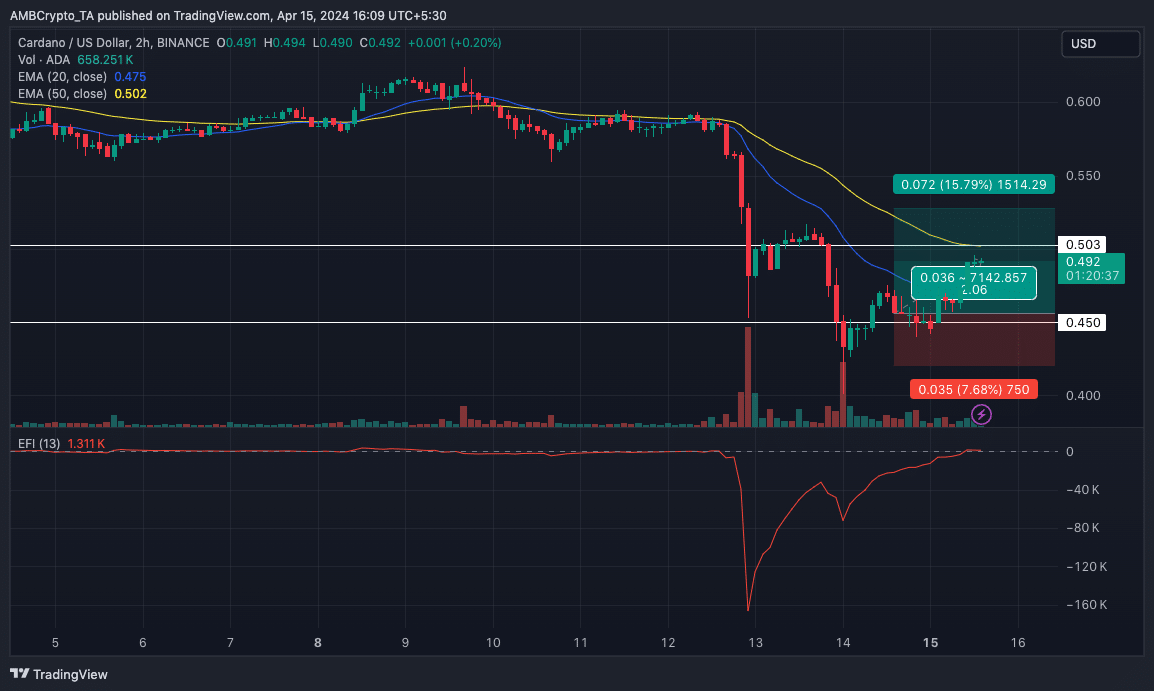

An examination of the token’s price movement revealed that it struggled to surpass the $0.50 mark, a significant psychological threshold.

If the Media Depiction Index Average (MDIA) keeps climbing, it’s possible that Ada’s price may not reach $0.50, instead dipping below $0.49 in the near future.

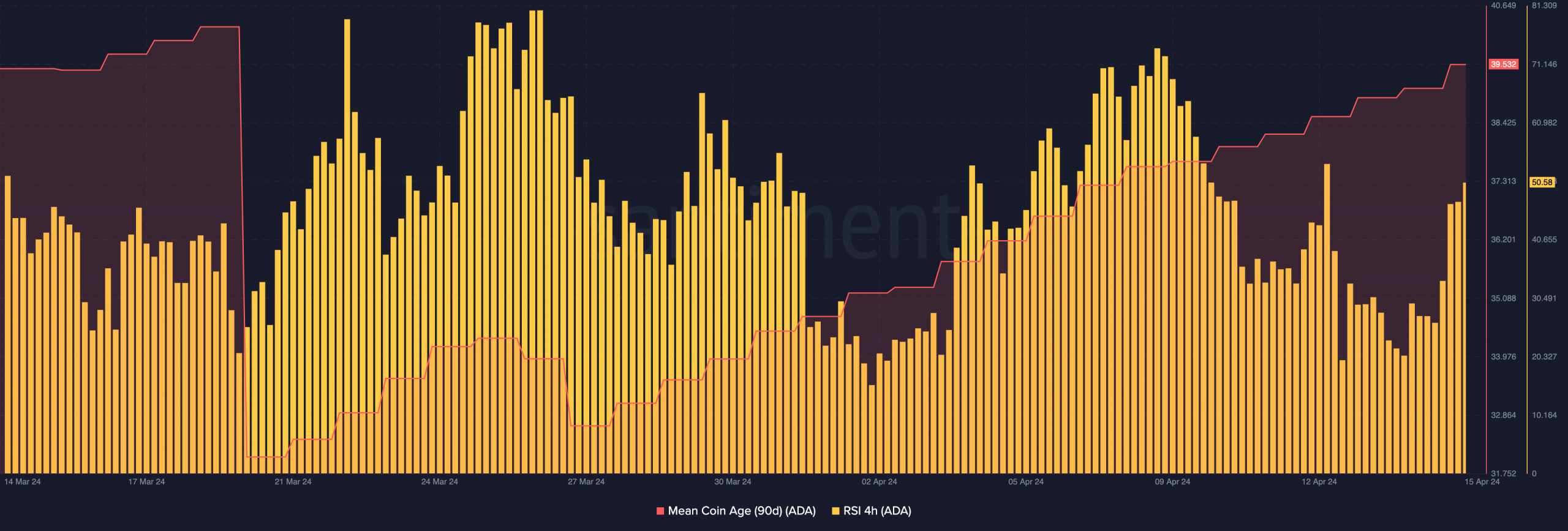

An earlier conclusion may not be entirely accurate, so instead of relying on just that, we explored other potential indicators. Specifically, we examined the Mean Coin Age (MCA) as an additional metric.

The MCA and MDIA share some commonalities in their signal outputs, yet there’s a subtle distinction. In this interpretation, a small coin age in the MCA indicates that fresh coins have been amassed and transferred to a cold storage wallet.

If more MCA (Median Confirmation Age) exists in Cardano’s network, this signifies that numerous coins have entered circulation. Generally, Cardano’s relationship with an aging coin has shown a negative correlation.

If the market took a turn for the worse, the cost of ADA could experience a significant decrease, even with short-term optimistic indicators. At its lowest point in a pessimistic scenario, ADA’s value might dip down to $0.46.

However, if the action of long-term holders changes, the value might be better.

Additionally, the RSI analysis indicated that buying power was not strong.

The RSI figure on the 4-hour chart rising to 50.58 did not necessarily mean that bulls held complete dominance.

A rise to $0.53 is possible

If the purchasing activity picking up, ADA could potentially surpass $0.50. On the other hand, if the Relative Strength Index (RSI) continues to hover near the middle value, ADA may fluctuate between $0.46 and $0.49.

On the 4-hour ADA/USD price chart, the Exponential Moving Average (EMA) indicated a persisting bearish trend. Specifically, at the current moment, the yellow 50 EMA line was moving above the blue 20 EMA line.

This is termed a death cross, which typically indicates a bearish trend.

With the ADA token now surpassing the 9-day moving average (EMA), it’s indicative that buyers are making an effort to drive the price up. Potentially, the token may aim for a $0.50 mark. Nevertheless, it could encounter resistance in this region.

Read Cardano’s [ADA] Price Prediction 2024-2025

If the current attempt to sell Cardano at a higher price is successful, it could push the price up to around $0.53. However, if this effort fails and investors reject the sale, there’s a risk of another correction that might bring the price down to the $0.45 support level instead.

In the meantime, the Elder Force Index (EFI) has halted, implying that ADA may be preparing to stabilize. An upward trend in the EFI could signal a potential price surge for the token. Conversely, a decrease in the indicator might indicate a downward trend for ADA’s price.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-04-16 04:07